|

市场调查报告书

商品编码

1629776

中东和非洲的泡壳包装:市场占有率分析、产业趋势和成长预测(2025-2030)MEA Blister Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

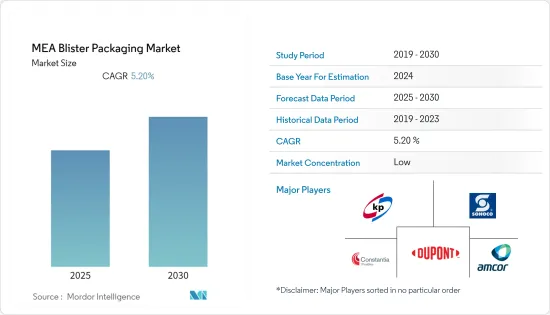

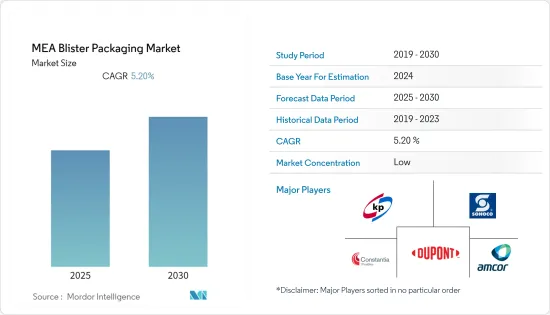

中东和非洲泡壳包装市场预计在预测期内复合年增长率为 5.2%

主要亮点

- 泡壳包装是用于小型消费品、食品和药品的几种预成型塑胶包装的总称。这些包装解决方案有助于长期保护产品免受潮湿和污染等外部因素的影响。不透明泡壳还可保护光敏产品免受紫外线伤害。如此广泛的应用使其在市场上具有吸引力。

- 疾病发病率的上升和政府对假药的严格监管正在促使製药公司超越维持其生产目的的功效的基本需求,生产包装清晰且难以模仿的药品,其中之一就是不断增加的需求压力。关键因素。泡壳包装为钞票认证系统等防伪系统提供了有效的方法。

- 随着製造商、消费者和监管机构对产品安全的需求增加,泡壳包装正成为越来越实用的选择。产品完整性和延长保质期等因素对于製药业非常重要,因为大多数消费者将药品储存在高温波动的环境中,这可能对未受保护的药品有害。

- 遵守安全法规的需求不断增长,加上对方便易用的包装产品的需求不断增长,正在推动所研究市场的成长,导致市场供应商与科技公司合作来实现这些功能。产品差异化优势。

- 此外,环保泡壳包装在该地区越来越受欢迎。例如,Sonoco 提供 EnviroSense,一种用于零售包装的纸泡壳,作为塑胶泡壳包装的替代品。该公司还计划在 2025年终减少塑胶的使用。

中东和非洲泡壳包装市场趋势

药品预计将显着成长

- 製药业对泡壳包装解决方案提出了不同的要求,例如与外部环境隔离、成本效益、高防护性、易于处理和保存药效等。这些包装特别适合满足严格的法规,并因其保护性能、成本效益、适应性以及製药和包装行业的需求而受到重视。

- 当药物包装在泡壳包装中时,消费者知道他们的药物和剂量,从而提高用药依从性。泡壳的单位剂量特征降低了错误剂量的风险。

- 零售层面的处方药製备对于製药技术人员和药剂师来说是一个挑战。在超级市场和药局的开放环境中给药可能会对敏感药物在容器之间转移时产生不利影响。泡壳包装可以确保直接配送给客户。

- 虽然保护产品完整性仍然是药品包装的首要目标,但包装产业的所有领域都在继续努力降低包装过程中的成本。

- 例如,Amcor 的 Polybar 阻隔薄膜系列涵盖广泛的防潮阻隔性,具有出色的抗压性能,可确保为锭剂和胶囊等製药应用提供最佳保护。我们使用 Aclar、COC、PE、PVC 和 PVdc 等材料。

