|

市场调查报告书

商品编码

1628812

安全分析 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Security Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

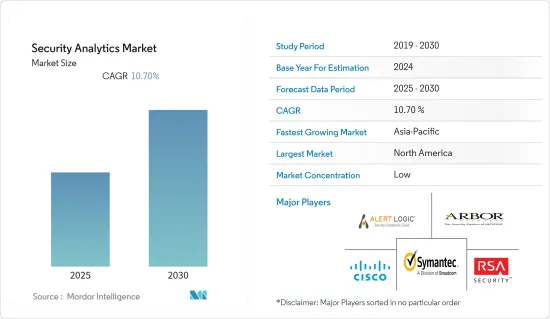

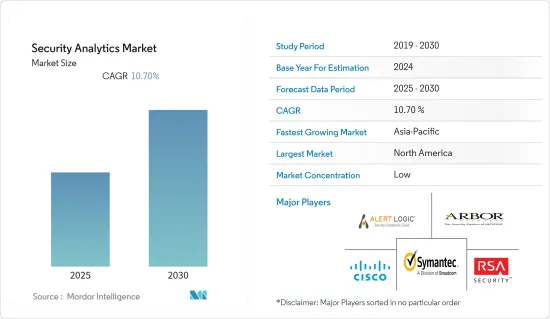

预计安全分析市场在预测期内复合年增长率为 10.7%

主要亮点

- 安全分析与您的 IT 资源搭配使用,并使用自动化安全智慧来回应环境中的不断变化。自动化和战术性修復必须与安全策略控制紧密结合。

- 物联网的发展以及数位转型的速度和范围使当前的网路架构更容易受到骇客的攻击。巨量资料分析将成为有效网路安全解决方案的关键部分。这是因为必须快速处理来自各种来源的大量资料,以便快速发现异常和攻击模式。这使得系统不易受到攻击且更具弹性。

- 在安全分析解决方案中,基于规则的检测已被机器学习 (ML) 和人工智慧 (AI) 等资料科学技术所取代。这是对更多资料、更复杂的基础设施以及缺乏熟练的安全专业人员等外部挑战的回应。在大多数情况下,安全团队需要将安全分析与大量机器产生的资料结合才能发挥作用。

- 随着资料外洩事件的增加和更多文件受到影响,各种规模的企业的成本都要高得多。

- COVID-19 的爆发对全球经济产生了重大影响,并改变了人们的沟通和工作方式。这些巨大的变化帮助垃圾邮件发送者和骇客在网路世界中蓬勃发展。因此,预计安全分析市场将大大受益于疫情造成的网路攻击的增加。

安全分析市场趋势

网路安全分析占有很大份额

- 全球最大的安全分析产品市场是网路安全应用程式。新一代防火墙 (NGFW)、入侵防御系统 (IPS) 和安全 Web 闸道 (SWG) 等安全工具安装在业务网路连接到公共网际网路的位置。大多数现场业务程序、使用者和设备都提供对所有传入和传出网路流量的可见性和控制。

- 程式设计师通常很难创建网路安全分析解决方案,因为攻击者经常适应变化。因此,需要持续的网路监控来寻找危险或入侵威胁的征兆。该软体通常与其他安全技术(例如防火墙、防毒程式和 IDP)结合使用。该软体可用于自动或手动监控网路安全。

- 此外,机器学习演算法已经失去了贝叶斯机率论的传统解决方案,贝叶斯机率论指出,透过考虑问题的各个方面并以数学方式计算可能的结果,可以高度准确地预测网路安全发生的可能性。

- 网路安全已成为网路安全领域最重要的议题之一。网路安全机制允许电脑、使用者和程式在安全的环境中执行重要的工作。

北美占有很大份额

- 采用和扩展新技术的最重要地区之一是北美,特别是美国和加拿大。北美拥有促进创新的政府支持措施、庞大的工业基础和高购买力。美国是多个产业安全分析的庞大市场。该国是大多数安全分析平台开发商的所在地。

- 北美正在经历高发的资料外洩、恶意软体攻击和进阶持续性威胁。在北美,安全合规管理系统的需求和对网路安全解决方案的投资增加也影响了安全分析的采用。

- 我们协助大型和小型企业准备其基础设施和资料库,以实现主动使用安全分析。该地区对高度针对性的攻击造成的损害的了解以及安全分析系统即时识别和阻止 APT 和 ATA 的能力都提高了。

