|

市场调查报告书

商品编码

1628848

拉丁美洲金属罐:市场占有率分析、产业趋势、成长预测(2025-2030)LA Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

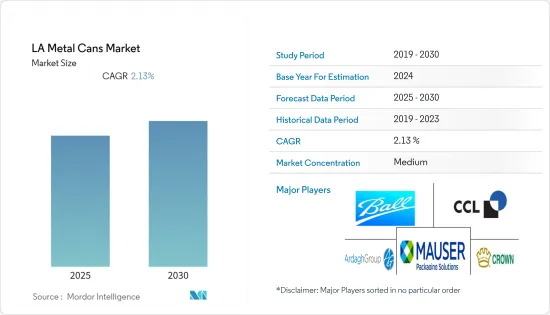

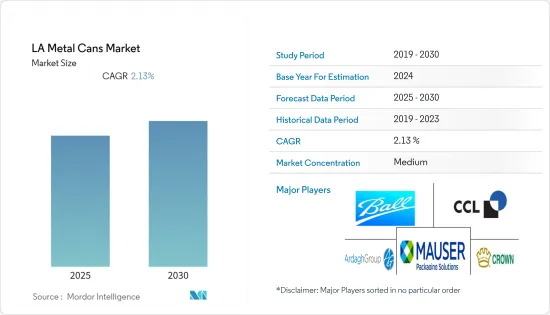

拉丁美洲金属罐市场预计在预测期内复合年增长率为2.13%

主要亮点

- 在各种类型的金属包装中,包括罐、桶、瓶、盖和封口,罐是最受欢迎的。上个世纪,易用性和可用性推动了金属罐在多种包装应用中的采用。此外,消费者趋势,例如偏好较小尺寸和多包装包装形式,正在支持所研究市场中金属罐市场的数量成长。

- 巴西和墨西哥等拉丁美洲市场对迷你罐的需求尤其明显。这就是该地区大多数饮料公司提供迷你罐的原因。迷你罐通常含有较少量的产品,并且比传统罐装产品更便宜。

- 这一趋势导致了单位消费量的增加。此外,随着环境问题的增加,消费者正在寻求对环境影响较小的金属罐。金属罐的高回收性是一些地区的市场驱动因素之一,而经济状况和罐头食品的低廉价格是其他地区的市场驱动因素。

- 由于 2021 年需求增加,Crown Holdings 等饮料罐供应商正计划扩大其在巴西的罐头工厂。该公司的目标是到2022年第二季末每年生产24亿个各种尺寸的两片铝罐。

- 此外,随着中等收入人口的成长、生活方式的改变和消费者偏好的变化,拉丁美洲国家的消费率正在稳步上升。根据世界银行统计,拉美地区人均国民总收入为8,775.3美元。

拉丁美洲金属罐市场趋势

铝罐占据主要市场占有率

- 铝是罐头包装解决方案中最受欢迎的金属之一。由于具有用于广告印刷、快速冷却、保护饮料风味、100% 可回收性以及对食品和饮料中的化学品和多种成分呈惰性等特性,成为饮料罐的首选。

- 由于其永续性和可回收性,铝罐是汽水、啤酒和能量饮料的首选包装。仅在过去十年中,用于多种包装目的的铝罐的重量就显着减轻。

- 因此,大多数金属罐製造商正在从钢罐转向铝罐。货物重量的显着减轻,导致运输成本降低和碳排放降低,推动了铝罐的使用。

- 环保政策的加强和对回收的兴趣不断增加,对铝罐的需求不断增加,而企业对提高环保品牌形象的关注正在推动铝罐市场的成长进一步扩大。製造技术的重大进步和消费者需求的变化预计将在预测期内为铝市场创造新的机会。

- 铝罐具有可回收且易于印刷的优点。此外,它重量轻,可作为出色的气体屏障。由于这些因素,铝罐在饮料行业比其他金属罐更受欢迎。预计非酒精饮料行业的持续需求将在预测期内推动铝罐市场的成长。

- 此外,由于该地区对铝金属罐的需求不断增加,供应商正在投资扩大设备。例如,Ambevarso 于 2020 年在巴西完成了一家饮料罐工厂的建设,儘管由于 COVID-19 大流行而造成延误。该公司投资1.75亿美元,扩建每年生产15亿个用于啤酒储存的铝罐。这导致了激烈的竞争,Ardagh、Ball 和 Canpack 等製造商竞相将产能扩大到每年 400 亿罐。

推动市场的食品和饮料

- 忙碌的生活方式和工作日程使包装食品和简便食品食品成为许多消费者的主食。结果,大型有组织的零售商开始储备罐头食品和饮料。如今,线下和线上零售商的商店上都备有各种品牌的包装食品。

