|

市场调查报告书

商品编码

1628706

声学感测器 -市场占有率分析、行业趋势/统计、成长预测 (2025-2030)Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

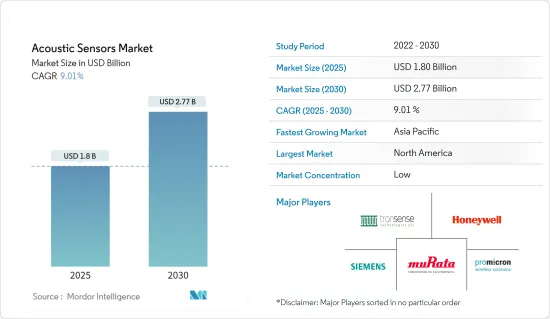

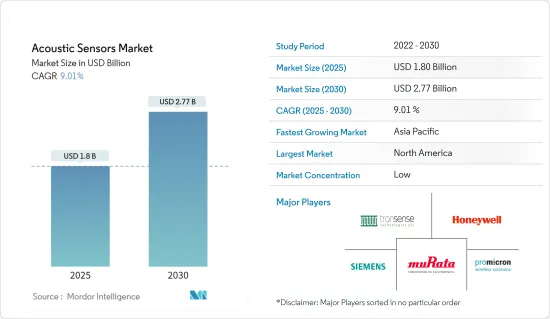

声学感测器市场规模预计到 2025 年为 18 亿美元,预计到 2030 年将达到 27.7 亿美元,预测期内(2025-2030 年)复合年增长率为 9.01%。

主要亮点

- 大多数人使用基于摄影机的感测技术。由于基于 RF 的方法简单且侵入性低,因此研究主要集中在这种方法上。由于RFID不需要电池,因此经常用于供应链管理和储存等企业业务。此外,由于室内 WiFi 基础设施的广泛可用性,基于 WiFi 的感测方法已被证明在将感测功能整合到智慧家庭和职场方面非常有效。

- 除了摄影机和基于射频的解决方案之外,声学讯号代表了感测的第三维。为了降噪和远距离拾音,Galaxy Note 3和Amazon Echo内建了多个高性能麦克风。 Galaxy S9 和 Google Home 配备了多个立体声扬声器。此外,许多行动装置现在提供发烧级的高品质录音(例如 192kHz),大大提高了基于声学的检测能力。

- 此外,通讯行业的进步正在推动整个声学感测器市场的发展。根据GSMA统计,截至2024年1月,已有47通讯业者在独立(SA)网路上部署了商用5G服务。此外,超过一半的营运商预计将在标准发布一年内实施 5G-Advanced。 2024 年 5G SA 和 5G-Advanced 的推广可能会引发新一波 5G 投资,特别是在关键市场。

- 此外,当今汽车应用对声学感测器的需求量很大。电动车中使用的马达完全静音,可能会对粗心的行人造成危险。因此,现代电动和混合动力汽车必须配备声音警报系统。因此,对交通管理的日益关注预计将推动市场成长。根据瑞银预测,到 2030 年,全球自动驾驶汽车感测器半导体市场规模预计将达到 300 亿美元。汽车趋势的变化可能会导致预测期内汽车声学感测器的潜在增长。

- 各种公司正在投资各种应用的声学感测器,包括国防应用中有毒有害蒸气的环境监测、食品分析和控制以及发动机油老化、微生物和癌细胞检测等医疗应用。智慧型设备。例如,2024年7月,特斯拉宣布有意推出自动驾驶叫车服务,但前提是自动驾驶技术已解决。特斯拉的专利详细介绍了一种先进的感测器阵列,其中包括影像、声学、热学、压力、电容、射频和气体感测器,用于监控车辆内部环境。

- 声学感测器面临许多技术挑战,包括刺耳的声音洩漏和高功耗,这相对缩短了电池供电设备的电池寿命。

- 此外,持续的政治动盪和挫折预计将对电子产业产生重大影响。这场衝突已经加剧了已经影响该行业的半导体供应链问题和晶片短缺问题。这种破坏可能以镍、钯、铜、钛、铝和铁矿石等关键原料的价格波动的形式出现,导致材料短缺。这被认为会在声学感测器的生产中引起问题。

