|

市场调查报告书

商品编码

1628825

北美汽车网路安全:市场占有率分析、产业趋势与成长预测(2025-2030)NA Market for Cyber Security of Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

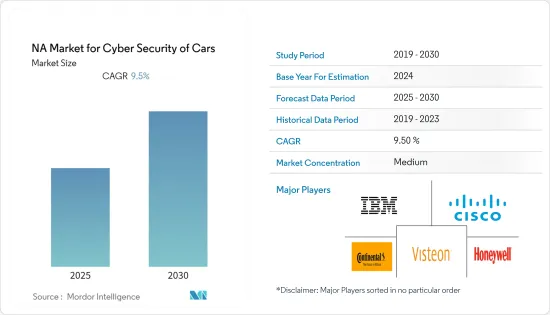

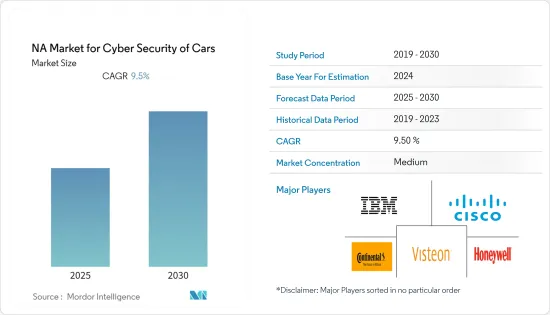

北美汽车网路安全市场预计在预测期内复合年增长率为 9.5%

主要亮点

- 联网汽车功能的动态特性对网路安全需求产生重大影响。新的连网型实体和联网汽车的新服务的发展也创造了新的攻击媒介,可能会损害车辆的安全。

- 联网汽车的出现以及乘用车对连网型解决方案日益增长的需求正在推动对网路安全的需求。吉普切诺基研究人员还能够在繁忙的高速公路上行驶时远端关闭车辆的引擎。这次骇客攻击促使菲亚特克莱斯勒召回了 7 个型号的 140 万辆汽车(约占当年美国销量的 50%)。

- 此外,监督联网汽车安全和保障标准的地区监管机构之一的美国运输安全管理局 (NHTSA) 宣布了其 5G FAST 计划。该计划包括向市场提供更多频谱、更新基础设施政策、对过时的法规进行现代化改造以及增加从车对车 (V2V) 到车对车 (V2X) 的高速通讯。在万物互联的环境中交换资料。这种资料交换允许自动驾驶车辆接收和提供超出车载感测器物理范围的资料。

- 另一方面,机器学习在异常检测方面具有优势,这对汽车网路安全有很大帮助。机器每天可以处理数十亿个安全事件,提供系统活动的可见性并标记异常以供人工审查。

北美汽车网路安全市场趋势

应用安全预计将占据主要市场占有率

- 为了应对不断增加的威胁和漏洞,市场上的各个供应商正在利用应用程式安全功能作为独特的功能来吸引业务并建立伙伴关係以加强安全性。例如,2021年1月,World 资料完成了SekurMessenger的所有测试。託管通讯安全和隐私解决方案。

- 2020 年 9 月,SaaS 供应商 StackHawk 宣布全面上市。该公司将把其方法从时间点笔测试和每週扫描转向对构成 CI/CD 管道中面向客户的应用程式的微服务进行自动化测试。这减少了修復时间,将潜在的漏洞推送给工程团队,并确保漏洞在影响生产之前被侦测到。我们与 CircleCI 和 GitLab 等重要的 CI 供应商合作,将 AppSec 测试简化到相同开发建置管道中。

- 此外,专注于开发人员的应用程式安全公司 Contrast 宣布推出其安全可观测平台。它为开发人员提供了单一管理平台来管理应用程式整个生命週期的安全性,并具有即时分析、报告和修復工具等附加优势。

- 为了应对 COVID-19,WhiteHat Security 宣布从 2021 年 1 月开始,它将开始提供 AppSec Stats Flash,这是一份每月播客和统计报告,可以更准确地描述应用程式安全的当前状态。

- 此外,根据 CompTIA 的数据,2020 年美国约有 13 万个活跃的网路安全职缺。到 2030 年,网路安全劳动力预计将达到约 17 万人。这将为应用程式管理应用创造大量就业机会。