- 饮料公司针对金属罐使用的正向行销策略也影响着所研究的市场。罐装饮料在年轻人中被认为是一种时尚,而即食罐装和半加工罐装食品在全球一些用户中被认为是方便和经济的,因此罐装产品的受欢迎程度正在迅速增加。

- 拉丁美洲对能量饮料和罐装冷咖啡的需求不断增长预计也将推动市场成长。因此,拉丁美洲食品和饮料行业预计将为所研究的市场提供机会。例如,根据巴西食品工业协会的数据,食品和饮料产业是巴西製造业最重要的部门,2020 年销售额为 7,892 亿雷亚尔,而 2019 年为 6,999 亿雷亚尔。

- 罐装饮料在中北美洲及加勒比海冠军联赛、南美解放者杯、大联盟世界职业棒球大赛等众多体育赛事中的高消费量归因于食品处理的日益便利,并增加了预计在预测期内调查的市场的需求。

- 在拉丁美洲市场,巴西拥有 889 家註册酿酒厂,生产 16,968 种产品,为金属罐的成长做出了贡献。此外,有机饮料产业消费的增加也促进了所研究市场的成长。根据有机贸易协会的数据,2020 年巴西有机饮料消费净收入为 4,420 万美元,而 2019 年为 4,280 万美元。

拉丁美洲金属罐产业概况

拉丁美洲金属罐市场较为分散,很少有公司占据主导市场占有率,也很少有新参与企业。公司不断创新并结成策略伙伴关係以维持市场占有率。

- 2020 年 8 月 - Ball Corporation 完成了对 Tubex Industria E Comercio de Embalagens Ltda 的收购,这是一家衝击挤压铝气雾剂包装企业,包括位于巴西 Itupeva 的一家製造工厂。 Itupeva 工厂拥有 8 条挤压铝气雾罐生产线,为全球和巴西本地客户生产个人护理包装。

- 2020 年 2 月 - Mouser Packaging Solutions 对设备进行重大投资,将田纳西州孟菲斯工厂的夸脱和加仑 F 型金属罐综合产能提高一倍。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 对市场的影响

- 市场驱动因素

- 金属包装回收率高

- 罐头食品方便且价格低廉

- 市场限制因素

- 替代包装解决方案的存在

第五章市场区隔

- 按材质

- 铝

- 钢

- 按最终用户产业

- 食品

- 饮料

- 其他最终用户产业

- 国家名称

- 巴西

- 阿根廷

- 墨西哥

- 其他国家

第六章 竞争状况

- 公司简介

- Ball Corporation

- Ardagh Group

- Mauser Packaging Solutions

- Crown Holdings Inc.

- CCL Container, Mexico

- Can Pack SA

- Ambev SA

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 55717

The LA Metal Cans Market is expected to register a CAGR of 2.13% during the forecast period.

Key Highlights

- Of all the different kinds of metal packages, such as cans, drums, bottles, caps, and closures, can have been the most popular. Ease of use and availability aided in the adoption of metal cans in several packaging applications over the last century. Additionally, consumer trends, such as a preference for small-size and multi-pack packaging formats, are supporting the volume growth of the metal cans market in the studied market.

- Increasing demand for mini-cans has been observed, especially in the Latin American markets, such as Brazil and Mexico. Therefore, most beverage companies in the region are offering mini-cans, which generally contain smaller volumes of products and cost less than the traditional canned products.

- This trend is resulting in more substantial unit consumption. Furthermore, with the increasing environmental concerns, consumers are demanding metal cans, owing to their low environmental impact. The high recyclability of metal cans is one of the significant drivers for the market studied in some regions, while in other regions, economic conditions and low price of canned goods remain, key drivers for the market studied.

- Beverage Can Vendors like Crown holding planned to expand their can facility in Brazil amid the increased demand in 2021. The company has aims to produce two-piece aluminum cans at an annual capacity of 2.4 billion with all types of sizes by the end of the second quarter of 2022.

- Also, with the growing middle-income group population, changing lifestyle, and evolving consumer preferences, the consumption rates among the Latin American countries are also rising steadily. According to the World Bank, the gross national income per capita in the Latin American region accounts for USD 8775.3.

Latin America Metal Cans Market Trends

Aluminum Cans to Hold Major Market Share

- Aluminum is one of the most popular metals for can packaging solutions. Traits, such as the provision of metal canvas for ad printing, fast cooling, protection of flavors of beverages, 100% recyclability, and inertness to chemicals and several ingredients in the food and beverage products, make it the most preferred choice for beverage cans.

