|

市场调查报告书

商品编码

1628728

亚太地区自动储存和搜寻系统:市场占有率分析、产业趋势和成长预测(2025-2030)Asia Pacific Automated Storage and Retrieval System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

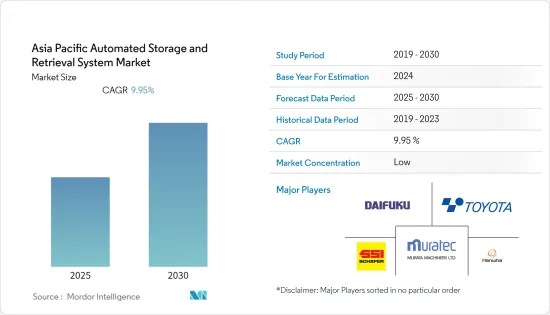

亚太地区自动储存和搜寻系统 (ASRS) 市场预计在预测期内复合年增长率为 9.95%

主要亮点

- 在亚太地区,仓库公司对自动化的日益关注预计将推动自动化储存和搜寻系统市场的发展。根据斑马技术进行的仓库2020亚太愿景研究,该地区73%的仓储公司计划在2020年增加仓库数量,其中52%计划在2020年扩大现有仓库的空间。

- 此外,许多食品和饮料公司已经认识到 ASRS 系统提供的优势,并更加重视市场实施。

- 例如,澳洲糖果零食製造商吉百利史威士已成功升级其位于墨尔本的全国配送中心。此次升级使仓库的自动化储存和搜寻系统的生产率提高了 20%,同时保持了完整的交付能力。升级包括维修和升级四台 ASRS 起重机,并对配送中心的输送机和分类系统进行现代化改造。

- 自1990年代以来,韩国一直是世界顶级汽车製造国之一,也是最大的汽车出口国之一。环保汽车,包括电动车、混合动力电动车和燃料电池电动车,预计将成为预测期内韩国成长最快的汽车最终用户细分市场。这代表着该国汽车产业自动化的巨大机会。

- 此外,日本也将精益製造、准时化概念引入物流。严密的结构使得日本在各个层面都采用了AS/RS系统,经济高效。当前,世界正在期待第四次工业革命,而日本正在发挥重要作用。

- 此外,印尼被列为积极采用自动化的国家。该国在工业工作中使用机器人的情况增加。由于日本既是供应国又是消费国,印尼预计将从与日本的贸易中受益。这增加了该地区对自动化的需求。

亚太地区ASRS系统市场趋势

零售业预计将占据主要市场占有率

- 与其他行业相比,零售业对 ASRS 的需求在该地区排名第二,仅次于邮件和小包裹。与不同类型的设备相比,ASRS 在该地区零售业的采用率很高,其中中国和印度对此做出了重大贡献。

- 此外,自2011年以来,中国零售收益稳定成长,有力推动了中国零售业的自动化发展。零售贸易的增加需要对需要 ASRS 的产品进行有效的储存和仓储。中国商务部表示,由于零售企业的创新和转型,中国的零售额预计将在未来几年超越美国。

- 此外,工业自动化系统的采用补充了印度市场的成长,不同的公司提供不同的解决方案,其特点是最新的趋势。例如,台达电子提供广泛的自动化产品和解决方案,包括仓库机器人解决方案。

- 技能印度和数位印度等旗舰项目的整合是实现这一目标的关键,从而促进该国的市场成长。 2020年12月,技能部与塔塔共同揭牌了第一批印度技能实验室。印度正在推出此类计划,以培养工厂自动化和搜寻系统的技能,并提高公众和商业组织的认识。

- 此外,在印尼,工业 4.0 的出现正在推动专注于食品和饮料行业、纺织和服饰、汽车、化学和电子製造中工厂自动化系统实施的研究市场。印尼和德国之间的一项政府间倡议正在加强该国的Start-Ups生态系统。此外,2020年6月,日本工业机械和施工机械公司Maruka Corp.宣布在印尼设立全资子公司,专门从事工厂自动化和仓储系统。随着东南亚国家对工厂自动化系统的需求增加,我们将设计、生产、销售和维修机器人系统、生产线和清洗设备。

中国占最大市场占有率

- 中国是亚太地区 ASRS 市场成长的主要贡献者。製造、零售、汽车和电子商务等行业对 ASRS 产品的需求不断增加,推动了市场的成长。

- 此外,政府雄心勃勃的「中国製造2025」倡议部分受到德国的启发,面向工业4.0,旨在加强中国在製造业的竞争。

- 中国电子商务巨头京东公司最近建立了一个高效的 ASRS,用于有效的仓库管理,以满足不断增长的零售销售的需求。此外,三星控股是中国家具行业最早引入ASRS的公司之一,允许自动、机械地存储、跟踪和搜寻所有生产的产品,使每批货物都独一无二,从而节省了组装所需的大量准备时间。 。

