|

市场调查报告书

商品编码

1628792

法国塑胶包装:市场占有率分析、产业趋势、成长预测(2025-2030)France Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

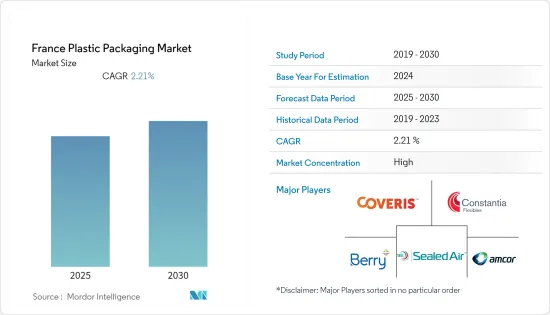

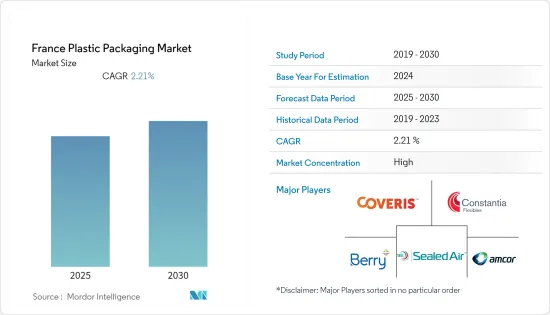

法国塑胶包装市场预计在预测期内复合年增长率为2.21%

主要亮点

- 硬质塑胶在食品包装中的使用继续受到移动性和便利性日益增长的趋势的严重影响。此外,行动消费的增加和份量控制的需求也推动了宝特瓶的使用。此外,在预测期内,热饮料可能仍然是软包装材料利用的主要驱动力。在预测期内,对女性用卫生产品的需求不断增长可能会推动软包装的成长。

- 此外,推动硬质塑胶在国内各行业使用的主要特性是其经济性、韧性、便携性和重量轻。软包装的扩张也受到其经济性、对不同形状和尺寸的适应性以及易于封闭的推动。

- 国内对塑胶使用的法规日益严格预计将影响国内塑胶包装市场。例如,2020年12月,法国众议院通过一项法律,从2040年起禁止使用所有一次性塑胶製品和包装,以及一系列加强再利用和回收的措施。除了2040年的最后期限外,多位环保人士表示,要实现从2021年开始消除塑胶杯、盘子、刀叉餐具和吸管的目标,需要更快的速度,而不是原计划的2020年。

- 在日本,塑胶的使用和禁止的环境是复杂的。环境部2021年10月11日宣布,法国将从2022年1月起禁止几乎所有水果和蔬菜使用塑胶包装,以减少塑胶垃圾。据估计,37%的水果和蔬菜以包装形式出售,此举预计每年将消除超过10亿件不必要的塑胶包装。

- 此外,各个最终用户产业及其客户对塑胶使用的日益担忧也影响了塑胶的使用。例如,国内化妆品供应商热衷于解决行业的塑胶问题,因此正在为领先企业开发永续的解决方案。

- 此外,法国最近禁止大多数水果和蔬菜使用塑胶包装。今年6月底,圣女果、芸豆、桃子等产品将全面禁用塑胶包装。到年终,菊苣、芦笋、洋菇以及某些沙拉和香草将不再以塑胶包装出售。到 2026 年 6 月,将不再使用塑胶来销售覆盆子、草莓和其他精緻浆果。

- 由于 COVID-19 的爆发,食品和饮料公司製定了对策和实际计划,以降低风险并准备应对冠状病毒的影响。这些计划包括建立一个由来自业务各个方面的人员组成的多学科危机应对团队,以识别、评估和管理所出现的风险。此外,俄罗斯-乌克兰战争影响了整个包装生态系统。

