|

市场调查报告书

商品编码

1628755

Tall oil衍生性商品市场市场占有率分析、产业趋势与统计、成长预测(2025-2030)Crude Tall Oil Derivatives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

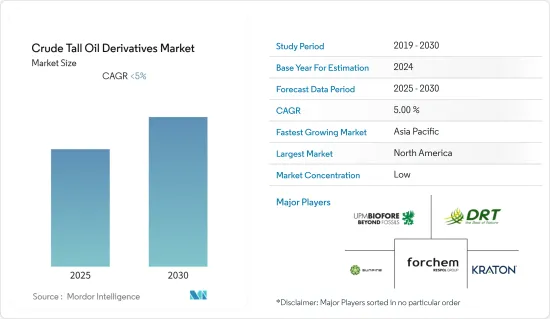

原油Tall oil衍生性商品市场预计在预测期内复合年增长率将低于5%

主要亮点

- 2020年,疫情导致各行业供应链中断,严重影响工业成长。然而,疫情后汽车产量的活性化带动了整个产业的成长。

- 推动市场成长的关键因素是终端用户产业对生物基化学品的需求不断增加以及原油Tall oil衍生物在汽车产业的应用不断扩大。另一方面,将更多粗Tall oil原料用于生质柴油应用预计将阻碍市场成长。

- 亚太和北美石油和天然气计划的扩张预计将在预测期内提供新的成长机会。北美在全球占据主导地位,其中美国的消费量最高。

原油Tall oil衍生性商品市场趋势

TOFA 细分市场占据主导地位

- 在全球范围内,欧盟(EU)和美国是Tall oil脂肪酸的主要生产国和消费国。因此,Tall oil脂肪酸几乎不存在净国际贸易,进口依赖度为零。欧盟每年生产两千吨Tall oil脂肪酸作为润滑油,其中大部分Tall oil脂肪酸生产也发生在北欧国家。

- Kraton Corporation、Ingevity、Chemceed、Forchem Oyj、Spectrum Chemical Mfg Corp、Industrial Oleochemical Products 和 Parchem Fine & Specialty Chemicals 是参与 TOFA 生产的着名参与企业。

- 2017 年 10 月,美国环保署 (EPA) 颁布了关于在以下情况下用作惰性成分(溶剂/载体)时Tall oil脂肪酸残留物的耐受性要求的豁免规定:原材料、应用于动物的杀虫剂、食品接触表面的抗菌配方。

- Ingevity Corporation 已根据《联邦食品、药品和化妆品法案》(FFDCA) 向 EPA 提交申请,要求根据耐受性要求制定这些豁免。该法规消除了对满足这些豁免标准的Tall oil残留物製定最大容许量的需要。这些新的豁免在过去两年推动了北美市场的成长。

- 随着汽车工业的发展,对润滑油的需求也预计会增加。欧盟、美国、亚太等地区汽车产销量的快速成长,带动了润滑油的需求。

- 2022年前三季度,欧盟生产了近800万辆汽车,比2021年同期成长5.8%。同时,2022年1月至9月,欧盟商用车註册量为120万辆,年减17.6%。

- 2022年1-9月北美产量成长11.8%至约800万台。此外,在美国,2020年大流行之后,2021年汽车产量增加至917万辆。此外,2022年1月至9月中国累计登记汽车数量增加8.2%,达到超过1530万辆。此外,中国汽车产量强劲復苏,1-9月累计生产1,640万辆。

- 因此,这些因素预计将推动润滑油中总油脂肪酸的消费,带动整个产业的成长。

美国主导北美市场

- 美国是世界上最大的经济体。 2021年经济成长率为5.7%。我们预计将实现 1984 年以来最强劲的经济。该国在尖端技术研究、开发和创新方面受到高度依赖。然而,在过去十年中,製造业已转移到墨西哥、加拿大、中国和印度等其他国家。

- 对此,本届政府正努力振兴国内製造业,使製造地。 2021年,美国汽车产量较2020年成长约4%。这导致该国润滑油产量和销售量的增加。 2021年,该国炼油厂净生产量为16.8万桶/日,与前一年同期比较增长约10.5%,减少了该国近年来居高不下的原油消费量。

- 汽车工业和设备製造业是金属加工液需求的主要驱动力。美国以开发和生产高端建筑和工业技术及设备而闻名,是金属加工液的主要消费国之一。

- 过去几十年来,美国石油和天然气产业经历了强劲成长,带动了工业成长。 2021年美国石油产量约7.11亿吨,较前一年略为下降。此外,预计2022年美国原油产量将达到1,170万桶/日,2023年将达到1,240万桶/日,超过2019年创下的历史新高。

