|

市场调查报告书

商品编码

1628747

天然脂肪酸:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Natural Fatty Acids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

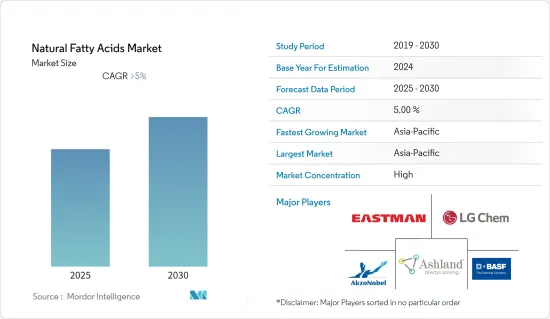

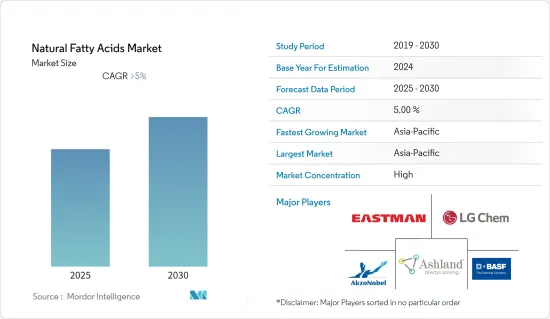

预计天然脂肪酸市场在预测期内的复合年增长率将超过 5%。

由于生产暂停,COVID-19影响了整个天然脂肪酸市场。然而,化妆品和个人保健产品的激增正在增加疫情后对脂肪酸的需求。

主要亮点

- 推动市场成长的关键因素包括用于生产丙二醇和环氧氯丙烷的甘油需求增加、政府法规促进使用环保产品、C18在油田和钻井应用、化妆品和个人用品中的广泛使用。

- 另一方面,原材料供应和价格的波动是该市场成长的主要障碍。

- 在预测期内,由于对生物基原料的需求,所研究的市场可能存在机会。

- 在化妆品、个人保健产品、清洁剂和肥皂的需求和产量不断增长的推动下,亚太地区在全球市场占据主导地位。

天然脂肪酸市场趋势

家居、化妆品和个人护理领域主导市场需求

天然脂肪酸的抗菌、抗真菌和抗病毒特性使其广泛应用于家庭、化妆品和个人护理市场。

- 此外,脂肪酸还提供乳浊效果和黏性,增加产品的厚度。由于这些特性,天然脂肪酸被广泛应用于化妆品和个人保健产品。

- 2021年个人护理和化妆品产业产值约为3,170亿美元,亚太地区和欧洲引领市场,这些市场对此类产品的高需求预计将推动市场成长。此外,到 2027 年,个人护理行业预计价值约 35.48 兆美元。

- 根据个人护理和清洁剂工业协会 (IKW)(60.246 亿美元)的数据,2021 年德国洗衣精和清洁产品的销售额将达到 50.92 亿欧元,而前一年为 52.46 亿欧元(59.8949 亿美元)。 。

- 此外,在美国,2021 年每位消费者在肥皂和清洁剂上的平均年支出约为 80.5 美元,高于 2020 年的 75.5 美元。这种增长可能会增加肥皂和清洁剂行业中天然脂肪酸的使用。

- 收入的增加、都市化进程的加快以及人们对卫生重要性认识的提高正在推动家居用品、化妆品和个人保健产品的需求稳定增长。

- 随着越来越多的个人保健产品和美容产品的出现,天然脂肪酸的使用在未来几年将继续增长。

亚太地区主导市场

- 亚太地区主导了全球市场占有率。在该地区,天然脂肪酸的需求主要是由于天然脂肪酸在化妆品和个人护理、清洁剂和肥皂、油田和润滑油等行业的使用不断增加而推动的。

- 在该地区,由于西方文化的影响,个人护理和化妆品的需求显着增长。这导致青少年化妆品使用量的增加、由于女性就业增加而提高的整装仪容意识以及卫生意识的提高,从而导致该地区这些产品的产量增加。

