|

市场调查报告书

商品编码

1628795

中东和非洲的冷冻食品包装:市场占有率分析、行业趋势和成长预测(2025-2030)Middle East and Africa Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

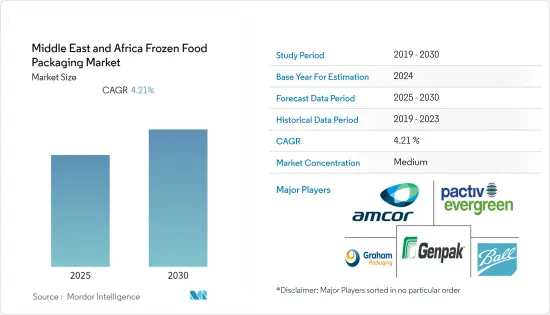

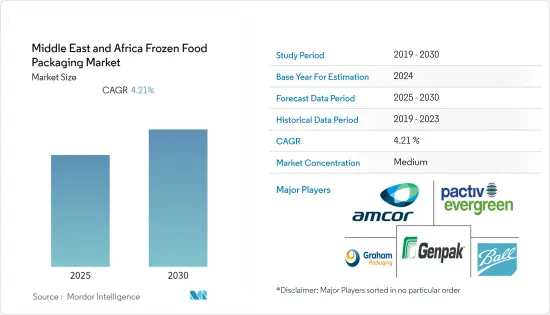

中东和非洲冷冻食品包装市场预计在预测期内复合年增长率为4.21%

主要亮点

- 包装食品的主要类别是烘焙产品和冷冻加工食品。该领域的一个新兴类别是冷冻已调理食品。随着消费者对食品品质期望的提高,保质期可以延长,特别是透过降低储存温度。

- 随着消费者对产品品质评价的提高,冷冻食品包装市场正在扩大。随着经济成长和生活方式的改变,中东和非洲对硬质食品包装的需求不断增加,预计该市场在预测期内将大幅成长。

- 冷冻食品是一种重要的营养来源,特别是对于预算有限或取得生鲜食品的机会有限的人。内衬可以防止食物与罐头金属相互作用吗?由含有双酚A的聚合物製成的环氧树脂一直被青睐用于涂料罐头,因为它们可以防止金属腐蚀并能承受灭菌的高温。

- 南非是撒哈拉以南非洲最大的食品服务市场,拥有庞大且具竞争力的旅馆业。儘管这将对国家的一些经济参数产生负面影响,但预计餐饮服务业在预测期内将出现可观的成长。同样,该国是许多国内和国际连锁餐厅的所在地,刺激了软包装的成长。

- 然而,冷冻食品含盐量高,会导致血压升高。此外,过量摄取盐会增加心臟病和中风的风险。随着越来越多的人意识到冷冻食品的影响并且更喜欢生鲜食品而不是冷冻食品,冷冻家常小菜市场的成长受到阻碍。

- 一些研究表明,该病毒可以透过纸板和塑胶传播,因此,全国各地的超级市场越来越多地使用一次性材料来包装其产品,例如用于水果和蔬菜的 Clinfilm。此外,随着 COVID-19 疫情加剧,该地区的纸张和包装製造商面临需求波动,可能会扰乱生产和收益。俄罗斯和乌克兰之间的战争也正在影响整个包装生态系统。

中东和非洲冷冻食品包装市场趋势

塑胶包装主导市场

- 食品和饮料行业的扩张、乳製品和冷冻乳製品消费的增加、食品和饮料行业对技术创新的日益关注以及中东和非洲国家对加工和冷冻包装食品的需求激增正在推动增长马苏。软包装是应用最广泛的包装材料。对方便、便携的食品包装的需求不断增长,推动了软质塑胶包装的使用。

- 在埃及等国家,对包装牛奶、冷冻半熟产品和即食零嘴零食的需求正在显着增长。此外,由于健康问题,COVID-19 大流行改变了偏好和购买行为,刺激了该地区需要软包装的食品销售。