美国预计将获得主要市场占有率

- 美国是主要汽车市场之一,对联网汽车有着巨大的需求。与全球市场一样,该国在 2020 年经历了需求下滑,但预计未来几年需求将会復苏。例如,根据 BEA 的数据,2020 年美国轻型汽车零售零售为 1,450 万辆。

- 福特、雪佛兰、吉普、公羊、GMC等汽车品牌2020年第一季销量为489,051辆、429,529辆、182,667辆、140,486辆、118,718辆,已成为具有代表性的汽车品牌。这种显着的成长增加了对网路安全的需求。

- 此外,未来三年,美国销售的汽车预计将有超过 85% 联网,而通用马达的 OnStar 平台就是该国使用最广泛的软体平台和安全系统之一。日本不断增长的渗透率正在增加对网路安全的需求。

- 根据运输部2020 年 1 月发布的报告,补充自动驾驶车辆技术能力的无线技术是本届政府的优先事项。因此,在美国市场运营的主要汽车品牌纷纷宣布,到2020年将只在该国销售连网汽车。仅此一项发展就增加了可能扰乱整个城市并导致生命损失的攻击的可能性。

北美汽车网路安全产业概况

北美汽车网路安全市场竞争适中。产品研究、高研发成本、联盟和收购是该地区公司维持激烈竞争的关键成长策略。

- 2021 年 9 月 - IBM 工程生命週期管理宣布为汽车合规性提供网路安全产业标准支援。此软体解决方案可协助汽车工程团队支援 UNECE 合规性准备工作,并利用 ISO/SAE 21434 标准保护车辆免受网路安全威胁。

- 2020 年 2 月 - 思科和 Oxbotica 合作将 OpenRoaming 引入自动驾驶汽车。透过 OpenRoaming,自动驾驶车辆无需实际输入使用者名称或密码即可连接到可信任的 Wi-Fi 网路。相反,自动驾驶汽车使用 Oxbotica 等製造商颁发的凭证进行身份验证。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对工业生态系的影响

第五章市场动态

- 市场驱动因素

- 由于汽车中安装的技术的增加,安全威胁日益增加

- 政府法规

- 市场挑战

- 市场动态

第六章 市场细分

- 按解决方案类型

- 基于软体

- 基于硬体

- 专业服务

- 一体化

- 其他解决方案

- 依设备类型

- 网路安全

- 应用程式安全

- 云端安全

- 其他安全

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Harman International Industries Inc.(Samsung)

- IBM Corporation

- Arilou Technologies

- Infineon Technologies AG

- Visteon Corporation

- Continental AG

- Cisco Systems Inc

- Argus Cybersecurity

- Secunet AG

- NXP Semiconductors NV

- Honeywell International Inc.

- Delphi Automotive PLC

第八章投资分析

第9章市场的未来

简介目录

Product Code: 55092

The NA Market for Cyber Security of Cars Industry is expected to register a CAGR of 9.5% during the forecast period.

Key Highlights

- The dynamic nature of the features in the connected vehicles is significantly influencing the demand for cybersecurity, as with the development of every new connected entity or new service for connected cars, a new attack vector is also created from which the security of the vehicle can be compromised.

- The advent of connected cars and increasing demand for a connected solution in passenger vehicles are driving the demand for cybersecurity, as more and more attacks are being carried on connected vehicles. Also, Jeep Cherokee researchers were able to stop the engine of a vehicle remotely while it drove down a busy highway; this one instance of hack led to Fiat Chrysler recalling 1.4 million vehicles of seven different models, which was about 50% of the cars they sold in the United States during that year.

- Further, the National Highway Transportation Safety Administration (NHTSA) is one of the regulatory bodies operating in the region overseeing the standards in safety and security of connected cars and released the 5G FAST Plan. This plan includes three key components such as pushing more spectrum into the marketplace, updating infrastructure policy, modernizing outdated regulations, High-speed communications support Vehicle-to-Vehicle (V2V), and Vehicle-to-Everything (V2X) environment data exchange. Such data exchange allows autonomous vehicles to receive and contribute data beyond their onboard sensors' physical range.

- On the other hand, machine learning provides advantages in outlier detection, much to the benefit of cybersecurity of cars. Machines can handle billions of security events in a single day, clarifying a system's activity and flagging anything unusual for human review.

North America Cyber Security of Cars Market Trends

Application Security Expected to Witness Significant Market Share

- Owing to the growing threats and vulnerabilities, various vendors in the market are using the security features of their applications as a unique capability to attract business and also forming partnerships to enhance security. For instance, in January 2021, world Data completed all testing of its SekurMessenger. The hosted messaging security and privacy solution.

