|

市场调查报告书

商品编码

1628708

日本塑胶包装:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Japan Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

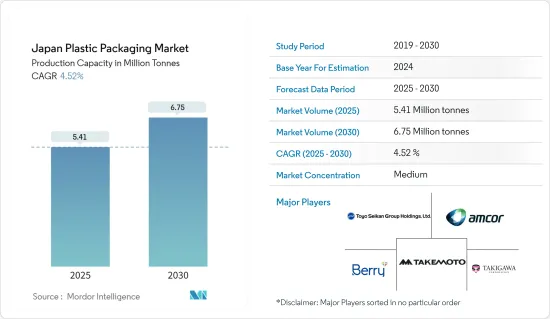

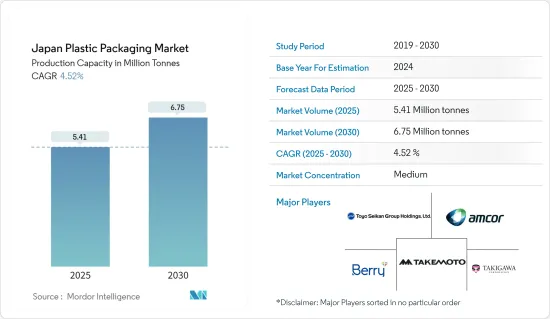

以产能计算,日本塑胶包装市场规模预计将从2025年的541万吨成长到2030年的675万吨,预测期间(2025-2030年)复合年增长率为4.52%。

食品和饮料业正在推动日本的塑胶包装市场。塑胶包装因其重量轻、不易破碎且易于处理而深受消费者欢迎。

主要亮点

- 在日本,消费者青睐塑胶包装,因为其耐用性、灵活性和成本效益。这种形式的包装使用塑胶薄膜、容器和其他聚合物材料来形成针对外部因素的屏障。这种多功能性使其成为包装各种产品的轻量级解决方案。食品和饮料、化妆品和药品等行业越来越依赖塑胶包装,这推动了对其产品的需求。

- 日本塑胶容器和包装製造商透过专注于为不同的最终用途行业开发刚性和柔性包装解决方案,有望实现显着成长。 2024年10月,凸版株式会社与RM Tohcello和三井化学株式会社合作,成功开发出可大量生产的再生BOPP薄膜。样品分发将于 2024 年 10 月开始。

- 新灌装技术和耐热宝特瓶的出现扩大了国内市场的可能性。为了满足不断增长的需求,饮料製造商正在日本提高宝特瓶的产量。

- 2024 年 9 月,可口可乐装瓶日本公司 (CCBJI) 宣布在爱知县东海工厂建造一条新的无菌生产线。该生产线的生产能力约为每分钟 600 个小宝特瓶,将增强 CCBJI应对力。

- 然而,塑胶废弃物的激增导致日本消费者寻求更环保的包装材料,例如玻璃和金属。该地区铝和玻璃的使用显着增加,这些材料被认为是可回收且环保的。这种远离塑胶的转变可能会对未来的产品需求带来挑战。

日本塑胶包装市场趋势

瓶子和罐子主导市场的前景

- 塑胶的轻质特性正在推动需求成长。在日本,食品和饮料行业对宝特瓶和罐的依赖日益增加,推动了对塑胶包装的需求。

- 宝特瓶的用途已扩展到饮料之外,目前在日本化妆品和製药领域备受关注。随着先进填充技术和耐热宝特瓶的推出等创新,市场动态不断发展。虽然宝特瓶在各个领域都处于领先地位,但聚乙烯 (PE) 瓶是饮料、化妆品、卫生用品和清洁剂等家用产品的首选。

- 日本公司正在增加饮料用宝特瓶的产量,这一趋势将推动市场成长。 2024年3月,日本大冢食品公司宣布计划推出碳酸维生素饮料「MATCH」系列两款新产品:500ml宝特瓶「MATCH菠萝汽水」和260g宝特瓶「MATCH菠萝汽水」匹配果冻」。

- 日本软性饮料协会的宏伟目标是到 2030 年实现 50% 的瓶对瓶回收率。工业公司正在努力使宝特瓶变得更轻,以减少 PET 树脂的使用量。日本软性饮料协会(JSDA)的资料显示,在日本非酒精饮料领域, 宝特瓶已超过钢瓶和玻璃瓶。此外,严格的政府法规使日本成为宝特瓶收集和回收的全球领导者,这是刺激市场成长的因素。

- 据经济产业省报告称,2023年日本塑胶包装产量与前一年同期比较减少10万吨(9.01%)。然而,预测显示 2024 年将反弹至 109 万吨,显示市场潜在成长。

饮料业成长显着

- 在健康饮料需求不断增长的推动下,日本饮料业正在大幅扩张。消费者越来越倾向于那些承诺对健康有益的饮料,例如增强免疫力、改善消化和增强认知功能。这种趋势在老年人和麵临与生活方式相关的健康挑战的人中尤其明显。

