|

市场调查报告书

商品编码

1628707

稀有气体 -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Noble Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

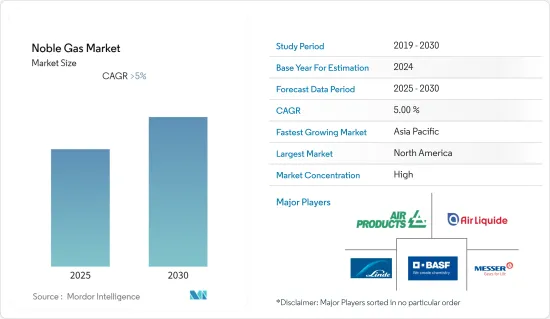

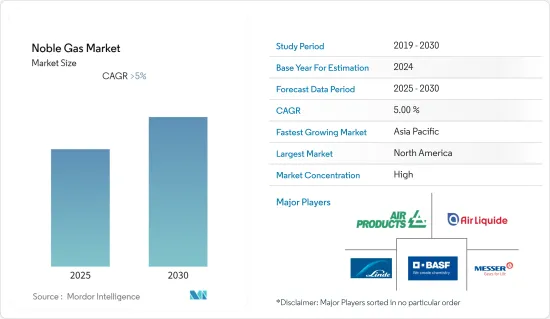

预计在预测期内,惰性气体市场的复合年增长率将超过 5%。

COVID-19 对惰性气体市场产生了正面影响。稀有气体主要用于医疗领域,基本上不受 COVID-19 大流行的影响。疫情期间医疗对氦气、氖气和氩气的需求增加,导致医疗产业稀有气体的消耗增加。

主要亮点

- 医疗行业需求的增加以及钢铁和汽车行业的扩张预计将推动稀有气体市场的成长。

- 医疗应用中使用量的增加可能会成为未来的机会。

- 然而,对高效能气体提取方法的需求和稀有气体的价格波动是阻碍所研究市场成长的主要因素。

- 预计美国将主导北美惰性气体市场,在预测期内也可能呈现最高的复合年增长率。

稀有气体市场趋势

医疗产业需求不断成长

- 稀有气体有着广泛的应用。氦气在医疗领域的需求量最大,因为它用于冷却磁振造影机 (MRI) 中的超导性磁体。

- 氦气对多种呼吸系统疾病有效,包括上呼吸道阻塞、气喘恶化和拔管后斜颈。显微镜为氦气在技术先进的医疗领域的使用开闢了新的可能性。

- 其他惰性气体如氩气和氙气也用于各种医疗目的。氩气用作麻醉剂和神经保护剂,氙气已被发现在神经保护和麻醉领域中有效。

- 此外,中国、美国和日本是医疗领域收益的主要贡献国家。新兴经济体,特别是印度、日本和中国等亚太地区,日益关注的健康问题和对医疗领域的关注,见证了对此类气体的巨大需求。

- 根据美国医疗保险和医疗补助服务中心预测,2021年美国国民医疗支出(NHE)将成长2.7%,达到4.3兆美元,占国内生产总值(GDP)的18.3%。

- 根据中国国家统计局数据,2021年中国整体医疗支出约7.7兆元人民币(1.19兆美元),与前一年同期比较增加6.4%。

- 医疗行业的这种积极增长可能会增加预测期内对稀有气体的需求。

美国在北美地区占主导地位

- 由于对消费品和投资品的需求不断增长,北美(尤其是美国)在收益方面占据了最高的市场占有率。

- 由于航太、石油和天然气、健康和雷射应用的需求不断增长,美国稀有气体市场预计将出现健康成长。

- 与建筑、医疗、汽车和半导体相关的大型製造业的存在预计将成为支持该国稀有气体市场成长的因素。

- 在石油和天然气工业中,稀有气体广泛用于原油的探勘和生产。稀有气体资料可以准确说明已发现石油和天然气勘探和开采所涉及的复杂岩土工程过程。

- 根据医疗保险和医疗补助服务中心的数据,从 2021 年到 2030 年,美国国家医疗支出 (NHE) 预计每年增长 5.1%。这一趋势显示了惰性气体在医疗领域的未来潜力。

- 根据EIA的数据,美国是全球最大的原油生产国,占14.5%。此外,根据英国石油公司 (BP) 的数据,2021 年美国石油产量总计约为 16,585,000 桶/日。这一趋势预计将支持石油和天然气领域的研究市场。

- 由于上述因素,预计在预测期内各行业对稀有气体的需求将会增加。

稀有气体产业概述

惰性气体市场已部分整合。该市场的主要企业(排名不分先后)包括BASF股份公司、空气化学产品公司、液化空气公司、林德公司和梅塞尔北美公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 医疗产业需求不断成长

- 钢铁和汽车工业的扩张

- 抑制因素

- 稀有气体价格波动

- 需要高效率的气体萃取方法

- 产业价值链分析

- 波特五力

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(金额:百万美元)

- 类型

- 氦

- 氪

- 氩气

- 氖

- 氙

- 放射性氡

- 目的

- 影像投影

- 麻醉剂

- 焊接

- 绝缘

- 照明

- 电视管

- 广告

- 冷媒

- 工作液

- 化学分析

- 最终用户产业

- 石油和天然气

- 矿业

- 医疗保健

- 航太

- 建造

- 能源/电力

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Air Liquide

- Air Products and Chemicals Inc.

- Airgas Inc.

- American Gas

- BASF SE

- Buzwair Industrial Gases Factories

- Gulf Cryo

- ITM Power

- Linde plc

- Messer North America, Inc.

