|

市场调查报告书

商品编码

1629768

亚太地区安全开关:市场占有率分析、产业趋势与成长预测(2025-2030)Asia Pacific Safety Switches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

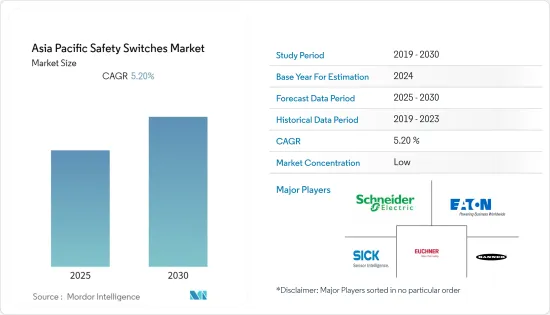

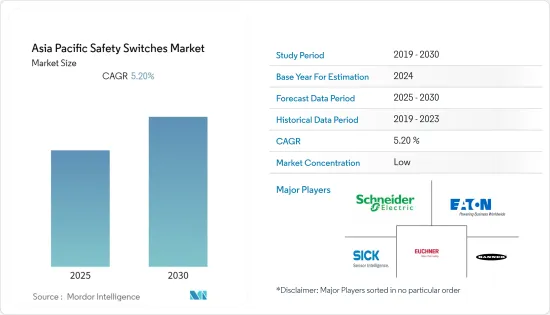

亚太地区安全开关市场预计在预测期内复合年增长率为 5.2%

主要亮点

- 公司和工厂工业事故的增加促使安装安全开关。根据国际劳工组织 (ILO) 的数据,每年有近 230 万人死于与工作有关的事故和疾病,相当于每天有 6,000 多人死亡。

- 技术进步正在增加对配备重型机械的製造工厂的需求。日本、中国和印度等新兴经济体的经济成长为建立更多生产设施和製造工厂创造了机会。

- 在潜在危险的工业环境中自动化的使用增加,政府加大力度确保企业设备和人员的安全,以及对非接触式门开关以提高门和防护装置稳定性的需求的增加是推动这一增长的主要因素。

- 印度政府也有望透过其智慧城市计画和国家智慧电网使命,在能源基础设施现代化方面发挥关键作用,特别是在地方层级。 NSGM 是一个在未来 10 年内实现国家智慧电网基础设施现代化的框架,利用创新技术改善公用事业业务。

- COVID-19 的爆发迫使多个行业停止了全球几乎所有的工业活动。此外,在当前的大流行中,安全开关市场高度依赖製造商和最终用户的垂直整合以及工业方面的大量采用,因为大流行在预测期内改变了几家公司的投资计划。

亚太地区安全开关市场趋势

工业安全开关的采用增加

- 在过去的几十年里,工业自动化改变了人类与机器互动的方式。近年来最重要的发展领域之一被称为工业 4.0 或工业物联网 (IIoT)。用于工厂设置的新型感测器可提供比前几代更高水准的资讯。这些感测器不仅捕获过程变量,还捕获温度等环境资讯。此外,现代感测器可以监控健康状况,并在需要校准或维护时提醒您。

- IIoT 也利用网路连线。旨在测量机器健康状况和性能的新型感测器的出现正在实现新的维护策略。还有某些工业应用需要手动安全停止。设备限位开关也可用作机械应用中的停止装置。

- 2022 年 6 月,Norstat 宣布将提供采用 RFID 技术来侦测致动器的安全开关,从而创建几乎防篡改的装置。 NS 系列安全开关专为即使在机器断电后仍然存在危险情况的机器应用而设计。

- 然而,儘管取得了这些进步,但为了工业安全,仍然需要高品质的手动控制停止开关和设备限位开关。这些开关必须承受恶劣的工作条件,例如极端温度范围和高振动。

中国占最大市场占有率

- 预测期内,中国安全开关市场预计成长最快。工业自动化程度不断提高,机器的复杂性也随之增加。因此,有必要引入感测器和安全开关。

- 2021年,中国整体用电量接近157.65艾焦耳。去年,数字为 134.7 艾焦耳。这是一个显着的成长。中国的主要电力消耗是第二产业,包括製造业。该行业在安全开关等功能安全产品方面拥有最大的市场占有率。

