|

市场调查报告书

商品编码

1628790

北美智慧製造:市场占有率分析、产业趋势与成长预测(2025-2030)North America Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

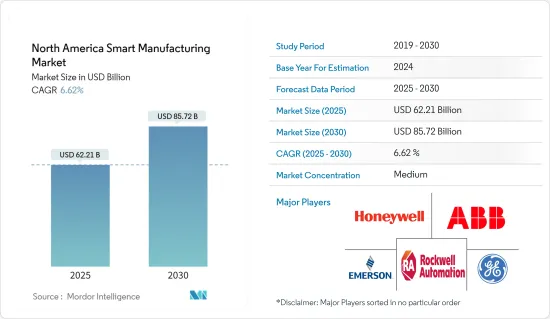

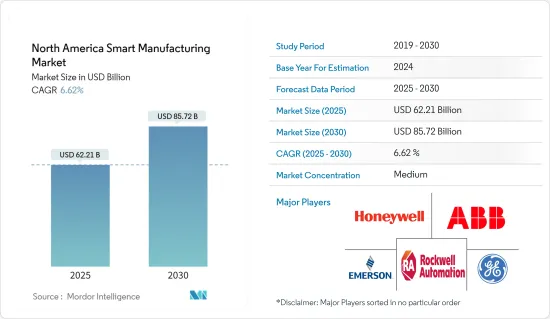

预计2025年北美智慧製造市场规模为622.1亿美元,2030年将达857.2亿美元,预测期间(2025-2030年)复合年增长率为6.62%。

为了实现效率和品质而对自动化的需求不断增长、对数位化和政府支持的合规需求、物联网的渗透等是影响市场成长的关键驱动因素。

主要亮点

- 北美製造业正在透过迅速提高各行业的自动化水平来奠定发展基础。在与日本和中国等全球製造地竞争的同时,北美一直致力于创造和实施机器人和自动化技术。因此,为了节省能源并提高成本效率,工厂自动化和工业控制系统的趋势正在该地区受到关注。

- 巨量资料分析在智慧製造中的应用是为了改善复杂的流程、管理供应链、改善大规模客製化和智慧製造带来的产品,而不是传统的按需营运模式——旨在支援新的经营模式,例如: -a-服务。此外,巨量资料分析使公司能够利用智慧製造,从反应性方法转变为预测性方法。这项变更旨在简化流程和产品性能,并已在该地区广泛采用。

- 然而,自动化系统的高成本与有效、稳健的硬体和高效的软体有关。自动化设备需要高资本支出来投资智慧工厂(自动化系统的安装、设计和製造可能花费数亿美元)。自动化机器也比手动系统需要更高的维护(即使灵活的自动化也不如最通用的机器人类灵活)。除此之外,一系列针对製造业企业的重大网路攻击凸显了该领域的极端风险。对流程控制和系统的依赖,加上 IT 和作业系统技术系统的整合,使得製造企业越来越容易受到网路攻击。

- 该地区的汽车工业始终处于在製造过程中实施机器人技术的最前沿。约翰迪尔等其他工业製造商也在进行大量投资,将自动化技术整合到其产品和流程中。该地区的製造业仍需充分利用这些优势。因此,该地区自动化采用和产品创新的范围很大。

北美智慧製造市场趋势

机器人技术有望实现显着成长

- 机器人改变了製造业,透过自动化使繁重的搬运和精细的任务变得更加容易。市场规模显着扩大,工业机器人和服务机器人的销售量预计在预测期内将增加。因此,对智慧製造的需求日益增加。

- 据IFR称,汽车产业是该地区机器人解决方案的第一大采用者,总部位于美国、加拿大和墨西哥的公司在2022年部署了20,391台工业机器人,与2021年相比增加了30%。特别是,北美是全球运作工业机器人数量第二多的地区,仅次于中国。

- 此外,根据国际机器人联合会 (IFR) 的数据,北美机器人市场显示出强劲增长,总製造安装量增长 12%,到 2022 年达到 41,624 台机器人。根据国际机器人联合会(IFR)的数据,美国的汽车和轻型汽车产量位居世界第二,仅次于中国。

- 此外,领先的製造商正在合作提供关键解决方案,同时加强消费群。例如,2022 年 3 月,3D 和人工智慧 (AI) 驱动的视觉软体领先製造商 Plus One Robotics 宣布与专注于物流和履约业务自动化的全球领导者 Tompkins Robotics 建立合作伙伴关係。两家公司合作开发了自动拣选解决方案,该解决方案将 Plus One Robotics 的 3D 和人工智慧 (AI) 软体与 Tompkins Robotics 的 tSort(TM) 系统结合。

预计美国将出现显着成长

- 美国正处于第四次工业革命的风口浪尖,在生产中大规模利用资料,并将其与整个供应链的各种製造系统整合。该国也是世界上最重要的汽车市场之一,约有 13 家主要汽车製造商在该国营运。此外,汽车製造业是美国最大的製造业收益来源之一。

- 除此之外,该国还有多家公司正在实施自动化以优化其营运。例如,施耐德电机宣布在美国推出首家智慧工厂,即时展示EcoStruxure架构和相关产品套件如何协助提高业务效率并降低客户成本。