法国塑胶包装市场趋势

轻质包装的采用增加可能会推动市场成长

- 根据 Custom-Pak 对以替代品(纸/板、玻璃、钢、铝、纺织品、橡胶、软木等)取代塑胶的影响的研究,替代品平均重 4.5 倍。替代品需要更多的材料生产来製造相同类型的包装。

- 为了采购更多的回收塑料,三得利还将投资法国新兴企业公司 Calbios,该公司开发了将聚合物分解为单体的技术,使它们更容易在饮料瓶等新型硬质塑胶包装中重复使用。它还将投资欧洲主要市场,以支持国家存款返还计划的实施。我们也努力确保塑胶包装被归类为 100% 本地可回收。

- 此外,在所有类型的塑胶中,PET的使用被认为最适合生产轻瓶和容器。 PETRA 表示,PET 是一种透明、坚固且轻质的塑料,广泛用于包装食品和饮料,尤其是方便尺寸的软性饮料、果汁和水。在英国销售的几乎所有单份和 2 公升瓶装碳酸饮料和水都是由 PET 製成的。

- 塑胶更轻、更坚固,比玻璃更容易运输。运输塑胶瓶和容器比玻璃消耗更少的燃料,因此消费量的能源更少,碳排放也更低。

- 此外,对可回收轻质塑胶包装产品不断增长的需求也促进了市场的发展。一些包装公司正致力于推出轻质包装产品,以涵盖更广泛的客户群。例如,塑胶包装解决方案公司 Greiner Packaging 去年 2 月宣布将于 3 月 8 日至 10 日参加在法国雷恩举行的 CFIA。格瑞纳包装公司的创新开发正在彻底改变纸板和塑胶组合的可回收性。以前,完全依赖消费者的角色来确保废弃物正确分类。然而,使用 K3(R)r100,纸板杯和塑胶杯在运往回收设施的途中会自动分离。这是一种理想的回收包装解决方案。

- K3 将薄塑胶杯与易于拆卸的外纸板包装结合在一起。塑胶仍然是食品包装材料的首选,因为它可以保护食品、延长保质期并减少食品废弃物。除了可回收之外,用于製造 K3 杯的塑胶有时也由再生材料(如 rPET)製成。 K3杯子比相同尺寸的直接印刷杯子可节省高达50%的塑胶。

- 此外,根据欧盟统计局的数据,去年法国塑胶包装生产指数为99.1,比前一年增加1.6件。大流行的强劲復苏意味着该国对塑胶包装用品的需求增加,导致人们越来越偏好轻质包装。

个人护理品预计将大幅成长

- 该地区的社会人口变化将影响化妆品及相关产品对天然成分的需求。该地区的人口老化正在增加对具有抗衰老和其他活性特性的天然成分的需求。

- 随着许多护肤品牌面临日益激烈的竞争,包装供应商正在为品牌提供各种方法来区分其设计,以提供便利、易于使用和先进的功能。护肤品有多种包装选择,以适应不同的产品形式和配方。例如,Nerd 护肤使用塑胶和其他材料製成的瓶子、管子、罐子和滴管。

- 一些品牌选择效仿其他行业,透过使用消费后再生 PET 来减少一次性塑胶消费量。例如,Aveda 目前使用 100% 消费后回收 PET 来製造护肤和美髮宝特瓶、罐子和甘蔗基生质塑胶。

- 多个政府机构表示,欧洲塑胶原物料价格上涨是主要因素。 Virgin Plastics的产能目前正在筹建中,预计将降低原生树脂的价格,同时也对再生树脂价格构成压力。

- 此外,法国美容产品製造商正在透过社群媒体活性化促销力度,这也鼓励并增加了线上网站的购买量。例如,这里是过去一年法国个护领域网路商店的销售额排名,依照电商年度净销售额排序。去年,法国个人护理和美容产品跨国零售商丝芙兰在法国的个人护理产品销售额达2.454亿美元。网路商店Nocibe.fr 位居第二,销售额为 1.931 亿美元。