- 此外,中国零售商正在开发无人商店。例如,中国网路购物平台苏宁推出了五家无人店,并将脸部辨识技术应用于付款服务,为消费者提供基于购物习惯的智慧购物体验。这对该地区研究市场的成长做出了重大贡献。

- 2020年10月,腾讯支持的外送服务公司美团点评在北京首钢园区推出了第一家智慧AI零售店MAI Shop。该店结合了人工智慧和机器人技术,遵循中国超级市场和便利商店常见的「新零售」业态。这种组合技术带来了无人驾驶配送零售体验,美团整合了全自动仓库和配送,以最大限度地提高外带配送能力。

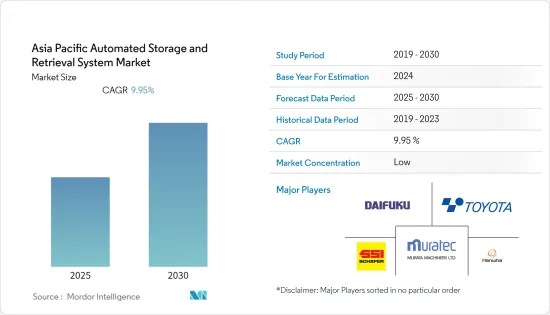

亚太地区ASRS系统产业概况

亚太地区自动化储存和搜寻系统市场细分且竞争激烈。产品发布、高额研发支出、伙伴关係和收购是该地区公司保持竞争力的关键成长策略。近期市场发展趋势如下。

- 2020 年 8 月 - 凯傲集团与一家中国製造商签署了一份销售协议和谅解备忘录,以製定联合开发计划,以扩展其自动化解决方案。与Quicktron的合作预计将进一步加强Quicktron在自动化仓库和卡车市场的地位。

- 2020 年 6 月 - Cohesio Group(现称为 Korber Supply Chain)在澳洲和纽西兰推出了新的分类机器人解决方案。 Colvar 的解决方案使物流业者能够透过灵活、经济且可扩展的自动化来最大限度地提高营运能力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 日益重视职业安全

- 人们对人事费用的担忧日益加剧

- 市场限制因素

- 对熟练劳动力的需求以及对人工替代的担忧

- COVID-19 对市场的影响

第六章 市场细分

- 依产品类型

- 固定通道法

- 轮播(水平轮播+垂直轮播)

- 垂直升降模组

- 按最终用户产业

- 飞机场

- 车

- 饮食

- 一般製造业

- 小包裹

- 零售业

- 其他的

- 按国家/地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- DAIFUKU Co. Ltd.

- Murata Machinery Ltd.

- Schaefer Systems International Pvt Ltd

- Toyota Industries Corporation

- Hanwha Group

- GEEK+INC.

- Kardex Group

- Siasun Robot & Automation Co. Ltd.

- System Logistics SpA

- Noblelift Intelligent Equipment Co. Ltd.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 52365

The Asia Pacific Automated Storage and Retrieval System Market is expected to register a CAGR of 9.95% during the forecast period.

Key Highlights

- The Asia-Pacific region is witnessing an increasing focus towards automation by the warehousing companies, which is anticipated to drive the market for Automated Storage and Retrieval Systems. According to Warehouse 2020 APAC Vision Study conducted by Zebra, 73% of the warehousing companies in the region plan to increase the number of warehouses by 2020, and 52% of them also plan to reduce space expansion in existing warehouses in 2020.

- Further, many of the food and beverage industry companies have recognized the advantages provided by the ASRS systems and have increased their focus towards market adoption.

- For instance, Australia's confectionery manufacturer, Cadbury Schweppes, successfully upgraded its national distribution center in Melbourne. The upgrade resulted in a 20% productivity improvement to its warehouse's automated storage and retrieval system while maintaining full distribution capability. It involved refurbishing and upgrading four ASRS cranes and modernizing the distribution center's conveyor and sortation system.

- South Korea has always been one of the world's top automotive manufacturing countries and one of the largest automotive exporters since the 1990s. Eco-friendly vehicles, including electric vehicles, hybrid electric vehicles, and fuel-cell electric vehicles, are expected to be the fastest-growing automotive end-user segment in South Korea during the forecast period. This provides a massive opportunity for automation in the automotive industry in the country.

- Moreover, Japan introduced lean manufacturing, a Just-In-Time concept in intralogistics. The close-knitted structure allowed the nation to adopt AS/RS systems at every level, economic and efficient. Currently, with the world looking forward to the fourth industrial revolution, Japan plays a significant part.

- Further, Indonesia is categorized as an aggressive automation-adopting nation. The country has recorded increased robotic usage for industrial work. Since Japan is both its supplier and consumer, Indonesia is expected to benefit from the trade with Japan. Thus increasing the demand for automation in the region.

