|

市场调查报告书

商品编码

1628814

泰国塑胶市场:份额分析、产业趋势、成长预测(2025-2030)Thailand Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

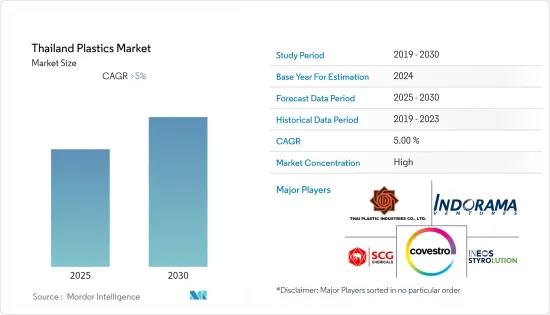

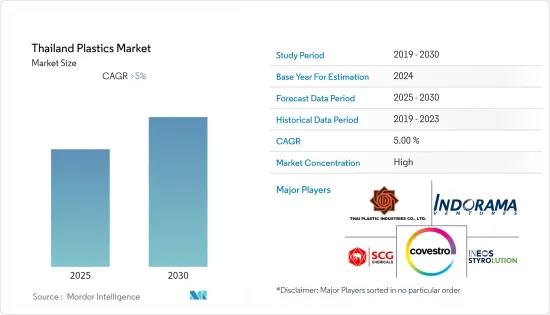

预计泰国塑胶市场在预测期内将维持5%以上的复合年增长率。

市场受到 COVID-19 的负面影响。供应链中断导致塑胶产量减少。然而,自从限制解除以来,情况一直在稳定復苏。工业活动水准的上升可能会对所研究的市场产生正面影响。

主要亮点

- 从短期来看,建筑领域塑胶使用量的增加以及食品和饮料包装需求的增加是推动市场成长的因素。

- 另一方面,导致塑胶禁令的严格政府法规预计将阻碍预测期内的市场成长。

- 生物分解性塑胶投资的增加预计将在未来几年为市场带来机会。

泰国塑胶市场趋势

聚对苯二甲酸乙二酯(PET)预计将主导市场

- 聚对苯二甲酸乙二醇酯 (PET) 树脂以其优异的熔体流动性能、紧密的成型公差以及多腔模具的高生产率而闻名。由于其机械和电气特性,PET 通常用于代替金属用于马达外壳、开关、感测器和其他电气应用。

- PET和聚烯是塑胶包装行业中使用最广泛的材料。 PET 作为包装材料的关键特性包括可回收性、强度和多功能性,这些特性推动了对这些产品的需求。

- 这些产品包括外带容器、冷冻食品、苏打水和果汁、番茄酱、瓶装水、罐子、烘焙点心容器等。它也用于食品工业中的翻盖、家常小菜容器、微波炉食品托盘等。

- PET 还具有出色的阻隔性,可保护和保存产品内容物。 PET 保留了碳酸饮料的碳酸化、果汁的维生素以及番茄酱的颜色。换句话说,PET 可以保护您的产品并使其不会妨碍货架或垃圾桶。

- 2020年11月,全球最大的PET生产商泰国Indrama Ventures宣布投资15亿美元,将塑胶回收再利用业务扩大两倍,以提振对环保饮料製造商的需求。 Indrama 最近收购了回收聚对苯二甲酸乙二醇酯的公司。我们的目标是到 2025 年将目前每年约 25 万吨的回收量扩大至 75 万吨。 Indrama 每年向饮料业供应的 400 万吨 PET 中,目标是回收材料占 20% 左右。

- 2022年5月,一家名为ENVICCO Limited的泰国公司在泰国罗勇府Map Ta Phut新建了一家再生塑胶工厂,每年可生产约4.5万吨再生聚对苯二甲酸乙二醇酯。预计这将提高PET在泰国塑胶市场的渗透率。

- 由于上述因素,预计在预测期内该国对 PET 的需求将会增加。

汽车产业主导市场

- 工程塑胶主要用于汽车工业。工程塑胶以其高性能而闻名,使汽车零件能够满足汽车行业的严格要求。在大多数情况下,工程塑胶用途广泛,非常适合实现汽车产业所需的创新。此外,这些塑胶重量轻,可以降低燃料消耗。

- 汽车工业常用的塑胶包括聚丙烯、聚氨酯、聚氯乙烯和聚丁烯对苯二甲酸酯(PBT)。

- 聚丙烯是一种由丙烯製成的高度耐用的聚合物。聚丙烯具有耐化学性和耐用性,因此可用于各种汽车零件,从保险桿到电缆绝缘层再到地毯纤维。

- 聚氨酯具有很强的耐辐射、耐溶剂和耐环境磨损能力。这些特性使其适合多种应用,包括轮胎、座椅、悬挂刷等的生产。

- 热塑性工程聚合物为汽车行业提供多种应用,包括生产高品质的仪表板组件、立柱饰件、汽车仪錶面板、轮罩、门衬、座椅靠背、把手、安全带组件等。预计这将在预测期内提振受调查市场的需求。

