|

市场调查报告书

商品编码

1628822

欧洲油田化学品 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Oilfield Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

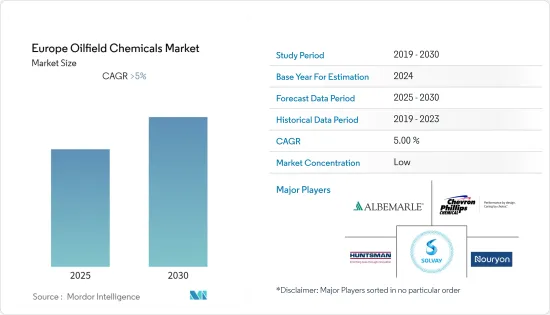

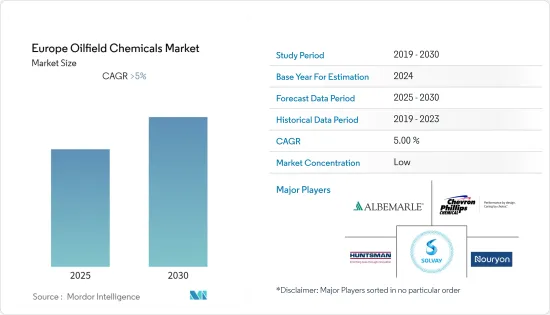

欧洲油田化学品市场预计在预测期内复合年增长率将超过 5%

主要亮点

- COVID-19 对 2020 年市场产生了负面影响。全国范围内的封锁和严格的社交距离规定扰乱了各个细分市场的供应链。然而,由于探勘和钻探投资以及欧洲能源需求的增加,预计该市场将稳定成长。

- 推动市场的主要因素是页岩气探勘和生产的增加以及运输业对石油燃料的需求增加。页岩气开采的环境永续性预计将阻碍市场成长。海上钻探作业开启的新视野很可能成为未来的机会。

欧洲油田化学品市场趋势

油井增产主导市场

- 按应用划分,油田化学品中最大份额是油井刺激剂。该领域使用的化学物质包括酸性腐蚀抑制剂、界面活性剂和非乳化剂。在油井增产过程中使用酸时,它们可以保护油井设备、泵浦和卡车免受腐蚀。界面活性剂降低各种酸、酸添加剂和压裂水的表面张力。

- 这些化学品的最佳应用是页岩气和緻密油等非传统资源的生产,其中需要水力压裂和酸化等技术。

- 英国石油公司公布的资料显示,2021年欧盟石油产量将达36.6万桶/日。这可能会影响油井增产所需的油田化学品的需求。

- 由于对能源独立的需求不断增加,预计欧洲将把重点转向北海的页岩油开发。因此,井眼增产化学品在不久的将来应该会成为一个非常盈利的市场。

俄罗斯主导市场

- 俄罗斯是世界第二大原油生产国,已探明原油蕴藏量约800亿桶。该国严重依赖石油和天然气产业的收入,该产业约占联邦收入的 40%。

- 俄罗斯石油和天然气工业在世界市场上极为重要,供应全球液态烃出口量的约13%。

- 此外,由于天然气价格竞争机制,俄罗斯向亚太地区特别是中国的天然气出口不断增加。

- 儘管从长远来看,俄罗斯预计仍将是重要的石油和天然气生产国,但最近达成的石油减产协议可能会暂时减缓石油工业的成长。

- 英国石油公司公布的资料显示,2021年欧盟石油产量将达到1,094.4万桶/日。预计将影响油田化学品的需求。

- 因此,俄罗斯油田化学品预计在预测期内将呈现温和成长。

欧洲油田化学品产业概况

欧洲油田化学品市场较分散。市场上的主要企业包括(排名不分先后)Nouryon、Albemarle Corporation、Huntsman International LLC、Solvay 和 Chevron Phillips Chemical Company(钻井特殊公司)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加页岩气探勘和生产

- 运输业对石油基燃料的需求增加

- 抑制因素

- 页岩气开采的环境永续性

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 化学类型

- 除生物剂

- 缓蚀/阻垢剂

- 破乳剂

- 聚合物

- 界面活性剂

- 其他的

- 目的

- 钻孔和固井

- 工作的中断和完成

- 井增产

- 生产

- 提高采收率

- 地区

- 俄罗斯

- 挪威

- 英国

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- Albemarle Corporation

- Ashland

- Baker Hughes, a GE Company LLC

- BASF SE

- Chevron Phillips Chemical Company(Drilling Specialties Company)

- Clariant

- Croda International Plc

- DowDuPont

- Ecolab(Nalco Champion Technologies Inc.)

- ELEMENTIS PLC

- Exxon Mobil Corporation

- Flotek Industries, Inc.

