|

市场调查报告书

商品编码

1628817

中东和非洲的药品包装:市场占有率分析、产业趋势和成长预测(2025-2030)MEA Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

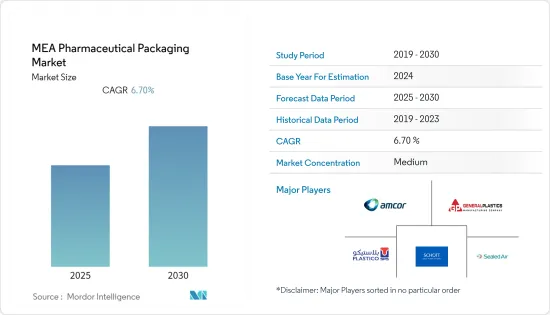

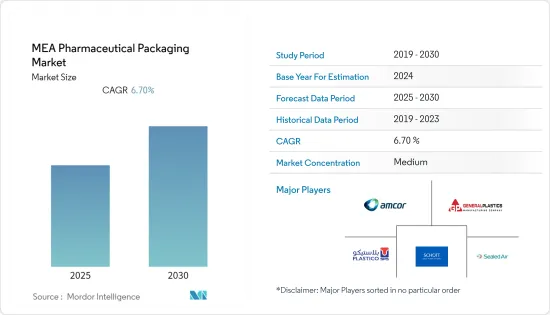

中东和非洲药品包装市场预计在预测期内复合年增长率为6.7%

主要亮点

- 中东地区仅占医药包装市场总量的3.5%。近年来,由于技术的逐步创新以及製药领域学名药和专科药物的增加,塑胶已成为製药市场上使用最广泛的包装材料。为了保护病人利益而对防伪技术的需求不断增长,进一步推动了药品包装的成长。

- 该研究市场的成长前景预计将取决于海湾合作委员会和其他邻近地区製药和医疗保健行业的整体成长。生活水准的整体提高、人口老化以及多国政府改善医疗保健产业的努力被视为促进该地区製药业成长的主要因素。此外,近几十年来,包装材料在製药领域的作用发生了显着变化。

- 他们现在需要遵守多项监管标准,提供产品讯息,并确保在自行给药的情况下正确输送药物。药品包装材料明确分为初级包装、二级包装和封闭系统。製药公司在选择塑胶包装材料时必须牢记其目标患者群体、产品稳定性要求、商业性可行性和监管考虑因素。

- 推动市场成长的因素包括该地区健康意识的提高、针对仿冒品的积极措施以及奈米技术和生物技术在製药领域的贡献不断增加。

- 用于对抗地方病、呼吸道疾病和其他流行病的新型医疗保健药物和设备的出现是推动医药塑胶包装市场成长的主要因素之一。相反,与塑胶使用相关的环境问题以及合规标准的不断变化预计将阻碍该市场的成长。

- 中东和非洲,特别是南非,正在经历空前数量的 COVID-19 病例,迫使药品包装业务暂停。其他医疗产品生产行业的下滑对 2020 年前几个月的医疗包装需求产生了负面影响。此外,包装材料总产量的减少导致药包材生产计划终止,导致药包材需求减少。中东和非洲其他国家也出现了类似的趋势,包括沙乌地阿拉伯和阿拉伯联合大公国。不过,预计该国将透过这种方式克服需求下降的影响,经济活动将会復苏,特别是在 2021 年初。

中东和非洲药品包装市场趋势

瓶装部门营业费用占比最大

该地区不同类型的药品包装均使用玻璃和塑胶瓶。大量药物製剂使用玻璃容器进行包装,玻璃容器通常是包装材料的首选。

- 瓶子一直是锭剂和胶囊的首选包装。也用于包装糖浆、滴鼻剂、眼药水等液体製剂。塑胶瓶将继续在主要药物容器中占据最高的市场占有率,这反映出它们在口服药物散装包装、处方量包装和固态剂量口服非处方药散装包装中的应用。

- 药品包装用塑胶材料的种类很多,包括PVC、PE、PP、PS、PET、尼龙等。 PE、PP、PET的比例最高,但PVC的用量正在减少。大部分塑胶瓶是椭圆形、方形和圆形容器,带有螺旋颈,适合各种瓶盖。