声学感测器市场趋势

消费性电子产品推动市场成长

- 声学感测器广泛应用于家用电子电器,特别是智慧型手机和笔记型电脑。家用电子电器极大地促进了合适的感测器和技术的开发,消费性电子产品是声学感测器的重要投资者和消费者。爱立信数据显示,2023年第二季全球5G用户数激增1.75亿,总合接近13亿人。中国、印度和美国的智慧型手机行动网路订阅数量最多。

- 在许多消费和通讯应用中,声学感测器的使用极大地有助于射频滤波器的开发。例如,创建一个声学设备相对容易。由于表面波声滤波器在智慧型手机领域的广泛使用,感测器材料的成本在过去三十年中有所下降。

- 大多数电话和类似设备都包括麦克风和扬声器,它们有利于声学感测应用,并且实施起来相对便宜。

- 此外,2023 年 11 月,日本科技巨头 NEC Corporation 开始在亚太地区扩展万事达卡的生物识别结帐计画。 NEC 和万事达卡签署了一份谅解备忘录,同意将 NEC 的尖端脸部认证和生物识别技术整合到该计划中。

- 由于 LTE、4G 和 5G 设备(尤其是 5G 智慧型手机)产量的增加,声学技术公司拥有巨大的业务扩展机会。由于射频滤波器能够将无线电讯号与智慧型手机用来发送和接收资料的多个频段分开,因此射频滤波器正日益成为这些设备中的标准组件。

- 随着 5G 技术的出现,新型先进 SAW 滤波器的发展潜力更大,因为它们在低于 2.7GHz 频率范围内提供比竞争性 BAW 滤波器更高性能的解决方案。家用电子电器的此类发展可能会进一步推动所研究的市场成长。

亚太地区成长率显着

- 由于亚太地区在全球半导体製造业中占据主导地位,预计在预测期内将显着成长。该地区也是全球领先的家用电子电器、电动车和先进电子设备製造商之一,也是全球声学感测器的主要消费者之一。 GSMA 报告称,到 2023 年,该地区将拥有 14.5 亿行动网路用户和近 20 亿个 4G 连线。到2024年初,该地区已累积3亿个5G连接,用户渗透率达10%。

- 由于该地区专注于建设基础设施以实现 5G 技术,因此预计该地区对射频半导体的需求将会增加。 GSMA预测,2020年至2025年间,亚太地区行动电话电信商将在网路上投资超过4,000亿美元,其中3,310亿美元将专门用于5G部署。

- 由于美国、中国、韩国、日本和印度等主要和新兴国家的智慧型手机、平板电脑和其他电子设备的使用量增加,声学感测器预计将在预测期内扩大。根据IBEF统计,2024年第一季印度智慧型手机出货量达3,530万部,较去年同期成长8%。此外,2023 年报告预测,全球高阶智慧型手机市场将在中国、印度、中东和非洲以及拉丁美洲实现创纪录的销售量。尤其是印度,将成为全球成长最快的高端市场。

- 大多数知名智慧型手机製造商,包括 LG 和三星,都在其最新的 5G 型号中使用射频滤波器。 SAW 感测器的开发也使 5G 和 4G 多模行动装置能够以比性能指标相当的竞争性商业替代品更低的成本使用更节能的射频路径。

- 由于声学感测器在家用电子电器的广泛应用,中国目前占据亚太声学感测器市场的最高份额。声学感测器在其他重要的最终用户产业(包括汽车、国防和工业领域)的使用尤其广泛。根据国际能源总署(IEA)预测,2023年中国新电动车登记数量将快速成长,达810万辆,与前一年同期比较增加35%。

声学感测器产业概况

声学感测器市场适度细分,由多家主要企业组成。从市场占有率来看,目前几家主要企业占据市场主导地位。然而,创新和永续技术使许多公司能够透过赢得新合约和开拓新市场来扩大其市场份额。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- 评估宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 通讯市场的成长

- 製造成本低

- 市场限制因素

- 与声学感测器相关的技术问题

第六章 市场细分

- 按类型

- 有线

- 无线的

- 按波浪类型

- 表面波

- 体波

- 按感测参数

- 温度

- 压力

- 扭力

- 按用途

- 车

- 航太/国防

- 家用电子电器

- 医疗保健

- 工业的

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Siemens AG

- Transense Technologies PLC

- Pro-micron GmbH

- Honeywell Sensing and Productivity Solutions

- Murata Manufacturing Co., Ltd.

- Vectron International Inc.(Microchip technology Incorporated)

- IFM Efector Inc.