- 去年 8 月,Sephora.fr 吸引了超过 500 万访客,成为法国客流量最大的网路商店。排名第二的是德国香水和化妆品公司 Douglas 的子公司 Nocibe.fr,网站流量为 370 万次。每个品牌的产品销售都包括广泛的塑胶包装产品,塑胶包装产品产生了可观的销售。

法国塑胶包装产业概况

法国塑胶包装市场趋于整合,少数公司占较大份额。由于法国地区对塑胶包装的需求大幅成长,市场高度集中,Amcor plc、Coveris Management GmbH、Berry Global Inc.、Sealed Air Corporation 和 Constantia Flexibles International GmbH 等大公司进驻。每家公司都持续参与新产品的开发,为新产品的进入创造了障碍。

2023 年 1 月,Berry 位于法国拉热内特的工厂获得了 RecyClass 认证,满足了包装中可回收性和可回收成分的可靠声明的需求。该公司正致力于从线性经济向循环经济转型,以实现欧盟到 2030 年使所有塑胶可回收和可重复使用的目标。这些发展循环经济的措施使得各行业的製造商在其塑胶包装解决方案中公开并展示回收和再生材料的使用变得越来越重要。

2022 年 2 月,Coveris 在法国 Montfaucon 投资了一家工厂。最近,该公司改进了设备,购买了一台挤出机,以增加工业收缩罩和拉伸罩的产量。这项投资是为了满足对可回收和可再生的软包装日益增长的需求。 Coveris的5层共挤技术挤出机旨在提高含有可回收材料的拉伸和收缩罩的生产能力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 更多采用轻量化包装方法

- 增加环保包装和再生塑料

- 市场挑战

- 原料(塑胶树脂)价格上涨

- 政府法规和环境问题

- 俄乌战争对市场的影响

- 全球塑胶包装市场概况

第六章 市场细分

- 按包装类型

- 软质塑胶包装

- 硬质塑胶包装

- 依产品类型

- 瓶子和罐子

- 托盘/容器

- 小袋

- 包包

- 薄膜包装

- 其他产品类型

- 按行业分类

- 食物

- 饮料

- 卫生保健

- 个人护理和家居产品

- 其他最终用户

第七章 竞争格局

- 公司简介

- Amcor Plc

- Coveris Management GmbH

- Berry Global Inc.

- Constantia Flexibles International GmbH

- Wipak Group

- Sonoco Products Company

- Sealed Air Corporation

- Tetra Laval International SA

- Silgan Holdings Inc.

- Industrial Packaging Solutions

第八章投资分析

第九章 市场未来展望

The France Plastic Packaging Market is expected to register a CAGR of 2.21% during the forecast period.

Key Highlights

- The usage of rigid plastics in food packaging continues to be significantly influenced by the rising trend toward mobility and convenience. Additionally, the use of PET bottles is driven by the rise in on-the-go consumption and the demand for portion control. Further, hot beverages would continue to be the primary driver of flexible packaging material utilization during the projection period. Increased demand for feminine hygiene products would drive flexible packaging growth through the forecast period.

- Moreover, the main attributes driving the use of rigid plastics across industries in the country are their affordability, toughness, portability, and low weight. The expansion of flexible packaging is also driven by its affordability, adaptability to various forms and sizes, and simplicity of closing.

- The increasing regulations in the country against the use of plastic are anticipated to affect the market for plastic packaging in the country. For instance, in December 2020, the French Parliament's lower chamber passed a law to ban all single-use plastic products and packaging after 2040 and a raft of measures to ramp up reuse and recycling. Various environmentalists complained that the 2040 deadline, plus targets for ending the use of plastic cups, plates, cutlery, and straws, starting in 2021 instead of 2020, as initially planned, needs to be faster.

- The country has been witnessing a mixed environment for the use and ban of plastic. The environment ministry said on October 11, 2021, that France will ban plastic packaging for nearly all fruit and vegetables from January 2022 to reduce plastic waste. According to estimates, 37% of fruits and vegetables are sold packaged, and it is anticipated that the move will stop more than one billion unnecessary plastic packaging items from being produced annually.