- 满足客户对方便冷冻食品包装需求的品质和特性正在推动该行业的快速成长。许多塑胶聚合物正在不断改进。聚合物已被用来满足客户和社区的需求、保存食物、保护其免受污染、提高生活品质和保存食品。

- 恶劣的环境条件和本地生产的水果和蔬菜很少,迫使该地区(尤其是中东地区)的人们依赖包装和冷冻食品。此外,为了满足不断增长的人口的粮食需求,该地区依赖包装食品,这对塑胶包装冷冻食品的需求产生了积极影响。

消费者对便利性的需求不断增长推动创新和市场成长

- 生活方式的改变、可支配收入的增加、开发中国家的快速都市化,特别是中等收入群体的增加等多种因素正在增加对冷冻食品袋的需求。人口密度正在推动对包装食品的需求,而千禧世代正在推动这种成长。

- 包装食品到达世界各地的消费者手中需要时间。包装食品在到达消费者之前可能不太新鲜,其香气和味道可能会受到影响。食品在到达消费者手中之前变质的威胁正在日益增加,因为这意味着投资于包装的资本的损失。

- 为了克服这个问题,食品加工业正在投资各种新型包装技术,例如智慧包装和工程科学,以帮助延长产品的保质期。这就是为什么业界对冷冻食品需求增加的原因。除了收益之外,组织也关註消费者满意度,这会影响他们在市场上的形象和价值。

- 由于快节奏和忙碌的生活方式,消费者的消费模式也从生食转向简便食品。此外,都市化进程的加速和人们生活方式的改变正在增加对冷冻已调理食品的需求。冷冻已调理食品是满足顾客日常营养需求的明智选择,因为它们易于准备、广泛供应、价格低廉且经济。

- 冷冻食品的增加也是由于该地区零售便利性的改善。近年来,零售商店的需求显着增加。

中东和非洲冷冻食品包装产业概况

中东和非洲冷冻食品包装市场适度分散,由几位大型参与者组成。拥有重要市场份额的领先公司,如 Pactiv Evergreen、Amcor Ltd、GenPack LLC 和 Graham Packaging Company,都致力于扩大基本客群。

2022年10月,尼日利亚标准组织(SON)和食品业相关人员将推出塑胶回收标准,以进一步改进塑胶生产过程。此类倡议可能会增加电子商务营运商对包装塑胶的永续使用。

2022 年 3 月,SABIC、Nueva Pescanova 和 Polivougaand 共同开发了一种海鲜包装解决方案,使用来自海洋塑胶的经过认证的循环 PE。世界上第一个采用 SABIC 认证的圆形聚乙烯(由海洋塑胶製成)的冷冻食品包装解决方案是透过共同开发实现的,该解决方案是知名品牌专门从事渔业、养殖、加工和分销新鲜、冷藏和冷冻海鲜产品的西班牙领先品牌所有者。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力——波特五力

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

- 技术概述

- 技术简介

- 冷冻食品包装产品的类型

- 冷冻食品包装使用的主要材料

- 持续发展

- 全球中东和非洲冷冻食品包装市场概况

第五章市场动态

- 市场驱动因素

- 消费者对便利性的需求不断成长

- 可支配所得的增加和消费行为的变化

- 市场限制因素

- 政府监管和干预

第六章 市场细分

- 按材质

- 玻璃

- 纸

- 金属

- 塑胶

- 其他的

- 按包装

- 包包

- 盒子

- 标籤和杯子

- 托盘

- 饶舌歌手

- 小袋

- 其他包装

- 依产品类型

- 准备好的饭菜

- 水果和蔬菜

- 肉

- 海鲜

- 烘焙点心

- 其他的

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 以色列

- 其他中东和非洲

第七章供应商市场占有率分析

第八章 竞争格局

- 公司简介

- Pactiv Evergreen

- Amcor Ltd

- Genpak LLC

- Graham Packaging Company, Inc.