- 塑胶也比金属更经济,并且透过减轻重量、耐用性、强度、设计灵活性、弹性、耐腐蚀性和高性能,有助于提高车辆的能源效率。还有一些塑胶具有优异的电绝缘性能。

- 泰国约有1,800家涉及汽车产业的公司,其中包括近30至40家大型公司、约700家一级汽车零件製造商以及超过1,000家二级和三级製造商。众多大公司在泰国的存在不仅意味着汽车供应链庞大,也意味着汽车产业在未来几年将进一步成长。

- 泰国工业联合会(FTI)报告显示,2022年11月泰国汽车产量年增近15%至约190,155辆,半导体短缺持续缓解,泰国生产的汽车数量增加这是过去 44 个月里最好的。

- 此外,根据FTI的数据,2022年1月至11月泰国汽车产量达到近172万辆,较去年同期成长约21%,大幅接近2022年约175万辆的目标。预计 2022 年至 2025 年,泰国电动车市场的复合年增长率将达到约 22%。这可能会增加所研究市场的需求。

- 根据泰国国土交通旅游部统计,2022年1月至4月泰国曼谷新增登记私家车数量约15.24万辆。过去十年,泰国首都新登记的乘用车数量出现波动。 2021年及2020年曼谷新增私家车登记数量分别为269.83辆及292.3辆。

- 由于这些因素,预计泰国塑胶市场在预测期内将稳定成长。

泰国塑胶工业概况

泰国的塑胶市场已部分一体化。主要企业包括(排名不分先后)Indorama Ventures Public Company Limited、SCG Chemicals、INEOS Styrolution Group GmbH、COVESTRO AG 和 THAI PLASTIC INDUSTRIES。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 塑胶在建筑和施工中的使用增加

- 食品和饮料包装需求增加

- 抑制因素

- 严格的政府法规导致塑胶禁令

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 种类

- 传统塑料

- 聚乙烯

- 聚丙烯

- 聚苯乙烯

- 聚氯乙烯

- 工程塑料

- 聚对苯二甲酸乙二酯 (PET)

- 聚酰胺

- 聚碳酸酯

- 苯乙烯共聚物(ABS 和 SAN)

- 聚丁烯对苯二甲酸酯(PBT)

- 聚甲基丙烯酸甲酯(PMMA)

- 其他工程塑料

- 生质塑胶

- 传统塑料

- 目的

- 包装

- 电力/电子

- 建筑/施工

- 汽车和交通

- 家具/寝具

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Covestro AG

- HMC Polymers Thailand

- Indorama Ventures Public Company Limited

- INEOS Styrolution Group GmbH

- PTT Global Chemical Public Company Limited

- SCG Chemicals Co. Ltd

- Thai Plastic Industries Co. Ltd

第七章 市场机会及未来趋势

- 增加生物分解性塑胶的投资

The Thailand Plastics Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19. The production of plastics was reduced due to disruptions in the supply chain. However, the sector has been recovering well since restrictions were lifted. The rise in the level of industrial activities is likely to positively impact the studied market.

Key Highlights

- Over the short term, increasing usage of plastics in building and construction, and rising demand for food and beverage packaging, are some factors driving the market growth.

- On the flip side, stringent government regulations resulting in the plastic ban are expected to hinder market growth during the forecast period.

- Increasing investments in biodegradable plastics will likely create opportunities for the market in the coming years.

Thailand Plastic Market Trends

Polyethylene Terephthalate (PET) is Expected to Dominate the Market

- Polyethylene Terephthalate (PET) resins are known for their excellent melt flow characteristics, close molding tolerances, and high productivity from multi-cavity molds. Owing to its mechanical and electrical properties, PET is often used to replace metals in motor housings, switches, sensors, and other electrical applications.

- PET and polyolefins are the most widely used materials in the plastic packaging industry. Some of the significant properties of PET as a packaging material are recyclability, strength, and versatility, which drive the demand for these products.

- These products include take-out containers, frozen foods, carbonated drinks and juices, ketchup, bottled water, jars, and baked goods containers. They are also used in the food industry for clamshells, deli containers, and microwave food trays.

- PET also has excellent barrier properties that protect and preserve the product's contents. PET keeps the fizz in carbonated soft drinks, the vitamins in juices, and the color in ketchup intact. In other words, it protects products and keeps them on the shelves and out of the rubbish bin.

- Thailand's Indorama Ventures, the world's top producer of PET, in November 2020, announced spending USD 1.5 billion to triple its plastics recycling operations to increase the demand among green-minded beverage producers. Indorama has been acquiring companies that recycle polyethylene terephthalate in recent years. It aims to expand its recycling capacity to 750,000 tons a year by 2025 from the current roughly 250,000 tons. The goal is to have recycled materials account for around 20% of the 4 million tons of PET Indorama supplies to the beverage industry a year.