- 然而,市场正由宝特瓶主导。使用高密度聚苯乙烯(HDPE) 和聚对苯二甲酸乙二醇酯 (PET) 製造的塑胶瓶比玻璃更广泛地用于包装药品。原因在于其高耐热性和耐衝击性、优异的气体和湿气阻隔性以及透明度和不透明性。

- 此外,该地区大量使用瓶子来透过处方笺分发口服药物。邮寄到药局的大剂量包装在方便的塑胶瓶中。

- 因此,根据要求和用途,製成了瓶子的类型。药品包装产业对塑胶瓶的易用性和高需求将支持市场成长,并将在 2021-2026 年预测期内占据市场占有率份额。

沙乌地阿拉伯抢占盈利的市场占有率

沙乌地阿拉伯已成为药品包装产业最赚钱的市场之一。药品进口占市场的80%以上,严重依赖外部市场来满足不断增长的国内需求。药品包装材料广泛用于再包装和出口在该地区加工的半成品药品。这些重新包装的药品在邻国进行商业销售,以回应供需模式。

- 近年来,医疗保健方面的公共支出有了显着改善。慢性病,特别是 COVID-19 和其他健康疾病的增加,正在促进製药业的成长。预计该地区特种药物的使用将出现高速成长。

- 沙乌地阿拉伯被誉为中东地区的药品製造热点。据估计,该国占海湾合作委员会医药市场的一半以上。沙乌地阿拉伯政府已采取多项积极措施,使高度依赖石油和原油的国内部门多元化。沙乌地阿拉伯的医疗保健产业因拥有最先进的医疗网路之一而闻名于世。

- 此外,四个「经济」城市(即KAEC、PABMEC、KEC、JEC)的发展预计将为该地区建立药品加工设施创造新的机会。辉瑞等製药巨头对扩大业务以加强其在海湾合作委员会地区的立足点非常感兴趣。

- 然而,与当地公司的合作仍然是一个重大挑战,因为跨国公司需要满足品质标准并遵守当地法规。沙乌地阿拉伯食品药物管理局以及其他海湾合作委员会成员国负责制定该地区的药品价格。药品製造商可能会鼓励药品包装公司降低价格,以降低整体製造成本。

- 由于油价波动,该地区目前正处于成长转型期,但强劲的经济储备预计将在短期内抵消油价下跌的影响。这些宏观经济变化预计将对药品包装市场产生间接影响。然而,预计报告期间整体需求仍将维持在高水准。

中东和非洲药品包装产业概况

中东和非洲的药品包装市场较为分散,主要企业包括 Indevco 集团、Amcor Worldwide、General Plastics、沙乌地阿拉伯塑胶包装系统有限公司和 Sealed Air Corporation,这些都是新公司。

- 2021 年 4 月 - Amcor 开发出革命性的可回收医疗保健包装,即新型 AmSky泡壳系统。这是一项最新的创新,正在改变医疗保健包装的永续性,使我们能够消除泡壳包装中的 PVC 并提高 Amcor 医疗保健的可回收性。这项创新为药品包装提供了耐儿科且适合老年人的解决方案。

- 2021 年 9 月 - 肖特股份公司收购了一家位于亚利桑那州的微阵列解决方案公司,扩大了该公司的业务并增强了其在生物科学领域的能力。透过此次收购,客户将受益于增强的开发和製造能力,包括高密度微阵列列印。

- 2021 年 11 月 - INDEVCO 与终结塑胶废弃物联盟合作,协助减少中东和北非地区的塑胶废弃物。 INDEVCO 是中东和北非 (MENA) 区域任务小组 AEPW(终结塑胶垃圾联盟)的联合主席。 AEPW 区域任务小组 (RTG) 的目标是将消除塑胶废弃物的全球策略转化为适合当地资源、挑战和需求的区域策略。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第 2 章执行摘要

第三章调查方法

第四章市场动态

- 市场概况

- 市场驱动因素

- 提高对环境问题的认识并采用新的监管标准

- 慢性疾病患者快速增加

- 市场限制因素

- 由于供应商议价能力而导致原物料成本波动

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 依材料类型

- 塑胶

- 玻璃

- 其他(纸/纸板、金属)

- 依产品类型

- 瓶子

- 管瓶/安瓿

- 注射器

- 管子

- 盖子和封口

- 小袋

- 标籤

- 其他产品类型

第六章 竞争状况

- 公司简介

- Indevco Group

- Amcor Worldwide

- Rexam PLC

- Schott AG

- Sealed Air Corporation

- Saudi Arabia plastic Packaging Systems Co.