- On the developer front, as of September 2020, StackHawk, a software-as-a-service provider, announced that it is launching into general availability. The company shifts the approach from point-in-time pen tests or weekly scheduled scans to automated testing of the microservices that make up a customer-facing application in the CI/CD pipeline. This shortens fix times, pushes potential vulnerabilities to the engineering teams, and ensures that vulnerabilities are caught before they hit production. It has partnered with significant CI providers such as CircleCI and GitLab to simplify AppSec tests into the build pipeline for the same development.

- Also, Contrast, a developer-centric application security company, announced its security observability platform launch. This offers developers a single pane of glass to manage an application's security across its lifecycle, along with added benefits of real-time analysis and reporting and remediation tools.

- Whereas in the wake of COVID-19, as of January 2021, WhiteHat Security announced the launch of AppSec Stats Flash, a monthly podcast and statistics report that provides a more accurate view of the current state of application security.

- Further, According to the CompTIA, In 2020, the number of active cybersecurity jobs in the United States was around 130 thousand. By 2030, the cybersecurity workforce is forecast to reach almost 170 thousand. This will create significant job opportunities in application management applications.

United States Expected to Witness Significant Market Share

- The United States is one of the major automotive markets and holds a significant demand for connected cars; the country observed a slump in demand similar to the global market in 2020; however, the demand is expected to pick up over the coming years. For instance, according to BEA, in 2020, the light vehicle retail sales in the United States stood at 14.5 million.

- Automotive brands, such as Ford, Chevrolet, Jeep, Ram, and GMC, were the leading car brands in the country with 489,051 units, 429,529 units, 182,667 units 140,486 units, and 118,718 units in sales during the first quarter of 2020. such substantial growth creates an increased need for cybersecurity.

- Moreover, over the period of the next three years, it is expected that over 85% of the cars sold in the US are expected to be connected over the internet, and General Motor's OnStar platform was one of the widely used software platforms and security system in the country. Such growing adoption and penetration rates in the country are augmenting the demand for cybersecurity.

- According to the Department of Transportation's report released in January 2020, wireless technologies that complement the capabilities of automated vehicle technologies are a priority of the current administration. In line with this, major car brands operating in the US market have stated that only connected vehicles will be sold by 2020 in the country. Such development alone increases the potential damage of an attack which could disrupt an entire city and may lead to loss of lives.

North America Cyber Security of Cars Industry Overview

The North America Market for Cyber Security of Cars is moderately competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- September 2021- IBM Engineering Lifecycle Management announced support for cyber security industry standards to Automobile Conformity. The software solution assists automobile engineering teams in supporting UNECE compliance readiness and leveraging ISO/SAE 21434 standards to ensure vehicle security against cyber security threats.

- February 2020 - Cisco and Oxbotica partnered to bring OpenRoaming to autonomous cars. With the help of OpenRoaming, Autonomous Vehicles can connect to trusted Wi-Fi networks without the need to physically enter the usernames or passwords. Instead, Autonomous Vehicles authenticate using credentials issued by the manufacturer, like Oxbotica.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industry Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Security Threats as More Technologies Get Integrated Into Cars

- 5.1.2 Government Regulations

- 5.2 Market Challenges

- 5.2.1 Dynamic Nature of the Market

6 MARKET SEGMENTATION

- 6.1 By Solution Type

- 6.1.1 Software-based

- 6.1.2 Hardware-based

- 6.1.3 Professional Service

- 6.1.4 Integration

- 6.1.5 Other Types of Solution

- 6.2 By Equipment Type

- 6.2.1 Network Security

- 6.2.2 Application Security

- 6.2.3 Cloud Security

- 6.2.4 Other Types of Security

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Harman International Industries Inc. (Samsung)

- 7.1.2 IBM Corporation

- 7.1.3 Arilou Technologies

- 7.1.4 Infineon Technologies AG

- 7.1.5 Visteon Corporation

- 7.1.6 Continental AG

- 7.1.7 Cisco Systems Inc

- 7.1.8 Argus Cybersecurity

- 7.1.9 Secunet AG

- 7.1.10 NXP Semiconductors NV

- 7.1.11 Honeywell International Inc.

- 7.1.12 Delphi Automotive PLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219