|

市场调查报告书

商品编码

1628832

欧洲能源储存:市场占有率分析、产业趋势与成长预测(2025-2030)Europe Energy Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

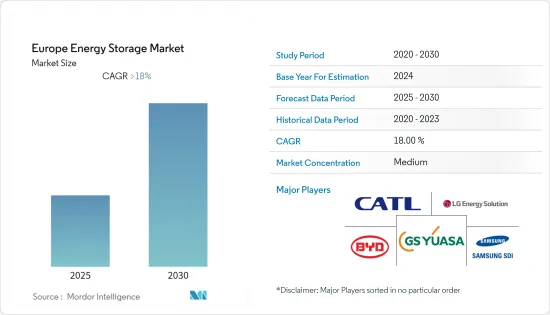

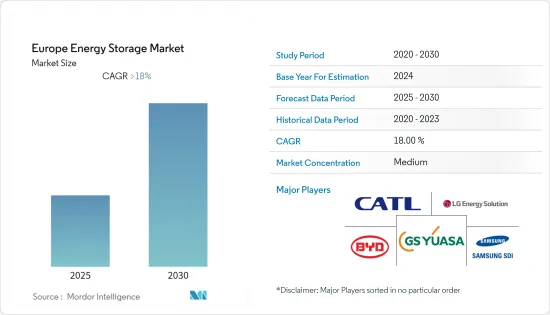

预计欧洲能源储存市场在预测期内的复合年增长率将超过18%。

2020 年市场受到 COVID-19 的负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从长远来看,不断电系统需求增加和锂离子电池价格下降等因素预计将推动市场发展。

- 另一方面,原材料供需不匹配是阻碍市场成长的主要因素。

- 各种技术进步的增加,例如比现有技术更有效率的压缩空气能源储存(CAES),预计将为欧洲能源储存市场创造巨大机会。

- 由于住宅、工业和商业部门能源需求的增加以及政府的支持措施,预计德国将在预测期内主导市场。

欧洲能源储存市场趋势

电池领域占据市场主导地位

- 电池能源储存被认为是向永续能源系统过渡的关键技术。电池能源储存系统係统调节电压和频率,降低尖峰需求,整合可再生能源,并列出备用电源。电池在能源储存系统中极为重要,约占係统总成本的60%。

- 电池储能係统与风能和太阳能等自然能源相结合,可以广泛提高电网稳定性,并且在技术和商业性都是可行的。欧洲正在经历能源转型,这一趋势预计将在未来几年加剧。这种转变还包括增加对可再生能源的依赖,以应对气候缓解措施。

- 在可再生能源发电中,电池充当剩余发电的媒介,可以在需要时使用。能源储存系统还可以作为提高电力利用率、提高电力利用效率的手段。这有助于平衡不同时间的能源以配合供需。

- 在欧洲,可再生能源的引进正在显着成长。 2021年欧洲可再生为647.39GW,较2017年的512.78GW成长26.25%。预计类似的趋势在预测期内也将持续。

- 此外,俄罗斯入侵乌克兰后,许多欧盟国家宣布计划加快可再生能源的部署,以减少对俄罗斯天然气进口的依赖。德国、荷兰和葡萄牙等国已经加强了可再生能源的雄心壮誌或加速了最初的目标。这将增加预测期内对电池能源储存系统的需求。

- 例如,2022年2月,电池製造商Saft宣布赢得Neoen的合同,在法国南部安图尼亚克承包交付8MW/8MWh电池能源储存系统(BESS)。该设施将是法国第一座 BESS 和太阳能联合发电厂,并将连接到 RTE(Reseau de Transport d'Electricite)高压电网。帅福得正在采用 EPC 方法建造新的 ESS,计划于 2022 年春季完成,即合约签署后 10 个月内。

- 鑑于上述情况,预计在预测期内欧洲能源储存市场将由电池产业主导。

德国主导市场

- 德国是欧洲最大的能源储存市场,也是世界上最大的储能市场之一。近年来,在雄心勃勃的能源转型计划和到 2050 年将温室气体排放减少至少 80%(与 1990 年相比)的目标的推动下,该国的能源储存业务显着增长。此外,德国计划在2023年逐步淘汰核子反应炉,并正在加速可再生能源的发展,以弥补发电能力的下降。