- Ball Corporation Inc

- Crown Holdings

- Tetra Pak International

- Placon Corporation

- Toyo Seikan Group Holdings, Ltd.

- WestRock Company

- Nuconic Packaging

- The Scoular Company

- Owens-Illinois

- Rexam Company

- Alcoa Corporation

第九章投资分析

第十章投资分析市场的未来

The Middle East and Africa Frozen Food Packaging Market is expected to register a CAGR of 4.21% during the forecast period.

Key Highlights

- The major categories of packaged food are bakery products and frozen processed food. Some of the emerging categories in this sector are frozen, ready-to-eat foods. As consumer expectations of food quality rise, storage life can be extended notably by making storage temperatures colder.

- There is an increase in the frozen food packaging market with the consumer appreciation of product quality. With the growth in the economy and changing lifestyles, there is an increased demand for rigid food packaging in the Middle East and Africa, and the market is expected to grow lucratively during the forecast period.

- Frozen food is a good source of nutrients, especially for people on tight budgets or with limited access to fresh foods. Can linings prevent the interaction of food with a can's metal? Epoxy resin, made from polymers containing Bisphenol A, has been favored for can coatings because it protects against metal corrosion and holds up to the heat extremes of sterilization.

- South Africa is the largest foodservice market in sub-Saharan Africa, with a large and highly competitive hospitality industry. Despite negative impacts on several economic parameters of the country, the food service industry is expected to experience considerable growth during the forecast period. Similarly, the country has a large number of domestic as well as international restaurant chains, thereby fueling the growth of flexible packaging.

- However, frozen meals have a high salt content, which could cause blood pressure to rise. Additionally, excessive salt consumption increases the risk of heart disease and stroke. The market growth of frozen ready meals is being hampered as more individuals become aware of the impacts of frozen food and prefer fresh food over frozen food.

- Some studies suggested that the virus can be passed on through cardboard and plastic, resulting in increased usage of single-use materials across supermarkets to wrap products, such as cling film for fruit and vegetables in the country. In addition, paper and packaging manufacturers in the region faced fluctuations in demand as the COVID-19 pandemic intensified, with potentially disruptive effects on production and revenues. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

MEA Frozen Food Packaging Market Trends

Plastic Packaging to Dominate the Market

- The expanding food & beverage industry, mounting consumption of dairy & frozen dairy products, surging focus on innovation in the food & beverage sector, and soaring demand for processed & frozen packaged food in the countries of the Middle East and Africa augmenting the plastic packaging growth. Flexible packaging is the most widely used packaging material. The rising demand for packaging foods in portable and convenient formats has driven the usage of flexible plastic packaging.

- The rising demand for packaged milk, frozen semi-prepared products, and on-the-go snacks has significantly risen in the countries like Egypt. Further, the COVID-19 pandemic has changed preferences, and purchasing behavior based on health concerns fueled food sales in the region that requires flexible packaging.

- The qualities and properties that have met customers' demand for convenient frozen food packaging propel the industry's rapid growth. Numerous plastic polymers are getting better all the time. Polymers have been employed to meet the needs of customers and the region's population, preserve food, guard against contamination, improve quality of life, and store food.

- Due to the harsh environmental conditions and few locally grown fruits and vegetables, the region, particularly the Middle East region, has to depend on packages and frozen food. Also, to meet the food requirement of the growing population, the region is dependent on packaged food, which positively affects the demand for plastic-packaged frozen food.

Increasing Demand for Convenience by Consumers to Drive Innovation and Market Growth

- Various factors, such as changing lifestyles, increasing disposable income, and rapid urbanization in developing countries, especially the growing middle-income population, are increasing the demand for bags for frozen food. Population density has increased demand for packaged food, with Millenials contributing to the growth.