- Halliburton

- Huntsman International LLC.

- Innospec

- Kemira

- Newpark Resources Inc.

- Nouryon

- Schlumberger Limited

- Solvay

- Zirax Limited

第七章 市场机会及未来趋势

- 海上钻井业务开启新视野

- 其他机会

简介目录

Product Code: 55023

The Europe Oilfield Chemicals Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. The nationwide lockdowns and stringent social distancing mandates led to supply chain disruptions across different market segments. However, the market is expected to grow steadily owing to increasing investments in exploration and drilling and demands for energy in the European region.

- The major factors driving the market studied are the increased shale gas exploration and production and the rising demand for petroleum-based fuel from the transportation industry. Environmental sustainability in shale gas extraction is expected to hinder the market's growth. New horizons opened up due to offshore drilling operations are likely to act as an opportunity in the future.

Europe Oilfield Chemicals Market Trends

Well Stimulation to Dominate the Market

- The well-stimulation segment holds the largest share of oilfield chemicals by application. The chemicals used in this segment include acid corrosion inhibitors, surfactants, and non-emulsifiers. These provide excellent protection to oil well equipment, pumps, and trucks from corrosion while working with acid for the well-stimulation process. Surfactants reduce the surface tension of various acids, acid additives, and water fracturing.

- The best application of these chemicals is seen in the production of unconventional resources like shale gas and tight oil, where there is a requirement for technologies such as hydraulic fracturing and acidizing.

- As per data published by British Petroleum, oil production in the European Union reached 366 thousand barrels per day in 2021. This will impact the demand for oilfield chemicals required for well stimulation.

- Europe is expected to shift its focus to shale exploration in the North Sea due to an increasing requirement for energy self-sufficiency. Hence, the well stimulation chemicals are supposed to have a very profitable market in the near future.

Russia to Dominate the Market

- Russia is the second largest producer of crude oil globally, with verified oil reserves of about 80,000 million barrels of oil. The country greatly depends on the revenues obtained from the oil & gas industry, which accounts for around 40% of the federal revenues.

- Russia's oil and gas industry is crucial in the global market, supplying about 13% of the global liquid hydrocarbon exports.

- Also, there are increasing exports of natural gas from Russia to the Asia-Pacific region, especially China, due to the competitive pricing mechanism for natural gas.

- Russia is expected to continue as one of the significant producers of oil & gas in the long run, but the recent agreement to cut the crude oil output might temporarily slow down the growth of the petroleum industry.

- As per data published by British Petroleum, oil production in the European Union reached 10,944 thousand barrels per day in 2021. This will impact the demand for oilfield chemicals.

- Hence oilfield chemicals are expected to witness moderate growth in Russia during the forecast period.

Europe Oilfield Chemicals Industry Overview

The Europe oilfield chemicals market is fragmented in nature. The major companies in the market (not in a particular order) include Nouryon, Albemarle Corporation, Huntsman International LLC, Solvay, and Chevron Phillips Chemical Company (Drilling Specialties Company), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Shale Gas Exploration and Production

- 4.1.2 Rising Demand for Petroleum-based Fuel from Transportation Industry

- 4.2 Restraints

- 4.2.1 Environmental Sustainability in Shale Gas Extraction

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemical Type

- 5.1.1 Biocide

- 5.1.2 Corrosion & Scale Inhibitors

- 5.1.3 Demulsifiers

- 5.1.4 Polymers

- 5.1.5 Surfactants

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Drilling & Cementing

- 5.2.2 Work-over & Completion

- 5.2.3 Well Stimulation

- 5.2.4 Production

- 5.2.5 Enhanced Oil Recovery

- 5.3 Geography

- 5.3.1 Russia

- 5.3.2 Norway

- 5.3.3 United Kingdom

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Ashland

- 6.4.3 Baker Hughes, a GE Company LLC

- 6.4.4 BASF SE

- 6.4.5 Chevron Phillips Chemical Company (Drilling Specialties Company)

- 6.4.6 Clariant

- 6.4.7 Croda International Plc

- 6.4.8 DowDuPont

- 6.4.9 Ecolab (Nalco Champion Technologies Inc.)

- 6.4.10 ELEMENTIS PLC

- 6.4.11 Exxon Mobil Corporation

- 6.4.12 Flotek Industries, Inc.

- 6.4.13 Halliburton

- 6.4.14 Huntsman International LLC.

- 6.4.15 Innospec

- 6.4.16 Kemira

- 6.4.17 Newpark Resources Inc.

- 6.4.18 Nouryon

- 6.4.19 Schlumberger Limited

- 6.4.20 Solvay

- 6.4.21 Zirax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Horizons Opened Up Due to Offshore Drilling Operations

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219