- In May 2022, a Thailand-based company named ENVICCO Limited started a new recycled plastic plant with the capacity to manufacture around 45,000 metric tons per year of recycled polyethylene terephthalate at Map Ta Phut, Rayong, Thailand. This will likely increase PET penetration in Thailand's plastics market.

- Owing to the abovementioned factors, the demand for PET will increase in the country over the forecast period.

Automotive Industry to Dominate the Market

- The automotive industry mainly uses engineering plastics as they are known for their high performance, thereby making the automotive parts compatible with the rigorous demands of the automotive sector. Mostly, engineering plastics are very versatile, which makes them suitable for achieving the needed innovation in the automotive industry. Moreover, these plastics are lightweight, which reduces fuel consumption.

- Some of the widely used plastics in the automotive industry include polypropylene, polyurethane, Polyvinyl chloride, Polybutylene Terephthalate (PBT), and others.

- Polypropylene is a very durable polymer that is manufactured from propylene. Owing to its chemical resistance and durability, polypropylene is used in various automotive components ranging from bumpers to cable insulation to carpet fibers.

- Polyurethanes are exceptionally resistant to radiation, solvents, and environmental wear. Owing to these qualities, they are well-suited for different applications, including the manufacturing of tires, seating, suspension brushes, etc.

- Thermoplastic-engineered polymers serve the automotive industry in different applications, such as the production of high-quality dashboard components, pillar trim, automotive instrument panels, wheel covers, door liners, seat backs, handles, and seat belt components, among others. This is expected to boost the demand for the studied market over the forecast period.

- Plastics are also more economical than metals and help to make automobiles energy-efficient by reducing weight, and offering durability, toughness, design flexibility, resiliency, corrosion resistance, and high performance. Some plastics also exhibit good electrical insulation properties.

- There are around 1,800 companies in Thailand in the automotive segment, which includes nearly 30 to 40 major players, about 700 Tier 1 automotive part manufacturers, and more than 1,000 Tier 2 and 3 producers. The presence of many major companies in the country not only signifies a vast automotive supply chain but also that the automotive industry is primed for further industry growth in the coming years.

- Car production in Thailand increased by nearly 15% year-on-year (Y-o-Y) to around 190,155 units in November 2022, which is the highest in the last 44 months, as the shortage of semiconductors continued to ease, according to the report of the Federation of Thai Industries (FTI).

- Furthermore, as per the FTI, the total number of car production in Thailand for the first 11 months of 2022 reached nearly 1.72 million units, registering a year-on-year growth of around 21%, and very close to the 2022 target of about 1.75 million units. The EVs market in Thailand is likely to register a CAGR of around 22% from 2022 to 2025. This is likely to boost the demand for the market studied.

- As per the Department of Land Transport (Thailand), around 152.4 thousand new private cars were registered in Bangkok, Thailand, from January to April 2022. The number of new registrations for passenger cars in the capital city of Thailand has fluctuated over the past 10 years. The number of new private cars registered in Bangkok in 2021 and 2020 was 269.83 and 292.3, respectively.

- Due to all such factors, the market for plastics in Thailand is expected to have steady growth during the forecast period.

Thailand Plastic Industry Overview

The plastics market in Thailand is partially consolidated in nature. The major companies include Indorama Ventures Public Company Limited, SCG Chemicals Co. Ltd, INEOS Styrolution Group GmbH, COVESTRO AG, and THAI PLASTIC INDUSTRIES CO. LTD, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Plastics in Building and Construction

- 4.1.2 Rising Demand from Food and Beverage Packaging

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations Resulting in Plastic Ban

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Traditional Plastics

- 5.1.1.1 Polyethylene

- 5.1.1.2 Polypropylene

- 5.1.1.3 Polystyrene

- 5.1.1.4 Polyvinyl Chloride

- 5.1.2 Engineering Plastics

- 5.1.2.1 Polyethylene Terephthalate (PET)

- 5.1.2.2 Polyamides

- 5.1.2.3 Polycarbonates

- 5.1.2.4 Styrene Copolymers (ABS and SAN)

- 5.1.2.5 Polybutylene Terephthalate (PBT)

- 5.1.2.6 Polymethyl Methacrylate (PMMA)

- 5.1.2.7 Other Engineering Plastics

- 5.1.3 Bioplastics

- 5.1.1 Traditional Plastics

- 5.2 Application

- 5.2.1 Packaging

- 5.2.2 Electrical and Electronics

- 5.2.3 Building and Construction

- 5.2.4 Automotive and Transportation

- 5.2.5 Furniture and Bedding

- 5.2.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Covestro AG

- 6.4.2 HMC Polymers Thailand

- 6.4.3 Indorama Ventures Public Company Limited

- 6.4.4 INEOS Styrolution Group GmbH

- 6.4.5 PTT Global Chemical Public Company Limited

- 6.4.6 SCG Chemicals Co. Ltd

- 6.4.7 Thai Plastic Industries Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investments in Biodegradable Plastics