- 美国石油和天然气产业一直是自动化任务可程式逻辑控制器 (PLC) 系统的基本需求驱动力。自动化使石油和天然气的大规模生产成为可能,并支援石油产品的顺利分配。

- 根据BEA(经济分析局)统计,2022年,美国汽车业销售了约1,375万辆轻型汽车。其中,乘用车零售量约290万辆,轻卡零售量约1,090万辆,预计未来将进一步成长,成为该国市场的驱动因素。

- 此外,先进製造伙伴关係关係的形成,旨在让工业界和联邦政府投资即将到来的技术,将极大地帮助我们在全球经济中竞争。国家製造创新网络整合了区域中心的发展,这些中心开发先进的製造技术以实施该领域的创新产品。

北美智慧製造概况

北美智慧製造市场是半固定的,有多个主要企业。在这个市场上拥有压倒性份额的主要公司正在专注于扩大海外基本客群。公司正在利用策略合作措施来提高市场占有率和盈利。

2023 年 6 月,艾默生宣布在其 DeltaV 分散式控制系统中添加新一代智慧防火墙,随着製造和工厂连接的不断扩展,增强网路安全性。该公司最近发布了新的 NextGen 智慧防火墙,以强化 DeltaV 系统并提高安全性。该防火墙专为工业製造而设计,与大多数製造流程相容。该防火墙的目的是提高网路安全性并确保工厂网路的安全,而不会给通常已经不堪重负的营运团队增加复杂性。

2022 年 11 月,罗克韦尔自动化宣布将提供具有零信任安全性的智慧边缘管理和编配平台以及具有开放产业标准的边缘应用生态系统,以支援工业客户的数位转型。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 为了实现效率和品质对自动化的需求增加

- 数位化的合规性和政府支持的需求

- 物联网的普及

- 市场限制因素

- 资料安全问题

- 高昂的初始实施成本和缺乏熟练劳动力阻碍了企业全面实施。

第五章市场区隔

- 依技术

- 可程式逻辑控制器(PLC)

- 监控/资料采集(SCADA)

- 企业资源规划(ERP)

- 集散控制系统(DCS)

- 人机介面 (HMI)

- 产品生命週期管理 (PLM)

- 製造执行系统(MES)

- 其他的

- 按成分

- 通讯段

- 控制设备

- 机器视觉系统

- 机器人技术

- 感应器

- 其他的

- 按最终用户产业

- 车

- 石油和天然气

- 化学/石化

- 药品

- 饮食

- 金属/矿业

- 其他的

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- ABB Ltd.

- Emerson Electric Company

- Fanuc Corporation

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

第七章 投资分析

第八章市场的未来

The North America Smart Manufacturing Market size is estimated at USD 62.21 billion in 2025, and is expected to reach USD 85.72 billion by 2030, at a CAGR of 6.62% during the forecast period (2025-2030).

The growing need for automation to attain efficiency and quality, the demand for adherence and government backing for digitization, and the proliferation of the IoT are some of the main driving factors influencing the market growth.

Key Highlights

- North American manufacturers across every industry are creating the development foundation by rapidly improving their level of automation. While competing with global manufacturing hubs like Japan and China, North America has strived to create and adopt robotic and automation technologies. Therefore, to save energy and to gain cost-benefit, the trend of factory automation and industrial control systems is attaining traction in the region.

- The application of big data analytics in smart manufacturing aims to refine complicated processes, manage supply chains, and support new business models, like mass customization and product-as-a-service, which can be made possible by smart manufacturing apart from the traditional operational models like on-demand. Besides, big data analytics allows an enterprise to use smart manufacturing to shift from reactionary practices to predictive ones. This change targets improving the efficiency of the process and product performance, which in turn witnessed significant adoption in the region.

- However, The high costs of automated systems are concerned with effective and robust hardware and efficient software. Automation equipment requires high capital investment to invest in the smart factory (an automated system can cost millions of dollars to install, design, and fabricate). Also, the need for maintenance of automated machines is more than a manual system (even flexible automation is less flexible than humans, the most versatile machines of all). In addition to this, a series of significant cyber-attacks on manufacturing companies has highlighted the extreme and growing risks in the sector. The dependence on process control and systems, combined with the convergence of IT and operating technologies systems, has increasingly exposed manufacturing firms to cyber attacks.

- The regional automotive sector has always led the way in implementing robotics in its manufacturing processes. Other industry manufacturers, like John Deere, are also making significant investments to integrate automated technology into their products and processes. The regional manufacturing industry still needs to utilize these benefits fully. Hence, the region's automation adoption and product innovation scope is high.

North America Smart Manufacturing Market Trends

Robotics is Expected to Witness Significant Growth

- Robots have transformed manufacturing, making moving heavy objects and performing delicate tasks easier through automation. There is a significant increase in the market, and sales for industrial and service robots are expected more over the forecasted period. Thus, it will lead to driving the need for smart manufacturing.

