|

市场调查报告书

商品编码

1628756

尼龙树脂:市场占有率分析、产业趋势、成长预测(2025-2030)Nylon Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

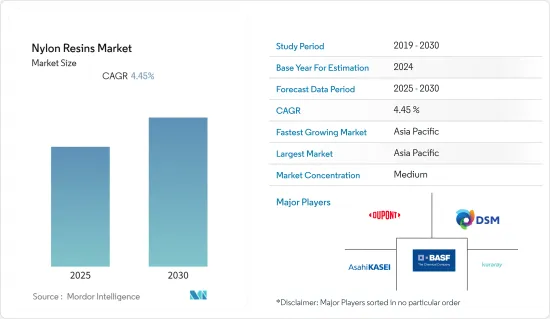

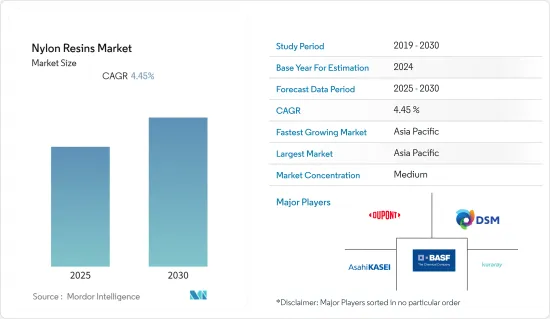

尼龙树脂市场预计在预测期间内复合年增长率为4.45%

主要亮点

- 推动市场的关键因素之一是包装行业需求的增加和汽车行业使用量的增加。

- 然而,有关塑胶使用的严格环境法规正在阻碍市场成长。

- 尼龙6和尼龙66的使用预计将提供未来的市场扩张机会。

- 在产品类型中,尼龙6预计将在研究期间占据市场主导地位。

尼龙树脂市场趋势

汽车产业需求增加

- 尼龙用于汽车生产,因为它是轻量材料,可以减轻车辆的整体重量并有助于提高燃油效率。

- 尼龙树脂广泛用于多种行业,包括汽车零件、配电和包装薄膜。汽车工业占尼龙树脂消费量的最大份额。

- 使用尼龙树脂的汽车零件包括门板、内装、安全气囊和地毯。汽车工业的成长将带动市场尼龙树脂的消费需求。

- 根据OICA预测,2022年全球汽车产量约8,501万辆,较上年的8,020.5万辆成长5.99%,显示汽车产业对尼龙树脂的需求不断增加。

- 2022年,全球汽车製造市场规模将达2.95兆美元,销售达7,800万辆。

- 汽车产业的成长也得益于全球对电动车的需求不断增长。根据世界经济论坛 (WEF) 的报告,2022 年上半年销售了近 430 万辆新纯电动车 (BEV) 和插电式混合动力电动车 (PHEV)。这增加了对尼龙树脂等材料的需求。

- 根据欧洲汽车工业协会统计,2022年北美汽车总产量增加10.3%,达1,040万辆。

- 从电动车(EV)保有量来看,2022年全球电动车(EV)销量达到1,052万辆,较2021年成长55%。

- 在欧洲,德国是主要的汽车製造商之一。由于梅赛德斯-奔驰、宝马、奥迪、保时捷和大众等主要汽车製造品牌的存在,德国汽车製造业是该地区整体生产的主要股东。

- 因此,综合考虑上述因素,预计近期汽车产业对尼龙树脂的需求将大幅增加。

亚太地区主导市场

- 亚太地区目前是尼龙树脂最大的市场,预计在预测期内将出现高速成长,这主要是由于该地区製造能力的增加。

- 根据东南亚国家汽车联合会(ASANAF)统计,2022年亚太地区汽车产量为438万辆,摩托车和Scooter产量为363万辆。同年,全区销售汽车342万辆、摩托车404万辆。

