|

市场调查报告书

商品编码

1629770

中东和非洲的塑胶包装:市场占有率分析、产业趋势和成长预测(2025-2030)Middle East And Africa Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

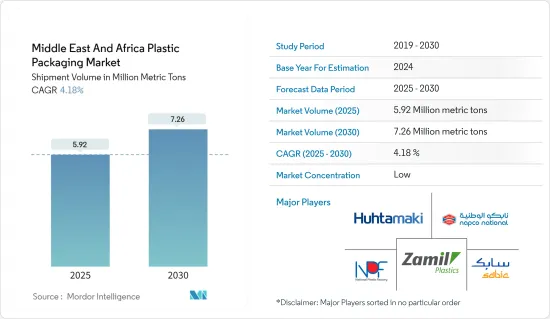

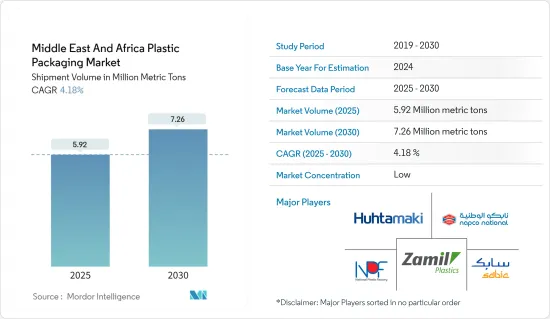

以出货量为准,中东和非洲塑胶包装市场规模预计将从2025年的592万吨扩大到2030年的726万吨,预测期间(2025-2030年)复合年增长率为4.18%。

主要亮点

- 随着消费者的健康偏好和永续发展意识日益增强,以及中东和非洲法规的不断发展,塑胶包装专业人士感受到了创新的压力。我们调整我们的材料、设计和技术来满足这些不断变化的需求。

- 在瓶装水和软性饮料消费量增加的支持下,饮料行业已成为塑胶包装的主要最终用户。阿拉伯联合大公国和埃及的研究人员最近的一项研究揭示了一个惊人的趋势。儘管阿联酋有严格的市政水质标准,但仍有超过 80% 的参与者选择普通瓶装水。

- 可氧化可分解塑胶正在兴起。中东和非洲国家,如阿联酋、沙乌地阿拉伯、叶门、象牙海岸共和国、南非、加纳和多哥等,不仅在推广Oxo可分解塑胶。

- 随着东非和西非国内经济的蓬勃发展、消费市场的迅速扩大、收入的增加和年轻人口的增加,该大陆正在成为塑胶包装产业的枢纽。

- 地方政府机构正在支持旨在减少碳排放和能源消耗的计划,这表明了市场的积极前景。例如,2024 年 2 月,卡达市政部 (MoM) 开始向当地回收工厂免费提供可回收材料,强调其对永续性和循环经济的承诺。

- 另一项倡议是,2023 年 12 月,终结塑胶废弃物联盟与沙乌地阿拉伯投资回收公司 (SIRC) 在杜拜签署了一份谅解备忘录。这项战略合作伙伴关係旨在在沙乌地阿拉伯部署有效的废弃物管理解决方案,并专门解决与某些塑胶相关的挑战。

- 新材料正在逐渐取代传统塑料,为市场供应商带来了挑战。此外,日益严重的环境问题和对永续包装(例如纸质包装)的需求不断增加,可能会阻碍市场成长。

中东和非洲塑胶包装市场趋势

软包装预计将显着成长

- 在中东和非洲,沙乌地阿拉伯、阿拉伯联合大公国和埃及等国家主要推动药品包装的需求。各行业对软塑胶解决方案(尤其是袋子)的关注和不断增长的需求正在推动市场扩张。

- 由于对结构化包装的需求不断增长,预计该领域的销量在预测期内将显着增长。此外,随着肉类和乳製品消费的增加,对塑胶包装的需求也将增加。所有这些因素都促进了软质塑胶包装市场的快速成长。

- 中东的塑胶袋和小袋製造商具有获得高性价比原料和原油、聚丙烯等原料的优势。这一优势支持塑胶袋的本地生产及其在电子商务中的使用。

- 阿联酋消费者食品偏好的变化正在为包装行业,特别是食品和饮料行业创造巨大的成长机会。根据阿联酋金融机构 Alpen Capital 的报告,由于其战略定位和该地区不断增长的人口,中东和非洲的食品工业预计将增长。疫情后线上食品宅配的激增增加了对包装、套袋和标籤等软包装的需求,推动了产业成长。