- 因此,在预测期内,该国的所有这些发展将导致用于生产生质柴油、金属加工液、油田化学品、采矿化学品、油漆、被覆剂和黏合剂等工业产品的粗Tall oil的生产。

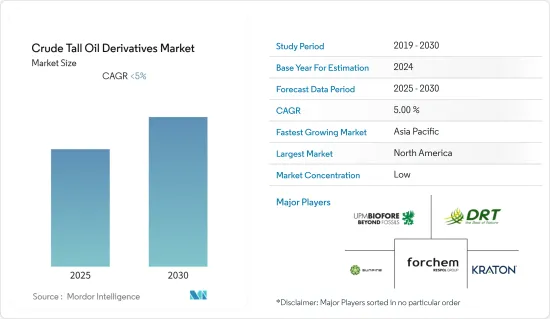

Tall oil衍生性商品产业概况

原油Tall oil衍生性商品市场部分整合,五家主要企业占据主要份额。原油Tall oil衍生性商品市场的主要企业包括Kraton Corporation、Forchem Oyj、UPM、Les Derives Resiniques Et Terpeniques、SunPine AB等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 最终用户产业对生物基化学品的需求增加

- 增加在汽车产业的应用

- 其他司机

- 抑制因素

- 扩大粗Tall oil原料在生质柴油应用的使用

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

- 原料分析

- 生产分析

- 贸易分析

第五章市场区隔(市场规模(数量))

- 分数

- 高油沥青 (TOP)

- Tall oil松香 (TOR)

- 蒸馏Tall oil(DTO)

- Tall oil脂肪酸 (TOFA)

- 最终用户产业

- 车

- 生质柴油(燃料)

- 润滑油

- 轮胎製造(橡胶)

- 特用化学品/石化产品

- 塑胶

- 金属加工液

- 肥皂/清洁剂

- 涂层

- 印刷油墨

- 纸张尺寸

- 胶水

- 石油、天然气和采矿

- 石油钻探

- 采矿浮式

- 其他的

- 固醇

- 口香糖

- 其他的

- 车

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 芬兰

- 瑞典

- 欧洲其他地区

- 其他的

- 巴西

- 南非

- 其他国家

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Eastman Chemical Company

- Forchem Oyj

- Ingevity

- Kraton Corporation

- Les Derives Resiniques Et Terpeniques

- Mercer International Inc.

- Neste

- Ooo Torgoviy Dom Lesokhimik

- Pine Chemical Group Oy

- Segezha Group

- Sunpine AB

- UPM

第七章市场机会与未来趋势

- 扩大亚太和北美石油和天然气计划

简介目录

Product Code: 53197

The Crude Tall Oil Derivatives Market is expected to register a CAGR of less than 5% during the forecast period.

Key Highlights

- In 2020, the pandemic severely impacted industry growth due to supply chain disruption across various industries. However, ramping automotive production post-pandemic propelled the overall industry growth.

- The major factors driving the market's growth are the increasing demand for bio-based chemicals in end-user industries and the rising application of crude tall oil derivatives in the automotive industry. On the flip side, directing crude tall oil feedstock more into biodiesel applications is expected to hinder the market's growth.

- The oil and gas project expansions in Asia-pacific and North America will likely offer new growth opportunities during the forecast period. North America dominates the world, with the largest consumption from the United States.

Crude Tall Oil Derivatives Market Trends

TOFA Segment to Dominate the Market

- Globally, the European Union (EU) and the United States are key producers and consumers of tall oil fatty acids. This implies little net international trade in tall oil fatty acids, resulting in zero import dependence. Tall oil fatty acids have a production volume for use as lubricants of 2-kilo metric tons/annum in the EU, and the majority of tall oil fatty acid production also takes place in Nordic countries.

- Kraton Corporation, Ingevity, Chemceed, Forchem Oyj, Spectrum Chemical Mfg Corp, Industrial Oleochemical Products, and Parchem Fine & Specialty Chemicals are the notable players involved in the production of TOFAs.

- In October 2017, the Environmental Protection Agency (EPA) enacted a regulation for exemptions from the requirement of a tolerance for residues of tall oil fatty acids when used as inert ingredients (solvent/carrier) in the following circumstances: in pesticide formulations applied to growing crops and raw agricultural commodities after harvest, in pesticides applied in/on animals, and in antimicrobial formulations for food contact surfaces.

- Ingevity Corporation submitted a petition to EPA under the Federal Food, Drug, and Cosmetic Act (FFDCA), requesting the establishment of these exemptions from the requirement of a tolerance. This regulation eliminates the need to establish maximum permissible levels for residues of tall oil fatty acids that are consistent with the conditions of these exemptions. These new exemptions have been encouraging market growth in North America for the past two years.

- With the growing automotive industry, the demand for lubricants is also expected to increase. The surging automotive production and sales in various regions, including the European Union, the United States, and the Asia-Pacific, drive the demand for lubricants.