- 亚太地区也是肥皂、橡胶和塑胶等产品的最大生产国。由于建筑、汽车和电子等行业使用量的增加,该地区的橡胶和塑胶产量显着增加。

- 2021年,我国塑胶製品总产量将达8,000万吨,与前一年同期比较增加5.27%。中国是全球最大的塑胶生产国,占全球塑胶产量的近三分之一。

- 而且,印度也是塑胶製品的主要生产国和消费国之一。 2021-22 年印度向法国的塑胶出口总额约为 2.25 亿美元。 「数位印度」、「印度製造」和「印度技能」等政府措施也预计将推动印度塑胶产业的发展。

- 在印度、中国、印尼、新加坡和越南等国家住宅和商业建筑增加的推动下,该地区的建筑业正在经历强劲增长。此外,印度、马来西亚、泰国、印尼等国家的汽车产量也大幅增加。

- 同时,人们可能会购买更多的塑胶和橡胶,这可能会在未来几年推动天然脂肪酸市场的发展。

因此,该地区的所有这些趋势预计将在未来几年推动天然脂肪酸市场的成长。

天然脂肪酸产业概况

天然脂肪酸市场得到整合,主要企业控制了很大一部分市场需求。市场的主要企业包括(排名不分先后)BASF、伊士曼化学公司、LG化学、阿克苏诺贝尔和亚什兰。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 生产丙二醇和环氧氯丙烷对甘油的需求增加

- 政府法规促进使用环保产品

- 扩大 C18 在油田和钻井应用的使用

- 化妆品和个人护理市场的需求不断增长

- 抑制因素

- 原物料供应和价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

- 生产流程

- 政府法规和措施

第五章 市场区隔(以金额为准的市场规模)

- 种类

- 硬脂酸

- 蒸馏脂肪酸

- C8辛脂肪酸

- Tall oil脂肪酸

- 油酸

- 目的

- 家居、化妆品、个人护理

- 肥皂和清洁剂

- 油田

- 橡胶/塑料

- 润滑油

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Ashland Inc.

- BASF SE

- Baerlocher GmbH

- Behn-Meyer Holding AG

- Chemithon Corporation

- Chemol Company Inc.

- Croda Industrial Chemicals

- Eastman Chemical Company

- Faci SpA

- Kraton Performance Polymers, Inc.

- LG Chemicals

- Pacific Oleochemicals Sdn Bhd

- SABIC

- Yueyang Ch-Cheng Oleochemicals Co. Ltd

- Zibo Fenbao Chemical Co. Ltd

第七章 市场机会及未来趋势

- 聚合物生产中对生物基原料的偏好

The Natural Fatty Acids Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 impacted the overall natural fatty acid market due to the halt in production. However, the upsurge in cosmetics and personal care products has propelled the demand for fatty acids post-pandemic.

Key Highlights

- The major factors driving the growth of the market studied are the increasing demand for glycerin to manufacture propylene glycol and epichlorohydrin, government regulations promoting the use of eco-friendly products, the broader use of C18 in oilfield and drilling applications, and the increasing demand from the cosmetics and personal care market.

- On the flip side, the fluctuating supply and prices of feedstock materials serve as the major stumbling blocks in the growth of the market studied.

- During the forecast period, the market that was looked at is likely to have opportunities due to the demand for bio-based raw materials.

- Asia-Pacific dominated the market across the world, where the demand is primarily driven by the growing demand for and production of cosmetics, personal care products, detergents, and soaps.

Natural Fatty Acids Market Trends

Household, Cosmetics, and Personal Care Segment to Dominate the Market Demand

The antibacterial, antifungal, and antiviral properties of natural fatty acids make them widely popular for use in the household, cosmetics, and personal care markets.

- Besides, fatty acid provides an opacifying effect and consistency and increases the thickness of the product. As a result of these properties, natural fatty acids are widely used in cosmetics and personal care products.

- The personal care and cosmetic industry accounted for around USD 317 billion in 2021, with Asia-Pacific and Europe leading the market, which is expected to be driven by high demand for such products in these markets. Also, by 2027, the personal care industry is expected to be worth about USD 354,80 billion.

- According to the Industry Association for Personal Care and Detergents e. V. (IKW), revenues from laundry detergents and cleaning products in Germany accounted for EUR 5,092 million (USD 6,024.60 million) in 2021, compared to EUR 5,246 million (USD 5,989.49 million) in the previous year.

