|

市场调查报告书

商品编码

1628733

虚拟桌面:市场占有率分析、产业趋势、成长预测(2025-2030)Desktop Virtualization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

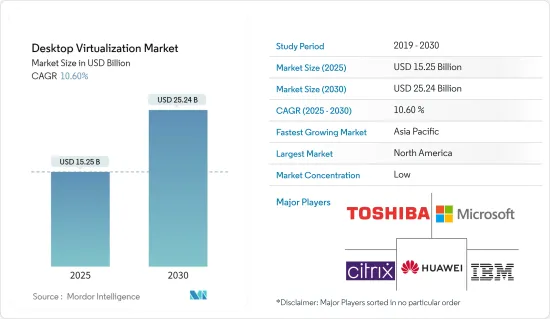

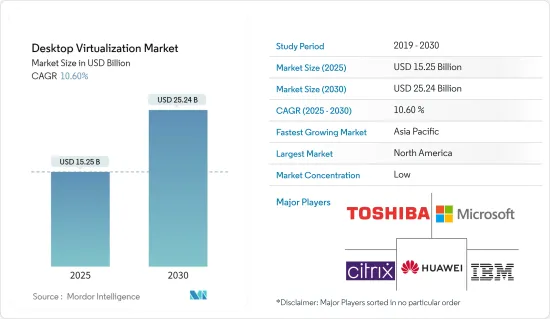

虚拟桌面市场规模预计到 2025 年将达到 152.5 亿美元,预计到 2030 年将达到 252.4 亿美元,预测期内(2025-2030 年)复合年增长率为 10.6%。

虚拟桌面与降低成本完美同步。因此,成本效益预计将成为市场成长的关键驱动力。

主要亮点

- 虚拟桌面对于中小型企业很有价值,因为它可以减少硬体支出并降低系统管理和维护成本。它提供了出色的计算体验并解决了一些复杂的问题。因此,虚拟桌面提供了多种好处,例如降低营运成本和提高用户满意度,预计这将在预测期内推动虚拟桌面市场的成长。

- 云端处理的日益普及和职场对 BYOD 的需求不断增加是推动该市场的关键因素。透过实施虚拟桌面,雇主可以利用 BYOD 来提高远端和办公室员工的灵活性和安全性。虚拟桌面虚拟化允许员工从几乎任何地方、在任何装置上存取安全、受监督的桌面。

- 虚拟桌面虚拟化越来越多地被各种类型的企业采用,因为它降低了复杂性并允许将应用程式交付给各种行动用户。管理和储存方面的进步使其成为更可行的选择,并正在推动全球市场的采用。

- 基础设施限制阻碍了市场成长。虚拟桌面增加了交付 Windows 桌面和应用程式的复杂性。为了使虚拟桌面能如预期运作,多层技术必须协调工作。对新基础设施的需求和相关成本是虚拟桌面市场成长的主要限制因素之一。

- 自 COVID-19 以来,随着许多公司转向远端工作,该市场受到关注。封锁和社交距离准则迫使许多公司立即做出必要的调整,并建立必要的电脑基础设施来支援远端工作人员。企业长期以来一直在使用虚拟桌面解决方案。

虚拟桌面市场趋势

云端采用模式预计将显着成长

- 许多公司正在使用云端运算来降低营运成本。云端託管的易于部署、可存取性和灵活性预计将推动组织采用云端运算。云端部署包括DaaS(桌面即服务)、WaaS(工作空间即服务)和SaaS(应用程式/软体即服务)等服务模式。虚拟桌面作为云端网路上的服务提供,所有运算和支援基础设施以云端部署模式託管在服务供应商侧。

- 透过云端进行的应用程式串流在业界越来越受欢迎,许多公司选择独立的应用程式服务。云端是各行业的首选,它提供更好的可扩展性、资料管理和成本节约。据 Flexera Software 称,到 2023 年,47% 的受访者将已经在 Amazon Web Services (AWS) 上运行关键工作负载。

- 企业可以轻鬆地为员工创建新的桌面,而无需购买实体 PC。当不再需要这些资源时,可以将它们关闭,此时客户将不再需要收费。儘管定价模式多种多样,但基于用量的定价是云端桌面的独特优势。

- 采用云端可以更轻鬆地在工作环境之间迁移资料。它还允许企业扩展其需求并获得额外的运算能力和资料,而无需实体安装。 DaaS 的这种弹性可以实现更好的资源管理。

- 2023年6月,云端软体集团宣布与Midis Group建立合作关係,开始共同服务东欧、中东和非洲的通路和消费者。这项合作关係为云端软体集团提供了支援消费者进行变革性技术合作所需的本地资源,以及扩大其在这些地区的业务所需的规模。

