|

市场调查报告书

商品编码

1628754

公共事业与能源分析:市场占有率分析、产业趋势、成长预测(2025-2030)Utility and Energy Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

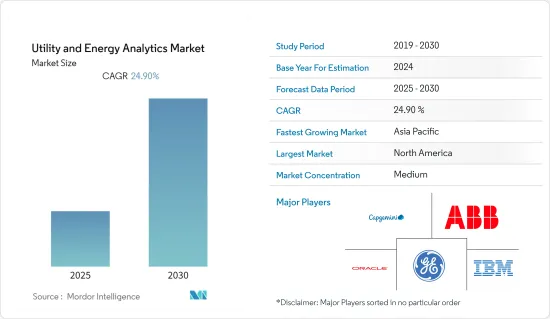

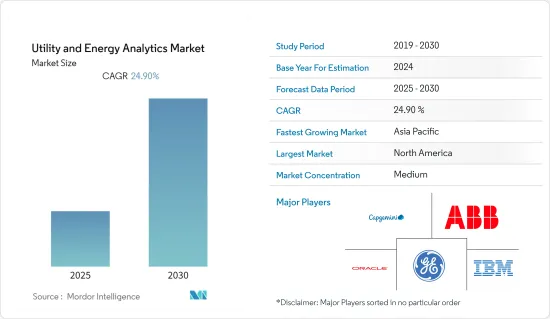

公共事业和能源分析市场预计在预测期内复合年增长率为 24.9%

主要亮点

- 巨量资料平台和云端运算等先进分析工具和技术还有巨大的未开发潜力。随着微电网控制系统和其他智慧电网系统的使用增加,这些系统可以从中央控制中心监控、控制和分析电网功能,公共产业和能源分析市场将显着成长。此外,支持智慧电网解决方案的有利政府立法和智慧电錶使用的快速增长预计也将增加公共产业对巨量资料分析的需求。

- 另一个可以从巨量资料分析中受益的重要因素是可再生能源。利用可再生能源的技术在全球范围内越来越受欢迎,特别是作为可靠的电力源。 IEA表示,预计未来五年可再生能源发电量将快速成长,到2026年将占全球发电量成长的约95%。预计2020年至2026年间,全球可再生能源发电容量将成长60%以上,达到4,800GW以上。预计太阳能将在未来四年内主导可再生能源发电市场,发电量将远远超过水力发电或风力发电。

- 分析解决方案使能源公共事业公司能够优化发电和发电规划。可再生能源产业大力鼓励采用分析技术。当用于可再生能源发电发电厂时,预测分析可以提供准确的能源生产预测。预测机械故障可以提高营运效率。例如,IBM 的混合可再生能源预测技术利用巨量资料、预测分析和天气建模技术来估计太阳能和风能的可变资源。这将使可再生能源发电增加 10%,足以为 14,000 个家庭供电。

- 此外,由于微电网控製网路和其他高阶晶格框架的使用不断增加,尖端分析工具和技术(例如巨型资讯阶段和分散式运算)存在巨大的未开发潜力。预计公共事业提供者对广泛资讯分析的需求将受到促进智慧网路部署和快速扩大智慧电錶接受度的重要政府指导方针的推动。

- 世界各地的多个政府越来越限制人员流动,主要是为了减缓 COVID-19 的传播。因此,公共事业和能源部门可能会预期电力需求将会改变。随着人们待在家里的时间更长,预计住宅消费和对水基础设施的需求也会增加。分析解决方案的使用将主要帮助这些公司更好地预测需求响应并制定准确的配电计划。

公共事业和能源分析市场趋势

云端基础的部署模型有望快速成长。

- 在技术进步的帮助下,云端基础的部署模型预计将快速成长,从而实现高扩充性和成本效率。预计未来五年负载预测和需量反应市场将占据重要份额。

- 预测分析在公共产业领域发挥重要作用,主要用于分析不断增长的资料量、识别故障的有形资产以及增进对客户行为的了解。公共产业公司依赖持续运营,包括各层面的舒适运作。因此,预测分析被广泛采用,以避免大规模影响。

- 此外,2022 年 1 月,着名的工业智慧软体即服务供应商 Uptake 宣布与领先的专业服务公司 Cognizant 建立合作伙伴关係,以公共产业统一的资料管理。 Uptake Fusion 收集、传输、组织和管理 Microsoft Azure 上的资料,并提供先进的工业分析和资产绩效管理,该公司已与 Cognizant 合作提供行业咨询、系统整合和应用服务。工业组织可以在企业云端环境中使用 Uptake Fusion,为内部工业智慧和第三方资料消费者提供资料。您还可以使用开放 API 作为目前非专有工具的插件,用于仪表板、报告和监控,例如 Microsoft 的 Power BI、PowerApps 和 Azure Time Series Insights。

