|

市场调查报告书

商品编码

1628826

亚太地区机器视觉系统:市场占有率分析、产业趋势与成长预测(2025-2030 年)APAC Machine Vision Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

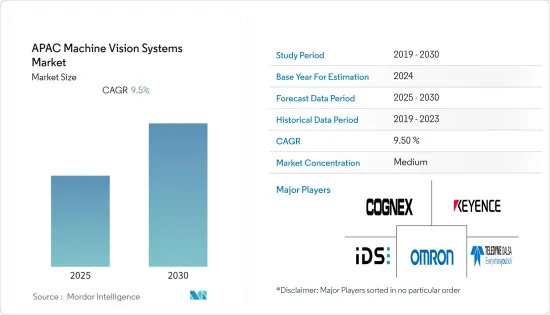

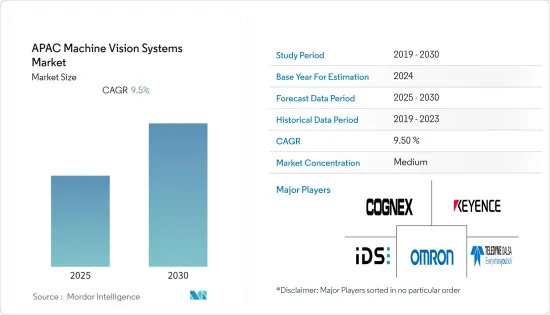

亚太地区机器视觉系统市场预计在预测期内复合年增长率为 9.5%

主要亮点

- 对自动化和工业 4.0 技术的投资增加、对安全和检查视觉系统不断增长的需求以及高产品创新率是推动亚太地区机器视觉系统市场成长的关键因素。机器视觉应用(例如用于恶劣环境中即时检查和分级操作的存在检测)正在成为许多行业的常态。最近的COVID-19进一步扩大了这些应用的范围。

- 在过去的一年里,二维机器视觉系统在全部区域获得了广泛的应用。然而,由于诸多限制,许多最终用户产业已经采用了3D系统。OMRON等市场供应商越来越多地投资于 3D 机器视觉系统的开发。

- 此外,工业4.0带动了机器人等在工业自动化中发挥关键作用的技术的发展,工业中的许多核心业务都由机器人来管理。 3D机器视觉也支援视觉引导机器人和自动屠宰等新应用。这些视觉引导机器人是 2D 和 3D 相机的组合。

- 人工智慧驱动的机器视觉正在重塑整个产业,从机器人和零售到医疗保健和製造。企业正在从整合影像感测器模组、电缆和GPU模组的AI视觉解决方案转向可立即开发的边缘AI智慧相机视觉系统,这减少了软体和硬体整合工作,使AI视觉开发人员可以专注于应用开发。

亚太地区机器视觉系统市场趋势

智慧相机基数可望大幅成长

- 由于许多最终用户行业的高产品创新率和现有应用的增强,基于智慧摄影机的产品在业界越来越受欢迎。智慧相机也有助于机器视觉系统的设计。近年来,该领域不断创新,包括具有更大影像感测器的模型、充当智慧相机的新兴嵌入式视觉相机以及能够执行深度学习和人工智慧任务的新型相机。

- 市场正在见证智慧相机中影像感测器解析度的提高、更快的处理器的整合、具有MIPI 介面的嵌入式视觉相机以及彩色和单色选项的可用性等创新,特别是在COVID-19 疫情爆发后,这些创新越来越受欢迎。

- 进一步的技术创新正在推动该地区的发展。例如,2021年5月,台湾边缘运算公司凌华科技推出了采用NVIDIA全新Jetson Xavier NX模组的NEON-2000-JNX系列工业AI智慧相机。这款新型相机的高性能、小外形规格和易于开发的特点为製造、物流、零售、酒店、农业、智慧城市、医疗保健、生命科学和其他边缘应用中的创新人工智慧视觉解决方案铺平了道路。

- 按地区划分,由于亚太地区在全球製造业市场中占据主导地位,并且该地区製造业和工业部门对自动化技术的投资不断增加,预计包括智慧相机在内的机器视觉系统市场将出现强劲增长。