- 根据中国工业协会(CAAM)的数据,中国的汽车製造业是世界上最大的。

- 许多汽车製造商正在该行业的各个领域进行大量投资。例如,2022年11月,马鲁蒂铃木印度公司投资8.6512亿美元用于设立新设施、采用新车型等多个计划。

- 2022年1月,本田中国宣布与东风汽车有限公司成立合资公司,在武汉兴建电动车製造工厂。新工厂将于2024年开业,年产能12万辆。

- 尼龙 6 化合物也有效地用于电气和电子领域。尼龙 6 树脂用于製造连接器、端子块、电路断流器和电动工具外壳等零件。

- 这些化合物具有韧性、阻燃、绝缘电阻和良好的二次电气强度等优异性能,使其适用于多种电气元件。

- 根据日本电子情报技术产业协会(JEITA)统计,2022年11月,电子产业总产值达70.9亿美元。 2022年12月,日本电子设备出口总额相当于83.9亿美元。

- 尼龙也用作对氧敏感类型食品的软包装薄膜。用于要求高熔点、高机械强度、透明性、阻隔性好的食品。

- 在印度等国家,对网路订餐的需求不断增加,带动了对包装材料的需求。例如,2022 年 2 月,印度主要企业之一 Zomato 宣布,在过去五年中,平均每月活跃的送餐餐厅成长了 6 倍,每月交易客户成长达到了他所说的 13 倍。

- 因此,由于上述因素,亚太地区很可能在预测期内主导调查市场。

尼龙树脂产业概况

全球尼龙树脂市场适度整合,大部分市场占有率被几家公司瓜分。主要参与企业包括BASF公司、杜邦公司、帝斯曼公司、旭化成公司和KURARAY CO. LTD.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 由于模製零件製造的高利用率,汽车产业的需求增加

- 包装产业需求增加

- 其他司机

- 抑制因素

- 严格的政府法规以减少对环境的负面影响

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 产品类型

- 尼龙6

- 尼龙6,6

- 生物基尼龙

- 其他的

- 目的

- 吸湿性

- 耐化学性

- 耐温性

- 美丽

- 显色

- 尼龙合金

- 最终用户产业

- 车

- 航太/国防

- 电力/电子

- 包装/储存

- 挤压

- 纤维

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Aquafil SpA

- Asahi Kasei Corporation

- Ascend Performance Materials

- BASF SE

- DSM

- Dupont

- INVISTA

- KURARAY CO., LTD.

- NILIT

- Solvay

第七章 市场机会及未来趋势

- 3D 列印中采用尼龙 6 与尼龙 66

- 其他机会

简介目录

Product Code: 53217

The Nylon Resins Market is expected to register a CAGR of 4.45% during the forecast period.

Key Highlights

- One of the major factors driving the market is the growing demand from the packaging industry and increasing usage in the automotive industry.

- However, strict environmental regulations regarding the plastics usage is hindering the growth of the market studied.

- The usage of Nylon 6 anf Nylon 66 is expected to provide opportunities in the market during the forceast period.

- Among the product types, Nylon 6 is expected to dominate the market studied during the market studied.

Nylon Resins Market Trends

Increasing Demand from Automotive Industry

- Nylon is a lightweight material that is used in the production of automobiles as it reduces the overall vehicle weight and helps improve fuel efficiency.

- There have been diverse industries for which nylon resins are used, including automotive components, electrical power distribution, and packaging films, among others. The automotive industry holds the largest share of nylon resin consumption.

- The section of the vehicle part that utilizes nylon resins includes door panels, upholstery, airbags, carpets, and others. The growing automotive industry boosts the demand for the consumption of nylon resins in the market.

- According to the OICA, in 2022, around 85.01 million vehicles were produced across the globe, witnessing a growth rate of 5.99% compared to 80.205 million vehicles in the previous year, thereby indicating an increased demand for nylon resins from the automotive industry.

- In 2022, the market for global automotive manufacturing reached USD 2.95 trillion, with unit sales volumes reaching 78 million units.

- The growth in the automotive industry can also be attributed to the rising demand for electric vehicles across the globe. As per the reports from the World Economic Forum (WEF), nearly 4.3 million new battery-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold in the first half year of 2022. This enhanced the demand for materials such as nylon resins and others.

- In 2022, according to the European Automobile Manufacturers Association, the total car production in the North American region rose by 10.3% and reached 10.4 million units.

