|

市场调查报告书

商品编码

1628837

北美界面活性剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)North America Surfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

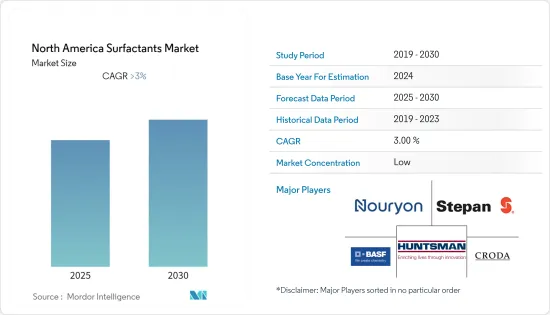

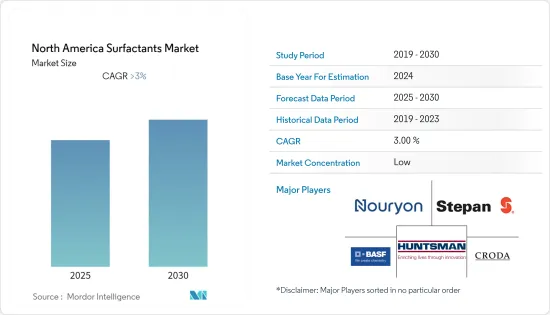

预计北美界面活性剂市场在预测期内复合年增长率将超过3%

主要亮点

- 由于对家用界面活性剂和生物表面活性剂的需求不断增加,预计市场在预测期内将增长。

- 另一方面,对合成界面活性剂日益增长的环境担忧预计将阻碍市场成长。

- 未来,可能有机会将其用作患有新生儿呼吸窘迫(NRD)综合征的婴儿的肺表面活性物质。

- 由于个人护理和食品加工等行业的增长,美国在该地区市场占据主导地位。

北美表面活性剂市场趋势

对家用肥皂和清洁剂的需求增加

- 清洁剂通常是主要用于清洗目的的表面活性剂混合物,并且有各种稀释度。烷基苯磺酸盐构成清洁剂。烷基苯磺酸盐的化学性质与肥皂相似,但极易溶于硬水。

- 清洁剂依离子性分类:阴离子、阳离子和非离子。细分中提到的肥皂主要涉及洗涤和洗衣应用。

- 清洁剂和肥皂中的界面活性剂与水混合,会附着在衣服和其他清洗表面上的污渍上。这可以降低表面张力并有助于去除污垢。

- 清洁剂的主要用途是用作家用清洗和燃料添加剂。

- 2021年,液体沐浴乳是美国销售量最大的肥皂产品。 2021年,液体沐浴乳细分市场在美国的多经销店销售额约为6.24亿件。

- 其次是洗手剂和洗手液,2021 年分别售出约 4.02 亿件和 2.54 亿件。预计这将有助于市场在预测期内显着成长。

- 换句话说,由于上述因素,家用肥皂和清洁剂需求的增加预计将推动未来几年的市场成长。

美国主导市场

- 美国是该地区最大的界面活性剂消费国。由于个人护理行业的扩张,表面活性剂的使用量在过去几年中有所增加,并且预计在预测期内将进一步增加。

- 该国食品加工业正在扩大,表面活性剂的使用预计会增加。美国是北美食品製造和加工厂的中心。

- 表面活性剂用于润滑油和燃料添加剂。这一因素正在推动表面活性剂在汽车工业中的使用增加。随着汽车销量的增加,对润滑油的需求增加,这支持了预测期内表面活性剂市场的成长。

- 根据经济分析局 (BEA) 的数据,2021 年美国汽车业销售了超过 1,490 万辆轻型汽车。在这 1,490 万辆总合中,零售了约 330 万辆轿车和 1,160 万辆轻型卡车。因此,预计在预测期内市场成长将得到支持。

- 此外,美国消费者在肥皂和清洁剂上的支出大幅增加。根据美国劳工统计局的数据,2021 年每位消费者在肥皂和清洁剂上的平均年支出为 80.5 美元,比 2020 年增长约 6.5%。

- 由于上述原因,预计美国将在预测期内引领市场。

北美表面活性剂产业概况

北美表面活性剂市场本质上是细分的。该市场的主要企业包括(排名不分先后)Stepan Company、Nouryon、 BASF SE、Croda International Plc 和 Huntsman International LLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对生物表面活性剂的需求增加

- 其他司机

- 抑制因素

- 关于合成界面活性剂的环境问题

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(销售))

- 类型

- 阴离子界面活性剂

- 阳离子界面活性剂

- 非离子界面活性剂

- 两性界面活性剂

- 硅胶表面活性剂

- 其他的

- 起源

- 合成界面活性剂

- 生物基界面活性剂

- 目的

- 家用肥皂和清洁剂

- 个人护理

- 润滑油和燃料添加剂

- 工业和设施清洗

- 食品加工

- 油田化学品

- 农业化学品

- 纤维加工

- 乳液聚合

- 其他的

- 地区

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Ashland

- BASF SE

- CLARIANT

- Croda International Plc

- Dow

- Evonik Industries AG

- GALAXY

- Godrej Industries Limited

- Henkel Corporation

- Huntsman International LLC

- Innospec

- Kao Corporation

- MITSUI CHEMICALS AMERICA, INC.

