|

市场调查报告书

商品编码

1628769

亚太地区声学感测器 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)APAC Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

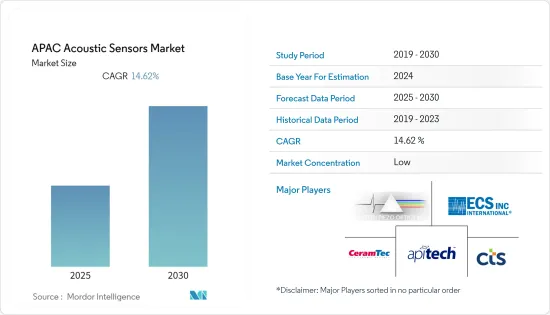

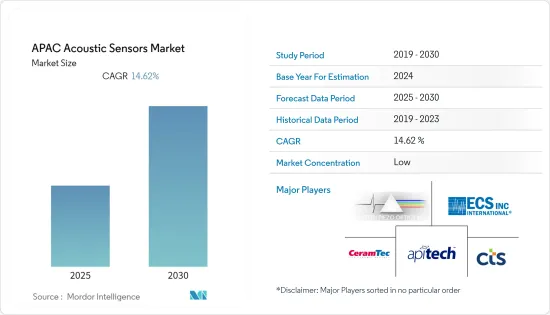

亚太声学感测器市场预计在预测期内复合年增长率为 14.62%

主要亮点

- 由于表面波声感测器在电视发送器和收音机中用于产生广播讯号,因此预计在预测期内将出现高速增长。 SAW 装置是射频应用中不可或缺的滤波器,也是卫星通讯终端和基地台使用的重要元件。

- 随着人们越来越关注支援 5G 技术的基础设施投资,预计整个全部区域对射频半导体的需求将会增加。根据GSMA预测,2020年至2025年间,亚太地区行动通讯业者预计将在网路上投资超过4,000亿美元,其中3,310亿美元将用于5G部署。

- 该地区还主导全球汽车 MEMS 感测器市场。电动车市场代表了该地区的主要商机。 2019年中国电动车销量稳定在120万辆左右(与前一年同期比较增长3%)。

- 2020年6月,中国电动车(EV)製造商比亚迪为其比亚迪半导体子公司获得第二轮融资,以提高产量。该公司有兴趣开发可提高电动车马达效率的半导体。这些提高该地区製造能力的努力预计将增加对 SAW 设备的需求。

- 在 COVID-19 的初期阶段,由于全国范围内的封锁和许多製造产能的关闭,受访市场出现了供应链中断。然而,从2020年第二季开始,市场开始出现需求和生产的復苏,半导体产业的趋势也反映在研究市场。

亚太声学感测器市场趋势

通讯应用推动市场成长

- 通讯业是声学感测器的最大消费者,主要由智慧型手机和基地台推动。为了支援不断增长的客户群,电信业者正在安装越来越多的塔和基地台。

- 此外,可支配收入的增加和低预算智慧型手机正在促使更多的人(尤其开发中国家)购买智慧型手机。

- 此外,大多数手机和其他类似的小工具已经安装了麦克风/扬声器,并且可以以相对较低的实施成本支援声音感测应用程式。

- 全球LTE和4G技术的基础建设不断取得进展,已开发国家对5G技术的基础设施投资不断加大,有力支撑了声学感测器(SAW滤波器)的成长。

- 由于中国、韩国、日本和印度等已开发经济体和新兴经济体的智慧型手机、平板电脑和其他电子设备的使用量不断增加,预计声学感测器将在预测期内出现成长。

家用电子电器占据最高市场占有率

- 智慧型手机销售的增加以及家用电子电器中新兴射频技术的日益采用导致声学感测器和其他相关设备的销售大幅增长,扩大了研究市场的范围。

- LTE、4G 和 5G 设备(尤其是 5G 智慧型手机)生产的扩大也为 SAW 技术供应商带来了巨大的成长机会。射频滤波器正在成为各种智慧型手机的标准部件,因为它们将无线电讯号与用于发送和接收讯息的不同频段分开。全新先进 SAW 滤波器在 2.7GHz 以下频段提供比同类 BAW 滤波器更高效能的解决方案,从而随着 5G 技术的出现提供高成长机会。

