|

市场调查报告书

商品编码

1627213

超磨粒:市场占有率分析、产业趋势、成长预测(2025-2030)Super Abrasives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

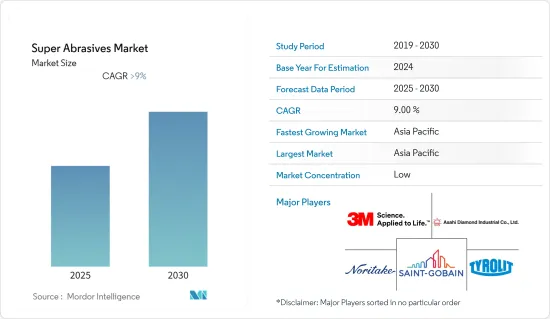

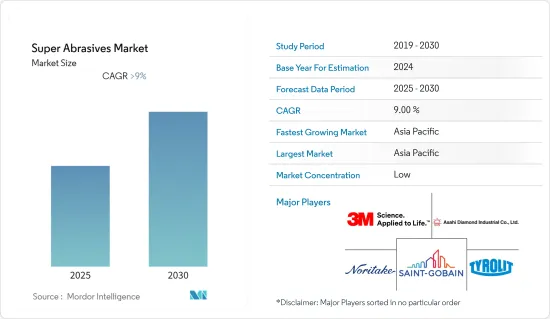

预计预测期内超磨粒市场复合年增长率将维持在9%以上。

COVID-19 对 2020 年市场产生了负面影响。不过,市场预计已达到疫情前水平,预计将稳定成长。

主要亮点

- 电子产业中超磨粒的使用不断增加预计将在预测期内推动市场成长。

- 另一方面,磨料磨俱的高成本增加了初始投资,预计这将阻碍市场成长。

- 促进超磨粒生产和使用的新技术可能会在未来几年提供市场机会。

- 由于印度、中国和日本等主要国家的市场开发不断增加,预计亚太地区将在预测期内主导市场。

超磨粒市场趋势

电子工业的扩张

- 超磨粒在电子工业中有多种应用。这些刀具用于加工半导体材料、陶瓷、硬质合金、铜及铜合金、铝、树脂、橡胶等,主要用于电子元件製造。

- 超磨粒研磨磨俱主要用于电子产业印刷电路基板(PCB)的开发。 PCB 对于许多电子设备至关重要,例如桌上型电脑和家庭剧院系统。

- 电子工业中的超磨粒具有稳定的切片性能、均匀的钻石数、均匀的线径、均匀的钻石分布、防止钻石丛集。

- 磁碟纹理、晶圆製造、抛光、光学窗口、半导体和散热器等电子应用也需要超磨粒。

- 此外,一些电子公司也在显着成长。例如,2022年,苹果以3,787亿美元的销售额位居《富比士》杂誌排行榜其他消费性电子公司第一,其次是三星电子。因此,随着电子製造企业的成长,对超磨粒的需求也大幅增加。

- 随着更多创新和高效能电子设备的使用,对超磨粒及其工具的需求预计也会增加。

亚太地区主导市场

- 亚太地区主导超磨粒市场。随着中国、印度、日本等国家对电子设备的需求不断增长,製造业对超磨粒的需求也不断增加。

- 中国拥有全球最大的电子产品生产基地。电线、电缆、计算设备和其他个人设备等电子产品在电子行业中成长最快。该国满足国内对电子产品的需求,并向其他国家出口电子产品。根据中国国家统计局的数据,2021 年家电及电器产品产业销售额达 9.3464 亿元(约 1.384 亿美元)。

- 此外,根据国际汽车工业协会(OICA)的数据,中国是全球最大的汽车生产国,约占全球产量的32.5%。 2021年全国产量为26,082,220辆,较2020年的25,225,242辆成长3%。

- 在印度,中产阶级收入的增加、快速都市化和工人阶级生活方式的改变导致家电等耐用消费品的生产和销售大幅增加。政府措施支持了家用电器的扩张。

- 印度的电子工业是世界上成长最快的工业之一。由于100%外国直接投资(FDI)、无需工业许可证、以及从手工生产流程向自动化生产过程的技术转变等有利的政府政策,国内电子製造业正在稳步扩张。

- 根据印度品牌股权基金会(IBEF)预测,到2025年,印度电子製造业的产值预计将达到5,200亿美元。由于「印度製造」、「电子设备国家政策」、「电子设备净零进口」和「印度製造」等政府倡议,印度的电气和电子设备产量正在迅速增长。国内製造业,减少进口依赖,促进出口,并支持印度製造计划等製造业倡议,该计划旨在使该国实现自力更生。

- 根据IATA(国际航空运输协会)的报告,预计到预测期结束时,印度将成为世界第三大航空市场。据国际航空运输协会称,印度预计到2030年将超过中国和美国,成为全球第三大航空客运市场。预计未来20年该国需要2,100架飞机,销售额将超过2,900亿美元。

- 所有上述因素预计将推动预测期内的市场研究。

超磨粒产业概况

超磨粒市场是分散的。市场主要企业包括(排名不分先后)Asahi Diamond Industrial、Saint-Gobain、3M、NORITAKE CO., LIMITED 和 TYROLIT。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 司机

- 电子工业的扩张

- 用超磨粒磨料取代传统磨料

- 抑制因素

- 研磨颗粒成本高,初期投资高

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 依材料类型

- 钻石

- 立方氮化硼(CBN)

- 按用途

- 动力传动系统

- 轴承

- 齿轮

- 工具研磨

- 涡轮

- 其他用途

- 按最终用户产业

- 航太

- 车

- 医疗保健

- 电子产品

- 石油和天然气

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 北欧国家

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Asahi Diamond Industrial Co.,Ltd.

