|

市场调查报告书

商品编码

1628746

合成橡胶涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Elastomeric Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

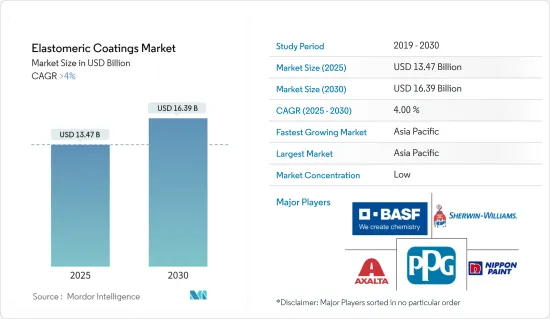

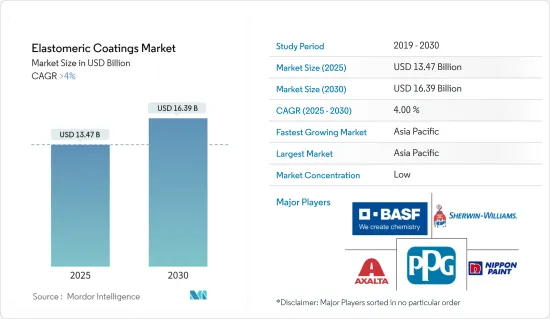

合成橡胶涂料市场规模预计到2025年为134.7亿美元,预计到2030年将达到163.9亿美元,在预测期内(2025-2030年)复合年增长率将超过4%。

COVID-19 大流行阻碍了合成橡胶涂料市场。由于多个国家采取全国封锁措施,严格的社会疏散措施影响了住宅和基础设施建设活动,进一步影响了合成橡胶涂料市场。然而,随着限制的取消以及世界各地住宅和基础设施建设活动的正常化,市场出现復苏。

主要亮点

- 建筑基础设施产业的使用量不断增加以及汽车产业对合成橡胶涂料产品的需求不断增长预计将推动合成橡胶涂料市场的发展。

- 另一方面,与传统涂料相比,成本较高,原材料价格波动预计将阻碍市场成长。

- 快速工业化和建筑业投资的增加预计将在预测期内为市场创造机会。

- 预计亚太地区将主导市场。预计在预测期内仍将维持最高复合年增长率。这是由于住宅和基础设施最终用户行业对合成橡胶涂料的需求不断增加。

合成橡胶涂料市场趋势

墙面涂料领域主导市场需求

- 墙面涂料应用预计将主导合成橡胶涂料的需求。合成橡胶墙面涂料以其优异的防水和伸长性能而闻名。因此,它是建筑领域墙壁和屋顶涂料的理想选择。

- 根据牛津经济研究院的数据,2022 年全球建筑业价值将达到 9.7 兆美元。在中国、美国和印度超级建筑市场的推动下,预计到 2037 年将达到 13.9 兆美元。此外,未来15年,全球前10大建筑市场国家的建筑工程预计将占全球建筑市场总量的70%。

- 根据国际建筑公司预测,2022年中国、北美和欧洲将成为建筑业最大的市场。儘管这些市场可能面临挑战,但印度预计将成为世界上成长最快的建筑强国。同时,菲律宾、越南、马来西亚和印尼预计将成为未来 15 年成长最快的建筑市场。

- 在北美地区,政府在房地产市场住宅建设方面的支出增加以及豪华住宅需求的增加预计将对市场成长产生积极影响。此外,房地产成本的上涨,特别是该地区单户住宅和多层公寓市场的发展,预计将推动墙面涂料市场的发展。

- 美国建筑业是北美最大的。根据美国人口普查局的数据,2022年美国年度建筑业价值为17,920亿美元,而2021年为16,264亿美元,成长率为10.2%。 2022 年美国住宅建筑年产值为 9,080 亿美元,而 2021 年为 8,020 亿美元。因此,住宅建筑市场的扩张预计将推动该国合成橡胶涂料市场的发展。