- Further, the growing concerns regarding the use of plastics across various end-user industries and among their customers are affecting the use of plastics. For instance, the cosmetic vendors in the country are keen on tackling the industry's plastic problem; hence, they are developing sustainable solutions for major players.

- Moreover, recently, France banned plastic packaging for most fruits and vegetables. By the end of June this year, plastic packing for cherry tomatoes, green beans, and peaches will be prohibited. Endives, asparagus, mushrooms, certain salads, and herbs will no longer be sold in plastic packaging by the end of next year. By June 2026, plastic will no longer be used to market raspberries, strawberries, and other delicate berries.

- Owing to the COVID-19 outbreak, Food & Beverage companies developed response actions and practical plans to mitigate their risk and prepare to deal with the coronavirus's effects. These plans included establishing an interdisciplinary crisis response team of personnel from all aspects of the business to identify, assess, and manage the risk presented. Further, the Russia-Ukraine war had an impact on the overall packaging ecosystem.

France Plastic Packaging Market Trends

Increase in Adoption of Light-Weight Packaging may Drive the Market Growth

- Custom-Pak's study on the ramifications of replacing plastic with alternatives (such as paper and paperboard, glass, steel, aluminum, textile, rubber, and cork) found that substitutes are, on average, 4.5 times heavier. The alternatives require substantially more material output to create the same type of packaging.

- Suntory is also investing in Carbios, a French startup that developed the technology that breaks down polymers into monomers, making them easy to reuse in new rigid plastics packaging, such as drinks bottles, in order to source more recycled plastics. It will also invest in supporting the implementation of national deposit-return schemes across its key European markets. It will also work to ensure that its plastic packaging is classed as 100% recyclable in the region.

- Moreover, of all the types of plastic, it is believed that using PET will help manufacture the lightest bottle and containers. According to PETRA, PET is a clear, strong, and lightweight plastic that is widely used for packaging food and beverages, especially convenience-sized soft drinks, juices, and water. Virtually all single-serving and 2-liter bottles of carbonated soft drinks and water sold in the United Kingdom are made from PET.

- Plastic is lightweight and tough, making it much more suitable for transportation than glass. Shipping of plastic bottles and containers consumes less fuel than that of glass, expending less energy and leaving a smaller carbon footprint.

- Furthermore, the growing demand for recyclable, lightweight plastic packaging products contributes to the market's development. Several packaging companies are focusing on introducing light packaging products to gain a broad customer base. For instance, Greiner Packaging, a plastic packaging solution company, stated in February of last year that the company would participate in the CFIA in Rennes, France, from March 8-10. An innovative development from Greiner Packaging is revolutionizing the recyclability of cardboard-plastic combinations. Making sure that waste was sorted correctly used to be fully reliant on consumers playing their part. But now with K3(R) r100, the cardboard wrap and theplastic cup separate all by themselves on the way to the recycling facility. This makes the packaging solution ideal for recycling

- K3 combines a thin plastic cup with an easily removed exterior cardboard wrap. Because plastic protects, increases shelf life, and decreases food waste, it remains the best packaging material for food goods. In addition to being recyclable, the plastic used to produce K3 cups may also be made from recycled materials like rPET. The K3 cup can save up to 50% more plastic than a directly printed cup of the same size.

- Moreover, according to Eurostat, last year, the production volume index of the manufacture of plastic packing goods in France was recorded at 99.1, which increased by 1.6 units from the previous year. The significant recovery from the pandemic represents the increased demand for plastic packaging goods in the country, leading to the growing preference for lightweight packaging.

Personal Care is Expected to Witness Significant Growth Rates

- Socio-demographic changes in the region affect the demand for natural ingredients for cosmetics and related products. The region's aging population is increasing the demand for natural ingredients with active properties, such as anti-aging.