- 此外,国内食品加工业的成长正在推动对塑胶包装的需求。阿联酋约有 568 家食品和饮料加工商,每年生产 596 万吨,推动了该国对塑胶包装的需求。此外,由于游客数量的增加、消费者偏好的变化以及人们消费能力的提高,该国的食品服务业正在成长,这可能会在未来几年推动市场成长。

沙乌地阿拉伯预计将经历显着成长

- 沙乌地阿拉伯在中东包装产业占据主导地位。除了着名的石油和天然气行业外,它还拥有多样化的工业活动,推动塑胶包装的年度需求激增。

- 随着全球油价下跌,沙乌地阿拉伯意识到迫切需要加强其非石油部门。为此,沙乌地阿拉伯推出了多项旨在扩大工业生产的措施和监管改革,包括国家工业发展和物流计画(NIDLP)和2030年愿景。

- 沙乌地阿拉伯的塑胶消费量在海湾合作委员会中处于领先地位。 GPCA 最近估计该国的人均塑胶消费量超过 95 公斤,突显其为海湾合作委员会最大的塑胶消费国。此外,出于旅游和教育目的,人们越来越接受西方文化,这将进一步提振市场。美食广场和美食广场的人气飙升进一步强调了这种成长轨迹。

- 此外,已调理食品和冷冻食品部分描述了食用前需要最少准备或无需准备的已调理食品。由于快节奏的城市生活和多元文化的影响,这个细分市场在中东国家越来越受欢迎,特别是在阿联酋和沙乌地阿拉伯。

- 沙乌地阿拉伯的加工肉品、水产品和肉类替代品市场正在成长。 2023年市场规模约为1,499.10吨。预计到 2027 年将增加至约 1,839.50 吨,反映了消费者对加工肉品偏好的变化和增加。

中东和非洲塑胶包装产业概况

中东和非洲的塑胶包装市场较为分散,有多家公司按地区营运。市场上的主要供应商正在采取产品创新和伙伴关係等策略来扩大市场范围并保持竞争力。该市场的主要参与企业包括 SABIC、Zamil Plastic Industries Co、HuhtamakiFlexibles UAE (Huhtamaki Oyj)、National Plastic Factory LLC 和 Napco Group (Napco National)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 回收和永续性景观

- 行业法规、政策和标准

- 进出口分析

第五章市场动态

- 市场驱动因素

- 对氧化可分解塑胶的需求

- 加工食品需求稳定成长

- 市场问题

- 有关回收和安全处置的环境问题

- 原料成本高且回收基础设施有限

第六章 市场细分

- 硬质塑胶包装

- 依材料类型

- 聚乙烯(PE)

- 聚对苯二甲酸乙二酯 (PET)

- 聚丙烯(PP)

- 聚苯乙烯 (PS) 和发泡聚苯乙烯 (EPS)

- 聚氯乙烯(PVC)

- 其他的

- 依产品类型

- 瓶子和罐子

- 托盘/容器

- 盖子与封口装置

- 其他的

- 按最终用户产业

- 食物

- 饮料

- 医疗保健

- 化妆品/个人护理

- 居家护理

- 其他最终用户产业(工业、电子商务等)

- 依材料类型

- 软质塑胶包装

- 依材料类型

- 聚乙烯(PE)

- 双轴延伸聚丙烯(BOPP)

- 流延聚丙烯 (CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 其他的

- 依产品类型

- 小袋

- 包包

- 薄膜和包装

- 其他的

- 按最终用户产业

- 食物

- 饮料

- 医疗保健

- 化妆品/个人护理

- 居家护理

- 其他最终用户产业(工业、电子商务等)

- 依材料类型

- 按国家/地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 南非

第七章 竞争格局

- 公司简介

- Zamil Plastic Industries Co.