- Cylance Inc.(人工智慧主导、预防优先的安全解决方案领先提供者)和 Securonix(北美 SIEM 以及安全分析中的用户和实体行为分析提供者)等公司最近推出了 Securonix 安全分析平台。伙伴关係以支援与 CylancePROTECT 的互通性。这显示安全分析云端解决方案的成长趋势。

安全分析产业概述

网路安全市场由多家全球和区域参与企业组成,其中包括 IBM 和 McAfee 等科技和网路巨头。此外,该市场的特点是产品渗透率不断提高、产品差异化不断增强、竞争激烈。市场的主要企业包括 Arbor Networks Inc.、RSA Security LLC (RSA) 和 Cisco。

2022 年 6 月,Alert Logic 宣布与 TD SYNNEX 建立新的战略伙伴关係,透过使Alert Logic 成为寻求向客户提供全面MDR 的全球技术合作伙伴网络的选择,扩大其领先的託管检测产品组合- 扩大兼容解决方案的全球销售。

2022 年 4 月,思科发布了安全防火墙 3100 系列,这是一款中阶多用途防火墙设备,采用专为混合工作设计的新架构。本系列介绍了高效能和灵活性,使混合工作人员和防火墙管理员能够从任何地方管理云端和混合防火墙。

CrowdStrike 和 Mandiant 于 2022 年 4 月建立策略伙伴关係关係,协助客户调查、修復和防御影响全球企业的日益复杂的网路安全事件。作为协议的一部分,Mandiant 将使用 CrowdStrike Falcon 平台和订阅选项为两家公司的客户提供主动咨询和事件回应 (IR) 服务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 威胁和安全漏洞日益复杂

- 不断上升的物联网和 BYOD 趋势

- 市场限制因素

- 缺乏资料整合和连接

第六章 市场细分

- 按用途

- 网路安全分析

- 应用程式安全分析

- 网路安全分析

- 端点安全分析

- 按最终用户产业

- 医疗保健

- 国防安全

- 银行/金融服务

- 通讯/IT

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Alert Logic Inc.

- Arbor Networks Inc.

- Broadcom Inc.(Symantec Corporation)

- Cisco Systems Inc.

- RSA Security LLC

- Hewlett-Packard Enterprise Co.

- IBM Corporation

- Logrhythm Inc.

- Fireeye Inc.

- Splunk Inc.

- Fortinet Inc.

- McAfee LLC

- Micro Focus International PLC

第八章投资分析

第九章 市场机会及未来趋势

The Security Analytics Market is expected to register a CAGR of 10.7% during the forecast period.

Key Highlights

- Security analytics work with IT resources and use automated security intelligence to respond to the constant changes in the environment.Automating and making tactical modifications should be firmly connected with security policy controls.

- The current network architecture is more vulnerable to hackers because of the growth of IoT and the speed and scope of digital transformation. Big data analytics will be a key part of any effective cyber security solution because it will be necessary to quickly process the high-velocity, high-volume data from many different sources in order to find anomalies and attack patterns as soon as possible. This will make the systems less vulnerable and more resilient.

- Rules-based detection has given way to data science techniques like machine learning (ML) and artificial intelligence (AI) in security analytics solutions. This is a response to outside problems like more data, more complicated infrastructure, and a lack of skilled security experts. Most of the time, for security teams to be effective, they need to combine security analytics with a huge amount of machine-generated data.

- Costs are much higher for businesses of all sizes because there are more and more data breaches and more documents that are affected.

- The COVID-19 epidemic significantly impacted the world economy and changed people's communication and work. These drastic changes helped spammers and hackers thrive in the cyber world. Because of this, it was predicted that the security analytics market would benefit significantly from the rise in cyberattacks caused by the pandemic.

Security Analytics Market Trends

Network Security Analytics to Account for Significant Share

- The largest global market for security analytics products is network security applications. At the point where the business network and the public Internet connect, security tools like a next-generation firewall (NGFW), an intrusion prevention system (IPS), and a secure web gateway (SWG) have been installed. The majority of on-site business programs, users, and devices provide visibility and control over all incoming and outgoing network traffic.