- According to the electric vehicle (EV) volumes, global electric vehicle (EVs) sales reached 10.52 million units in 2022, registering a growth rate of 55% as compared to 2021.

- In Europe, Germany is among the key manufacturer of vehicles. The automobile manufacturing industry in Germany is a key shareholder of the overall production in the region due to the presence of major car-making brands such as Mercedes-Benz, BMW, Audi, Porche, and Volkswagen, among others.

- Therefore, considering the aforementioned factors, the demand for nylon resins is expected to rise in the automotive industry significantly in the near future.

Asia-Pacific to Dominate the Market

- Currently, Asia-Pacific is the largest market for nylon resins and is expected to grow at a high rate during the forecast period, mainly because of increasing manufacturing capacities in the region.

- According to the Association of Southeast Asian Nations Automotive Federation (ASANAF), in 2022, Asia-Pacific produced 4.38 million units of motor vehicles and 3.63 million units of motorcycles and scooters. In the same year, a total number of 3.42 million units and 4.04 million units of motor vehicles and two-wheelers, respectively, were sold in the region.

- According to the China Association of Automobile Manufacturers (CAAM), the automotive manufacturing industry of China is the largest in the world.

- Many Automakers have been investing heavily in various segments of the industry. For instance, in November 2022, Maruti Suzuki India invested an amount of USD 865.12 million on various projects, including new facilities set-up and the introduction of new models.

- In January 2022, Honda China announced a joint venture with Dongfeng Motor Corporation Ltd for the development of an electric-vehicle manufacturing factory in Wuhan. The new facility will be opened in 2024 with a production capacity of 120,000 units per year.

- Nylon 6 compounds are also used effectively in the electrical and electronics sector. The components such as connectors, terminal blocks, circuit breakers, power tool housing, and others utilize nylon 6 resin.

- These compounds provide excellent properties, including toughness, flame retardant characteristics, insulation resistance, and good di-electric strength, among others, that make them suitable to be used in various electrical parts.

- According to Japan Electronics and Information Technology Industries Association (JEITA), in November 2022, the total production of the electronics industry reached USD 7.09 billion. In December 2022, the total electronics exported from Japan amounted worth USD 8.39 billion.

- Nylon is also used as a flexible packaging film for the type of food that is sensitive to oxygen. It is used for food items that require a high melting point, high mechanical strength, transparency, and a good oxygen barrier.

- In the countries such as India, the demand for online food ordering has increased, which boosts the demand for packaging materials. For instance, in February 2022, one of the leading food delivery companies in India, Zomato, stated its average monthly active food delivery restaurants grew six times while the growth in the monthly transacting customers reached 13 times over the period of the past five years.

- Hence, owing to the above-mentioned factors, Asia-Pacific is likely to dominate the market studied during the forecast period.

Nylon Resins Industry Overview

The global nylon resins market is moderately consolidated as most of the market share is divided among a few players. Some of the major players include BASF SE, DuPont, DSM, Asahi Kasei Corporation, and Kuraray Co Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Automobile Industry due to its High Utilization in making Molded Parts

- 4.1.2 Rising Demand from the Packaging Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Government Regulations for Reducing Negative Environmental Impacts

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Nylon 6

- 5.1.2 Nylon 6,6

- 5.1.3 Bio-based Nylon

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Moisture Absorbent

- 5.2.2 Chemical Resistant

- 5.2.3 Temperature Resistant

- 5.2.4 Aesthetic

- 5.2.5 Colorable

- 5.2.6 Nylon Alloys

- 5.3 End-User Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Electrical and Electronics

- 5.3.4 Packaging and Storage

- 5.3.5 Extrusion

- 5.3.6 Textile

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aquafil S.p.A.

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 Ascend Performance Materials

- 6.4.4 BASF SE

- 6.4.5 DSM

- 6.4.6 Dupont

- 6.4.7 INVISTA

- 6.4.8 KURARAY CO., LTD.

- 6.4.9 NILIT

- 6.4.10 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Inclusion of Nylon 6 and Nylon 66 in 3D Printing

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219