- Takween Advanced Industries

- Packaging Products Company(PPC)

- PrimePak Industries Nigeria Ltd(Enpee Group)

- Constantia Flexibles Afripack

- Huhtamaki South Africa(Pty)Ltd

- Al Bayader International(H&H Group of Companies)

- Napco National

- Falcon Pack

- Arabian Flexible Packaging LLC

- Hotpack Packaging Industries LLC

- ENPI Group

- Gulf East Paper and Plastic Industries LLC

- 热图分析

第八章投资分析

第九章 市场机会及未来趋势

The Middle East And Africa Plastic Packaging Market size in terms of shipment volume is expected to grow from 5.92 million metric tons in 2025 to 7.26 million metric tons by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Key Highlights

- As consumer preferences increasingly lean towards health-conscious and sustainable products, and with evolving regulations in the Middle East and Africa, professionals in plastic packaging are feeling the pressure to innovate. They are adjusting materials, designs, and technologies to align with these shifting demands.

- The beverage sector, buoyed by a rise in bottled water and soft drink consumption, emerges as the dominant end-user of plastic packaging. A recent study by researchers from the UAE and Egypt unveiled a striking trend: even with the UAE's stringent municipal water quality standards, over 80% of participants opted for bottled plain drinking water.

- Oxo-degradable plastics are on the rise. Countries in the Middle East and Africa, such as the UAE, Saudi Arabia, Yemen, Ivory Coast, South Africa, Ghana, and Togo, are not only endorsing oxo-degradable plastics but some have even made their use mandatory.

- With East and West Africa witnessing booming domestic economies, a surge in consumer markets, rising incomes, and a youthful demographic, the continent is emerging as a pivotal hub for the plastic packaging industry.

- Regional government agencies are backing projects aimed at curbing carbon emissions and energy consumption, signaling a positive outlook for the market. For example, in February 2024, Qatar's Ministry of Municipality (MoM) began offering recyclable materials at no cost to local recycling factories, underscoring their commitment to sustainability and a circular economy.

- In another move, December 2023 saw the Alliance to End Plastic Waste ink a Memorandum of Understanding (MoU) with Saudi Investment Recycling Company (SIRC) in Dubai. This strategic collaboration is set to roll out effective waste management solutions in Saudi Arabia, specifically addressing challenges linked to certain plastics.

- New materials, set to gradually take the place of conventional plastics, present a challenge for market vendors. Furthermore, growing environmental concerns and a rising demand for sustainable packaging, such as those crafted from paper, could pose hurdles to the market's growth.

Middle East And Africa Plastic Packaging Market Trends

Flexible Packaging is Expected to Witness Significant Growth

- Countries like Saudi Arabia, the United Arab Emirates and Egypt are primarily fueling the rising demand for pharmaceutical packaging in the Middle East and Africa. This emphasis and a growing demand for flexible plastic solutions, particularly pouches across various industries, propel the market's expansion.

- With a rising demand for structured packaging, the sector is poised for significant volume growth during the forecast period. Furthermore, as meat and dairy consumption increases, so will the demand for plastic packaging. All these factors contribute to the burgeoning market for flexible plastic packaging.

- Middle Eastern manufacturers of plastic bags and pouches are expected to benefit from access to cost-effective feedstock and raw materials, such as crude oil and polypropylene. This advantage bolsters the local production of plastic pouches and their use in e-commerce.

- The changing consumer food preferences in the United Arab Emirates have created significant growth opportunities in the packaging industry, especially for the food and beverage industry. According to report by Alpen Capital, a financial institute in United Arab Emirates, the food industry in the Middle East and African region is estimated to grow due to its strategic location and region's growing population. Post-pandemic, the surge in online food delivery has enhanced the demand for flexible packaging such as wraps, sleeves , labels and others, which is driving industry growth.

- Additionally, growth in the food processing industry in the country drives the demand for plastic packaging. Around 568 food and beverage processors operate across the United Arab Emirates, producing 5.96 million metric tonnes annually, boosting the demand for plastic packaging in the country. Also, the rise in the food service industry in the country due to a boost in tourism, changing consumer preferences, and the growing spending capacity of the population is likely to boost the market growth in the coming years.

Saudi Arabia is Expected to Witness Significant Growth

- Saudi Arabia stands out as a dominant player in the Middle Eastern packaging industry. Beyond its renowned oil and gas sector, the nation boasts a diverse array of industrial activities, fueling a surging annual demand for plastic packaging.

- In light of declining global crude oil prices, Saudi Arabia recognizes the imperative to bolster its non-oil sector. To this end, the nation has rolled out several initiatives and regulatory reforms, including the National Industrial Development and Logistics Program (NIDLP) and Vision 2030, aiming to amplify industrial production.