- CUMI

- Dr.Kaiser

- Gunter Effgen GmbH

- Heger GmbH Excellent Diamond Tools

- Husqvarna Group

- Hyperion Materials & Technologies

- KURE GRINDING WHEEL

- NORITAKE CO., LIMITED

- Saint-Gobain

- Tyrolit

- Zhengzhou Hongtuo Superabrasive Products Co. Ltd

第七章 市场机会及未来趋势

- 新技术促进超磨粒的生产和使用

简介目录

Product Code: 51124

The Super Abrasives Market is expected to register a CAGR of greater than 9% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and is expected to grow steadily.

Key Highlights

- Increasing usage of super abrasives in the Electronics industry is likely to fuel the market growth during the forecast period.

- On the other hand, high initial investment due to the high cost of abrasives is expected to hinder market growth.

- Emerging technologies easing production and using super abrasives will likely create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market during the forecast period owing to its growing development in major countries such as India, China, and Japan.

Super Abrasives Market Trends

Expanding Electronics Industry

- Super abrasives find various applications in the electronics industry. These tools can be used to process semiconductor materials, ceramics, carbide alloys, copper and copper alloys, aluminum, resin, and rubber, which are majorly used in electronic component manufacturing.

- Super abrasive grinding tools are primarily used to develop Printed Circuit Boards (PCBs) PCBs in the electronics industry. PCBs are critical for many electronic devices, like desktop computers and home theater systems.

- Super abrasives in the electronics industry provide consistent slicing performance, uniform diamond counts, uniform wire diameter, even diamond distribution, and no diamond clustering.

- Super abrasives are also required in the electronics sector for disc texturing, wafer manufacturing, polishing, optic windows, semiconductors, and heat sinks.

- Furthermore, several electronic companies are also growing substantially. For instance, in 2022, Apple, with 378.7 billion US dollars in sales, ranked number one among other consumer electronics companies on the Forbes list, followed by Samsung Electronics. Thus, with the growth of electronic manufacturing companies, the demand for super abrasives also increases substantially.

- The increasing usage of more innovative and efficient electronic devices is expected to lead to increased demand for super abrasives and their tools.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the super abrasives market. Owing to the demand for electronics in countries such as China, India, and Japan, the demand for super abrasives in manufacturing is also increasing in the region.

- China includes the world's most extensive electronics production base. Electronic products, such as wires, cables, computing devices, and other personal devices, recorded the highest growth in the electronics segment. The country serves the domestic demand for electronics and exports electronic output to other countries. According to the National Bureau of Statistics of China, the revenue in the consumer electronics and household appliances segment reached CNY 934.64 million (~USD 138.40 million) in 2021.

- Furthermore, according to the International Organization of Motor Vehicle Manufacturers (OICA), China is the largest producer of automobiles, accounting for about 32.5% of the global volume. The country produced 26,082,220 units in 2021, registering an increase of 3% compared to 25,225,242 units in 2020.

- In India, the consumer durables, like electronic appliances, have witnessed a tremendous increase in production and sales, owing to the growing middle-class income, rapid urbanization, and change in lifestyle of the working class. Government initiatives have supported the expansion of consumer electronics products.

- The Indian electronics industry is one of the fastest-growing industries globally. The domestic electronics manufacturing sector is expanding at a steady rate, owing to favorable government policies, such as 100% foreign direct investment (FDI), no requirement for industrial licenses, and the technological transformation from manual to automatic production processes.

- According to the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025. Electrical and electronics production in India is expected to increase rapidly due to government initiatives with policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence, energizing exports, and manufacturing, like the "Make in India" program to make the country self-reliant.

- According to IATA (International Air Transport Association) report, India is poised to become the third-largest aviation market in the world by the end of the forecast period. According to the IATA, India is expected to overtake China and the United States as the world's third-largest air passenger market by 2030. The country is projected to demand 2,100 aircraft over the next two decades, amounting to over USD 290 billion in sales.

- All the factors above are expected to boost the market studied during the forecast period.

Super Abrasives Industry Overview

The super abrasives market is fragmented in nature. Some of the major players in the market include Asahi Diamond Industrial Co., Ltd., Saint-Gobain, 3M, NORITAKE CO., LIMITED, and TYROLIT, among others. (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expanding Electronics Industry

- 4.1.2 Conventional Abrasives Substituted by Super Abrasives

- 4.2 Restraints

- 4.2.1 High Initial Investment due to High Cost of Abrasives

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Diamond

- 5.1.2 Cubic Boron Nitride (CBN)

- 5.2 Application

- 5.2.1 Powertrain

- 5.2.2 Bearing

- 5.2.3 Gear

- 5.2.4 Tool Grinding

- 5.2.5 Turbine

- 5.2.6 Other Applications

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Automotive

- 5.3.3 Medical

- 5.3.4 Electronics

- 5.3.5 Oil and Gas

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Nordic Countries

- 5.4.3.6 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Asahi Diamond Industrial Co.,Ltd.

- 6.4.3 CUMI

- 6.4.4 Dr.Kaiser

- 6.4.5 Gunter Effgen GmbH

- 6.4.6 Heger GmbH Excellent Diamond Tools

- 6.4.7 Husqvarna Group

- 6.4.8 Hyperion Materials & Technologies

- 6.4.9 KURE GRINDING WHEEL

- 6.4.10 NORITAKE CO., LIMITED

- 6.4.11 Saint-Gobain

- 6.4.12 Tyrolit

- 6.4.13 Zhengzhou Hongtuo Superabrasive Products Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Technologies Easing Production and Use of Super Abrasives

02-2729-4219

+886-2-2729-4219