- Nouryon

- Procter & Gamble

- Sasol

- Solvay

- Stepan Company

第七章 市场机会及未来趋势

- 用作新生儿呼吸窘迫 (NRD) 症候群的肺表面活性剂

简介目录

Product Code: 55453

The North America Surfactants Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- During the forecast period, the market is likely to grow because there will be more demand for household surfaces and bio-surfactants.

- On the other hand, rising environmental concerns related to synthetic surfactants are expected to hamper market growth.

- In the future, there may be a chance to use it as a lung surfactant for babies with Neonatal Respiratory Distress (NRD) syndrome.

- Due to the growth of industries like personal care, food processing, and so on, the United States dominated the market in the area.

North America Surfactants Market Trends

Increasing Demand for Household Soaps and Detergents

- Detergent is usually a mixture of surfactants used mainly for the purpose of cleaning and is available in varying dilutions. Alkylbenzene sulfonates make up detergents. They are chemically similar to soap, but they dissolve better in hard water.

- Detergents are classified in terms of their ionic properties, namely anionic, cationic, and non-ionic. The soap mentioned in the segmentation deals mainly with washing and laundry applications.

- The surfactants incorporated in detergents and soaps mix with water and attach themselves to the dirt on clothes and other cleaning surfaces. This helps reduce surface tension and remove dirt from the concerned surface.

- The major applications of detergents are reflected in household cleaning and fuel additives.

- In 2021, liquid body wash had the greatest unit sales among soap products in the United States. In 2021, the liquid body wash category generated around 624 million units in multi-outlet sales in the United States.

- Also, it was followed by liquid hand soap and hand sanitizer, which sold about 402 million units and 254 million units, respectively, in 2021. This is expected to help the market grow a lot during the time period covered by the forecast.

- So, because of the above factors, the growing demand for soaps and detergents for the home is expected to drive market growth over the next few years.

United States to Dominate the Market

- The United States is the largest consumer of surfactants in the region. Due to the expansion of the personal care industry, the usage of surfactants has increased over the past few years and is expected to increase further over the forecast period.

- The food processing industry in the country is expanding, which is expected to augment the use of surfactants. The United States is the hub of North America's food manufacturing and processing plants.

- Surfactants are used in lubricants and fuel additives. This factor has been driving the increased usage of surfactants in the automotive industry. With the increasing sales of motor vehicles, the demand for lubricants increases, which in turn supports the growth of the surfactants market during the forecast period.

- According to the Bureau of Economic Analysis (BEA), the United States auto sector sold over 14.9 million light vehicle units in 2021. Out of a total of 14.9 million, approximately 3.3 million vehicles and 11.6 million light truck units were sold at retail.As a result, market growth will be supported during the forecast period.

- Moreover, consumer spending on soaps and detergents has climbed significantly in the United States. According to the United States Bureau of Labor Statistics, the average yearly expenditures for soaps and detergents in 2021 were USD 80.5 per consumer unit, representing an increase of around 6.5 percent compared to 2020. thus benefiting the market's growth significantly.

- Due to the above reasons, it is expected that the United States will lead the market during the forecast period.

North America Surfactants Industry Overview

The North American surfactant market is fragmented by nature. Some of the major players in the market include Stepan Company, Nouryon, BASF SE, Croda International Plc, and Huntsman International LLC, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Bio-surfactants

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Concerns Related to Synthetic Surfactants

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Type

- 5.1.1 Anionic Surfactant

- 5.1.2 Cationic Surfactant

- 5.1.3 Non-ionic Surfactant

- 5.1.4 Amphoteric Surfactant

- 5.1.5 Silicone Surfactant

- 5.1.6 Other Types

- 5.2 Origin

- 5.2.1 Synthetic Surfactant

- 5.2.2 Bio-based Surfactant

- 5.3 Application

- 5.3.1 Household Soap and Detergent

- 5.3.2 Personal Care

- 5.3.3 Lubricants and Fuel Additives

- 5.3.4 Industry & Institutional Cleaning

- 5.3.5 Food Processing

- 5.3.6 Oilfield Chemicals

- 5.3.7 Agricultural Chemicals

- 5.3.8 Textile Processing

- 5.3.9 Emulsion Polymerization

- 5.3.10 Other Applications

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ashland

- 6.4.3 BASF SE

- 6.4.4 CLARIANT

- 6.4.5 Croda International Plc

- 6.4.6 Dow

- 6.4.7 Evonik Industries AG

- 6.4.8 GALAXY

- 6.4.9 Godrej Industries Limited

- 6.4.10 Henkel Corporation

- 6.4.11 Huntsman International LLC

- 6.4.12 Innospec

- 6.4.13 Kao Corporation

- 6.4.14 MITSUI CHEMICALS AMERICA, INC.

- 6.4.15 Nouryon

- 6.4.16 Procter & Gamble

- 6.4.17 Sasol

- 6.4.18 Solvay

- 6.4.19 Stepan Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage as Lung Surfactant in Neonatal Respiratory Distress (NRD) Syndrome

02-2729-4219

+886-2-2729-4219