- Saudi Arabia leads the GCC in plastic consumption. Recent GPCA estimates highlight a per capita plastic consumption exceeding 95 kg, underscoring its position as the GCC's top plastic consumer. Additionally, a growing embrace of Western culture, spurred by tourism and educational pursuits, is poised to further energize the market. The burgeoning popularity of food malls and courts further underscores this growth trajectory.

- Furthermore, the ready-to-eat meals and frozen food segment offers prepared food that requires minimal or no preparation before consumption. This segment is gaining popularity in Middle Eastern countries, particularly in the United Arab Emirates and Saudi Arabia, due to the fast-paced urban lifestyle and diverse cultural influences.

- The Saudi Arabian market for processed meat, seafood, and meat alternatives is experiencing growth. In 2023, the market volume was approximately 1,499.10 metric tons. Projections indicate an increase to about 1,839.50 metric tons by 2027, reflecting the country's changing and growing consumer preferences for processed meat.

Middle East And Africa Plastic Packaging Industry Overview

The Middle East and Africa Plastic Packaging Market is fragmented in nature, with multiple players in the market operating regionally. The major vendors in the market adopt strategies such as product innovation and partnerships, among others, to expand their reach and stay competitive in the market. Some of the major players in the market are SABIC, Zamil Plastic Industries Co., and Huhtamaki Flexibles UAE (Huhtamaki Oyj), National Plastic Factory LLC, Napco Group (Napco National), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Recycling and Sustainability Landscape

- 4.5 Industry Regulation, Policy and Standards

- 4.6 Import-Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Oxo-Degradable Plastics

- 5.1.2 Steady Rise in Demand for Processing Food

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns over Recycling and Safe Disposal

- 5.2.2 High Raw Material Costs and Limited Recycling Infrastructure

6 MARKET SEGMENTATION

- 6.1 Rigid Plastic Packaging

- 6.1.1 By Material Type

- 6.1.1.1 Polyethylene (PE)

- 6.1.1.2 Polyethylene Terephthalate (PET)

- 6.1.1.3 Polypropylene (PP)

- 6.1.1.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 6.1.1.5 Polyvinyl Chloride (PVC)

- 6.1.1.6 Other Material Types

- 6.1.2 By Product Type

- 6.1.2.1 Bottles and Jars

- 6.1.2.2 Trays and containers

- 6.1.2.3 Caps and Closures

- 6.1.2.4 Other Product Types

- 6.1.3 By End-User Industry

- 6.1.3.1 Food

- 6.1.3.2 Beverage

- 6.1.3.3 Healthcare

- 6.1.3.4 Cosmetics and Personal Care

- 6.1.3.5 Household Care

- 6.1.3.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 6.1.1 By Material Type

- 6.2 Flexible Plastic Packaging

- 6.2.1 By Material Type

- 6.2.1.1 Polyethylene (PE)

- 6.2.1.2 Bi-Orientated Polypropylene (BOPP)

- 6.2.1.3 Cast Polypropylene (CPP)

- 6.2.1.4 Polyvinyl Chloride (PVC)

- 6.2.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.2.1.6 Other Material Types

- 6.2.2 By Product Type

- 6.2.2.1 Pouches

- 6.2.2.2 Bags

- 6.2.2.3 Films & Wraps

- 6.2.2.4 Other Product Types

- 6.2.3 By End-User Industry

- 6.2.3.1 Food

- 6.2.3.2 Beverage

- 6.2.3.3 Healthcare

- 6.2.3.4 Cosmetics and Personal Care

- 6.2.3.5 Household Care

- 6.2.3.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 6.2.1 By Material Type

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Egypt

- 6.3.4 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zamil Plastic Industries Co.

- 7.1.2 Takween Advanced Industries

- 7.1.3 Packaging Products Company (PPC)

- 7.1.4 PrimePak Industries Nigeria Ltd (Enpee Group)

- 7.1.5 Constantia Flexibles Afripack

- 7.1.6 Huhtamaki South Africa (Pty) Ltd

- 7.1.7 Al Bayader International (H&H Group of Companies

- 7.1.8 Napco National

- 7.1.9 Falcon Pack

- 7.1.10 Arabian Flexible Packaging LLC

- 7.1.11 Hotpack Packaging Industries LLC

- 7.1.12 ENPI Group

- 7.1.13 Gulf East Paper and Plastic Industries LLC

- 7.2 Heat Map Analysis