- Praxair Technology, Inc.

- Ras Gas Company Limited

- Royal Dutch Shell PLC

- TAIYO NIPPON SANSO CORPORATION

第七章 市场机会及未来趋势

- 增加在医疗应用的使用

The Noble Gas Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 had a positive impact on the noble gas market. Noble gases are primarily used in the healthcare sector and were largely unaffected by the COVID-19 pandemic. The demand for helium, neon, and argon increased during the pandemic for medical Purposes, which in turn increased the consumption of noble gases in the healthcare industry.

Key Highlights

- Increasing demand from the healthcare industry and the expansion of the steel and automotive industry are expected to drive the noble gas market's growth.

- Growing usage in medical applications is likely to act as an opportunity in the future.

- However, the need for a high-efficient gas-extracting method and fluctuating prices of noble gases are the major factors hindering the growth of the studied market.

- United States is expected to dominate the noble gas market in North America and is also likely to witness the highest CAGR during the forecast period.

Noble Gas Market Trends

Increasing Demand from the Healthcare Industry

- Noble gases find usage in a wide range of applications. They have the highest demand in the medical sector as they are involved in the cooling of superconducting magnets in magnetic resonance imaging (MRI) scanners.

- Helium has been effective in a variety of respiratory conditions, including upper airway obstruction, asthma exacerbation, post-extubation strido, etc. Microscopy has opened new possibilities for the use of helium gas in the technologically advanced fields of medicine.

- Other noble gases, such as argon and xenon, are also used for various medical purposes. Argon is used as an anesthetic and neuroprotective agent, and xenon is found to be effective in the field of neuroprotective and anesthesia.

- Moreover, countries such as China, the United States, Japan, etc., are the major countries contributing to the revenue of the healthcare sector. Rising health concerns and focus on the medical sector in developing economies, mainly in the Asia-Pacific region, including India, Japan, and China, have witnessed a great demand for such gases.

- According to the Centers for Medicare & Medicaid Services, national health expenditures (NHE) in the United States grew 2.7% to USD 4.3 trillion in 2021, accounting for 18.3% of the Gross Domestic Product (GDP).

- According to the National Bureau of Statistics of China, overall healthcare expenditure in China was around 7.7 trillion yuan (USD 1.19 trillion) in 2021, representing a 6.4% increase over the previous year.

- Such positive growth in the healthcare industry is likely to increase the demand for noble gas in the forecast period.

United States to Dominate the North America Region

- North America holds the highest market share in terms of revenue, due to the increasing demand for consumer and investment goods, especially in the United States.

- It is estimated that the noble gas market in the United States is likely to witness healthy growth on account of increased demand from aerospace, oil and gas, health, and laser applications.

- The presence of large manufacturing industries associated with construction, healthcare, automobiles, and semiconductors is expected to be a factor that will support the growth of the noble gases market in the country.

- In the oil and gas industry, noble gas is widely used in the exploration and production of crude oil. The noble gas data permit an accurate description of complex natural and technological processes involved in exploring and extracting oil and gas discoveries.

- According to the Centers for Medicare & Medicaid Services, national health expenditures (NHE) in the United States are projected to rise 5.1 percent annually from 2021 to 2030. This trend is indicating about the future opportunity for noble gases in the healthcare sector.

- According to the EIA, the United States is the largest producer of crude oil, with a share of 14.5% across the world. Furthermore, according to BP, the production of oil in the United States was about 16,585 thousand barrels per day in 2021. This trend is expected to support the studied market in the oil and gas sector.

- Owing to the aforementioned factors, the demand for noble gases is expected to increase in various industries during the forecast period.

Noble Gas Industry Overview

The noble gas market is partially consolidated in nature. Some of the major players (not in any particular order) in the market include BASF SE, Air Products and Chemicals, Inc, Air Liquide, Linde plc, and Messer North America, Inc, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand in the Healthcare Industry

- 4.1.2 Expansion of Steel and Automotive industry

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Noble gases

- 4.2.2 Need of high-efficient gas extracting method

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Value in USD Million)

- 5.1 Type

- 5.1.1 Helium

- 5.1.2 Krypton

- 5.1.3 Argon

- 5.1.4 Neon

- 5.1.5 Xenon

- 5.1.6 Radioactive Radon

- 5.2 Application

- 5.2.1 Picture Projection

- 5.2.2 Anesthetic

- 5.2.3 Welding

- 5.2.4 Insulation

- 5.2.5 Lighting

- 5.2.6 Television Tubes

- 5.2.7 Advertising

- 5.2.8 Refrigerant

- 5.2.9 Working Fluid

- 5.2.10 Chemical Analysis

- 5.3 End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Mining

- 5.3.3 Healthcare

- 5.3.4 Aerospace

- 5.3.5 Construction

- 5.3.6 Energy and Power

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products and Chemicals Inc.

- 6.4.3 Airgas Inc.

- 6.4.4 American Gas

- 6.4.5 BASF SE

- 6.4.6 Buzwair Industrial Gases Factories

- 6.4.7 Gulf Cryo

- 6.4.8 ITM Power

- 6.4.9 Linde plc

- 6.4.10 Messer North America, Inc.

- 6.4.11 Praxair Technology, Inc.

- 6.4.12 Ras Gas Company Limited

- 6.4.13 Royal Dutch Shell PLC

- 6.4.14 TAIYO NIPPON SANSO CORPORATION

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing usage in medical applications