中国正在实现令人瞩目的成长

- 由于自动化和机器人技术,中国正迅速成为机器视觉的主要市场之一。中国机器视觉产业采用了新的术语标准。此外,中国机器视觉产业联盟(CMVU)于2020年8月公布了《工业数位相机术语》和《工业相机镜头术语》标准。

- 在软体领域显示出巨大成长潜力的同时,研究市场的硬体领域也随着感测器和半导体的整体发展而发展。像SONY这样的公司在全球 CMOS 影像感测器创新以及製造自动化应用领域处于主导。

- 全国各地的製造公司都在认识到机器视觉系统的优势,尤其是在需要准确执行检查等冗余任务时。它们在高速生产线和危险环境中发挥着重要作用。这些系统的显着优势包括提高生产率、减少机器停机时间以及更严格的製程控制。

- 此外,视觉引导机器人可望在电子、汽车、运输和食品加工产业等领域取得根本性进展。由于电弧焊接、切割和码垛应用的高需求,3D视觉引导技术主要在这些行业中占据主导地位。

亚太地区机器视觉系统产业概况

亚太地区机器视觉系统市场竞争温和。产品探索、研发、联盟和收购是该地区公司为保持竞争力而采取的关键成长策略。

- 2021 年 8 月 - Keyence Corporation 推出 XG-X 系列可自订视觉系统,该系统具有先进的编程接口,具有 3D 和线扫描功能,可实现高品质、高速检测和控制。 XG-X系列透过高速、高解析度相机实现高精度侦测,为各种製造问题提供稳健的解决方案。

- 2021 年 1 月 - 康耐视公司宣布推出 In-Sight 3D-L4000 嵌入式影像处理系统。这款智慧相机配备3D雷射位移技术,使工程师能够快速、有效且经济高效地解决自动化生产线中的各种检查和测试。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对智慧工厂的需求不断增加

- 对精确缺陷检测的需求不断增长

- 市场挑战

- 实施 MV 系统的复杂性

第六章 市场细分

- 按成分

- 硬体

- 视觉系统

- 相机

- 光学和照明系统

- 影像撷取卡

- 其他硬体

- 软体

- 硬体

- 副产品

- 基于PC

- 智慧型相机底座

- 按最终用户产业

- 饮食

- 医疗保健/製药

- 物流/零售

- 汽车工业

- 电子/半导体

- 其他最终用户产业

- 国家名称

- 中国

- 印度

- 日本

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Cognex Corporation

- Keyence Corporation

- Omron Corporation

- Basler AG

- National Instruments Corporation

- Teledyne DALSA

- Datalogic SpA

- Perceptron Inc

- Uss Vision Inc

- IDS Imaging Development Systems GmbH

第八章投资分析

第9章市场的未来

简介目录

Product Code: 55095

The APAC Machine Vision Systems Market is expected to register a CAGR of 9.5% during the forecast period.

Key Highlights

- The growing investment in automation and Industry 4.0 technologies, increasing need for safety and inspection vision systems, and high rate of product innovation are significant factors driving the growth of the Asia Pacific machine vision systems market. Machine vision applications like presence detection to real-time inspection and grading tasks in harsh environments are becoming standard across many industries. The recent COVID-19 has further expanded the scope of these applications.

- Over the year, the 2D machine vision system has gained significant application across the region. However, due to many limitations, many end-user industries are embracing 3D systems. Market vendors like OMRON are increasingly investing in the development of 3D machine vision systems.

- Further, Industry 4.0 fueled the development of technologies like robots playing a crucial role in industrial automation, with many core operations in industries being managed by robots. Also, 3D machine vision supports new applications, such as vision-guided robotics and automated butchering. These vision-guided robots are a combination of 2D and 3D cameras.

- Also, AI-powered machine vision is reshaping entire industries ranging from robotics and retail to healthcare and manufacturing. Companies are shifting from an AI vision solution, integrated image sensor module, cables, and GPU modules, to a ready-to-develop edge AI smart camera vision system, which reduces the effort of software and hardware integration, allowing AI vision developers to focus on application development.