- 大多数着名的智慧型手机製造商都在其最新的 5G 智慧型手机中采用了射频滤波器。 SAW 感测器的进步也使OEM(目的地设备製造商)能够以比具有类似性能指标的竞争性商业解决方案更低的成本和更高能效的 RF 在 5G 和 4G 多模行动装置中使用 RF。

- 此外,许多研究人员正在探索 SAW MEMS 麦克风的潜力,它也可用作无线被动加速计和压力感测器。预计到2024年,全球MEMS麦克风市场将超过16.7亿美元。

亚太地区声学感测器产业概况

声学感测器是相对容易製造的设备。因此,市场高度分散,许多全球和本地製造商为市场动态做出了贡献。儘管MEMS市场正在稳步成长,主要企业都面临着激烈的竞争,迫使它们降低价格并降低利润率。参与企业数量持续增加。

- 2020 年 6 月 - 中国电动车 (EV) 製造商比亚迪已为其比亚迪半导体子公司获得第二轮融资,以提高产量。该公司有兴趣开发可提高电动车马达效率的半导体。这些提高该地区製造能力的努力预计将增加对声学感测器的需求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 通讯市场的成长

- 製造成本低

- 市场限制因素

- 声学感测器的技术问题

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场区隔

- 按类型

- 有线

- 无线的

- 按波浪类型

- 表面波

- 体波

- 按感测参数

- 温度

- 压力

- 扭力

- 低价

- 湿度

- 黏度

- 化学蒸气

- 按用途

- 车

- 航太/国防

- 家用电子电器产品

- 医疗保健

- 工业的

- 其他的

- 按国家/地区

- 印度

- 中国

- 日本

- 韩国

- 澳洲

- 其他亚太地区

第六章 竞争状况

- 公司简介

- API Technologies Corp.

- ASR&D Corporation

- Boston Piezo-optics Inc.

- Ceramtec

- CTS Corporation

- ECS Inc. International

- Epcos

- Epson Toyocom

- Honeywell International Inc.

- Kyocera

- Murata Manufacturing Co. Ltd.

- Panasonic Corp.

- Phonon Corporation

- Rakon

- Raltron Electronics Corporation

- Senseor

- Shoulder Electronics Ltd.

- Teledyne Microwave Solutions

- Triquint Semiconductor, Inc.

- Vectron International

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 53619

The APAC Acoustic Sensors Market is expected to register a CAGR of 14.62% during the forecast period.

Key Highlights

- The surface wave acoustic sensor is expected to have high growth during the forecast period due to its implementation in television transmitters and radios to generate signals for broadcasting. SAW devices are indispensable as filters in radio frequency applications and are essential components used in the terminals and base stations for satellite communication.

- The increasing focus on investments to develop infrastructure for supporting 5G technology is expected to boost the demand for RF semiconductors across the region. According to the GSMA, mobile operators in the Asia-Pacific region are expected to invest over USD 400 billion in their networks between 2020 and 2025, of which USD 331 billion will be spent on 5G deployments.

- The region is also dominating the global market for automotive MEMS sensors. The EV market is a massive opportunity in the region. EV sales remained constant in China in 2019, at around 1.2 million units sold (a 3% increase from the previous year).

- In June 2020, the China-based electric vehicle (EV) producer, BYD, secured a second round of financing for its BYD Semiconductor subsidiary to increase its production. The company is interested in developing semiconductors that can increase the efficiency of the electric motor in EVs. With such initiatives to improve the manufacturing capacities in the region, the demand for SAW devices is expected to increase.

- In the initial phase of the COVID-19, the studied market witnessed the disruption in the supply chain owing to nationwide lockdown and closure of many manufacturing capacities. However, after the 2nd Q of 2020, the market started witnessing a recovery in demand and production, the semiconductor industry trend that was also reflected in the studied market.

APAC Acoustic Sensors Market Trends

Telecommunications Applications to Drive the Market Growth

- The telecommunications industry is the largest consumer of acoustic sensors, primarily driven by smartphones and base stations. With telecom companies setting up more and more towers to support the ever-increasing customer base, base stations are increasing.

- Moreover, people, especially in developing countries, buy smartphones due to increasing disposable incomes and low-budget smartphones.