- Aluminum cans are the most preferred type of packaging for soda, brew beers, and energy drinks, owing to their sustainability and recycling properties. In the last decade alone, there has been a significant reduction in the weight of aluminum cans used for several packaging purposes.

- This has pushed most of the manufacturers of metal cans to shift from steel to aluminum cans. A considerable reduction in freight weight, resulting in low transportation costs and reduced carbon emission, is encouraging the use of aluminum cans.

- Increasing environmental policies and growing focus on recycling is augmenting the need for the material, while the focus of companies on improving the eco-friendly brand image is further expanding the growth of the aluminum segment of the market studied. Considerable advancements in manufacturing techniques and changing consumer needs are expected to open new opportunities to the aluminum segment of the market studied during the forecast period.

- Aluminum cans offer the advantages of recyclability and ease of printing. Additionally, they are lightweight and act as excellent barriers to gases. Such factors allow a higher penetration of aluminum variants in the beverages industry compared to other metal cans. Over the forecast period, sustained demand from the non-alcoholic beverage sector is expected to drive the growth of the aluminum cans market.

- Further, Vendors are investing in facility expansion with an increase in demands for aluminum metal cans in the region. For instance, Ambevalso completed the construction of a beverage can plant in Brazil in 2020 despite the delays caused by the spread of the COVID-19. The company invested USD 175 million and expanded the production to 1.5 billion aluminum cans every year for the storage of beer. This has increased competition among players as manufacturers like Ardagh, Ball, Canpack are competing to grow their respective production capacity to 40 billion cans a year.

Canned Food and Beverages to Drive the Market

- Packaged and convenience food has become a staple food for many consumers, owing to their hectic lifestyles and work schedules. Therefore, large organized retailers have started to stack huge amounts of canned food and beverages. Nowadays, offline and online retailers stock a wide range of brands of packaged food items in their stores.

- Aggressive marketing strategies of beverage companies toward the usage of metal cans have also had an impact on the studied market. As canned beverages are being considered trendy among the youth, and ready-to-eat or semi-processed canned foods are considered convenient and economical among several global users, the penetration of canned products is increasing rapidly.

- The rising demand for energy drinks and canned cold coffee in Latin America is also expected to boost market growth. Hence, the food and beverage industry in Latin America is expected to offer opportunities for the market studied. For instance, according to the Associacao Brasileira das Industrias da Alimentacao, the food and beverage industry is the most significant sector of Brazilian manufacturing, accounting for revenue of BRL 789.2 billion in 2020 compared to BRL 699.9 billion in 2019.

- High consumption of canned beverages in numerous sports tournaments, including CONCACAF Champions League, Copa Libertadores, and Big League World Series, among others, owing to the growing convenience in handling the food items, is expected to boost the demand in the market studied over the forecast period.

- In the Latin American market, Brazil contributes to the growth of metal cans through the presence of 889 registered breweries, with the country producing 16,968 products. Further, the increasing consumption of the organic beverage industry also contributes to the studied market's growth. According to Organic Trade Association, the net revenue on the consumption of organic beverages in Brazil accounted for USD 44.2 million in 2020 compared to USD 42.8 million in 2019.

Latin America Metal Cans Industry Overview

The Latin America Metal Cans Market is moderately fragmented, with few companies having a dominant market share and few new entrants in the market. The companies keep on innovating and entering into strategic partnerships to retain their market share.

- August 2020 - Ball Corporation completed the acquisition of Tubex Industria E Comercio de Embalagens Ltda, an impact extruded aluminum aerosol packaging business that includes a manufacturing plant in Itupeva, Brazil. The Itupeva plant includes eight extruded aluminum aerosol can lines and produces personal care packaging for global and local customers in Brazil.

- February 2020 - Mauser Packaging Solutions made significant investments in its facility on pieces of equipment to double the combined production capacity of quart and gallon-sized F- Style Metal Cans at its Memphis, Tennessee facility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 High Recyclability Rates of Metal Packaging

- 4.5.2 Convenience and Lower Price Offered by Canned Food

- 4.6 Market Restraints

- 4.6.1 Presence of Alternate Packaging Solutions

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Aluminum

- 5.1.2 Steel

- 5.2 End-User Industry

- 5.2.1 Food

- 5.2.2 Beverage

- 5.2.3 Other End-user Industries

- 5.3 Country

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Mexico

- 5.3.4 Other Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ball Corporation

- 6.1.2 Ardagh Group

- 6.1.3 Mauser Packaging Solutions

- 6.1.4 Crown Holdings Inc.

- 6.1.5 CCL Container, Mexico

- 6.1.6 Can Pack SA

- 6.1.7 Ambev SA

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219