- 由于国内外製造公司数量众多、工业化快速发展以及製造活动不断扩大,中国的新兴经济预计将成为工厂车间机器状态监测活动和安全开关市场的驱动力。

- 该地区的无损检测工具和服务市场预计将受到乘用车、中型和大型巴士和卡车的高需求的推动。预计市场在预测期内将继续产生保护这些宝贵工业资产的需求。例如,亚太地区新车市场,包括卡车、巴士和轿车,到2021年将超过6500万辆,其中中国和印度在这一成长中发挥关键作用。

亚太安全开关产业概况

竞争激烈的亚太安全开关市场存在多个竞争对手。目前,少数大型竞争对手在市场占有率方面控制大部分市场。拥有重要市场占有率的大公司都致力于扩大其国际消费群。许多公司依靠策略联盟计划来增加市场占有率和盈利。

- 2022 年 4 月 - Vishay Intertechnology, Inc. 宣布了 PCIM Europe 2022 的产品阵容。 Vishay 展示了业界领先的最新被动元件、二极管、MOSFET 和电源 IC 技术,这些技术为当今快速成长的市场(包括电动车、5G、工业 4.0 和物联网)的创新铺平了道路。我们在 PCIM 的展位还将展示多种适用于汽车和工业应用的参考设计,包括 48V 和 800V 电池安全开关以及功率高达 3kW 的 48V/12V DC/DC 转换器。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 日益重视职场安全

- 关于机器和人员安全的严格规定

- 市场挑战

- 产品与各种现有平台的兼容性

- 政府参与确保企业设备和人身安全

第六章 市场细分

- 按类型

- 电磁

- 非接触式

- 其他类型

- 按最终用户

- 工业的

- 商业的

- 卫生保健

- 石油和天然气

- 其他最终用户

- 按国家/地区

- 中国

- 日本

- 印度

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Schneider Electric

- Rockwell Automation Inc.

- Banner Engineering Corp.

- Eaton Corporation

- Euchner GmbH

- SICK AG

- Pilz GmbH & Co. KG

- Siemens AG

- Omron Electronics LLC

- Honeywell International Inc.

- Murrelektronik GmbH

- Parmley Graham Ltd

第八章投资分析

第9章市场的未来

简介目录

Product Code: 56342

The Asia Pacific Safety Switches Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- The increasing incidence of worker accidents in businesses and factories is driving the installation of safety switches. According to the International Labor Organization (ILO), nearly 2.3 million people die yearly from work-related accidents or diseases, equating to over 6000 deaths daily.

- Technological advancements are increasing the demand for manufacturing plants with heavy machinery. The growing economies of various developing and emerging economies, such as Japan, China, and India, are creating opportunities to set up more production facilities and manufacturing plants.

- The increasing use of automation in potentially dangerous industrial settings, increased government involvement in efforts to ensure the equipment and personnel safety of businesses, and rising demand for non-contact door switches to increase the stability of doors and guards are the main factors propelling the growth of this market.

- In addition, the Indian government is anticipated to play a vital role in modernizing the country's energy infrastructure, particularly at the provincial level, through smart city programs and the National Smart Grid Mission. The NSGM is a framework for modernizing the country's smart grid infrastructure over the next ten years by using innovative technologies to improve utility company operations.

- The outbreak of COVID-19 has forced multiple industries to halt almost every industrial operation globally. Also, amidst the pandemic spread, the market for safety switches that significantly relies on the manufacturer and end-user verticals and substantial adoption at the industrial front is likely to be impacted, as the pandemic has resulted in changes in the planned investments of multiple companies over the forecast period.

