|

市场调查报告书

商品编码

1628714

欧洲环氧树脂:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Epoxy Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

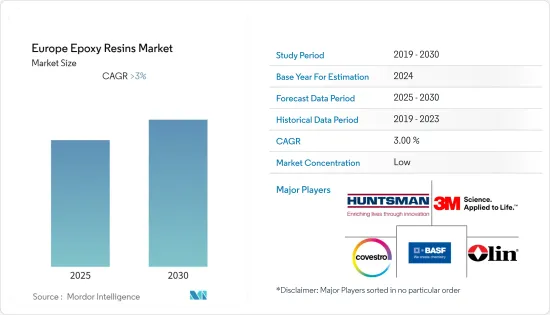

预计欧洲环氧树脂市场在预测期内将维持3%以上的复合年增长率

主要亮点

- COVID-19 对 2020 年市场产生了负面影响。不过,预计2022年市场将达到疫情前水平,并持续稳定成长。

- 建筑业的成长以及汽车业对黏合剂和密封剂需求的增加预计将推动市场成长。另一方面,环氧树脂的有害影响预计将阻碍市场成长。

- 在预测期内,越来越多地采用可回收和可改性环氧树脂预计将成为市场机会。德国在欧洲环氧树脂市场占据主导地位,大部分需求来自油漆和涂料行业。

欧洲环氧树脂市场趋势

油漆和涂料领域占据市场主导地位

- 环氧树脂是由涉及环氧化物单元的反应过程产生的石油资源衍生的增强聚合物复合材料。这些树脂在涂料应用中用作黏合剂,以提高地板和金属应用涂料的耐久性。

- 环氧树脂有助于提高涂层的多种性能,包括强度、耐久性和耐化学性。快干、韧性、附着力好、固化性好、耐磨、耐水性好等特性和能力使其适合保护金属和其他表面。

- 环氧粉末涂料用于洗衣机、烘干机、钢管、配件等。由于其灵活的适用性,它也用于石油和天然气工业、水管道和混凝土钢筋。

- 汽车、船舶和航太工业使用环氧涂料作为底漆来防止腐蚀。 2021年,义大利造船商Fincantieri签署了建造两艘氢动力邮轮的协议备忘录(MOA),将于2027-28年交付,推动了船舶行业对环氧涂料的需求。

- 该地区的住宅也大幅增加,包括住宅和中檔住宅,预计将推动市场成长。例如,Thorpebury Housing Community 在 2022 年第一季启动了价值 7.09 亿美元的建设计划。该计划旨在在英格兰东米德兰占地 364 公顷的土地上建造 4,500 套住宅,并正在推动建设产业环氧树脂油漆和涂料行业的成长。

- 此外,根据联合国欧洲经济委员会(UNEC)的数据,欧洲国家之间建设业占GDP的比重差异很大。 2021年,阿尔巴尼亚建筑业约占GDP的11%,德国为5.9%,法国为5.6%,贡献了该地区对环氧树脂的需求。

- 预计这些因素将推动油漆和涂料中环氧树脂的需求,并促进预测期内的市场成长。

德国实现最高成长

- 由于建筑、电气和电子以及其他几个行业的扩张,预计德国市场在预测期内将显着成长。

- 在商业建设活动增加的推动下,该国的建设产业正在经历显着增长。例如,价值12.93亿美元的OstendstraBe1-14商业建筑建设计划于2022年第一季在德国柏林开工。该计划旨在满足德国对办公、零售、酒店和商业房地产不断增长的需求。

- 多个住宅计划也在进行中。例如,价值18.31亿美元的KrampnitzHousing开发计划正在德国勃兰登堡建设,预计将于2038年第四季完工。该计划旨在为10,000人提供居住空间。

- 因此,随着国内建筑和其他行业的成长,油漆和涂料行业对环氧树脂的需求预计在未来几年将扩大。

- 此外,德国也订单了开发液化天然气动力来源邮轮的订单。例如,2021年,德国造船厂Flensburger Schiffbau-Gesellschaft(FSG)与塔斯马尼亚航运公司SeaRoad合作建造了价值1.1729亿美元的新型液化天然气(LNG)驱动滚装卡车。由此可见,随着国家海洋产业的扩张,环氧树脂的需求也大幅增加。

- 此外,德国汽车产业对环氧树脂的需求很大。在德国,2021年二手车销量将成长33%,卡车销量将成长9%,推动汽车重涂领域对环氧树脂的需求。此外,2021年新卡车销量较2020年成长约8%。

- 因此,所有上述因素都对预测期内德国环氧树脂需求的成长做出了重大贡献。

欧洲环氧树脂产业概况

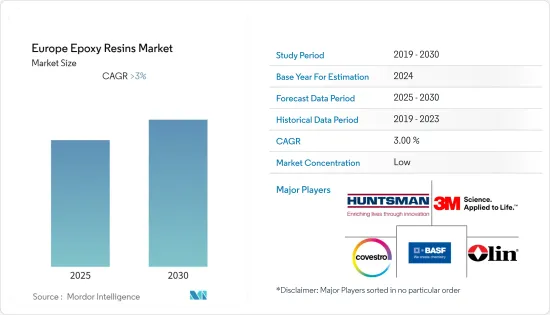

欧洲环氧树脂市场因其性质而部分分散。该市场的主要企业包括 3M、Covestro AG、 BASF SE、Huntsman International LLC 和 Olin Corporation。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业的成长

- 汽车产业对黏合剂和密封剂的需求增加

- 抑制因素

- 环氧树脂的危险影响

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 按原料分

- DGBEA(双酚 A 和 ECH)

- DGBEF(双酚 F 和 ECH)

- 酚醛清漆(甲醛和苯酚)

- 脂肪族(脂肪醇)

- 缩水甘油胺(芳香胺和ECH)

- 其他原料

- 按用途

- 油漆和被覆剂

- 黏合剂和密封剂

- 复合材料

- 电力/电子

- 风力发电机

- 其他用途

- 按地区

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- BASF SE

- Covestro AG

- Daicel Corporation

- DuPont de Nemours, Inc.

