|

市场调查报告书

商品编码

1628798

软性饮料包装:市场占有率分析、产业趋势、成长预测(2025-2030)Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

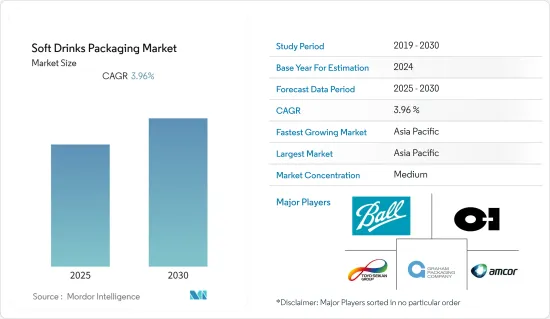

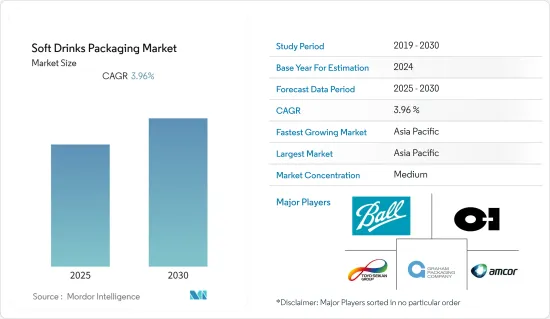

预计软性饮料包装市场在预测期内复合年增长率为 3.96%

主要亮点

- 在饮料业中,碳酸软性饮料(CSD)市场已经成熟。最近发生了一些变化,预计将持续一段时间。近年来,消费者的健康意识日益增强。消费者正在花更多的钱购买能够滋养他们并且可以安全食用的产品。

- 客户想要具有多种口味选择的健康产品。此外,公司正在推出新产品来满足这些期望。因此,这些产品将为包装产业创造更多机会。

- 中国和印度等新兴经济体正在扩张,公众的可支配收入正在增加。目前,消费者对即用型包装饮料的需求量大。

- 政府对非生物分解塑胶的使用有严格的规定,阻止企业使用其他环保包装材料。这些材料的高价格降低了利润率,从而影响了软性饮料包装市场。

- 为应对 COVID-19 大流行紧急情况而采取的封锁程序严重扰乱了供应链,并减少了消费者的可支配收入。碳酸软性饮料产业无疑将受到后COVID-19时代经济衰退强劲反弹以及新出现的健康和健身担忧的影响。

软性饮料包装市场趋势

塑胶占据最大的市场占有率

- 在软性饮料产业,消费者比其他产品更喜欢塑胶包装,因为塑胶包装比其他产品更轻、更容易处理。此外,主要製造商更喜欢塑胶包装,因为它的生产成本便宜得多。

- 政府立法和客户要求迫使製造商要求采用生物分解性或由永续来源製成的包装选项,预计将为该行业带来挑战。

- 近年来,许多塑胶製品被回收甚至再利用。提高该领域市场占有率的另一个因素是可用于包装的塑胶种类繁多,包括 PVC、PE、PP、PS、PET 和尼龙。

- 宝特瓶重量轻,可降低储存和运输成本,使其成为软性饮料最经济的包装选择之一。但很快,消费者对新鲜产品的需求可能会对全球软性饮料包装产业的扩张产生负面影响。

- 用于包装碳酸饮料的 宝特瓶所使用的树脂品质非常高。 宝特瓶必须非常坚固,才能承受 CO2 的内部压力而不变形或膨胀。

亚太地区将经历最快的成长

- 亚太地区拥有庞大的基本客群和多个经济快速成长的国家。然而,不同地区的包装偏好差异很大,采用针对地区和应用的解决方案有望改善产品运输。此外,由于消费者权益团体、政府和消费者的压力越来越大,製造商正在积极实施永续包装标准。

- 在亚洲,日本的消费者人均所得最高。再加上中国不断增长的老年人口以及具有功能声称系统的新食品,为专门针对老年消费者的健康声称的豪华软饮料品牌开闢了空间。

- 在印度,为实现成长和技术进步而进行大量投资的领域之一是饮料业务。该国的软性饮料包装行业最近已经从所有软性饮料类别中普遍存在的典型多份包装转向较小的“随身”包装,更重要的是“家庭包装”,这一趋势变得越来越明显。

- 此外,由于多种宏观原因,该地区的非酒精饮料市场是全球成长最快的市场之一。鑑于目前人均消费量较低,未来消费量成长潜力大。

软性饮料包装产业概况

多家提供软性饮料包装解决方案的公司的存在加剧了市场竞争。因此,市场可能更具凝聚力,许多公司正在製定扩大策略。一些着名的市场参与者包括 Amcor PLC、Toyo Seikan Group Holdings Ltd 和 Graham Packaging Company。

2022 年 7 月,LinkOwens-Illinois Inc. 宣布将在肯塔基州鲍灵格林新建待开发区玻璃工厂。这符合健康、可回收和永续食品和饮料包装的强劲消费趋势。该公司计划分期投资高达 2.4 亿美元,为该地区增加约 140 个就业机会。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 可支配所得增加和经济成长

- 对即用饮料的需求不断增长

- 市场限制因素

- 政府对非生物分解产品的严格规定

第六章 市场细分

- 按材质

- 塑胶

- 金属

- 玻璃

- 纸板

- 依产品类型

- 瓶子

- 能

- 纸箱/盒

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor PLC

- Toyo Seikan Group Holdings Ltd

- Graham Packaging Company

- Ball Corporation

- Owens-Illinois Inc.