- 在日本,硬质塑胶包装(常见于宝特瓶和容器)广泛支持食品和饮料应用。使用 HDPE 和宝特瓶包装果汁、碳酸软性饮料和其他饮料,大大推动了对这些产品的需求。值得注意的是,像东洋製罐这样的製造商生产专门用于饮料用途的耐热耐压宝特瓶。

- 注重天然成分与科学进步结合的技术创新正在重塑日本的饮料产业。 2024年,软性饮料、运动饮料、能量饮料等细分市场将代表消费者对机能饮料的多样化偏好。透过优先考虑创新、有针对性的行销和永续性,公司可以在日本快速成长的机能饮料领域中取得一席之地。

- 此外,根据美国农业部(USDA)的资料,2023年日本非酒精饮料市场价值约400亿美元,其中进口额约为10亿美元。美国是日本非酒精饮料的主要供应国,出口主要为矿泉水和果汁。健康饮料和无酒精啤酒正在成为主要消费趋势,极大地影响了塑胶包装的需求。

- 日本对非酒精饮料的强劲购买兴趣正在加强塑胶包装领域。日本领先企业朝日集团控股公司的报告显示,到 2023 年,即饮茶将引领软性饮料领域,约占销售额的 30%。日本非酒精饮料类型的多样性推动了对刚性和软包装解决方案的需求。

日本塑胶包装产业概况

日本塑胶包装市场主要由 Amcor Group、Takemoto Yohki、Toyo Seikan Group Holdings Ltd、Berry Global Inc. 和 Takikawa Corporation 等公司组成,这些公司积极寻求产品创新、合作和併购,以扩大业务并提高产量。市场占有率。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 日本多个最终用户产业对塑胶包装解决方案的需求不断增长

- 塑胶饮料瓶在日本越来越受欢迎

- 市场问题

- 日本对塑胶包装回收的环境担忧日益严重

第六章 行业法规、政策与标准

第七章 市场区隔

- 按包装类型

- 软质塑胶包装

- 硬质塑胶包装

- 依产品类型

- 瓶子和罐子

- 托盘和容器

- 小袋

- 包包

- 薄膜包装

- 其他的

- 按行业分类

- 食物

- 饮料

- 医疗保健

- 个人护理和家居产品

- 其他的

第八章 竞争格局

- 公司简介

- Amcor Group

- Takemoto Yohki Co. Ltd.

- Berry Global

- Takigawa Corporation

- Toyo Seiken Group Holdings Ltd.

- Sonoco Products Company

- Sealed Air Corporation

- Hosokawa Yoko Co. ltd.

- Toppan Inc.

- Kodama Plastics Co. Ltd.

- 热图分析

- 竞争对手分析 -新兴企业与老牌公司

第九章投资分析

第10章市场的未来

The Japan Plastic Packaging Market size in terms of production capacity is expected to grow from 5.41 million tonnes in 2025 to 6.75 million tonnes by 2030, at a CAGR of 4.52% during the forecast period (2025-2030).

The food and beverage industry drives the plastic packaging market in Japan. Consumers favor plastic packaging for its lightweight and unbreakable nature, enhancing ease of handling.

Key Highlights

- In Japan, consumers favor plastic packaging for its durability, flexibility, and cost-effectiveness. This packaging form employs plastic films, containers, and other polymer-based materials, creating a barrier against external elements. This versatility makes it a lightweight solution for packaging various goods. Industries such as beverage, food, cosmetics, and pharmaceuticals increasingly rely on plastic container packaging, which drives the product demand.

- Japanese manufacturers of plastic packaging are poised for substantial growth by focusing on the development of both rigid and flexible packaging solutions tailored to diverse end-use industries. In October 2024, Toppan Inc., in collaboration with RM Tohcello Co. Ltd. and Mitsui Chemicals Inc., has successfully created a recycled BOPP film primed for mass production. Starting October 2024, these companies will commence the distribution of samples for this innovative film.

- New filling technologies and the advent of heat-resistant PET bottles have broadened market possibilities in the country. In response to rising demand, beverage manufacturers are ramping up PET bottle production in Japan.

- In September 2024, Coca-Cola Bottlers Japan Inc. (CCBJI) unveiled a new aseptic production line at its Tokai Plant in Aichi Prefecture. This line boasts a production capacity of around 600 small PET bottles per minute, bolstering CCBJI's ability to meet surging demand.

- However, a surge in plastic waste has led Japanese consumers to gravitate towards eco-friendlier packaging materials such as glass and metal. The region has seen a notable uptick in the adoption of aluminum and glass, celebrated for their recyclability and eco-friendly attributes. This shift away from plastic could pose challenges for product demand in the future.

Japan Plastic Packaging Market Trends

Bottles and Jars Segment is Expected to Dominate the Market

- The lightweight nature of plastics fuels their rising demand. In Japan, the food and beverage sector's increasing reliance on plastic bottles and jars propels the need for plastic packaging.

- Plastic bottles extend their utility beyond beverages, finding prominence in Japan's cosmetics and pharmaceuticals sectors. Market dynamics are evolving with innovations like advanced filling technologies and the launch of heat-resistant PET bottles. While PET bottles lead in various sectors, polyethylene (PE) bottles are the preferred choice for beverages, cosmetics, sanitary items, and household items such as detergents.