APAC Safety Switches Market Trends

Increased Adoption of Safety Switches for Industrial Use

- Over the past couple of decades, industrial automation has transformed how humans interact with machines. One of the most significant areas of development over the last few years is known as Industry 4.0 or the Industrial Internet of Things (IIoT). New sensors for factory settings offer a much higher level of information than previous generations. These sensors capture the process variable as well as ambient information like temperature. In addition, modern sensors can monitor their health and raise an alert when they need calibration or maintenance.

- IIoT also makes use of network connectivity. The availability of new sensors designed to measure the health and performance of machines has made new maintenance strategies possible. There are also specific industrial applications that require manual safety stops. Equipment limit switches are also helpful to stop devices for machinery applications.

- In June 2022, Norstat announced offering Safety Switch that incorporates RFID technology to detect the actuator creating a virtually tamper-resistant device. The NS SERIES safety switch is designed for application on machines where hazardous conditions remain even after the machine has been powered down.

- However, despite all these advances, there remains a need for high-quality manual controlled stop switches and equipment limit switches for industrial safety. These switches must withstand the harsh operating conditions of extreme temperature ranges and high vibration.

China to hold the largest Market Share

- China is anticipated to have the fastest market growth for safety switches over the forecast period. Automation is being adopted by industries, which increases the complexity of the machinery. Ultimately, this necessitates the deployment of extra sensors and safety switches.

- In 2021, China's overall electricity usage was close to 157.65 Exajoules. They compare this to the prior year when consumption was 134.7 Exajoules. There was a noticeable increase. China's primary power consumer is the secondary sector, which includes the manufacturing industries. This sector has the biggest market share for functional safety goods like safety switches.

- The presence of numerous domestic and foreign manufacturing firms, rapid industrialization, and expanding manufacturing activities are anticipated to drive machine condition monitoring activities on the factory floor and the safety switches market in the emerging economies of China.

- The region's market for non-destructive testing tools and services is expected to be driven by a high demand for passenger cars, medium and large buses, and trucks. Over the projection period, the market is anticipated to continue to produce demand in order to protect such valuable industrial assets. For instance, the Asia-Pacific market for new vehicles, which includes trucks, buses, and passenger cars, will surpass 65 million units in 2021, with China and India playing a significant role in this growth.

APAC Safety Switches Industry Overview

Several competitors exist in the fiercely competitive Asia Pacific Safety Switches Market. Few big competitors now control most of the market in terms of market share. Major firms with a sizable market share are concentrating on growing their consumer base internationally. Many businesses rely on strategic collaboration projects to improve their market share and profitability.

- April 2022 - Vishay Intertechnology, Inc. announced its product lineup for PCIM Europe 2022. Vishay will present its latest industry-leading passive component, diode, MOSFET, and power IC technologies, that are paving the way for innovation in today's fastest-growing markets, including e-mobility, 5G, Industry 4.0, and IoT. The company's stand at PCIM will also feature several reference designs for automotive and industrial applications, including 48 V and 800 V battery safety switches; a 48 V / 12 V DC/DC converter capable of handling up to 3 kW, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porters Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Stringent Regulations on Machine and Personnel Safety

- 5.2 Market Challenges

- 5.2.1 Product Compatibility with Different Existing Platforms

- 5.2.2 Government involvement to ensure the equipment and Personal safety of businesses

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Electromagnetic

- 6.1.2 Non-contact

- 6.1.3 Other Types

- 6.2 By End-users

- 6.2.1 Industrial

- 6.2.2 Commercial

- 6.2.3 Healthcare

- 6.2.4 Oil and Gas

- 6.2.5 Other End Users

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company profiles

- 7.1.1 Schneider Electric

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Banner Engineering Corp.

- 7.1.4 Eaton Corporation

- 7.1.5 Euchner GmbH

- 7.1.6 SICK AG

- 7.1.7 Pilz GmbH & Co. KG

- 7.1.8 Siemens AG

- 7.1.9 Omron Electronics LLC

- 7.1.10 Honeywell International Inc.

- 7.1.11 Murrelektronik GmbH

- 7.1.12 Parmley Graham Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219