|

市场调查报告书

商品编码

1628709

安全驱动和马达:市场占有率分析、行业趋势和成长预测(2025-2030)Safety Drives and Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

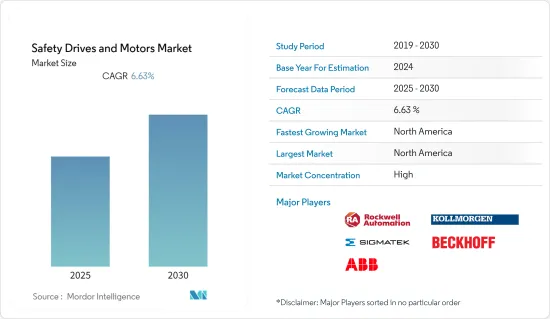

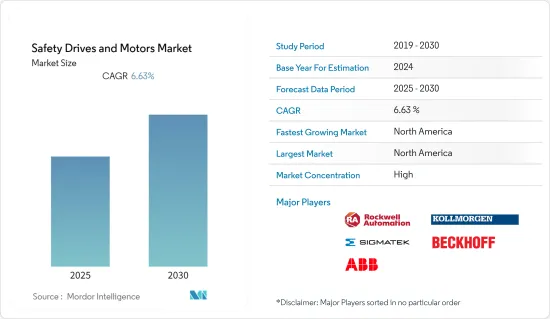

预计安全驱动和马达市场在预测期内复合年增长率为 6.63%

主要亮点

马达用于为各种机器动力来源,包括输送系统和重型工业设备。自动化的日益普及需要对工业机械进行精确控制,以实现资源的最佳利用并保持预定的运作品质。

引入电动装置来控制机械和其他设备的运动和速度。在处理精緻、易碎或易爆产品的製造环境中,这些需求尤其高。人们对工业安全的日益关注正在推动全球对安全驱动和马达系统的需求。

然而,采矿业的大幅放缓限制了市场的成长。所有主要矿业巨头,包括加拿大、澳洲、乌克兰和俄罗斯等国家,矿业市场成长都已放缓,甚至在某些情况下出现下降。监管限制的增加是市场放缓的主要原因。

安全驱动和马达市场趋势

石油和天然气占最大的市场占有率

- 电力驱动器和马达在石油和天然气生产和发行、抽油系统以及天然气基础设施的压缩传动系统中发挥关键作用。

- 据 GE 称,由于马达故障导致的非计划性停电,每停电 30 分钟就会给炼油厂造成 110 万美元的收益损失。

- 因此,石油和天然气产业越来越多地使用变频驱动装置(VFD) 来控制流量和速度调节,以避免限制器中的能源浪费。

- 利莱森玛总部位于法国,是石油和天然气供应链驱动系统的先驱。该公司的产品包括Dyneo®永磁同步马达、ATEX粉尘和气体安全马达以及Powerdrive MD2交流变频器,这些产品以其可靠性、坚固性、效率和灵活性而闻名。

- GE 提供完整的解决方案,使用由基于闸流体技术(用于 LCI)或 IGBT 技术的高功率驱动器驱动的电动马达(同步或感应)来驱动主冷媒压缩机。这将支援液化天然气供应链的加工、运输和分销网路。

- 中东作为最大的石油和天然气生产国,在石油和天然气领域规划了许多活跃的计划。

北美占据主要市场占有率

- 北美是全球最大的安全驱动器和马达市场之一。该地区上游石油和天然气行业以及工业部门的需求很高。事实上,该地区是世界上采用工业4.0政策最多的地区之一。此外,美国政府增加产量和减少对出口依赖的政策预计将成为工业部门需求的主要推动力。

- 根据BP《2019年世界能源统计年鑑》,全球石油产量增加220万桶/日。最大的净增量来自美国,产量增加了 220 万桶/日。美国的天然气消费量也以 78 bcm 的增幅领先。

- 此外,美国内政部 (DoI) 将允许根据国家外大陆棚石油和天然气租赁计划(国家 OCS 计划)从 2019 年至 2024 年在约 90% 的外大陆棚(OCS) 英亩土地上进行海上勘探钻探该地区的石油和天然气产业可望开闢新的市场机会。

- 然而,加拿大采矿业的衰退限制了该地区的市场成长。根据加拿大矿业协会统计,2018年至2028年间规划和建设的采矿计划总价值自2014年以来下降了55%。这是由于人们对加拿大新兴大麻产业的兴趣增加,该产业在 2018 年 10 月娱乐性使用大麻合法化后受到关注。

安全驱动和马达产业概述

该市场集中在石油和天然气、石化和化学、能源和公共事业行业的几大需求参与者,占据最大的市场占有率。

- 2019 年 6 月 - 总部位于林茨的 KEBA Group 收购了德国驱动解决方案先驱 LTI Motion Group。我们为机械工程领域的客户提供服务。透过此次收购,KEBA成为工业自动化领域整体解决方案供应商。

- 2018 年 10 月 - 罗克韦尔自动化推出整合安全功能选项模组,为 Allen-Bradley PowerFlex 755 和 755T交流变频器提供基于 IEC 61800-5-2 标准的多种安全功能。这包括监控 EtherNet/IP 网路上的速度、方向和位置的能力。

- 2019 年 9 月 - Beckhoff Automation 扩大了在东北地区的业务范围,在大波士顿和费城设立了新办事处。我们为希望提高基于 PC 的控制、高级运动控制、机电一体化和 EtherCAT工业乙太网技术方面专业知识的 Beckhoff 客户提供教育机会。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 随着自动化的进步,需要对工业机械进行精确控制,以促进市场成长。

- 市场限制因素

- 由于监管限制,采矿业大幅放缓,对市场成长构成挑战

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 驾驶

- AC

- DC

- 马达

- AC

- DC

- 驾驶

- 按最终用户产业

- 能源/电力

- 製造业

- 矿业

- 石油和天然气

- 化学/石化

- 建造

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Rockwell Automation Inc.