- Oracle超越了 2020 年房地产和设施使用 33%可再生能源的目标,并设定了 2025 年达到 100% 的新目标。 Oracle Cloud也设定了2025年使用100%永续能源的新目标。预计这些因素将在预测期内增加市场需求。

- IDC 预计,2022 年数位转型 (DX) 总支出将达到 1.8 兆美国。到 2025 年,全球数位转型支出预计将达到 2.8 兆美元。因此,随着数位转型支出的增加,预计市场在未来几年将面临各种利润丰厚的成长机会。

北美将引领和开拓公共事业和能源分析解决方案市场

- 北美被认为是公共事业和能源分析的最大市场之一,也是分析解决方案的顶级采用者之一。该地区的大部分需求源于新兴经济体透过研发和技术改进更加重视创新。与加拿大相比,美国是该地区需求成长的主要因素。石油和天然气、精製和发电行业的需求尤其增加。

- 该地区的製造商在市场上拥有强大的立足点。其中包括 SAS Institute Inc、Oracle Corporation、BuildingIQ、IBM Corporation 等。该地区也处于实施智慧电网技术的前沿。该地区能源和公共事业领域的大量公司已经完全采用或正在实施巨量资料分析。在美国市场,许多大型投资者拥有的公用事业公司正在向其客户推出智慧电錶。

- 美国能源情报署预测,2016年至2040年全球能源消费量将增加5%。鑑于成长率较低,企业必须减少停机时间并有效保持盈利。这种情况推动了公共事业和能源领域资料分析市场的发展。为了减少能源使用,美国政府也对其能源系统进行现代化改造,并转向先进计量基础设施 (AMI)。例如,根据美国能源资讯管理局 (EIA) 的数据,住宅领域的 AMI 普及率是全国最高的。由于在人口最多的地区做出了雄心勃勃的努力,加拿大的智慧电錶普及率很高。预计大量小型市政和合作公用事业公司对于市场渗透也至关重要。

- 电力效率研究所预测,到 2024 年,美国智慧电錶的年出货量将达到 9,000 万台,高于 2015 年的 6,100 万台。由于包括 Consolidated Edison、Duke Energy、Ameren、Entergy、PSEG、National Grid 和 Xcel Energy 在内的多家营运商部署智慧电錶,智慧电錶出货量预计将在未来几年增加。

- 此外,该地区的公用事业公司正在探索新技术,为期望高科技数位体验的日益成熟的客户提供服务。国内电力公司正在充分利用巨量资料来做出更好的决策。巴尔的摩天然气和电力公司(Baltimore Gas & Electric)是一家天然气和电力公司,正在进行一系列流程和组织变革,以支援集中式资料分析解决方案并从中获取价值。

公共事业和能源分析产业概述

公共事业和能源分析市场竞争激烈,由多家大型企业组成。这些领先公司在市场上占有重要地位,并专注于扩大跨细分市场的基本客群。公司正在利用策略联合措施来扩大市场占有率并提高盈利。在这个市场上营运的公司也在收购公共事业和能源分析技术领域的新兴企业或与之合作,以增强产品功能并引入新功能。

- 2022 年 7 月 - 推动世界数位转型的领先空间资料公司 Matterport 宣布与为关键基础设施公司提供服务的工程、施工和建筑公司 Barnes & McDonnell 建立合作伙伴关係。此次合作将使 Burns & McDonnell 的客户能够利用 Matterport 数位双胞胎平台(包括软体服务和硬体)来优化建筑扩建和维护计划。透过这种合作关係,能源、公共产业和製造公司将能够获得持续的数位视觉化文件解决方案,从而改善每个计划阶段的业务、加强协作并提高安全性。

- 2021 年 12 月 - Cerner 是一家为医院和医疗保健组织提供数位资讯系统的供应商,被Oracle收购。 Cerner 使用巨量资料分析来储存和处理患者资料。此外,此次收购将使医疗专业人员能够为当地社区和特定个人提供更好的医疗保健服务。

- 2021 年 9 月 - 华盛顿州第二大公共电力公司斯诺霍米甚县公共产业区 (Snohomish PUD) 将安装西门子 EnergyIP 仪表资料管理解决方案,作为该区的Connect Up 计划的一部分,用于实施、整合、和交货。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 能源需求的增加和对环境的日益重视

- 消费者对能源消费模式分析的兴趣日益浓厚

- 市场挑战

- 相容性问题和技能差距

- 安全问题

第六章 市场细分

- 按发展

- 云

- 本地

- 按类型

- 软体

- 服务

- 按用途

- 仪表操作

- 负荷预测

- 需量反应

- 配电方案

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Oracle Corporation

- Capgemini SE

- ABB Corporation

- IBM Corporation

- General Electric Company

- SAS Institute Inc.

