|

市场调查报告书

商品编码

1628723

美国冷冻食品包装:市场占有率分析、产业趋势与成长预测(2025-2030)United States Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

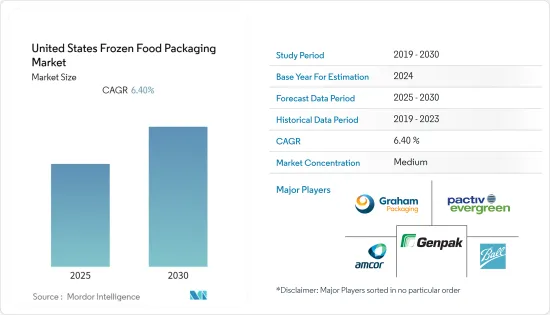

美国冷冻食品包装市场预计在预测期内复合年增长率为 6.4%

主要亮点

- 大多数冷冻食品消费者喜欢从大型商店、超级市场和大卖场购买。有组织的零售商店是大型零售连锁店的重要组成部分,在市场上占有很大份额。有组织的零售连锁店的成长与冷冻食品产业对食品包装解决方案的需求直接相关。

- 此外,肉类、家禽和鱼贝类等冷冻食品的包装是成长最快的冷冻食品应用之一。美国几家领先的食品包装公司正在大力投资创意包装。

- 此外,快速的都市化和生活方式的变化导致消费者的偏好发生重大转变,转向需要更短准备时间的冷冻食品。此外,劳动力中女性人数的增加和家庭结构的变化也增加了冷冻食品的消费,并推动市场成长。

- 此外,技术创新,包括改进保存、保护和促销产品的设计,在推动冷冻食品包装的需求方面发挥关键作用。拉炼、凹口和图案的使用等各种增值功能预计将进一步推动市场成长。

- 例如,2020年3月,Sonoco Products公司与美国包装公司Tellus合作推出了甘蔗纤维碗。该碗是该公司推出的首款产品,是一款100%甘蔗纤维碗,可用于冷藏、家常小菜和冷冻食品。该纤维碗以 Natrellis 品牌推出,作为传统硬质塑胶包装的双通风、不含 PFAS 的替代品。

美国冷冻食品包装市场趋势

箱包可望占较大市场占有率

- 生活方式的改变和便利性等多种因素正在推动对冷冻食品包装袋的需求。在美国,冷冻袋的使用量不断增加,推动了冷冻食品包装市场的成长。例如,根据美国人口普查资料和西蒙斯全国消费者调查 (NHCS),2020 年约有 1.779 亿美国使用塑胶冷冻袋。

- 塑胶袋有多种尺寸和形式,并具有耐热性和技术优势等多重优势,进一步增加了冷冻食品包装市场对塑胶材质袋的需求。

- 随着新冠肺炎 (COVID-19) 大流行的蔓延及其人道主义影响的加大,那些帮助向客户提供必要舒适服务(例如安全提供食品以及其他基本日常生活必需品)的企业正日益受到影响。由于电子商务运输中使用的增加,对某些类型的包装(例如袋子)的需求正在增加。

- 随着美国消费者越来越多地在网上购买食品,并且这种趋势预计将在预测期内持续下去,对能够透过复杂的分销管道安全运输食品的袋包装解决方案的需求将显着增加。

冷冻食品需求的扩大预计将推动市场发展

- 冷冻包装食品的主要类别是肉类、家禽和冷冻加工食品。该领域的一个新兴类别是冷冻已调理食品。将食品保持在低温下,可以显着延长食品的保质期。消费者对食品品质的期望也不断提高。

- 随着消费者重视产品品质,冷冻食品包装类别正在兴起。随着经济成长和生活方式的改变,美国对冷冻食品包装的需求不断增加,预计市场在预测期内将大幅成长。

- 此外,美国冷冻食品协会根据许多重要变数(包括冷冻食品製造商满足客户的营养需求)预测冷冻食品将继续进一步成长。从植物性饮食到增强免疫力的食品,再到客製化的营养品,冷冻食品的创新表明,冷冻食品箱中可以满足每个人的需要,适应当今多样化的生活方式。

- 此外,冷冻食品包装产品的需求通常由国内千禧世代客户推动。因为他们对单份、即食式食品和饮料表现出强烈的偏好。

美国冷冻食品包装产业概况

美国冷冻食品包装市场竞争激烈,国内外都有许多参与企业。市场集中度中等,主要企业纷纷采取产品创新、併购等策略扩大市场范围,为市场带来更好的产品。市场上一些主要的参与者包括 Amcor plc、Genpak LLC、Pactiv Evergreen 和 Graham Packaging Company, Inc.。

- 2021 年 1 月 - 总部位于宾夕法尼亚州的金属包装技术企业 Crown Holdings Inc. 宣布计划在美国亨利县建造一座耗资 1.45 亿美元的铝罐製造工厂。一座占地 355,000 平方英尺的铝罐製造工厂将建在 Commonwealth Crossing 商务中心。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 消费者对便利性的需求不断增加

- 冷冻食品需求快速成长

- 市场限制因素

- 政府监管和干预

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 按材质

- 玻璃

- 纸

- 金属

- 塑胶

- 依产品类型

- 准备好的饭菜

- 水果和蔬菜

- 肉

- 海鲜

- 烘焙点心

- 依包装产品类型

- 包包

- 盒子

- 能

- 托盘

- 饶舌歌手

- 其他的

第六章 竞争状况

- 公司简介

- Pactiv Evergreen

- Amcor Plc

- Genpak LLC

- Graham Packaging Company, Inc.