- 服务提供者託管的伺服器和设备无需技术人员和 IT 资源来维护和作业系统。透过云端部署部署的虚拟桌面解决方案,公共事业和应用程式会自动更新。用户不需要被「推送」更新。用户几乎可以使用任何设备访问虚拟桌面和程序,因此无论他们选择PC、Mac、Linux、iOS还是Android,他们都可以看到以相同方式工作的应用程序,并且在需要时使用起来很方便。

预计北美将占据最大的市场占有率

- 北美地区被认为是许多行业的全球中心,也是虚拟桌面最大的区域市场。美国是北美最大的虚拟桌面消费者。美国多家云端服务供应商的存在以及託管伺服器数量的增加正在促进北美市场的成长。

- 美国主要企业的存在正在推动整个全部区域的市场成长,在靠近已开发国家的加拿大设立了新的工作空间,并强调采用环保和节能的做法。

- 该地区组织早期采用新技术是全球主导地位的主要驱动力。主要云端服务供应商在该地区云端基础的虚拟桌面部署的成长中发挥着重要作用。

- 北美的 IT 和通讯业是所有其他区域市场中最大的。银行、医疗保健和政府机构等行业处理敏感资讯的大型资料库。这些公司对虚拟桌面感到兴奋,虚拟桌面它为用户提供了灵活性,同时保留了其智慧财产权的完整性。

虚拟桌面虚拟化产业概况

虚拟桌面市场高度分散,主要公司包括思杰系统公司、IBM公司、华为科技公司、微软公司和东芝公司。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 11 月 - Microsft 宣布全面推出全新的 Azure 虚拟桌面 Web 用户端使用者介面。此更新允许使用者将 Web 用户端设定重设为预设值、在浅色和深色模式之间切换以及以网格或清单格式检视资源。

- 2023 年 7 月 - Citrix 与客户参与软体领域的全球领导者 Twilio 合作。此次合作致力于为 Citrix DaaS 和 Twilio Flex 环境提供整合的高效能解决方案。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 对自备设备的需求不断增长

- 扩大云端运算的采用

- 市场限制因素

- 基础设施限制

第六章 市场细分

- 透过桌面产品

- 託管虚拟桌面 (HVD)

- 託管共用桌面 (HSD)

- 其他桌面产品

- 按发展

- 本地

- 云

- 按最终用户产业

- 金融服务

- 卫生保健

- 製造业

- 资讯科技/通讯

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Citrix Systems Inc.

- IBM Corporation

- Huawei Technologies Co. Ltd

- Microsoft Corporation

- Toshiba Corporation

- DELL Technologies Inc.

- Parallels International GmbH

- Red Hat Inc.

- NComputing Co. Ltd.

- Ericom Software Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Desktop Virtualization Market size is estimated at USD 15.25 billion in 2025, and is expected to reach USD 25.24 billion by 2030, at a CAGR of 10.6% during the forecast period (2025-2030).

Desktop Virtualization is completely in sync with cost reduction. Hence, cost-effectiveness is expected to be a key driving factor for the growth of the market.

Key Highlights

- Desktop virtualization is valuable for small and medium businesses, as it lowers expenditure on hardware and reduces system administration and maintenance costs. It provides a superior computing experience and solves several complex problems. As a result, desktop virtualization has several benefits, such as a reduction of operational costs and increased user satisfaction, which is expected to fuel the growth of the desktop virtualization market during the forecast period.

- The growing adoption of cloud computing and increasing demand for BYOD in the workplace are significant factors driving this market. By implementing desktop virtualization, employers can leverage BYOD to boost the flexibility and security of both a remote workforce and those working in the office. Employees that use desktop virtualization have access to a secure, monitored desktop from almost any location and on any device.

- The ability to lower complexity and deliver apps to various mobile users is boosting the adoption of desktop virtualization in all types of businesses. The advancements in management and storage make it a more viable option, which is driving the adoption of the market worldwide.

- Infrastructural constraints are hindering the growth of the market. Desktop virtualization increases the complexity of delivering Windows desktops and applications. For virtual desktops to perform as intended, several layers of technology have to work in harmony. The need for new infrastructure, along with the costs associated with it, is one of the major constraints for the growth of the desktop virtualization market.

- The market has been brought to focus since COVID-19 because many businesses have turned to remote working. The lockdown and social distancing guidelines forced many businesses to make the necessary adjustments immediately and build the computer infrastructure needed to support their remote workers. Businesses have been using desktop virtualization solutions for a long time.