- Siemens AG

- Schneider Electric SE

- SAP SE

- Teradata Corporation

第八章投资分析

第9章市场的未来

The Utility and Energy Analytics Market is expected to register a CAGR of 24.9% during the forecast period.

Key Highlights

- There lies a huge untapped potential for advanced analytics tools and techniques, such as the big data platform and cloud computing. With the rise in the use of the microgrids control system and other smart grid systems, which enable businesses to monitor, control, and analyze grid functioning from a central control center, the market for utility and energy analytics will grow significantly. The need for big data analytics among utility providers is also anticipated to increase as a result of the favorable government legislation supporting smart grid solutions and the exponentially rising usage of smart meters.

- Another significant element that can profit from big data analytics is renewable energy. Technologies utilizing renewable energy are becoming more popular on a global scale, particularly as a dependable source of electricity. According to the IEA, renewable energy capacity is anticipated to grow at a rapid pace in the following five years, accounting for about 95% of the increase in global power capacity by 2026. The global renewable electricity capacity is anticipated to increase by more than 60% between 2020 and 2026, reaching more than 4 800 GW. Solar energy is expected to dominate the renewables market, generating far more electricity in the next four years than hydropower and wind.

- Energy utilities can optimize power generation and planning with analytics solutions. Analytics adoption is well encouraged by the renewable energy industry. When used in renewable energy power plants, predictive analytics can provide precise energy production forecasts. It anticipates mechanical glitches, thereby enhancing operational effectiveness. For instance, to estimate the variable resources for solar and wind power generation, IBM's hybrid renewable energy forecast technique makes use of big data, predictive analysis, and weather modeling technologies. This can provide 10% more renewable energy generation to the system, which is enough to power an additional 14,000 houses.

- Furthermore, there is a vast untapped potential for cutting-edge analytics tools and methods, like the huge information stage and distributed computing, as a result of the expansion in the use of the microgrids control network and other brilliant lattice frameworks, which enable organizations to screen, control, and examine network working from a focal control focus. The demand for extensive information analytics among utility merchants is anticipated to be driven by great government guidelines pushing savvy network arrangements and exponentially expanding reception of shrewd meters.

- Multiple governments across the world are increasingly limiting the movement of people primarily to slow down the spread of COVID-19. Due to this, the utilities and the energy sector may expect a shift in the demand for electricity. The residential consumption and demands on water infrastructure are also expected to witness an increase as people are at home for longer periods of time. The usage of analytics solutions will primarily help these companies better forecast the demand response and make accurate distribution planning.

Utility and Energy Analytics Market Trends

The cloud-based deployment model is expected to grow at a rapid pace.

- The cloud-based deployment model is anticipated to grow at a rapid rate, aided by technological advancements, leading to high levels of scalability and cost-effectiveness. The markets for load forecasting and demand response are expected to have significant shares of the market over the next five years.

- Predictive analytics plays a crucial role in the utility sector, mainly analyzing the growing data volumes, identifying failing physical assets, and improving customer behavior understanding. Utility companies rely on continuous operation, which includes pleasant functionality at every level. Hence, to avoid massive repercussions, predictive analytics is being widely adopted.

- Moreover, in January 2022, Uptake, a prominent provider of industrial intelligence software-as-a-service, announced a partnership with Cognizant, a significant player in professional services, to allow unified data management for the energy and utility industries. Uptake Fusion, which collects, transfers, organizes, and curates data in Microsoft Azure to provide advanced industrial analytics and asset performance management, has collaborated with Cognizant to provide industry consulting, systems integration, and application services. Industrial organizations can utilize Uptake Fusion in their enterprise cloud environment to supply data for industrial intelligence to internal and third-party data consumers. Users can also use its open APIs as plug-ins with current non-proprietary tools for dashboards, reporting, and monitoring, such as Microsoft Power BI, PowerApps, and Azure Time Series Insights.

- Oracle surpassed its 2020 objective of 33% renewable energy use in Real Estate and Facilities and established a new goal of 100% by 2025. Oracle Cloud also established a new aim of using 100% sustainable energy by 2025. These factors are thus expected to bolster the demand for the market during the forecast period.

- As per IDC, In 2022, the total spending on digital transformation (DX) is projected to reach 1.8 trillion U.S. dollars. By 2025, global digital transformation spending is forecasted to reach 2.8 trillion U.S. dollars. Hence with the rise in digital transformation spending, the market is expected to face various lucrative growth opportunities in the upcoming days.