- Many skincare brands face increased competition, and the packaging suppliers provide brands with ways to differentiate designs that deliver convenience, ease of use, and advanced capabilities. A broad range of options is available for packaging skin care products to accommodate different product formats and formulations. For example, Nerd Skincare uses bottles, tubes, jars, and droppers in plastic and other materials.

- Some brands choose to reduce their single-use plastic consumption by using post-consumer recycled PET, following the suit of other industries. Aveda, for instance, is now using 100% post-consumer recycled PET in 85% of its skin care and hair styling PET bottles, jars, and bioplastic from sugarcane.

- Multiple government agencies cited that prices of plastic materials in Europe increased, with a significant contributor. With virgin plastics production capacity being in the current pipeline, this would place pressure on virgin resin prices downward and also on recycled resin prices.

- Also, the growing promotional activities of beauty product manufacturer in France through social media has boosted and increased purchasing through online websites. For example, the statistic presents a ranking of the top online stores in France in the personal care segment in the last year, sorted by annual net e-commerce sales. Last year, a significant market shareholding player, Sephora, a French multinational retailer of personal care and beauty products, generated USD 245.4 million via selling products from the personal care segment in France. The online store Nocibe.fr was ranked second with a revenue of USD 193.1 million.

- With more than five million visits in August last year, Sephora.fr garnered the highest traffic to its website among selected French online stores for beauty and personal care products. In second place came Nocibe.fr, a German perfume and cosmetics company Douglas subsidiary, with 3.7 million website visits. The brands' product sales include a wide range of plastic packaging products, generating significant sales from plastic packaging products.

France Plastic Packaging Industry Overview

The France Plastic Packaging Market is consolidated owing to a few players holding significant shares. As the demand for plastic packaging has been increasing significantly in the France region, the market is highly concentrated with the presence of major players like Amcor plc, Coveris Management GmbH, Berry Global Inc., Sealed Air Corporation, and Constantia Flexibles International GmbH, among others. The companies are involved in developing new products consistently, creating a barrier to new entrants.

In January 2023, the Berry factory in La Genete, France, received RecyClass certification to fulfill the demand for credible claims regarding recyclability and recycled content in packaging. The company is working to shift from a linear to a circular economy to meet the EU goal of having all plastic recyclable and reused by 2030. These measures to develop circularity make it more and more critical for manufacturers in all sectors to be open about recycling and using recycled material in their plastic packaging solutions and to prove it.

In February 2022, Coveris invested in its facilities in Montfaucon, France. Recently, the business bought an extruder to improve its equipment and increase the production of shrink and stretch hoods for industrial uses. The investment is meant to satisfy the rising demand for recyclable and recycled flexible packaging materials. The five-layer coextrusion technology extruder from Coveris is intended to boost the plant's capability for producing stretch and shrink hoods, including those made of recyclable materials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.1.2 Increased Eco-friendly Packaging and Recycled Plastic

- 5.2 Market Challenges

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations & Environmental Concerns

- 5.3 Impact of Russia-Ukraine War on the Market

- 5.4 Overview of the Global Plastic Packaging Market

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Flexible Plastic Packaging

- 6.1.2 Rigid Plastic Packaging

- 6.2 By Product Type

- 6.2.1 Bottles and Jars

- 6.2.2 Trays and containers

- 6.2.3 Pouches

- 6.2.4 Bags

- 6.2.5 Films & Wraps

- 6.2.6 Other Product Types

- 6.3 By End-User Vertical

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Personal Care and Household

- 6.3.5 Other End-User Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Plc

- 7.1.2 Coveris Management GmbH

- 7.1.3 Berry Global Inc.

- 7.1.4 Constantia Flexibles International GmbH

- 7.1.5 Wipak Group

- 7.1.6 Sonoco Products Company

- 7.1.7 Sealed Air Corporation

- 7.1.8 Tetra Laval International SA

- 7.1.9 Silgan Holdings Inc.

- 7.1.10 Industrial Packaging Solutions