- Pacific Can China Holdings Limited

- Crown Holdings Incorporated

- CAN-PACK SA

- CKS Packaging Inc.

- Refresco Group NV

- Tetra Pak Inc.

- Ardagh Group SA

第八章投资分析

第九章 市场机会及未来趋势

The Soft Drinks Packaging Market is expected to register a CAGR of 3.96% during the forecast period.

Key Highlights

- The market for carbonated soft drinks (CSD) has matured within the beverage industry. It has undergone several changes recently, and it is anticipated that this flux will last for some time. Consumers have been becoming more and more health-conscious in recent years. Customers are spending more money on products that replenish them and are safe to ingest.

- Customers seek healthy products with a variety of flavor options. Furthermore, to accommodate these expectations, businesses are introducing additional products. Consequently, more chances will arise for the packaging industry for these items.

- The economies of developing nations like China and India are expanding, increasing the disposable income available to the general public. Ready-to-use packaged drinks are currently more in demand from consumers.

- The use of non-biodegradable plastics is subject to stringent government regulations preventing businesses from using other eco-friendly packaging materials. Due to their outstanding prices, these items reduce the profit margin, ultimately impacting the soft drink packaging market.

- Lockdown procedures in response to the COVID-19 pandemic emergency have severely disrupted the supply chain and reduced consumer disposable income. The carbonated soft drink industry will undoubtedly be impacted by the solid recessionary repercussions and new health and fitness concerns in the post-COVID-19 age.

Soft Drinks Packaging Market Trends

Plastic to Account for the Largest Market Share

- Since plastic packets are lighter and more comfortable to handle than other items, consumers have been seen to prefer them over other products in the soft drink business. Additionally, the big manufacturers favor plastic packaging options due to the much cheaper production costs.

- Government laws and customer demand, which are causing manufacturers to seek out packaging options that are biodegradable or made from sustainable sources, are predicted to present difficulties to the industry.

- In recent years, many plastic products have also been recycled and utilized again. Another factor boosting the market share of this sector is the diversity of plastics available for packaging, including PVC, PE, PP, PS, PET, and nylon.

- PET bottles are one of the most economical packaging options for soft drinks because of their small weight, which lowers storage and shipping expenses. However, shortly, the demand for freshly manufactured goods by consumers could have a detrimental effect on expanding the worldwide soft drink packaging industry.

- The resins used in PET bottles to pack carbonated drinks are of exceptional quality. The PET bottles have to be extremely strong to contain the internal pressure of CO2 without distortion and expansion.

Asia-Pacific to Witness Fastest Growth

- Asia-Pacific has a sizable customer base and several economies that are expanding quickly. However, regional packaging preferences vary widely; therefore, adopting regional and application-specific solutions is anticipated to improve product transportation. Additionally, manufacturers are actively implementing sustainable packaging standards due to rising pressure from consumer advocacy organizations, the government, and consumers.

- In Asia, Japanese consumers have the highest per capita income. This, together with the country's elderly population's growth and the new functional food labeling system, has made room for luxury available soft drink brands, particularly those that target older consumers with health claims.

- In India, one of the sectors where significant investments are being made for growth and technological advancement is the beverage business. The country's soft drink packaging sector has recently seen a substantial trend away from the common multi-serve presentations prevalent in all soft drink categories in favor of more miniature "on the go" packs and, even more critical, "family packs."

- Additionally, for several macro reasons, the non-alcoholic beverage market in the region is among the fastest-growing markets globally. The current low per capita consumption indicates a huge future volume growth potential.

Soft Drinks Packaging Industry Overview

The availability of several players providing soft drinks packaging solutions has intensified the competition in the market. Therefore, the market could be more cohesive, with many companies developing expansion strategies. Some prominent market players are Amcor PLC, Toyo Seikan Group Holdings Ltd, and Graham Packaging Company.

In July 2022, LinkOwens-Illinois Inc. announced the building of a new greenfield glass plant in Bowling Green, KY. In line with strong consumer trends toward healthy, recyclable, and sustainable food and beverage packaging. The company plans to invest up to USD 240 million in several waves of expansion over time, adding about 140 additional jobs to the area.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Disposable Income and Growing Economies

- 5.1.2 Growing Demand for Ready-to-use Drinks

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations Against Non-biodegradable Products

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Metal

- 6.1.3 Glass

- 6.1.4 Paper and Paperboard

- 6.2 By Product Type

- 6.2.1 Bottle

- 6.2.2 Can

- 6.2.3 Cartons and Boxes

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.5 Middle-East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 South Africa

- 6.3.5.3 United Arab Emirates

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Toyo Seikan Group Holdings Ltd

- 7.1.3 Graham Packaging Company

- 7.1.4 Ball Corporation

- 7.1.5 Owens-Illinois Inc.

- 7.1.6 Pacific Can China Holdings Limited

- 7.1.7 Crown Holdings Incorporated

- 7.1.8 CAN-PACK SA

- 7.1.9 CKS Packaging Inc.

- 7.1.10 Refresco Group NV

- 7.1.11 Tetra Pak Inc.

- 7.1.12 Ardagh Group SA