APAC Machine Vision Systems Market Trends

Smart Camera-based Expected to Witness Significant Growth

- Smart camera-based products are gaining popularity in industries due to the high rate of product innovation and expansion of existing applications in many end-user industries. Also, Smart cameras have long eased the task of machine vision system design. The segment has witnessed continuous innovation in recent years, including models with larger image sensors, emerging embedded vision cameras that function as smart cameras, and new cameras capable of performing deep learning and AI tasks.

- The market witnessed innovations like image sensor resolution in smart cameras has increased, integrating much faster processors or embedded vision cameras with MIPI interfaces, and availability in color and monochrome options are increasingly witnessing in the market, which is also gaining popularity especially after the COVID-19 outbreak.

- Further innovations are driving the region. For instance, In May 2021, Taiwan-based edge computing company ADLINK Technology Inc launched the NEON-2000-JNX series, the industrial AI smart camera that incorporates NVIDIA's new Jetson Xavier NX module. The high performance, small form factor, and ease of development of the new camera pave the way for innovative AI vision solutions in manufacturing, logistics, retail, service, agriculture, smart cities, healthcare and life sciences, and other edge applications.

- Geographically, the Asia-Pacific region is expected to record significant growth in the machine vision systems market that includes smart cameras due to dominance in the global manufacturing market and growing investment in automation technologies in the regional manufacturing and industrial sectors.

China to Witness Significant Growth

- China is rapidly becoming one of the significant markets for machine vision owing to automation and robotics. In China's machine vision industry, new terminology standards have been adopted. Also, The Chinese 'Machine Vision Industry Union' (CMVU) published the standard 'Terminology for Industrial Digital Cameras' and 'Terminology for Industrial Camera Lenses' in August 2020.

- Although the software segment is showing significant growth potential, the growing development in the overall sensor and semiconductor is also bringing development in the hardware section of the studied market. Companies like Sony are leading innovation in CMOS image sensors globally, even for manufacturing automation applications.

- Manufacturing firms across the country realize the benefits of machine vision systems, mainly where redundant tasks, like inspection, should be performed with precision. These play an essential role in high-speed production lines and hazardous environments. Some of the significant benefits offered by these systems include increased productivity, reduced machine downtime, and tighter process control.

- Further, Vision-guided robots are expected to evolve radically in the region, including electronics, automotive, transportation, and food processing industries. The 3D vision-guided technology mainly dominates these industries due to the massive demand for arc welding, cutting, and palletizing applications.

APAC Machine Vision Systems Industry Overview

The Asia Pacific Machine Vision Systems Market is moderately competitive in nature. Product launches, high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- August 2021 - Keyence Corporation introduced a customizable vision system XG-X series Advanced programming interface with 3D and linescan capabilities for high-quality, high-speed inspection and control. The XG-X Series provides high-speed, high-resolution cameras for high-accuracy inspection, providing robust solutions to a wide range of manufacturing problems.

- January 2021 - Cognex Corporation announced In-Sight 3D-L4000 embedded vision system. The smart camera, which features 3D laser displacement technology, enables engineers to quickly, effectively, and cost-effectively solve a variety of inspections and testing on automated production lines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Smart Factories

- 5.1.2 Rising Demand for Accurate Defect Detection

- 5.2 Market Challenges

- 5.2.1 Complications in the Implementation of Mv Systems

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.1.1 Vision Systems

- 6.1.1.2 Cameras

- 6.1.1.3 Optics and Illumination Systems

- 6.1.1.4 Frame Grabber

- 6.1.1.5 Other Types of Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 Product

- 6.2.1 PC-based

- 6.2.2 Smart Camera-based

- 6.3 End-User Industry

- 6.3.1 Food and Beverage

- 6.3.2 Healthcare and Pharmaceutical

- 6.3.3 Logistic and Retail

- 6.3.4 Automotive

- 6.3.5 Electronics and Semiconductors

- 6.3.6 Other End-User Industries

- 6.4 Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognex Corporation

- 7.1.2 Keyence Corporation

- 7.1.3 Omron Corporation

- 7.1.4 Basler AG

- 7.1.5 National Instruments Corporation

- 7.1.6 Teledyne DALSA

- 7.1.7 Datalogic SpA

- 7.1.8 Perceptron Inc

- 7.1.9 Uss Vision Inc

- 7.1.10 IDS Imaging Development Systems GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219