|

市场调查报告书

商品编码

1628716

美国缆线测井服务:市场占有率分析、产业趋势与成长预测(2025-2030)US Wireline Logging Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

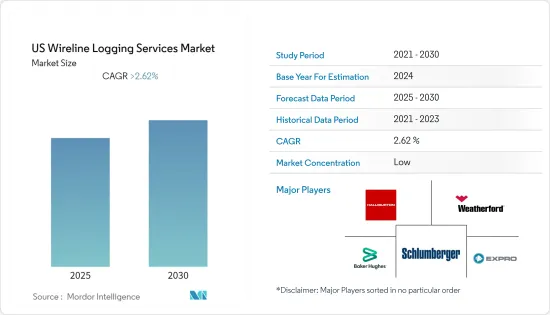

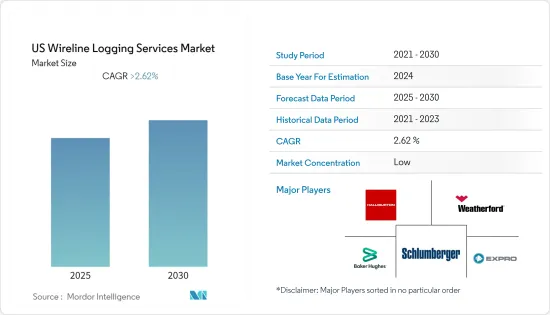

预计美国缆线测井服务市场在预测期内的复合年增长率将超过 2.62%。

COVID-19 大流行大大减少了全球对碳氢化合物的需求,对市场产生了重大影响。然而,市场现已復苏,预计在预测期内将达到疫情前的水平。

主要亮点

- 从长远来看,发电和供热产业对天然气的需求不断增加,预计将推动天然气产能增加的需求,从而在预测期内推动市场。

- 然而,对与水力压裂相关的环境问题的担忧预计将抑制页岩钻探,这可能对预测期内的市场成长产生负面影响。

- 越来越多的石油和天然气发现以及工业自由化为外国公司投资该国有缆线测井服务市场提供了有利可图的机会。

美国缆线测井服务市场趋势

陆上市场占主导地位

- 美国是世界主要石油和天然气生产国之一,近75%的石油产量生产陆上油田。该国大部分产量来自大型陆上页岩地层,主要是巴尼特页岩、海恩斯维尔页岩、巴肯页岩和阿纳达科-伍德福德页岩。德克萨斯州西部的二迭纪页岩地层是世界上最大的页岩地层之一,页岩开发成本最低。

- 根据贝克休斯钻机统计,截至 2022 年 12 月 9 日,美国和加拿大部署了 962 台陆地钻机。这显示了陆上和海上部门新钻探活动的差异。

- 根据最新的钻井产能报告,截至2022年11月,陆上已钻但未完井井近4,443口,比2022年9月已钻但未完井的4,421口陆上井增加了近0.4%。这些井中的大多数需要有线补充,这将是预测期内推动该国市场的关键因素。

- 因此,预计上述因素也会在预测期内推动市场,类似于近年来观察到的趋势。

页岩气钻探驱动市场

- 美国是世界上最大的页岩气生产国,儘管 COVID-19 大流行削弱了全球对碳氢化合物的需求并迫使钻探商关闭业务,但市场仍在反弹。

- 页岩气通常透过水力压裂储存来生产,以增加渗透性,使气体更容易流动。页岩气通常是纯度为 95% 的甲烷气体,含有很少的硫等杂质,使其加工成本比天然气便宜。

- 根据美国能源资讯署(EIA)的数据,2021年美国页岩地层的干天然气产量约为27.2兆立方英尺(Tcf),约占2021年美国干天然气总产量的79%。此外,2021年页岩气井回采总量约30 Tcf,与前一年同期比较增长约5.5%。

- 美国是全球水力压裂成本最低的国家之一,吸引了许多投资者投资这一领域,推动其在预测期内的成长。根据美国能源资讯署 (EIA) 的数据,美国近 95% 的钻井均采用水力压裂法。页岩井需要压裂和完井服务,其中大部分是使用有线进行的,预计这将在预测期内推动市场。

美国缆线测井服务业概况

美国缆线测井服务市场是细分的。在该市场运营的主要企业包括(排名不分先后)斯伦贝谢有限公司、哈里伯顿公司、贝克休斯公司、Expro Group 和 ADES International。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 截至 2022 年 12 月陆上及海上活跃钻机数量

- 即将实施的重大上游计划

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 部署

- 陆上

- 离岸

- 类型(仅限定性分析)

- 电线

- 滑线

- 孔类型(仅限定性分析)

- 裸井

- 下套管井

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Expro Group

- Weatherford International PLC

- Superior Energy Services Inc.