- Ball Corporation Inc

- Crown Holdings

- Tetra Pak International

- Placon Corporation

- WestRock Company

第七章 投资分析

第八章 市场机会及未来趋势

The United States Frozen Food Packaging Market is expected to register a CAGR of 6.4% during the forecast period.

Key Highlights

- The majority of the consumers of frozen food products have preferred large retail stores, supermarkets, and hypermarkets for their purchases. Organized retail stores have been are a significant part of larger retail chains, having a huge presence in the market. The growth in the organized retail chain is translating directly into the demand for food packaging solutions in the frozen food industry.

- Moreover, packaging for frozen food products such as meat, poultry, and seafood are among the fastest-growing products among frozen food applications. Multiple large food packaging companies in the country are investing hugely in creative packaging.

- Further, the rapid growth in urbanization and changing lifestyle has significantly shifted consumer preference towards frozen products requiring lesser time for cooking. Also, the increase in the female working population and changes in family dynamics has increased the consumption of frozen food, thereby driving the growth of the market.

- Additionally, technological innovations, including improved designs to store, protect, and promote the product, have been playing a vital role in boosting the demand for frozen packaging for food. Various value-added features such as zippers, notches, and the use of graphics are further anticipated to drive the market's growth.

- For instance, in Mar 2020, Sonoco Products Company collaborated with Tellus, which is a packaging company in the United States, launched a sugarcane-based fiber bowl. The bowl was the first product launched by the company, which was a 100% sugarcane-based fiber bowl that can be used for refrigerated, prepared, and frozen foods. The fiber bowl was branded as Natrellis and was dual-ovenable, PFAS-free, and introduced as an alternative to the traditional rigid plastic packaging.

US Frozen Food Packaging Market Trends

Bags are Anticipated to Account for a Major Market Share

- Multiple factors such as changing lifestyle, convenience, among others, have been instrumental in increasing the demand for bags for the packaging of frozen foods. In the United States, the growing adoption of freezer bags has increased the growth of the frozen food packaging market. For instance, according to the U.S. Census data and Simmons National Consumer Survey (NHCS), around 177.9 million Americans made use of plastic-based freezer bags in 2020.

- Plastic bags are made available in different sizes and shapes and offer multiple benefits, such as the ability to tolerate temperatures, and technical advantages, which is further fuelling the demand for plastic material bags in the frozen food packaging market.

- As the COVID-19 pandemic spreads and its humanitarian effect grows, companies that have been assisting in providing necessary amenities, such as providing food, among other vital commodities to the customers securely, have been increasingly impacted. The demand for certain types of packaging, such as bags, has been increasing, owing to their increasing usage in e-commerce shipments.

- The consumers in the United States are increasingly purchasing food items on the Internet as well., and this trend is anticipated to continue over the forecast period, significantly increasing the demand for bags packaging solutions that can securely transport food items via complicated distribution routes.

Growing Demand for Frozen Food Products is Expected to Drive the Market

- The major categories of frozen packaged food items have been meat, poultry, and frozen processed food. Some of the emerging categories in the sector include frozen ready-to-eat foods. The food's storage life can be extended significantly by making the storage temperatures colder. The consumer's expectations of food quality are also on the rise.

- There has been an increase in the frozen food packaging category, with the consumer appreciating the product quality. With the growth in the economy and changing lifestyles, there has been an increased demand for frozen food packaging in the United States, and the market is anticipated to grow significantly over the forecast period.

- Moreover, based on numerous significant variables, that includes the frozen food makers supplying the customers' nutritional demands, the American Frozen Food Institute projects that frozen food products will continue to grow further. Right from plant-based meals to immunity-boosting foods to customized nutrition, frozen food product innovations demonstrate that there is something for everyone in the freezer case that speaks to today's diverse lives.

- Further, the demand for frozen food packaging products is generally driven by the millennial customers in the country, as they showcase an ardent preference for single-serving and on-the-go style foods and beverage foodstuffs.

US Frozen Food Packaging Industry Overview

The United States Frozen Food Packaging Market is significantly competitive owing to the presence of multiple domestic and international players. The market is moderately concentrated, with major players adopting strategies such as product innovation, mergers, and acquisition to expand their reach and launch better products in the market. Some of the major players operating in the market are Amcor plc, Genpak LLC, Pactiv Evergreen, Graham Packaging Company, Inc., among others.

- January 2021 - Crown Holdings Inc., which is a Pennsylvania-based metal packaging technology business, announced that it plans to build a USD 145 million aluminum can manufacturing facility in Henry County (United States). In the Commonwealth Crossing Business Centre, the business will construct a 355,000-square-foot plant to manufacture aluminum cans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Convenience by Consumers

- 4.2.2 Rapid Growing Demand for Frozen Food Products

- 4.3 Market Restraints

- 4.3.1 Government Regulations and Interventions

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Glass

- 5.1.2 Paper

- 5.1.3 Metal

- 5.1.4 Plastic

- 5.2 By Type of Food Product

- 5.2.1 Readymade Meals

- 5.2.2 Fruits and Vegetables

- 5.2.3 Meat

- 5.2.4 Sea Food

- 5.2.5 Baked Goods

- 5.3 By Type of Packaging Product

- 5.3.1 Bags

- 5.3.2 Boxes

- 5.3.3 Cans

- 5.3.4 Trays

- 5.3.5 Wrappers

- 5.3.6 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Pactiv Evergreen

- 6.1.2 Amcor Plc

- 6.1.3 Genpak LLC

- 6.1.4 Graham Packaging Company, Inc.

- 6.1.5 Ball Corporation Inc

- 6.1.6 Crown Holdings

- 6.1.7 Tetra Pak International

- 6.1.8 Placon Corporation

- 6.1.9 WestRock Company