- General Plastics Limited

- Medical Packaging(SAE)

- Frank NOE Limited

- Rose Plastics Medical Packaging

第七章 投资分析

第八章市场的未来

The MEA Pharmaceutical Packaging Market is expected to register a CAGR of 6.7% during the forecast period.

Key Highlights

- The Middle East region accounts for a meager portion of 3.5% of the overall pharmaceutical packaging market. Over the last few years, plastics have emerged as the most widely used packaging materials in the pharmaceutical market owing to incremental technological changes and growth in generic and specialty drugs in the pharmaceutical sector. The increasing need for anti-counterfeiting techniques to protect the interests of patients has further strengthened the growth of pharmaceutical packaging.

- The growth prospects of the study market are expected to be dependent on the overall growth of the pharmaceutical and healthcare sector in GCC and other neighboring regions. An overall rise in living standards, coupled with an increase in the aging population and the endeavors of several governments towards improving their healthcare sector, can be seen as major factors contributing to the growth of the pharmaceutical sector in this region. Moreover, the role of packaging materials in the pharma sector has greatly evolved over the last few decades.

- They are now expected to comply with several regulatory standards and provide product information and ensure proper drug delivery in case of self-administering drugs. The pharmaceutical packaging materials have been distinctly categorized into primary, secondary, and closure systems. Pharmaceutical companies have to be mindful of their target patient base, product stability requirements, commercial viability, and regulatory considerations while opting for plastic packaging materials.

- The major drivers for growth in this market include growing health awareness in the region, proactive measures against counterfeit products, and increased contribution of nanotechnology and biotechnology practices in the pharmaceutical sector.

- The advent of new healthcare medicines and devices to counter endemics, respiratory diseases, and other prevalent ailments is one of the major drivers for growth in the pharmaceutical plastic packaging market. Conversely, environmental concerns related to the use of plastics and constant changes in compliance standards are expected to impede the growth in this market.

- In the Middle East and Africa, particularly South Africa, an unprecedented number of COVID-19 cases have resulted in the suspension of the medical packaging business. The decline in other medical product production sectors had a negative impact on medical packaging demand in the first month of 2020. Moreover, the decrease in the total production of packaging materials led to the termination of the medical packaging material production project, which led to a decrease in the demand for medical packaging materials. Similar trends were observed in other countries in the Middle East and Africa, namely Saudi Arabia and the UAE. However, the country is likely to overcome the decline in demand in this way, and economic activity is expected to recover, especially in early 2021.

MEA Pharmaceutical Packaging Market Trends

Bottle Packaging segment to hold biggest operating expense

Glass and Plastic Bottles are used for various kinds of drug packaging in the region. A considerable number of pharmaceutical formulations have been packaged using glass containers, and they are usually the first choice of packaging materials.

- Bottles have been the preferred mode of packaging tablets and capsules. They are also used for packaging liquid dosages like syrups, nasal and ophthalmic medications. Plastic bottles will continue to have the highest market share among primary pharmaceutical containers, reflecting the usage in the bulk and prescription dose packaging of oral ethical drugs and the packaging of solid dose oral over-the-counter medicines in large quantities.

- There are many kinds of medicine packaging plastic materials, including PVC, PE, PP, PS, PET, nylon, etc. The PE, PP, and PET account for the largest proportion; however, the amount of PVC is reducing. The largest share within plastic bottles is for ovals, square and round containers with threaded necks designed to fit a wide variety of closures.

- However, the market is getting progressively occupied by Plastic bottles. Plastic bottles manufactured using high-density polyethene (HDPE) and polyethene terephthalate (PET) are being used to pack pharmaceuticals than glass. This is due to high temperature and impact resistance, the excellent barrier to gas and moisture, and transparency and opacity properties.

- Moreover, bottles are used in large quantities for oral drugs that are distributed through prescription in the region. Bulk dose volumes that are mailed to pharmacies are conveniently packed in plastic bottles.

- Hence, based on the requirement and usage, the types of bottles are made. The ease of use and high demand for plastic bottles in the pharmaceutical packaging industry will help the market grow, and it will be the highest market shareholder in the forecast period of 2021-2026.