- Dytran Instruments Inc.

- CTS Corporation

- Campbell Scientific Inc.

- API Technologies Corp.

第八章投资分析

第9章 未来趋势

简介目录

Product Code: 51622

The Acoustic Sensors Market size is estimated at USD 1.80 billion in 2025, and is expected to reach USD 2.77 billion by 2030, at a CAGR of 9.01% during the forecast period (2025-2030).

Key Highlights

- Most people use camera-based sensing. Research has focused on RF-based approaches for their ease and lack of intrusion. Because RFID doesn't require batteries, it is frequently used in corporate operations like supply chain management and storage. Furthermore, WiFi-based sensing approaches have been shown to be quite effective in integrating sensing functions in a smart home or workplace due to the widespread availability of indoor WiFi infrastructures.

- Acoustic signals offer a third dimension for sensing in addition to camera- and RF-based solutions since microphones and speakers are increasingly often found in mobile, wearable, and smart appliance devices. For noise reduction and far-field speech pickup, the Galaxy Note 3 and Amazon Echo include numerous sophisticated microphones built into them. Both the Galaxy S9 and Google Home have multiple stereo speakers. Additionally, many mobile devices now offer high recording quality (such as 192 kHz) aimed at audiophiles, which has significantly improved acoustic-based detection capabilities.

- Furthermore, advancement in the communication industry is boosting the overall acoustic sensor market. According to GSMA, As of January 2024, 47 operators have rolled out commercial 5G services on Standalone (SA) networks. Additionally, over half of these operators anticipate implementing 5G-Advanced within a year of its standard release. The surge in 5G SA and 5G-Advanced initiatives in 2024 is poised to catalyze a fresh wave of 5G investments, particularly in leading markets.

- Moreover, acoustic sensors have recently seen significant demand in automotive applications. The complete silence of the motors used in EVs may pose a hazard to inattentive pedestrians. As a result, the latest electric and hybrid cars will have to be equipped with an acoustic warning system. Therefore, rising concerns regarding traffic management will drive market growth. According to UBS, the global market for sensor semiconductors in autonomous vehicles is anticipated to reach USD 30 billion by 2030. Changes in automotive trends may lead to potential growth for acoustic sensors for automotive applications during the forecast period.

- Various companies are investing in Acoustic sensors due to their deployment in smart devices that can be used in diverse fields like environmental monitoring of toxic and hazardous vapors in defense applications, food analysis and control, engine oil aging, microorganism, and healthcare applications like cancer cell detection. For instance, in In July 2024, Tesla unveiled its intentions to introduce an automated ride-hailing service, contingent on resolving self-driving technology. Tesla's patent details a sophisticated sensor array, encompassing image, acoustic, thermal, pressure, capacitive, radio frequency, and gas sensors, to monitor the vehicle's interior environment. such instances are creating the demand for acoustic sensors from automotive industry.

- There are many technical challenges associated with acoustic sensors, such as annoying audible sound leakage and large power consumption, which can relatively reduce the battery life of battery-powered devices, and the acoustic sensing system can affect the music play and voice calls.

- Furthermore, the ongoing political pus and downs are expected to impact the electronics industry significantly. The conflict has already exacerbated the semiconductor supply chain issues and the chip shortage that have affected the industry for some time. The disruption may come in the form of volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, resulting in material shortages. This would obstruct the manufacturing of acoustic sensors.

Acoustic Sensors Market Trends

Consumer Electronics to Drive the Market Growth

- Acoustic sensors are widely used in consumer electronics, notably smartphones and laptops. The development of the appropriate sensors and technologies was greatly aided by consumer electronics, one of the significant investors and consumers of acoustic sensors. According to Ericsson, in Q2 of 2023, global 5G subscriptions surged by 175 million, nearing a total of 1.3 billion. China, India, and the United States have the highest smartphone mobile network subscriptions.

- In many consumer and communication applications, using sound sensors greatly aided the development of RF filters. For instance, the creation of acoustic devices is relatively straightforward. The cost of sensor materials has declined over the past three decades due to the widespread use of surface wave acoustic filters in the smartphone sector.

- Most telephones and comparable devices are equipped with microphones and speakers that facilitate acoustic-sensing applications and have a comparatively cheap implementation cost.