North America to Lead and Pioneer Market for Utility and Energy Analytics Solutions

- North America is regarded as one of the greatest markets for utilities and energy analytics and is one of the top adopters of analytics solutions. The region's demand is mostly driven by developed economies' increased emphasis on innovations through R&D and technological improvement. When compared to Canada, the United States is a major factor in increasing the demand from the region. Demand in the nation has increased, particularly from the oil and gas, refining, and power generation sectors.

- The region has a strong foothold of manufacturers in the market. Some of them include SAS Institute Inc, Oracle Corporation, BuildingIQ, and IBM Corporation, among others. Also, the region has been at the forefront of adopting smart grid technology. A vast number of companies operating in the energy utility sector in the region have either fully deployed big data analytics or are in the process of implementation. Many large investor-owned utilities in the US market are still in the process of rolling out smart meters for their customers.

- The US Energy Information Administration predicts that between 2016 and 2040, global energy consumption will rise by 5%. Companies must cut downtime to sustain profitability effectively in light of the low growth rate. The market for data analytics in utilities and energy is fueled by this. In order to decrease energy use, the US government is also modernizing its energy systems and switching to Advanced Metering Infrastructure (AMI). For instance, the residential sector saw the highest rate of AMI adoption in the nation, according to the US Energy Information Administration (EIA). Canada has a high smart meter penetration rate as a result of the country's ambitious endeavors in its most populous regions. It is also expected that a large number of smaller municipal and cooperative utilities will be crucial to market penetration.

- The Institute for Electric Efficiency predicts that by 2024, there will be 90 million smart electricity meters shipped annually in the US, up from 61 million in 2015. The deployment of smart meters by several businesses, including Consolidated Edison, Duke Energy, Ameren, Entergy, PSEG, National Grid, and Xcel Energy, is anticipated to increase the number of smart meter shipments over the next years.

- Furthermore, the electric power companies in the region are exploring new technologies to serve increasingly sophisticated customers to expect a high-tech digital experience. Utilities in the country are highly using big data for better decision-making. Baltimore Gas & Electric, a gas and electric utility, makes numerous process and organizational changes to support and drive value from a centralized data analytics solution.

Utility and Energy Analytics Industry Overview

The utility and energy analytics market is extremely competitive and consists of several major players. These major players, with a prominent presence in the market, are focusing on expanding their customer base across the market segments. The companies are leveraging strategic collaborative initiatives to increase their market share and improve profitability. The companies functioning in the market are also acquiring or partnering with start-ups working on utility and energy analytics technologies to strengthen their product capabilities and introduce new features.

- July 2022 - Matterport, Inc., the leading spatial data company driving the digital transformation of the world, announced a partnership with Burns & McDonnell, an engineering, construction, and architecture firm providing services for critical infrastructure companies. Through the partnership, Burns & McDonnell customers can use the Matterport Digital Twin Platform, including software services and hardware, to optimize construction expansion and maintenance projects. The collaboration equips businesses in the energy, utilities, and manufacturing industries with a continuous digital, visual documentation solution that improves operations, enhances collaboration and increases safety in each project stage.

- December 2021 - The provider of digital information systems for hospitals and healthcare institutions, Cerner, was purchased by Oracle Corporation. Cerner utilizes big data analytics to store and process the patient's data. Additionally, this acquisition will make it possible for medical experts to provide both communities and specific individuals with improved healthcare.

- September 2021 - Snohomish County Public Utility District (Snohomish PUD), which is the second-largest publicly owned utility in Washington state, selected TRC Companies to implement, integrate and deliver its meter data management on the Siemens EnergyIP solution as a part of the utility's Connect Up program.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Energy and Increasing Emphasis on a Greener Environment

- 5.1.2 Growing Consumer Focus on Energy Consumption Pattern Analysis

- 5.2 Market Challenges

- 5.2.1 Compatibility Issues and Skill Gap

- 5.2.2 Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Type

- 6.2.1 Software

- 6.2.2 Services

- 6.3 By Application

- 6.3.1 Meter Operation

- 6.3.2 Load Forecasting

- 6.3.3 Demand Response

- 6.3.4 Distribution Planning

- 6.3.5 Other Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Capgemini SE

- 7.1.3 ABB Corporation

- 7.1.4 IBM Corporation

- 7.1.5 General Electric Company

- 7.1.6 SAS Institute Inc.

- 7.1.7 Siemens AG

- 7.1.8 Schneider Electric SE

- 7.1.9 SAP SE

- 7.1.10 Teradata Corporation