- During the first three quarters of 2022, nearly 8 million cars were manufactured in the European Union, 5.8% more than during the same period in 2021. In contrast, 1.2 million commercial vehicles were registered in the European Union from January to September 2022, a year-on-year decline of 17.6%.

- North American output increased by 11.8% during the first nine months of 2022 - to nearly 8 million cars. Additionally, in the United States, automotive production increased to 9.17 million units in 2021 after the pandemic in 2020. Furthermore, in 2022, from January to September, cumulative volumes in China increased by 8.2% to more than 15.3 million cars registered. Additionally, Chinese car production rebounded strongly to reach 16.4 million units from January to September.

- Therefore, these factors are projected to boost the consumption of total oil fatty acid in lubricants, propelling the overall industry growth.

United States to Dominate the North America Market

- The United States is the world's largest and most powerful economy. In 2021, the economy increased by an annualized 5.7%. There were signs that the economy was the strongest since 1984. The country is highly relied on when it comes to R&D and innovation of advanced technologies. However, in the past decade, the country has shifted the manufacturing sector to other nations, such as Mexico, Canada, China, India, etc.

- In this regard, the present government has been making efforts to revitalize the manufacturing sector in the country and make the country a manufacturing hub of high-end products. In 2021, the United States recorded about a 4% increase in automotive production over 2020. This led to the country's inclining production and sales of lubricants. In 2021, the refinery's net production of lubricants stood at 168 thousand barrels per day, up by roughly 10.5 percent from the previous year in the country, reducing the consumption of crude tall in the country in recent years.

- The automotive and equipment manufacturing industries significantly drive the demand for metalworking fluid. The United States is well-known for advancing and producing high-end technologies and equipment for construction and industrial use, making the country one of the major consumers of metalworking fluids, further driving its production at a moderate rate in the domestic market.

- Strong growth in the oil and gas industry in the last few decades in the country has propelled the industry growth. Oil production in the United States amounted to some 711 million metric tons in 2021, a slight decrease compared to the previous year. Additionally, US crude oil production was 11.7 million b/d in 2022 and is forecasted to reach 12.4 million b/d in 2023, surpassing the record high set in 2019.

- Hence, all such trends in the country are anticipated to increase the demand and consumption of crude tall oil derivatives used in producing industrial products, such as biodiesel, metalworking fluids, oilfield chemicals, mining chemicals, paints, coatings, adhesives, etc., during the forecast period.

Crude Tall Oil Derivatives Industry Overview

The crude tall oil derivatives market is partially consolidated, with the top five players accounting for a significant share. Key players in the crude tall oil derivative market include Kraton corporation, Forchem Oyj, UPM, Les Derives Resiniques Et Terpeniques, and SunPine AB, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand For Bio-based Chemicals In End-user Industries

- 4.1.2 Rising Application in the Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Directing Crude Tall Oil Feedstock More Into Biodiesel Application

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

- 4.6 Raw Material Analysis

- 4.7 Production Analysis

- 4.8 Trade Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Fraction

- 5.1.1 Tall Oil Pitch (TOP)

- 5.1.2 Tall Oil Rosin (TOR)

- 5.1.3 Distilled Tall Oil (DTO)

- 5.1.4 Tall Oil Fatty Acid (TOFA)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.1.1 Bio-diesel (fuel)

- 5.2.1.2 Lubricant

- 5.2.1.3 Tire Manufacturing (rubber)

- 5.2.2 Specialty Chemicals & Petrochemicals

- 5.2.2.1 Plastics

- 5.2.2.2 Metalworking Fluids

- 5.2.2.3 Soap & Detergents

- 5.2.2.4 Coatings

- 5.2.2.5 Printing inks

- 5.2.2.6 Paper Sizing

- 5.2.2.7 Adhesives

- 5.2.3 Oil & Gas and Mining

- 5.2.3.1 Oil Drilling

- 5.2.3.2 Mining flotation

- 5.2.4 Other End-user Industries

- 5.2.4.1 Sterols

- 5.2.4.2 Chewing gum

- 5.2.4.3 Other End Users

- 5.2.1 Automotive

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Spain

- 5.3.3.5 Finland

- 5.3.3.6 Sweden

- 5.3.3.7 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of the Countries

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Eastman Chemical Company

- 6.4.2 Forchem Oyj

- 6.4.3 Ingevity

- 6.4.4 Kraton Corporation

- 6.4.5 Les Derives Resiniques Et Terpeniques

- 6.4.6 Mercer International Inc.

- 6.4.7 Neste

- 6.4.8 Ooo Torgoviy Dom Lesokhimik

- 6.4.9 Pine Chemical Group Oy

- 6.4.10 Segezha Group

- 6.4.11 Sunpine AB

- 6.4.12 UPM

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Oil and Gas Project Expansions in Asia-pacific And North America

02-2729-4219

+886-2-2729-4219