- Further, iIn November 2023, NEC Corporation, a leading Japanese technology firm, took the helm in expanding the Mastercard Biometric Checkout Programme across the Asia Pacific (APAC). Signing a Memorandum of Understanding, NEC and Mastercard agreed to integrate NEC's cutting-edge face recognition and liveness verification tech into the initiative, aiming to boost its uptake among APAC merchants.

- Acoustic wave technology companies have a massive opportunity to expand due to the rising production of LTE, 4G, and 5G devices, particularly 5G smartphones. Due to their ability to separate radio signals from the many spectrum bands smartphones utilize to receive and send data, RF filters are increasingly employed as standard parts in these devices.

- With the advent of 5G technology, new advanced SAW filters have more development potential since they provide a higher performance solution than competitive BAW filters in the sub-2.7 GHz frequency region. Such developments in consumer electronics may further propel the studied market growth.

Asia-Pacific to Witness a Significant Growth Rate

- The Asia-Pacific region is anticipated to grow significantly over the forecast period due to its dominance in the global semiconductor manufacturing industry. The region is also one of the global manufacturers of consumer electronics, electric vehicles, and advanced electronic devices, among others, making it one of the significant consumers of acoustic sensors globally. In 2023, the region boasted 1.45 billion mobile internet subscribers and nearly 2 billion 4G connections, as reported by GSMA. By early 2024, the region had already amassed 300 million 5G connections, marking a 10% adoption rate among subscribers.

- The region's demand for RF semiconductors is anticipated to rise due to the growing emphasis on expenditures to build infrastructure to enable 5G technology. The GSMA estimates that between 2020 and 2025, mobile operators in the Asia-Pacific region will invest more than USD 400 billion in their networks, of which USD 331 billion will go toward 5G deployments.

- Acoustic sensors are anticipated to expand throughout the projected period due to the rising use of smartphones, tablets, and other electronic devices in major and emerging countries, including the United States, China, South Korea, Japan, and India. According to IBEF,In the first quarter of 2024, India's smartphone shipments surged by 8% year-on-year, hitting a total of 35.3 million units.. Further, in its 2023 report it was stated on the global premium smartphone market forecasts record-setting sales in China, India, the Middle East, Africa, and Latin America. India, in particular, is set to lead as the world's fastest-growing premium market..

- Most well-known smartphone manufacturers, including LG and Samsung, use RF filters in their most recent 5G models. The development of SAW sensors also makes it possible for 5G and 4G multimode mobile devices to use more power-efficient RF pathways at a lower cost than competing commercial alternatives with comparable performance metrics.

- Due to the widespread usage of acoustic sensors in consumer electronics, China now owns the highest share of the Asia-Pacific acoustic sensor market. The use of acoustic sensors in other significant end-user industries, including the automotive, defense, and industrial sectors, is particularly strong. According to international Energy Agency , In 2023, China saw a surge in new electric car registrations, hitting 8.1 million, marking a 35% rise from the previous year. such instances are playing a huge role in the growth of the studied market.

Acoustic Sensors Industry Overview

The Acoustic Sensors Market is moderately fragmented and consists of several prominent players. In terms of market share, some of the significant players currently dominate the market. However, with innovative and sustainable technologies, many organizations expand their market existence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Telecommunications Market

- 5.1.2 Low Manufacturing Costs

- 5.2 Market Restraints

- 5.2.1 Technical Challenges Associated with Acoustic Sensors

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Wave Type

- 6.2.1 Surface Wave

- 6.2.2 Bulk Wave

- 6.3 By Sensing Parameter

- 6.3.1 Temperature

- 6.3.2 Pressure

- 6.3.3 Torque

- 6.4 By Application

- 6.4.1 Automotive

- 6.4.2 Aerospace & Defense

- 6.4.3 Consumer Electronics

- 6.4.4 Healthcare

- 6.4.5 Industrial

- 6.4.6 Other Applications

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Transense Technologies PLC

- 7.1.3 Pro-micron GmbH

- 7.1.4 Honeywell Sensing and Productivity Solutions

- 7.1.5 Murata Manufacturing Co., Ltd.

- 7.1.6 Vectron International Inc. (Microchip technology Incorporated)

- 7.1.7 IFM Efector Inc.

- 7.1.8 Dytran Instruments Inc.

- 7.1.9 CTS Corporation

- 7.1.10 Campbell Scientific Inc.

- 7.1.11 API Technologies Corp.

8 INVESTMENT ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219