Desktop Virtualization Market Trends

Cloud Deployment Mode is Expected to Witness Significant Growth

- Various organizations are using cloud computing to reduce businesses' operational costs. Easy implementation, accessibility, and flexibility of cloud hosting are expected to drive organizations' adoption of cloud computing. Cloud deployment includes service models, such as Desktop-as-a-Service (DaaS), Workspace-as-a-Service (WaaS), and Application/Software-as-a-Service (SaaS). Desktop virtualization is offered as a service over cloud networks, with all computing and supporting infrastructure hosted on the service provider's end in the cloud deployment mode, which makes the migration of data between working environments easy.

- Application streaming over the cloud is gaining popularity in the industry, with many businesses choosing standalone application services. Cloud is preferred across industries, providing better scalability, data management, and cost savings. According to Flexera Software, in 2023, 47 percent of respondents are already running significant workloads on Amazon Web Services (AWS).

- Businesses can easily create new desktops for their workforce without needing to purchase physical PCs. When these resources are no longer needed, they can be turned off, at which point the customer is no longer billed. Although there are various pricing models, consumption-based pricing is a unique benefit of cloud desktops.

- Cloud deployment makes the migration of data between working environments easy. Also, companies have the option to scale up their requirements and procure additional computing power and data without the need for physical installation. This flexibility of DaaS enables better resource management.

- In June 2023, Cloud Software Group announced a partnership with Midis Group, in its collaboration to serve its channel and consumers in Eastern Europe, the Middle East, and Africa. The collaboration offers Cloud Software Group the local resources consumers need to help their transformative technology collaboration and the scale required to expand its presence in these regions.

- With servers and equipment hosted on the service provider's side, the need for technical staff and IT resources to maintain and operate systems is eliminated. In cloud-deployed desktop virtualization solutions, utilities and applications are updated automatically. Users do not need to be "pushed" for updates. The fact that users may access their virtual desktop or programs using almost any device means that regardless of whether they prefer PC, Mac, Linux, iOS, or Android, they will see the same applications that work in the same way and have them conveniently available whenever they need them.

North America is Expected to Hold the Largest Market Share

- The North American region is considered to be the global hub for many industry verticals, and as a result, it is the largest regional market for desktop virtualization. The United States is the largest consumer of desktop virtualization in North America. The presence of several cloud service providers and an increasing number of hosted servers in the United States have contributed to the growth of the market in North America.

- The presence of major companies in the United States has led to the setting up of new workspaces in Canada due to the proximity of its developed counterpart and emphasis on installing eco-friendly and energy-saving practices, thus bolstering the growth of the market across the region.

- The early adoption of new technologies by organizations in the region is the primary driving force behind global dominance. Large cloud service providers play a significant role in the growth of cloud-based desktop virtualization deployment in the region.

- The North American IT and telecommunications industry is the largest among other regional markets. Industries, such as banking, healthcare, and government organizations, handle large databases of sensitive information. They are looking forward to using desktop virtualization deployments, as they preserve the integrity of the intellectual property and simultaneously provide flexibility to users.

Desktop Virtualization Industry Overview

The Desktop Virtualization market is highly fragmented with the presence of major players like Citrix Systems Inc., IBM Corporation, Huawei Technologies Co. Ltd, Microsoft Corporation, and Toshiba Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Microsft has announced the General Availability of the latest new Azure Virtual Desktop Web Client User Interface. With this update, Users can Reset web client settings to their defaults, Switch between Light and Dark Mode, and View their resources in a grid or list format.

- July 2023 - Citrix has partnered with Twilio, one of the global leaders in customer engagement software. This partnership represents the commitment to provide integrated, high-performance solutions for the Citrix DaaS and Twilio Flex environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Bring Your Own Device

- 5.1.2 Growing Adoption of Cloud Computing

- 5.2 Market Restraints

- 5.2.1 Infrastructural Constraints

6 MARKET SEGMENTATION

- 6.1 By Desktop Delivery Platform

- 6.1.1 Hosted Virtual Desktop (HVD)

- 6.1.2 Hosted Shared Desktop (HSD)

- 6.1.3 Other Desktop Delivery Forms

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-User Vertical

- 6.3.1 Financial Services

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 IT & Telecommunications

- 6.3.5 Other End-User Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Citrix Systems Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Microsoft Corporation

- 7.1.5 Toshiba Corporation

- 7.1.6 DELL Technologies Inc.

- 7.1.7 Parallels International GmbH

- 7.1.8 Red Hat Inc.

- 7.1.9 NComputing Co. Ltd.

- 7.1.10 Ericom Software Inc.