- According to the IFR, the number one adopter of robotics solutions in the region is the automotive industry, and companies based in the US, Canada, and Mexico installed 20,391 industrial robots in 2022, which was up by 30 percent compared to 2021. Notably, North America has evolved as the second largest operational stock for industrial robots in the world after China.

- Furthermore, as per the International Federation of Robotics (IFR), the North American robotics market observed strong growth, with total installations in manufacturing growing by 12 percent and reaching 41,624 units in 2022. In addition, according to the International Federation of Robotics (IFR), the United States is the world's second-largest production volume of cars and light vehicles, following China.

- Moreover, major manufacturers have been teaming up to provide significant solutions along with enhancing their consumer base. For instance, in March 2022, Plus One Robotics, a leading manufacturer of 3D and artificial intelligence (AI)-powered vision software, announced a partnership with Tompkins Robotics, a global leader focused on robotic automation of distribution and fulfillment operations. The two companies teamed up to offer an automated picking solution combining Plus One Robotics 3D and artificial intelligence (AI) software with the Tompkins Robotics tSort(TM) system.

United States is Expected to Grow Significantly

- The United States is on the boundary of the fourth industrial revolution, where data is used on a big scale for production while integrating the data with different manufacturing systems throughout the supply chain. The country is also one of the significant automotive markets in the world and has been home to about 13 major auto manufacturers. Moreover, automotive manufacturing is one of the largest revenue generators for the US in the manufacturing sector.

- In addition to this, the country is home to various enterprises adopting automation to optimize operations. For instance, Schneider Electric announced the launch of the first Smart Factory in the United States to demonstrate in real-time how EcoStruxure architecture and related suite of offerings can help enhance operational efficiency and reduce customer costs.

- The US oil and gas industry has been a basic demand driver for programmable logic controller (PLC) systems for automation tasks. Automation has enabled the country's high oil and gas production and has also been responsible for the smooth distribution of oil products.

- According to BEA (The Bureau of Economic Analysis), in 2022, the automobile industry in the United States sold around 13.75 million light vehicle units, which includes retail sales of about 2.9 million passenger cars and about 10.9 million light trucks, which is expected to grow more in future, and thus being a driving factor for the market in the country.

- Also, the formation of the Advanced Manufacturing Partnership has been an initiative undertaken for making the industry and the federal government invest in upcoming technologies, which has substantially aided the country in gaining a competitive edge in the global economy. The National Network for Manufacturing Innovation incorporates developing regional hubs, which will develop advanced manufacturing technologies for implementing innovative products in the sector.

North America Smart Manufacturing Industry Overview

The North American smart manufacturing market is semi-consolidated and has several major players. The major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. The companies leverage strategic collaborative initiatives to increase their market share and profitability.

In June 2023, Emerson announced that it enhanced its DeltaV Distributed Control System with the addition of their NextGen Smart Firewall for better network security as manufacturing and plant connectivity continue to grow. The company has recently released its new NextGen Smart Firewall for enhancing the DeltaV system and enhance its security. The firewall is built with a purpose for the industrial manufacturing industry and fits into most manufacturing processes. The objective of the firewall is to aid manufacturers in surging cyber security and secure plant networks without adding complexity to operations teams, who are often already overburdened.

In November 2022, Rockwell Automation, Inc. announced that it delivered an intelligent edge management and orchestration platform with an edge application ecosystem - based on zero trust security and open industry standards - accelerating digital transformation for industrial customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 impact on the industry

- 4.5 Market Drivers

- 4.5.1 Increasing Demand for Automation to Achieve Efficiency and Quality

- 4.5.2 Need for Compliance and Government Support for Digitization

- 4.5.3 Proliferation of Internet of Things

- 4.6 Market Restraints

- 4.6.1 Concerns Regarding Data Security

- 4.6.2 High Initial Installation Costs and Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Programmable Logic Controller (PLC)

- 5.1.2 Supervisory Controller and Data Acquisition (SCADA)

- 5.1.3 Enterprise Resource and Planning (ERP)

- 5.1.4 Distributed Control System (DCS)

- 5.1.5 Human Machine Interface (HMI)

- 5.1.6 Product Lifecycle Management (PLM)

- 5.1.7 Manufacturing Execution System (MES)

- 5.1.8 Other Technologies

- 5.2 By Component

- 5.2.1 Communication Segment

- 5.2.2 Control Device

- 5.2.3 Machine Vision Systems

- 5.2.4 Robotics

- 5.2.5 Sensor

- 5.2.6 Other Components

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Oil and Gas

- 5.3.3 Chemical and Petrochemical

- 5.3.4 Pharmaceutical

- 5.3.5 Food and Beverage

- 5.3.6 Metals and Mining

- 5.3.7 Other End-User Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd.

- 6.1.2 Emerson Electric Company

- 6.1.3 Fanuc Corporation

- 6.1.4 General Electric Company

- 6.1.5 Honeywell International Inc.

- 6.1.6 Mitsubishi Electric Corporation

- 6.1.7 Robert Bosch GmbH

- 6.1.8 Rockwell Automation Inc.

- 6.1.9 Schneider Electric SE

- 6.1.10 Siemens AG

- 6.1.11 Texas Instruments Incorporated

- 6.1.12 Yokogawa Electric Corporation