- 德国已经走在可再生能源发展的前沿。德国政府设定的目标是到2030年透过可再生能源满足该国80%的电力需求。太阳能、陆上和离岸风力发电将成为可再生能源生产的支柱。

- 近年来,德国能源储存市场出现了显着成长,这在很大程度上要归功于该国雄心勃勃的能源转型计划「Energiewende」。电池和其他储能技术的蓬勃发展预计将对德国的能源转型产生重大影响。

- 此外,由于高电费和当前的能源危机,德国家庭太阳能储存系统的安装量正在增加,预计2021年新增安装量将增加近60%。据德国太阳能集团BSW称,2021年德国家庭将安装约14.1万套新太阳能储存系统,使全国累积安装量达到41.3万套。

- 该国电池储存的关键驱动因素是锂离子电池的价格迅速下降,因为它们广泛用于家用电子电器和其他应用。过去五年来,国内电池成本已经减少了一半以上,而且这一趋势预计将持续下去。

- 据国际能源总署(IEA)称,德国正在透过创新竞标鼓励电池存储,奖励再生能源和电池储存的结合。 2021年和2022年授予的所有计划的总合装置容量均达到或超过1吉瓦太阳能光伏和电池储存组合。

- 例如,2022年10月,Fluence Energy GmbH和TransnetBW GmbH宣布将开发一个使用全球最大蓄电池的交付计划。透过提高现有电网基础设施的效率,该计划将改善能源安全并大力支持德国的能源转型道路。由 Fluence 提供的 250 MW 基于电池的储能係统将安装在重要的电网枢纽 Kupfelzell。计划竣工日期为2025年。

- 鑑于上述情况,德国预计将在预测期内主导欧洲能源储存市场。

欧洲能源储存产业概况

欧洲能源储存市场适度细分。主要参与企业(排名不分先后)为 GS Yuasa Corporation、Contemporary Amperex Technology Co. Ltd.、比亚迪、LG Energy Solution, Ltd. 和 Samsung SDI。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 科技

- 电池

- 抽水蓄能发电(PSH)

- 能源储存(TES)

- 飞轮能源储存(FES)

- 其他的

- 最终用户

- 住宅

- 商业/工业

- 按地区划分(2028 年之前的市场规模和需求预测)

- 德国

- 英国

- 法国

- 义大利

- 奥地利

- 瑞士

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- GS Yuasa Corporation

- Contemporary Amperex Technology Co. Limited

- Tesla Inc

- BYD Co. Ltd

- Clarios(Formerly Johnson Controls International PLC)

- Varta AG

- LG Energy Solution, Ltd.

- NGK Insulators Ltd

- Samsung SDI Co. Ltd

第七章 市场机会及未来趋势

简介目录

Product Code: 55300

The Europe Energy Storage Market is expected to register a CAGR of greater than 18% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors like increasing demand for uninterrupted power supply and decreasing price of lithium-ion batteries are expected to drive the market.

- On the other hand, a mismatch in the supply and demand of raw materials is a significant restraint hindering the market's growth.

- Nevertheless, the increasing technological advancements in various technologies like compressed air energy storage (CAES), which has higher efficiency than present-day technologies, are expected to create enormous opportunities for the Europe Energy Storage Market.

- Germany is expected to dominate the market during the forecast period, owing to the increasing energy demand from residential, industrial, and commercial sectors and supportive government policies.

Europe Energy Storage Market Trends

Batteries Segment to Dominate the Market

- Battery energy storage is considered a critical technology in transitioning to a sustainable energy system. The battery energy storage systems regulate voltage and frequency, reduce peak demand charges, integrate renewable sources, and provide a backup power supply. Batteries are crucial in energy storage systems and are responsible for around 60% of the system's total cost.

- Battery energy storage systems, coupled with renewables, such as wind and solar, are technically and commercially viable for extensively increasing grid stability. Europe is undergoing an energy transformation, expected to intensify over the coming years. The change includes a greater reliance on renewable energy in response to climate mitigation policies.

- In renewable energy generation, battery energy storage serves as a medium for an excess generation which can be used when needed. Energy storage systems also served as a means of increasing power utilization and increased power utilization efficiency rates. This helps balance energy in various time ranges to match demand and supply.