- Japanese companies are increasingly producing PET bottles for beverages, a trend poised to fuel market growth. In March 2024, Otsuka Foods Co., Ltd., a prominent player based in Japan, unveiled its plans to launch two new products in its MATCH line of carbonated vitamin drinks: MATCH Pineapple Soda in a 500-ml PET bottle and MATCH Jelly in a 260-gram PET bottle in the Japanese market.

- The Japan Soft Drink Association has set an ambitious goal of achieving 50% bottle-to-bottle recycling by 2030. Industry players are lightening the weight of PET bottles to reduce the amount of PET resin used. Data from the Japan Soft Drink Association (JSDA) highlights that PET bottles have overtaken steel and glass in the country's non-alcoholic beverage sector. Furthermore, stringent government regulations have positioned Japan as a global leader in PET bottle collection and recycling, a factor poised to stimulate market growth.

- As reported by the Ministry of Economy, Trade and Industry (METI) Japan, the country's plastic packaging production saw a dip of 0.1 million tons (-9.01 percent) in 2023 compared to the prior year. However, projections indicate a rebound to 1.09 million tons in 2024, signaling potential market growth.

Beverage Industry Set for Significant Growth

- Japan's beverage industry is expanding significantly, fueled by a rising demand for health-oriented drinks. Consumers are increasingly gravitating towards beverages that promise health benefits, including immunity enhancement, better digestion, and sharper cognitive functions. This trend is especially evident among the elderly and those facing health challenges linked to their lifestyles.

- In Japan, rigid plastic packaging, commonly found in plastic bottles and containers, is widely favored for food and beverage applications. The demand for these products is notably driven by the use of HDPE and PET bottles for packaging juices, carbonated soft drinks, and other beverages. Notably, manufacturers such as Toyo Seikan Co. Ltd. are producing heat and pressure-resistant PET bottles tailored specifically for beverage applications.

- Innovations are reshaping Japan's beverage landscape, with a focus on merging natural ingredients and scientific advancements. In 2024, segments such as soft drinks, sports drinks, and energy drinks are poised to showcase the varied consumer preferences for functional beverages. By prioritizing innovation, targeted marketing, and sustainability, companies can cement their foothold in Japan's burgeoning functional beverage arena.

- Additionally, data from the US Department of Agriculture (USDA) reveals that Japan's non-alcoholic beverage market was valued at approximately USD 40 billion in 2023, with imports accounting for about USD 1 billion. The U.S. stands as Japan's chief supplier of non-alcoholic drinks, with exports predominantly comprising mineral water and juices. Healthy beverages and non-alcoholic beers are emerging as leading consumer trends, significantly influencing the demand for plastic packaging.

- Japan's surging appetite for non-alcoholic drinks is bolstering its plastic packaging sector. As reported by Asahi Group Holdings, a prominent Japanese firm, Ready-to-Drink (RTD) tea led the soft drinks segment in 2023, capturing roughly 30% of sales. The diverse range of non-alcoholic beverages in Japan is driving a heightened demand for both rigid and flexible packaging solutions in the nation.

Japan Plastic Packaging Industry Overview

The Japanese plastic packaging market is moderately consolidated with the presence of global and domestic players such as Amcor Group, Takemoto Yohki Co. Ltd, Toyo Seikan Group Holdings Ltd, Berry Global Inc. and Takigawa Corporation. These companies are actively pursuing strategies such as product innovations, collaborations, mergers and acquisitions, and investments to expand their business and capture a larger market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand of Plastic Packaging Solutions for Multiple End-User Industries in Japan

- 5.1.2 Rising Popularity of Plastic Bottles for Beverage Industry in Japan

- 5.2 Market Challenges

- 5.2.1 Increasing Environmental Concerns Regarding Plastic Packaging Recycling in Japan

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGEMENTATION

- 7.1 By Packaging Type

- 7.1.1 Flexible Plastic Packaging

- 7.1.2 Rigid Plastic Packaging

- 7.2 By Product Type

- 7.2.1 Bottles and Jars

- 7.2.2 Trays and containers

- 7.2.3 Pouches

- 7.2.4 Bags

- 7.2.5 Films and Wraps

- 7.2.6 Other Product Types

- 7.3 By End-User Vertical

- 7.3.1 Food

- 7.3.2 Beverage

- 7.3.3 Healthcare

- 7.3.4 Personal Care and Household

- 7.3.5 Other End-Users

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor Group

- 8.1.2 Takemoto Yohki Co. Ltd.

- 8.1.3 Berry Global

- 8.1.4 Takigawa Corporation

- 8.1.5 Toyo Seiken Group Holdings Ltd.

- 8.1.6 Sonoco Products Company

- 8.1.7 Sealed Air Corporation

- 8.1.8 Hosokawa Yoko Co. ltd.

- 8.1.9 Toppan Inc.

- 8.1.10 Kodama Plastics Co. Ltd.

- 8.2 Heat Map Analysis

- 8.3 Competitor Analysis - Emerging vs. Established Players