Saudi Arabia to hold profitable market share

Saudi Arabia has emerged as one of the most lucrative markets for the pharmaceutical packaging sector. Drug imports account for more than 80% of the market, as it heavily relies on external markets for meeting the ever-growing domestic demand. Pharmaceutical packaging materials are widely used for the repackaging and export of semi-finished medicaments processed in this region. These repackaged drugs are commercially sold in neighboring countries to address the demand-supply paradigm.

- Public spending on healthcare has improved considerably over the last few years; the rise in chronic diseases, especially COVID-19 and other health ailments, has contributed to the growth of the pharmaceutical sector. The use of specialty pharma drugs is expected to witness high growth in this region.

- Saudi Arabia is widely known as a pharma manufacturing hot spot in the Middle East. The country has been estimated to account for more than half of the GCC pharmaceuticals market. The Saudi government has been taking several proactive measures to diversify the domestic sector, which is heavily reliant on petroleum and oil. The Saudi Arabian healthcare sector is world-renowned as one of the most sophisticated healthcare networks.

- Moreover, the development of four 'economic' cities (namely KAEC, PABMEC, KEC, and JEC) is expected to create new opportunities for the establishment of pharmaceutical processing units in this region. Pharma giants like Pfizer have taken a keen interest in expanding their operations in a bid to gain more ground in the GCC region.

- However, collaborating with local companies remains a considerable challenge for global companies, as they are required to meet their quality standards and comply with regional regulations. The Saudi Food and Drug Authority, in conjunction with other GCC member countries, is responsible for the pricing of pharmaceutical products in this region. Pharmaceutical packaging companies could be prompted to cut down on their prices by drug manufacturers in a bid to keep the overall production costs under check.

- This region is currently growing through a transition due to the fluctuations in the oil prices; however, strong economic reserves are expected to offset the impact of the reduction in oil prices in the short term. These macroeconomic changes are anticipated to have an indirect impact on the pharmaceutical packaging market. However, the overall demand shall remain fairly high over the reporting period.

MEA Pharmaceutical Packaging Industry Overview

The Middle East and Africa Pharmaceutical Packaging Market are fragmented due to the presence of key players like Indevco group, Amcor Worldwide, General Plastics, Saudi Arabia Plastic Packaging Systems Co., and Sealed Air Corporation; all these players are investing in new innovations and for R&D upscaling the industry.

- April 2021 - Amcor developed breakthrough recyclable healthcare packaging, the new AmSky blister system, the recent innovation to transform the sustainability of healthcare packaging and to eliminate PVC from blister packaging, enabling Amcor healthcare to improve its recyclability. This innovation offers child-resistant and senior-friendly solutions for pharmaceutical packaging.

- Sep 2021 - SCHOTT AG acquired the Arizona-based microarray solutions compnay extending the companies presence and strengthening its bioscience capabilities. This acquisition helps customers to benefit from enhanced development and manufacturing capabilities, including high-density microarray printing.

- Nov 2021 - INDEVCO partners with the Alliance to End Plastic Waste to help reduce plastic waste in the Middle East and North Africa region. INDEVCO took on the role of Co-Chair to the Alliance to End Plastic Waste (AEPW), the Middle East & North Africa (MENA) Regional Task Group. The objective of the AEPW Regional Task Group (RTG) is to translate its global strategy for eliminating plastic waste into a regional strategy that tailors to the local resources, challenges, and needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Awareness of Environmental Issues and Adoption of New Regulatory Standards

- 4.2.2 Surging Number of Chronic Disease Cases

- 4.3 Market Restraints

- 4.3.1 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Others (Paper and Paperboard, Metal)

- 5.2 Product Type

- 5.2.1 Bottles

- 5.2.2 Vials and Ampoules

- 5.2.3 Syringes

- 5.2.4 Tubes

- 5.2.5 Caps and Closures

- 5.2.6 Pouches

- 5.2.7 Labels

- 5.2.8 Other Product Types

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Indevco Group

- 6.1.2 Amcor Worldwide

- 6.1.3 Rexam PLC

- 6.1.4 Schott AG

- 6.1.5 Sealed Air Corporation

- 6.1.6 Saudi Arabia plastic Packaging Systems Co.

- 6.1.7 General Plastics Limited

- 6.1.8 Medical Packaging ( S.A.E)

- 6.1.9 Frank NOE Limited

- 6.1.10 Rose Plastics Medical Packaging