- Moreover, most telephone devices and other similar gadgets already have microphones/speakers installed, which support acoustic-sensing applications with a relatively low deployment cost.

- The growing infrastructure development of LTE and 4G technology across the globe and rising infrastructure investment in 5G technology by developed countries is providing a massive boost to the growth of acoustic sensors (SAW Filters).

- Owing to the increasing usage of smartphones, tablets, and other electronic devices in developed and developing economies such as China, South Korea, Japan, and India, acoustic sensors are expected to witness growth during the forecast period.

Consumer Electronics holds the highest market share

- There is a significant surge in the sales of acoustic sensors and other related equipment due to the increasing smartphone sales and the increasing adoption of emerging RF technologies in consumer electronics, expanding the scope of the market studied.

- The growing production of LTE, 4G & 5G devices, especially 5G smartphones, also creates a massive growth opportunity for the SAW technology provider. RF filters are becoming standard components in these devices as they isolate radio signals from the different spectrum bands used by various smartphones to receive and transmit information. New advanced SAW filters offer a higher performance solution than competing for BAW filters in the sub-2.7 GHz frequency range, hence having higher growth opportunities with the emergence of 5G technology.

- Most renowned smartphone manufacturers adopt RF filters in their latest 5G smartphones; LG and Samsung are few among these. The advancement in SAW sensors also enables more power-efficient RF paths in 5G and 4G multimode mobile devices at a lower cost point than competing commercial solutions with similar performance metrics for original equipment manufacturers (OEMs).

- Many researchers are also exploring the scope of the SAW MEMS microphone that can also be used as a wireless passive accelerometer and pressure sensor. The global MEMS microphone market will be expected to cross USD 1.67 billion by 2024.

APAC Acoustic Sensors Industry Overview

Acoustic sensors are a relatively simple device to manufacture. Consequently, the market is highly fragmented, with many global and local manufacturers contributing to the market dynamics. The MEMS market is seeing steady growth, but companies have to face cut-throat competition leading to brutal price declines and low margins. The market is continually adding new entrants into the market.

- June 2020 - The China-based electric vehicle (EV) producer, BYD, secured a second round of financing for its BYD Semiconductor subsidiary to increase its production. The company is interested in developing semiconductors that can increase the electric motor's efficiency in EVs. With such initiatives to improve the manufacturing capacities in the region, the demand for acoustic sensors is expected to increase.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Telecommunications Market

- 4.2.2 Low Manufacturing Costs

- 4.3 Market Restraints

- 4.3.1 Technical Challenges Associated with Acoustic Sensors

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Wave Type

- 5.2.1 Surface Wave

- 5.2.2 Bulk Wave

- 5.3 By Sensing Parameter

- 5.3.1 Temperature

- 5.3.2 Pressure

- 5.3.3 Torque

- 5.3.4 Mass

- 5.3.5 Humidity

- 5.3.6 Viscosity

- 5.3.7 Chemical Vapor

- 5.4 By Application

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Consumer Electronics

- 5.4.4 Healthcare

- 5.4.5 Industrial

- 5.4.6 Other Applications

- 5.5 By Country

- 5.5.1 India

- 5.5.2 China

- 5.5.3 Japan

- 5.5.4 South Korea

- 5.5.5 Australia

- 5.5.6 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 API Technologies Corp.

- 6.1.2 ASR&D Corporation

- 6.1.3 Boston Piezo-optics Inc.

- 6.1.4 Ceramtec

- 6.1.5 CTS Corporation

- 6.1.6 ECS Inc. International

- 6.1.7 Epcos

- 6.1.8 Epson Toyocom

- 6.1.9 Honeywell International Inc.

- 6.1.10 Kyocera

- 6.1.11 Murata Manufacturing Co. Ltd.

- 6.1.12 Panasonic Corp.

- 6.1.13 Phonon Corporation

- 6.1.14 Rakon

- 6.1.15 Raltron Electronics Corporation

- 6.1.16 Senseor

- 6.1.17 Shoulder Electronics Ltd.

- 6.1.18 Teledyne Microwave Solutions

- 6.1.19 Triquint Semiconductor, Inc.

- 6.1.20 Vectron International

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219