- Westlake Corporation

- Huntsman International LLC

- Olin Corporation

- Sir Industriale

- Spolchemie

- Epoxy Europe

第七章 市场机会及未来趋势

- 扩大可回收和可改质环氧树脂的采用

简介目录

Product Code: 51757

The Europe Epoxy Resins Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The growing construction industry and increasing demand for adhesives and sealants from the automotive industry are expected to drive market growth. On the flip side, the hazardous impact of epoxy resins is expected to hinder the market's growth.

- The growing adoption of recyclable and reformable epoxy resin is expected to be a market opportunity in the forecast period. Germany dominates the Europe epoxy resins market, with most of the demand generating from the paints and coatings segment.

Europe Epoxy Resin Market Trends

Paints and Coatings Segment to Dominate the Market

- Epoxy resins are reinforced polymer composites derived from petroleum sources resulting from a reactive process involving epoxide units. These resins are used as binders for coating applications to enhance the durability of coating for floor and metal applications.

- Epoxy resins help develop several properties in coatings, such as strength, durability, and chemical resistance. Its properties and abilities of quick-drying, toughness, excellent adhesion, good curing, abrasion resistance, and excellent water resistivity make it suitable for protecting metals and other surfaces.

- Epoxy powder coatings are used on washers, dryers, steel pipes, and fittings. Due to its flexible applicability, it is also used in the oil and gas industry, water transmission pipelines, and concrete reinforcing rebar.

- The automotive, marine, and aerospace industries use epoxy coatings as primers for corrosion protection. In 2021, Fincantieri, an Italian shipbuilder, signed a memorandum of agreement (MOA) for the construction of two hydrogen-powered cruise ships to be delivered in 2027-28, driving the demand for epoxy coatings in the marine industry.

- Residential construction is also increasing significantly in the region comprising luxury and middle-class housing, which are expected to drive market growth. For instance, the Thorpebury Housing Community started a construction project worth USD 709 million in Q1 2022. The project aims to construct 4,500 homes on 364 ha of land in East Midlands, England, propelling the growth of the construction industry's epoxy resins paints and coatings segment.

- Furthermore, according to the United Nations Economic Commission (UNEC) for Europe, the construction industry's value as a percentage of GDP varied widely between European countries. In 2021, Albania's construction industry accounted for around 11% of GDP, Germany 5.9%, and France 5.6% , contributing to the demand for epoxy resins in the region.

- Such factors are expected to drive the demand for epoxy resins in paints and coatings, thus increasing the market's growth during the forecast period.

Germany to Witness Highest Growth

- Germany is expected to witness significant market growth during the forecast period owing to the expanding construction, electrical and electronics, and several other industries.

- The construction industry in the country has been growing considerably, driven by the increasing number of commercial construction activities. For instance, the OstendstraBe1-14 Commercial Buildings construction project worth USD 1,293 million was initiated in Q1 2022 in Berlin, Germany. The project aims to fulfill the growing demand for office, retail, hotel, and commercial facilities in Germany.

- Also, several residential construction projects are ongoing. For example, the KrampnitzHousing Development Project worth USD 1,831 million is under construction in Brandenburg, Germany, and is expected to be completed in Q4 2038. The project aims to provide living space for 10,000 people.

- Hence, with the growth of construction and building, and other sectors in the country, the demand for epoxy resins in the paints and coatings industry is expected to grow in the country in the upcoming years.

- Moreover, Germany received orders for the development of LNG-powered cruise ships. For instance, in 2021, Flensburger Schiffbau-Gesellschaft (FSG), a German shipbuilding yard, signed a contract with SeaRoad, a Tasmania-based transport firm, for the construction of a new roll-on/roll-off (RoRo) vessel with liquefied natural gas (LNG) propulsion worth USD 117.29 million. Thus, with the country's expanding marine industry, the demand for epoxy resins also increases significantly.

- Additionally, the country is also witnessing considerable epoxy resin demand from its automotive sector. Germany witnessed an increase in used car and truck sales in 2021, reflecting a 33% and 9% increase, respectively, contributing to the demand for epoxy resins in the automotive refinish sector. In addition, new truck sales increased by about 8% in 2021 compared to 2020.

- Thus, all the above-mentioned factors contribute significantly to the increasing demand for epoxy resins in Germany during the forecast period.

Europe Epoxy Resin Industry Overview

The Europe epoxy resins market is partially fragmented in nature. Some of the major players in the market include 3M, Covestro AG, BASF SE, Huntsman International LLC, and Olin Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Industry

- 4.1.2 Increasing Demand for Adhesives and Sealants from the Automotive Industry

- 4.2 Restraints

- 4.2.1 Hazardous Impact of Epoxy Resins

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenols)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Composites

- 5.2.4 Electrical and Electronics

- 5.2.5 Wind Turbines

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Russia

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 BASF SE

- 6.4.3 Covestro AG

- 6.4.4 Daicel Corporation

- 6.4.5 DuPont de Nemours, Inc.

- 6.4.6 Westlake Corporation

- 6.4.7 Huntsman International LLC

- 6.4.8 Olin Corporation

- 6.4.9 Sir Industriale

- 6.4.10 Spolchemie

- 6.4.11 Epoxy Europe

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption Of Recyclable And Reformable Epoxy Resin

02-2729-4219

+886-2-2729-4219