- 因此,建筑业的这种有利趋势预计将在预测期内推动合成橡胶涂料市场的发展。

亚太地区主导市场

- 亚太地区主导全球市场。由于印度、中国、菲律宾、越南和印尼等国家对住宅和商业建筑的投资增加,预计未来几年合成橡胶涂料市场将扩大。

- 由于人口成长、中等收入群体的壮大和都市化进程,亚太地区的建筑业正在健康发展。中国和印度不断扩大的住宅建筑市场预计将成为亚太地区成长最快的地区。

- 根据中国国家统计局的数据,建筑业产值将从2021年的29.3兆元(4.2兆美元)增加至2022年的31.2兆元(4.5兆美元)。预计到2030年,中国在建筑方面的支出将达到约13兆美元,为目前的研究市场创造了光明的前景。

- 住宅需求的增加预计将推动该国公共和私营部门的住宅建设。高层建筑和酒店建设的增加正在推动市场。住宅的增加将进一步推动对纤维混凝土的需求。中国政府已主动向全国40个主要城市赠送650万套保障性租赁住宅。这将导致约 1300 万人居住在该国。

- 同样,印度政府正在积极推动住宅建设,为约13亿人提供住宅。预计未来六到七年印度的住宅投资将达到约 1.3 兆美元。全国将新建6000万住宅。

- 因此,亚太地区的这些投资和计划计划正在推动该地区的建设活动。在预测期内,该地区对合成橡胶涂料的需求可能会增加。

合成橡胶涂料市场-产业概览

合成橡胶涂料市场是细分的。市场上的主要企业包括(排名不分先后)艾仕得涂料系统有限公司、BASFSE、立邦涂料控股公司、PPG工业公司和宣伟公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑基础设施产业的使用量增加

- 汽车产业对合成橡胶涂料产品的需求增加

- 其他司机

- 抑制因素

- 与传统涂料相比成本高

- 原物料价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 种类

- 丁基

- 聚氨酯

- 硅胶

- 丙烯酸纤维

- 其他类型(聚硫、乙烯基等)

- 科技

- 水性的

- 溶剂型

- 目的

- 墙漆

- 屋顶涂料

- 地坪涂料

- 其他用途(汽车内装漆等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems, LLC

- BASF SE

- Dow

- Gaco

- Henry Company

- Jotun

- Kansai Nerolac Paints Limited

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- Progressive Painting, Inc.

- RODDA PAINT, CO

- Sika AG

- The Sherwin-Williams Company

第七章 市场机会及未来趋势

- 工业化快速发展,建筑业投资增加

- 其他机会

The Elastomeric Coatings Market size is estimated at USD 13.47 billion in 2025, and is expected to reach USD 16.39 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the Elastomeric coatings market. Due to nationwide lockdowns in several countries, strict social distancing measures affected residential and infrastructural construction activities, further affecting the market for elastomeric coatings. However, the market recovered after the restrictions were lifted and residential and infrastructural activities across the globe normalized.

Key Highlights

- The increasing usage in the architectural and infrastructural industries and the rising demand for elastomeric coating products in the automotive industry are expected to drive the market for elastomeric coatings.

- On the flip side, the higher costs compared to conventional coatings and the fluctuations in the prices of raw materials are expected to hinder the growth of the market.

- The rapid industrialization and the increasing investments in the construction industry are expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period. It is due to the rising demand for elastomeric coatings in residential and infrastructural end-user industries.

Elastomeric Coatings Market Trends

Wall Coatings Segment to Dominate the Market Demand

- The wall coating application is expected to dominate the demand for elastomeric coatings. Elastomeric wall coatings are known for their superior waterproofing and elongation properties. It makes them ideal to use as wall and roof coatings in the construction sector.