- RECON Petro Technologies Ltd.

- Pioneer Energy Services Corp.

- NexTier Oilfield Solution Inc.

第七章 市场机会及未来趋势

The US Wireline Logging Services Market is expected to register a CAGR of greater than 2.62% during the forecast period.

The market was severely impacted by the Covid-19 pandemic, as global demand for hydrocarbons plummeted. However, the market has since rebounded and is expected to reach pre-pandemic values during the forecast period.

Key Highlights

- Over the long term, as demand for natural gas from the power generation and heating sectors increases, it is expected to drive the demand for increasing natural gas production capacity, which is expected to drive the market during the forecast period.

- However, environmental concerns about fracking are expected to restrain shale drilling, which may negatively impact the market's growth during the forecast period.

- The increase in oil and gas discoveries, coupled with the liberalization of the industry, has opened lucrative opportunities for foreign players to invest in the country's studied wireline logging services market.

US Wireline Logging Services Market Trends

Onshore Segment to Dominate the Market

- The United States is one of the largest oil and natural gas producers globally, and nearly 75% of its oil production comes from onshore fields. Most of the country's production comes primarily from the massive onshore shale plays in the country, such as Barnett, Haynesville, Bakken, and Anadarko-Woodford shale plays. The Permian Shale play in West Texas is one of the largest shale plays globally, with the lowest shale development costs.

- According to Baker Hughes Rig Count, as of December 9th, 2022, the United States and Canada had nearly 962 land rigs being deployed, in contrast to the 20 offshore rigs active during the same time. This demonstrates the disparity between new drilling activity in the onshore and offshore segments.

- According to the latest drilling productivity report, as of November 2022, there were nearly 4443 drilled but uncompleted onshore wells, up by almost 0.4% from 4421 drilled but uncompleted onshore wells in September 2022. As most of these wells will require wireline completion, This provides a significant factor driving the market in the country during the forecast period.

- Therefore, the factors above are expected to drive the market in the forecast period, similar to the trend witnessed in recent years.

Shale gas drilling to drive the market

- The United States is the world's largest shale gas producer, and despite the Covid-19 pandemic, which decimated global hydrocarbon demand forcing fracking crews to suspend operations, the market has been recovering.

- Shale gas is generally produced by hydrofracturing the reservoir to increase the permeability so the gas can easily flow and be produced. Shale gas is usually 95% pure methane and has very less amount of impurities, like sulfur, due to which the processing cost of the shale gas decreases than the natural gas processing cost.

- The U.S. Energy Information Administration (EIA) estimates that in 2021, United States dry natural gas production from shale formations was about 27.2 trillion cubic feet (Tcf) and equal to about 79% of total U.S. dry natural gas production in 2021. Additionally, in 2021, gross withdrawals from shale gas wells stood at nearly 30 Tcf, up by nearly 5.5% year-on-year.

- As the United States has one of the lowest costs of fracking globally, most investors are attracted to invest in the sector, thereby driving the growth of the sector during the forecast period. According to the United States EIA, nearly 95% of all wells drilled in the United States are fracked. As shale wells require fracking and completion services which are mostly done using wirelines, this is expected to drive the market during the forecast period.

US Wireline Logging Services Industry Overview

The United States Wireline Logging Services Market is fragmented. Some of the key players operating in the market (not in particular order) are Schlumberger Limited, Halliburton Company, Baker Hughes Company, Expro Group, and ADES International, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Onshore and Offshore Active Rig Count, till December 2022

- 4.4 Major Upcoming Upstream Projects

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Type (Qualitative Analysis Only)

- 5.2.1 Electric Line

- 5.2.2 Slick Line

- 5.3 Hole Type (Qualitative Analysis Only)

- 5.3.1 Open Hole

- 5.3.2 Cased Hole

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Halliburton Company

- 6.3.3 Baker Hughes Company

- 6.3.4 Expro Group

- 6.3.5 Weatherford International PLC

- 6.3.6 Superior Energy Services Inc.

- 6.3.7 RECON Petro Technologies Ltd.

- 6.3.8 Pioneer Energy Services Corp.

- 6.3.9 NexTier Oilfield Solution Inc.