- Statistical analysis isn't easy to use in security analysis, unlike in other fields where things are more stable.Because attackers often adapt to changes, it is usually very hard for programmers to make solutions for network security analytics.Thus, ongoing network monitoring is necessary to seek out signs of dangerous or intrusive threats. It frequently works in conjunction with other security technologies like firewalls, antivirus programs, and IDPs. The software can be used to monitor network security automatically or manually.

- Additionally, network security analytics solutions are becoming more reliable as machine learning algorithms replace conventional solutions based on the Bayesian probability theory, which holds that it is possible to predict with high accuracy the likelihood of something occurring by capturing every aspect of a problem and mathematically calculating possible outcomes.

- Network security has become one of the most important topics in cybersecurity because of how often, how different, and how likely it is that new and more destructive attacks will happen in the future. Network security mechanisms make it possible for computers, users, and programs to do important tasks in a safe environment.

North America to Account for Major Share

- One of the most important areas for the adoption and expansion of new technology is North America, specifically the US and Canada, with its supportive government policies to foster innovation, vast industrial base, and high purchasing power. The US represents a sizable market for security analytics across several industries. This nation is home to the vast majority of security analytics platform developers.

- North America has more data breaches, malware attacks, and advanced persistent threats. This is helping the security analytics industry grow in North America.In North America, the adoption of security analytics is also affected by the need for security compliance management systems and the rise in investments in cybersecurity solutions.

- End-user industries in the region were among the first to use analytics solutions, so they could stay ahead of other regions.In order to enable the proactive use of security analytics, this has helped both major enterprises and small and medium-sized businesses develop their infrastructure and databases. The understanding of the damage caused by advanced targeted threats and the capacity of security analytics systems to identify and thwart APT or ATA in real-time are both growing in the region.

- Businesses like Cylance Inc., the top provider of AI-driven, prevention-first security solutions, and Securonix, a North American provider of SIEM and user and entity behavioral analytics in security analytics, recently announced a partnership to support the interoperability of CylancePROTECT with the new release of the Securonix Security Analytics Platform. This shows the growing trend toward cloud solutions in security analytics.

Security Analytics Industry Overview

The network security market comprises several global and regional players, including technology and networking giants such as IBM and McAfee. Further, this market is characterized by growing levels of product penetration, moderate product differentiation, and high levels of competition. Some key players in the market are Arbor Networks Inc., RSA Security LLC (RSA), and Cisco.

In June 2022, Alert Logic will expand global distribution of its leading managed detection and response solution through a new strategic partnership with TD SYNNEX, where an agreement will make Alert Logic the choice for a global network of technology partners seeking to offer comprehensive MDR to customers.

In April 2022, Cisco announced the Secure Firewall 3100 Series, a midrange multipurpose firewall appliance with a new architecture designed for hybrid work. This series offers high performance and flexibility to empower hybrid workers and firewall administrators who manage their cloud and hybrid firewalls from anywhere.

CrowdStrike and Mandiant formed a strategic partnership in April 2022 to help their customers investigate, fix, and defend against increasingly complex cybersecurity events that affect businesses around the world. As part of the deal, Mandiant will use the CrowdStrike Falcon platform and subscription options to offer proactive consulting and incident response (IR) services to customers of both companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Level of Sophistication of Threats And Security Breaches

- 5.1.2 Rise in IoT and BYOD Trend

- 5.2 Market Restraints

- 5.2.1 Lack of Data Integration and Connectivity

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Network Security Analytics

- 6.1.2 Application Security Analytics

- 6.1.3 Web Security Analytics

- 6.1.4 Endpoint Security Analytics

- 6.2 By End-user Industry

- 6.2.1 Healthcare

- 6.2.2 Defense and Security

- 6.2.3 Banking and Financial Services

- 6.2.4 Telecom and IT

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alert Logic Inc.

- 7.1.2 Arbor Networks Inc.

- 7.1.3 Broadcom Inc. (Symantec Corporation)

- 7.1.4 Cisco Systems Inc.

- 7.1.5 RSA Security LLC

- 7.1.6 Hewlett-Packard Enterprise Co.

- 7.1.7 IBM Corporation

- 7.1.8 Logrhythm Inc.

- 7.1.9 Fireeye Inc.

- 7.1.10 Splunk Inc.

- 7.1.11 Fortinet Inc.

- 7.1.12 McAfee LLC

- 7.1.13 Micro Focus International PLC