- Furthermore, in the United States, the average annual expenditures for soaps and detergents amounted to roughly USD 80.5 per consumer unit in 2021, up from USD 75.5 in 2020. This growth is likely to make the soap and detergent business use more natural fatty acids.

- Rising incomes, increased urbanization, and increased awareness of the importance of hygiene have resulted in a robust increase in demand for household, cosmetic, and personal care products.

- Since more personal care and beauty products are being made, the use of natural fatty acids will also continue to grow over the next few years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. In the region, the demand for natural fatty acids is widely driven by their increasing application in industries such as cosmetics and personal care, detergents and soaps, oilfields, and lubricants.

- The region has been witnessing strong growth in the demand for personal care and cosmetic products, largely driven by the influence of western culture. This has led to the increased usage of cosmetic products by teenagers, increased awareness of being presentable with growing women's employment, and increased hygiene awareness, owing to which the production of such products has also been increasing in the region.

- Besides, Asia-Pacific is also the largest producer of products such as soaps, rubber, and plastics. The production of rubber and plastics has been increasing noticeably in the region with growing usage from industries such as construction, automotive, and electronics.

- In 2021, the total production of plastic products in China will amount to 80 million metric tons, an increase of 5.27 percent from the previous year. China is the world's largest plastics producer, accounting for nearly one-third of global plastics production.

- Furthermore, India is also one of the major producers and consumers of plastic products. The total plastic exports from India to France during 2021-22 were around USD 225 million. Government initiatives like "Digital India," "Make in India," and "Skill India" will also boost India's plastics industry.

- The construction industry in the region has been witnessing strong growth owing to the growing residential and commercial construction in countries such as India, China, Indonesia, Singapore, and Vietnam. Besides, automotive production in countries like India, Malaysia, Thailand, and Indonesia has also been increasing substantially.

- With this, people are likely to buy more plastic and rubber, which is likely to drive the market for natural fatty acids over the next few years.

Hence, all such trends in the region are projected to drive the growth of the natural fatty acid market in the coming years.

Natural Fatty Acids Industry Overview

The natural fatty acids market is consolidated, with key major players controlling a sizable portion of market demand. Some of the major players in the market include BASF SE, Eastman Chemical Company, LG Chemicals, AkzoNobel N.V., and Ashland, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Glycerin to Manufacture Propylene Glycol and Epichlorohydrin

- 4.1.2 Government Regulations Promoting the Use of Eco-friendly Products

- 4.1.3 Broader Use of C18s in Oilfield and Drilling Applications

- 4.1.4 Increasing Demand from the Cosmetics and Personal Care Market

- 4.2 Restraints

- 4.2.1 Fluctuating Supply and Prices of Feed Stock Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Production Process

- 4.7 Government Regulations and Policies

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Stearic Acid

- 5.1.2 Distilled Fatty Acid

- 5.1.3 C8 Caprylic Fatty Acid

- 5.1.4 Tall Oil Fatty Acid

- 5.1.5 Oleic Acid

- 5.2 Application

- 5.2.1 Household, Cosmetics, and Personal Care

- 5.2.2 Soap and Detergent

- 5.2.3 Oilfield

- 5.2.4 Rubber and Plastic

- 5.2.5 Lubricants

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Ashland Inc.

- 6.4.3 BASF SE

- 6.4.4 Baerlocher GmbH

- 6.4.5 Behn-Meyer Holding AG

- 6.4.6 Chemithon Corporation

- 6.4.7 Chemol Company Inc.

- 6.4.8 Croda Industrial Chemicals

- 6.4.9 Eastman Chemical Company

- 6.4.10 Faci SpA

- 6.4.11 Kraton Performance Polymers, Inc.

- 6.4.12 LG Chemicals

- 6.4.13 Pacific Oleochemicals Sdn Bhd

- 6.4.14 SABIC

- 6.4.15 Yueyang Ch-Cheng Oleochemicals Co. Ltd

- 6.4.16 Zibo Fenbao Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Preference for Bio-based Raw Materials in Polymer Manufacturing