Asia-Pacific ASRS Systems Market Trends

Retail Industry is Expected to Hold Significant Market Share

- The retail sector generated the second-highest demand for ASRS in the region, after post and parcel, compared to other industries. ASRS, when compared to different equipment types, has witnessed a higher adoption in the region's retail sector, and China and India have significantly contributed to this.

- Additionally, the Chinese retail revenue has been on a constant increase since 2011, significantly driving up the automation in the country's retail sector. A rise in retail requires effective storage and warehouse management of products suitably requiring ASRS. According to China's Ministry of Commerce (MOFCOM), China's retail sales are expected to surpass sales in the United States in upcoming years due to the innovation and transformation of retail enterprises.

- Moreover, the growth of the market in India is complemented by the adoption of industrial automation systems with various companies offering different solutions and is characterized by recent developments. For instance, Delta Electronics provides a wide range of automation products and solutions, including robot solutions for warehouses.

- The convergence of flagship programs, such as Skill India and Digital India, is the key to achieving this goal, thereby driving the country's market growth. In December 2020, Skill Ministry and Tata launched the first batch of the Indian Institute of Skills. Such programs are rolled out in India to develop Factory Automation and Retrieval System skills and create greater awareness amongst the general public and business organizations.

- Further, In Indonesia, the onset of Industry 4.0 is driving the studied market, focusing on implementing factory automation systems in the manufacturing of the food and beverage industry, textiles and clothing, automotive, chemical, and electronics. Cross government initiatives between Indonesia and Germany are strengthening the start-up ecosystem in the country. In addition to this, in June 2020, Maruka Corp., a Japanese industrial and construction machinery trader, announced to set up a wholly-owned subsidiary in Indonesia for a dedicated factory automation and storage system unit. It offers to design, produce, market, and repair robot systems, production lines, and washing equipment as demand for factory automated systems in the Southeast Asian country increases.

China Accounts For the Largest Market Share

- China has been a prominent contributor to the growth of the ASRS market in the Asia-Pacific region. The increasing demand for ASRS products across industries, such as manufacturing, retail, automotive, and e-commerce, boosts the market's growth.

- Further, the government's ambitious 'Made in China 2025' initiative, partially inspired by Germany, for Industry 4.0 aims to boost the country's competitiveness in the manufacturing sector.

- An e-commerce giant in China, JD.com Inc., recently built an efficient ASRS for effective warehouse management to cater to the demand for increasing retail sales. Additionally, Samson Holding was one of the first companies to implement ASRS in the Chinese furniture industry, enabling automatically and mechanically storing, tracking, and retrieving every product produced, thus saving ample preparation time required to assemble different products for each shipment.

- Furthermore, Chinese retailers are developing unmanned shops. For instance, Suning, the Chinese online shopping platform, launched five unmanned shops in China, which apply facial recognition technology to payment services and offer shoppers an intelligent shopping experience based on their consumption habits. This has significantly contributed to the growth of the market studied in the region.

- In October 2020, Tencent-backed food delivery service, Meituan-Dianping, introduced its first-ever smart AI retail store, MAI Shop, within Beijing's Shougang Park. The store is equipped with a combination of AI and robotics, which are regularly seen in "New Retail" formats across supermarkets, convenience stores, and more in China. The combined technology brings an unmanned delivery retail experience as Meituan integrates a fully automated warehouse and distribution to maximize its takeout delivery capacity.

Asia-Pacific ASRS Systems Industry Overview

The Asia-Pacific automated storage and retrieval system market is fragmented and highly competitive. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Some of the recent developments in the market are -

- August 2020 - KION Group has signed a distribution agreement and a memorandum of understanding on plans for joint development with the Chinese manufacturer to expand automation solutions. The collaboration with Quicktron is anticipated to strengthen further the former's position in the automated storage and trucks market.

- June 2020 - Cohesio Group, now known as Korber Supply Chain, introduced a new sorting robot solution in Australia and New Zealand. The Korber solution will allow logistics operators to maximize operational capabilities through flexible, affordable, and scalable automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Increasing Concerns about Labor Costs

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed Aisle System

- 6.1.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.1.3 Vertical Lift Module

- 6.2 By End-User Industries

- 6.2.1 Airports

- 6.2.2 Automotive

- 6.2.3 Food and Beverage

- 6.2.4 General Manufacturing

- 6.2.5 Post and Parcel

- 6.2.6 Retail

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DAIFUKU Co. Ltd.

- 7.1.2 Murata Machinery Ltd.

- 7.1.3 Schaefer Systems International Pvt Ltd

- 7.1.4 Toyota Industries Corporation

- 7.1.5 Hanwha Group

- 7.1.6 GEEK+ INC.

- 7.1.7 Kardex Group

- 7.1.8 Siasun Robot & Automation Co. Ltd.

- 7.1.9 System Logistics S.p.A.

- 7.1.10 Noblelift Intelligent Equipment Co. Ltd.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219