- According to Oxford Economics, the global construction industry was valued at USD 9.7 trillion in 2022. It is estimated to reach USD 13.9 trillion by 2037, driven by superpower construction markets China, the United States, and India. Furthermore, all construction work done over the next 15 years by the world's top 10 construction markets is expected to account for 70% of the total global construction market.

- According to International Construction, China, North America, and Europe were the largest markets for the construction industry in 2022. While these markets will likely face challenges, India is forecasted to be the fastest-growing construction superpower in the world. In contrast, the Philippines, Vietnam, Malaysia, and Indonesia are forecasted to be the fastest-growing construction markets over the next 15 years.

- In the North American region, the increased government spending in the real estate market for residential construction and the growing demand for high-class residential homes are likely to benefit the market's growth. In addition, rising real estate costs, particularly the development of single-family homes and multistory apartments in the region, are expected to drive the market for wall coatings.

- The construction industry in the United States is the largest in North America. According to the US Census Bureau, the annual construction in the United States accounted for USD 1,792 billion in 2022, compared to USD 1,626.4 billion in 2021, at a growth rate of 10.2%. The annual value of residential construction output in the United States was valued at USD 908 billion in 2022, compared to USD 802 billion in 2021. Thus, increasing the residential construction market is expected to drive the market for elastomeric coatings in the country.

- Hence, such favorable trends in the construction industry are expected to boost the elastomeric coatings market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. Owing to the growing investments in residential and commercial construction in countries such as India, China, the Philippines, Vietnam, and Indonesia, the market for elastomeric coatings is expected to increase in the coming years.

- The construction sector in the Asia-Pacific region is increasing at a healthy rate, owing to the rising population, increase in middle-class income and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for the current studied market.

- The growing demand for housing is likely to drive residential construction in the country, both in the public and private sectors. The increase in the construction of tall buildings and hotels is driving the market studied. This increasing residential construction further fuels the demand for fiber reinforced concrete. China's government took the initiative to gift 40 key cities in the country with 6.5 million government-subsidized rental homes. These are supposed to accommodate around 13 million people in the country.

- Similarly, the Indian government is actively boosting housing construction to provide homes to about 1.3 billion people. The country will likely witness around USD 1.3 trillion of investment in housing over the next six to seven years. It is likely to witness the construction of 60 million new homes in the country.

- Hence, such investments and planned projects in Asia-Pacific are boosting the construction activities in the region. It may increase the demand for elastomeric coatings in the region during the forecast period.

Elastomeric Coatings Market - Industry Overview

The Elastomeric coatings market is fragmented. Some of the major players (not in any particular order) in the market include Axalta Coating Systems, LLC, BASF SE, Nippon Paint Holdings Co., Ltd, PPG Industries Inc., and The Sherwin-Williams Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing usage in the Architectural and Infrastructural Industries

- 4.1.2 Rising Demand for Elastomeric Coating Products in the Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Costs Compared to Conventional Coatings

- 4.2.2 Fluctuations in the Prices of Raw materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Butyl

- 5.1.2 Polyurethane

- 5.1.3 Silicone

- 5.1.4 Acrylic

- 5.1.5 Other Types (Polysulfide, Vinyl, etc.)

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.3 Application

- 5.3.1 Wall Coatings

- 5.3.2 Roof Coatings

- 5.3.3 Floor Coatings

- 5.3.4 Other Applications (Automotive Interior Coatings, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems, LLC

- 6.4.4 BASF SE

- 6.4.5 Dow

- 6.4.6 Gaco

- 6.4.7 Henry Company

- 6.4.8 Jotun

- 6.4.9 Kansai Nerolac Paints Limited

- 6.4.10 Nippon Paint Holdings Co., Ltd.

- 6.4.11 PPG Industries Inc.

- 6.4.12 Progressive Painting, Inc.

- 6.4.13 RODDA PAINT, CO

- 6.4.14 Sika AG

- 6.4.15 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Industrialization and Increasing Investments in the Construction Industry

- 7.2 Other Opportunities