- The installation of renewable energy sources has grown significantly in Europe. In 2021 the installed renewable energy capacity in Europe was 647.39 GW compared to 512.78 GW in 2017, showing a growth rate of 26.25%. A similar trend is expected to be followed during the forecasted period.

- Moreover, in response to the Russian invasion of Ukraine, many European Union countries announced plans to accelerate renewable deployment to reduce their dependence on Russian natural gas imports. Countries like Germany, the Netherlands, and Portugal have either increased their renewable energy ambitions or moved their initial targets earlier. This will increase the demand for battery energy storage systems during the forecasted period.

- For instance, in February 2022, Battery manufacturer Saft announced that it had secured a contract from Neoen to deliver a turnkey 8MW/8 MWh battery energy storage system (BESS) in Antugnac, Southern France. The facility will be the first co-located BESS and solar farm connected to Reseau de Transport d'Electricite's (RTE) high-voltage transmission grid in France. Saft is building the new ESS on an EPC basis, with completion scheduled for spring 2022, within ten months of contract signing.

- Therefore, owing to the above points, the battery segment is expected to dominate the Europe energy storage market during the forecast period.

Germany to Dominate the Market

- Germany has one of Europe's and the world's largest energy storage markets. The country's energy storage business has grown significantly in recent years due to ambitious energy transition projects and a target of lowering greenhouse gas emissions by at least 80% (relative to 1990 levels) by 2050. In addition, the country intends to phase out nuclear power reactors by 2023, accelerating renewable energy development to compensate for the lower power-producing capability.

- Germany is already at the forefront of renewable energy development. The German government has a target for renewables to meet 80% of the electricity demand in the country by 2030. Solar power and onshore- and offshore wind power will be the main pillars of renewable energy production.

- The energy storage market in Germany has experienced a massive boost in recent years, majorly due to the country's ambitious energy transition project, "Energiewende." The boom of batteries and other storage technologies are expected to profoundly impact Germany's energy transition.

- Additionally, The adoption of household solar storage systems is increasing in Germany, owing to high power costs and the present energy crisis, with the number of new installations projected to increase by almost 60% in 2021. According to the German solar energy group BSW, about 141,000 new solar storage systems were installed in 2021 by German households, reaching the cumulative installation 413,000 units across the country.

- The primary driver of battery storage in the country is the sharp price decline in lithium-ion batteries due to their wide use in consumer electronics and other applications. In the last five years, battery costs have more than halved in the country, and this trend is expected to continue in the coming years.

- According to International Energy Agency (IEA), in Germany, storage deployment is encouraged through innovation auctions, which reward the combination of renewables and storage. All successful bids in 2021 and 2022, totaling over 1 GW of installed capacity, were projects combining solar PV with battery storage.

- For instance, in October 2022, Fluence Energy GmbH and TransnetBW GmbH announced they would deploy the world's largest battery-based energy storage-as-transmission project. The project will improve energy security and significantly support Germany's energy transition pathway by increasing the efficiency of the existing grid infrastructure. The 250 MW battery-based energy storage system, supplied by Fluence, will be located at Kupferzell, a significant grid hub. It is planned for completion in 2025.

- Therefore, owing to the above points, Germany is expected to dominate the Europe energy storage market during the forecast period.

Europe Energy Storage Industry Overview

The Europe energy storage market is moderately fragmented. Some key players (in no particular order) are GS Yuasa Corporation, Contemporary Amperex Technology Co. Limited, BYD Co. Ltd, LG Energy Solution, Ltd., and Samsung SDI Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Batteries

- 5.1.2 Pumped-Storage Hydroelectricity (PSH)

- 5.1.3 Thermal Energy Storage (TES)

- 5.1.4 Fywheel Energy Storage (FES)

- 5.1.5 Others

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial & Indsutrial

- 5.3 Geography {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Austria

- 5.3.6 Switzerland

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa Corporation

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Tesla Inc

- 6.3.4 BYD Co. Ltd

- 6.3.5 Clarios (Formerly Johnson Controls International PLC)

- 6.3.6 Varta AG

- 6.3.7 LG Energy Solution, Ltd.

- 6.3.8 NGK Insulators Ltd

- 6.3.9 Samsung SDI Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219