- After packaging, it takes time for packaged food to reach consumers across various parts of the world. The packaged food may not be fresh and might lose its aroma and taste before reaching the consumer. The threat of food being spoilt before reaching the consumer is increasing, as it would result in a loss of the capital invested in the packaging.

- To overcome this, food processing industries are investing in technologies and various new packaging techniques, such as intelligent packaging and engineering science, which help increase the product's shelf life. This is the reason for the industry's increased demand for frozen food. Organizations are focusing on consumer satisfaction, apart from revenues, as it impacts the image and value in the market.

- The consumption pattern of consumers has also been switching from raw food to convenience foods as a result of a fast-paced and hectic lifestyle. Additionally, the demand for frozen prepared meals is rising as a result of expanding urbanization and a changing population lifestyle. Frozen-ready meals are a sensible choice to meet customers' daily nutritional needs because they are simple to prepare, widely accessible, inexpensive, and economical.

- The increase in frozen food is also due to the increased convenience of retail stores in the region. The demand from retailers has risen significantly in the past few years.

MEA Frozen Food Packaging Industry Overview

The Middle East and Africa Frozen Food packaging market is moderately fragmented and consists of several major players. The major players, such as Pactiv Evergreen, Amcor Ltd, GenPack LLC, and Graham Packaging Company, with a prominent share in the market, are focusing on expanding their customer base across foreign countries.

In October 2022, the Standards Organization of Nigeria (SON) and stakeholders in the food industry introduced a standard regarding plastic recycling, which would further improve the production processes of plastics. Such initiatives would increase the use of sustainable plastic for packaging by e-commerce players.

In March 2022, SABIC, Nueva Pescanova, and Polivougaand collaborated on a seafood packaging solution using certified circular PE from ocean-bound plastic. The world's first frozen food packaging solution using SABIC's certified circular polyethylene from feedstock sourced from ocean-bound plastic has been developed through collaboration with the Nueva Pescanova Group, a leading Spanish brand owner specializing in the fishing, farming, processing, and marketing of fresh, chilled, and frozen seafood products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the market

- 4.5 Technology Overview

- 4.5.1 Technology Snapshot

- 4.5.2 Type of Frozen Food Packaging Products

- 4.5.3 Primary Materials used for Frozen Food Packaging

- 4.5.4 Ongoing Developments

- 4.6 Global Overview of the Middle East and Africa Frozen Food Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience by Consumers

- 5.1.2 Increase in Disposable Income and Changing Consumer Behavior

- 5.2 Market Restraints

- 5.2.1 Government Regulations and Interventions

6 MARKET SEGMENTATION

- 6.1 By Primary Material

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Plastic

- 6.1.5 Others

- 6.2 By Type of Packaging Product

- 6.2.1 Bags

- 6.2.2 Boxes

- 6.2.3 Tubs and Cups

- 6.2.4 Trays

- 6.2.5 Wrappers

- 6.2.6 Pouches

- 6.2.7 Other Types of Packaging

- 6.3 By Type of Food Product

- 6.3.1 Readymade Meals

- 6.3.2 Fruits and Vegetables

- 6.3.3 Meat

- 6.3.4 Sea Food

- 6.3.5 Baked Goods

- 6.3.6 Others

- 6.4 By Country

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 South Africa

- 6.4.4 Israel

- 6.4.5 Rest of Middle East and Africa

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Pactiv Evergreen

- 8.1.2 Amcor Ltd

- 8.1.3 Genpak LLC

- 8.1.4 Graham Packaging Company, Inc.

- 8.1.5 Ball Corporation Inc

- 8.1.6 Crown Holdings

- 8.1.7 Tetra Pak International

- 8.1.8 Placon Corporation

- 8.1.9 Toyo Seikan Group Holdings, Ltd.

- 8.1.10 WestRock Company

- 8.1.11 Nuconic Packaging

- 8.1.12 The Scoular Company

- 8.1.13 Owens-Illinois

- 8.1.14 Rexam Company

- 8.1.15 Alcoa Corporation