- SIGMATEK Safety Systems

- ABB Ltd

- Beckhoff Automation GmbH

- KOLLMORGEN Corporation

- Siemens AG

- KEBA Corporation

- Hoerbiger Holding AG

- Pilz International

- WEG SA

第七章 投资分析

第八章 市场机会及未来趋势

The Safety Drives and Motors Market is expected to register a CAGR of 6.63% during the forecast period.

Key Highlights

Electric motors are used to power a wide range of machinery, including conveyer systems and heavy industrial equipment. Growing adoption of automation has created a need for accurate control of industrial machinery to realize optimal use of resources and maintain predefined quality of operation.

Electric drives aredeployed to control the movements and speeds of the machinery and other devices. This need is particularly high in manufacturing environments that deal with sensitive, fragile or explosive products. Growing focus on safety in such industries is driving the demand for safety drives and motor systems globally.

However, considerable slowdown in the mining industry is restraining the growth of the market. All the major mining giants, including countries, like Canada, Australia, Ukraine, Russia, etc., have recorded slow growth or in some case, decline in the mining market. Increasing regulatory constraints stand to be the major cause for slowdown in the market.

Safety Drives Motors Market Trends

Oil & Gas to Occupy the Maximum Market Share

- Electric drives and motors play a major role in the oil & gas production and distribution, pumping systems for oil and compression drive trains for gas infrastructure.

- According to GE, unplanned outages from moto failure can cause a refinery revenue loss of USD 1.1 million for every half hour offline.

- With this, VFDs (Variable Frequency Drives) are increasingly being used in the oil & gas industry to control the flow, by adjusting speed that avoids energy wastage in the throttling valves.

- France-based Leroy Somer is a pioneer in drive system for oil & gas supply chain. Some of their products are Dyneo(R) Permanent Magnet Synchronous Motors, ATEX Dust and Gas Safety Motors, Powerdrive MD2 AC Drives which are known for offering reliability, robustness, efficiency and flexibility.

- GE is providing a complete solution to drive the main refrigerant compressors using electrical motors (synchronous or induction) powered by high-power drives based on thyristor technology (for LCI) or IGBT technology. This would assist LNG supply chain in processing, transport and distribution network.

- There are many active and planned project work in the oil and gas sector across the Middle East, which is the largest producer of oil & gas.

North America to Occupy Major Market Share

- North America is one of the largest markets for safety drives and motors globally. The region has a high demand form the upstream oil and gas sector and industrial segment. In fact it is one of the largest adopter of industry 4.0 policies in the world. Additionally, the US government's policies to increase production and depend less on exports is expected to be the primary driver for demand from the industrial sector.

- According to BP Statistical Review of World Energy 2019, global oil production rose by 2.2 million b/d. Maximum net increase was accounted for by the US, with their growth in production of 2.2 million b/d. Growth in gas consumption was also driven by the United States at 78 bcm.

- Moreover, with the United States Department of the Interior (DoI) planning to allow offshore exploratory drilling in about 90% of the outer continental shelf (OCS) acreage, under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open up new opportunities to the market.

- However declining mining industry in Canada is restraining the market growth in this region. According to the Mining Association of Canada, value of total mining projects planned and under construction from 2018 to 2028 has reduced by 55% since 2014. This was due to an increasing interest in Canada's emerging cannabis sector, which gained attention after recreational use of marijuana was legalized in October 2018.

Safety Drives Motors Industry Overview

The market is concentrated with some major players occupying maximum market share which are in demand byOil and Gas, Petrochemicals and Chemicals, and Energy utility industries.

- June 2019 - The Linz-based KEBA Groupacquired LTI Motion Group, a pioneer of drive solutions from Germany. It servescustomers in mechanical engineering sectors. The acquisition makes KEBA a total solution provider in the area of industrial automation.

- October 2018 - Rockwell Automation launched theIntegrated Safety Functions Option Module which offers several safety functions based on IEC 61800-5-2 standards for Allen-Bradley PowerFlex 755 and 755T AC drives. It includes the ability to monitor speed, direction and position on an EtherNet/IP network.

- September 2019 -Beckhoff Automationexpanded its footprint in the Northeast region with new offices in Greater Boston and Philadelphia. It now offerseducational opportunities for Beckhoff customers who want to increase their expertise in PC-based control, advanced motion control, mechatronics and EtherCAT industrial Ethernet technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Adoption of automation has Created a Need for Accurate Control of Industrial Machinery, thus Helping in Market Growth

- 4.4 Market Restraints

- 4.4.1 Considerable Slowdown in Mining Industry due to Regulatory Constraints is Challenging the Market Growth

- 4.5 Value Chain n Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Drives

- 5.1.1.1 AC

- 5.1.1.2 DC

- 5.1.2 Motors

- 5.1.2.1 AC

- 5.1.2.2 DC

- 5.1.1 Drives

- 5.2 By End-user Vertical

- 5.2.1 Energy and Power

- 5.2.2 Manufacturing

- 5.2.3 Mining

- 5.2.4 Oil and Gas

- 5.2.5 Chemical and Petrochemical

- 5.2.6 Construction

- 5.2.7 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Rockwell Automation Inc.

- 6.1.2 SIGMATEK Safety Systems

- 6.1.3 ABB Ltd

- 6.1.4 Beckhoff Automation GmbH

- 6.1.5 KOLLMORGEN Corporation

- 6.1.6 Siemens AG

- 6.1.7 KEBA Corporation

- 6.1.8 Hoerbiger Holding AG

- 6.1.9 Pilz International

- 6.1.10 WEG SA