- 然而,由于 COVID-19 的影响导致供应链中断,2020 年整个非洲的药品出口下降。例如,根据 Trade Map,摩洛哥的药品出口额从 2019 年的 1.1708 亿美元降至 2020 年的 1.099 亿美元。

非洲占最大市场占有率

- 该国的泡壳包装广泛用于封装各 CMO 供应商生产的 API。在中东和非洲地区,南非被誉为非洲最大的CMO市场之一。南非医药契约製造具有吸引力的主要因素是其成熟、稳定的市场和较高的投资周转率。

- 对于想要进入市场的外国公司来说,税收和关税可能是一个挑战。同时,政府支持的增加、医疗保健支出的增加以及支持药物配方创新的倡议以及对药品的兴趣预计将扩大该国的商机。

- 此外,奈及利亚是西非最有前景、成长最快的药品生产地区之一,拥有 150 多个药品製剂生产设施。药品契约製造的主要成长要素是成本优势、生物製药需求的增加、政府法规和专利到期。

中东和非洲泡壳包装产业概况

中东和非洲泡壳包装产业高度集中。伙伴关係、併购和收购已成为市场上供应商生产最终用户行业可接受的产品的重要策略,其中包装材料经过严格的品质检查,以确保它们不会污染内容物并影响健康。维持原料的持续流动仍是促进伙伴关係的挑战。市场的主要参与者包括 Amcor Ltd、Sonoco Products Company、Constantia Flexibles GmbH 和 Honeywell International Inc.。

- 2021 年 4 月 - Amcor 宣布对可回收聚乙烯基热成型泡壳包装进行客户试验。这种新包装旨在满足高度专业化和监管的药品包装的严格要求,为最受欢迎的医疗保健包装类型创造更永续的选择。与市场上的替代包装相比,这种创新包装可减少高达 70% 的碳足迹。

- 2021 年 7 月 - Futamaki 为医疗保健产业推出纸质泡壳包装「Push Tab」。该公司使用的纸张经过 FSC 认证,可取代由热成型 PVC 或铝製成的传统推入式包装,从而减少整个价值链对环境的影响。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 市场驱动因素

- 老年人口增加和疾病传播

- 产品创新,例如相对便宜的小型化

- 市场挑战

- 法规的动态性和缺乏处理重载的能力

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间敌对关係的强度

- 替代品的威胁

- 评估 COVID-19 对泡壳包装市场的影响

第五章市场区隔

- 按流程

- 热成型

- 冷成型

- 按材质

- 塑胶薄膜

- 纸板

- 铝

- 其他材料

- 按最终用户产业

- 消费品

- 药品

- 工业的

- 其他最终用户产业

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 中东及非洲其他地区

第六章 竞争状况

- 公司简介

- Amcor PLC

- MTS Medication Technologies

- Constantia Flexibles GmbH

- Sonoco Products Company

- Klockner Pentaplast Group

- Du Pont De Nemours and Company

- Honeywell International Inc.

- The Dow Chemical Company

第七章 投资分析

第八章市场的未来

The MEA Blister Packaging Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- Blister pack is a term for several types of pre-formed plastic packaging used for small consumer goods, foods, and pharmaceuticals. These packaging solutions are useful for protecting products against external factors, such as humidity and contamination, for extended periods of time. Opaque blisters also protect light-sensitive products against UV rays. Such a wide base of applications has helped it gain traction in the market.

- Increasing pressure on pharmaceutical companies to manufacture medicines that are distinct in packaging and hard to imitate, beyond the basic need of keeping it effective for the purpose it was produced, for it to be made available for patients, owing to rise in diseases and stringent government regulations against counterfeit drugs, are among the major factors propelling the market. Blister packaging offers an efficient method of anti-counterfeit systems, like banknote authentication systems and others.

- The rising need for a level of product safety from manufacturers, consumers, and regulatory organizations makes blister packaging an increasingly practical option. Factors like product integrity and extended shelf life are highly necessary for the pharmaceutical sector, considering that most consumers store their drugs in a temperature variant atmosphere that can be harmful to unprotected medicines.

- The growing need for compliance with safety regulations, coupled with increased demand for convenient and easy-to-use packaging products, is also expected to drive the growth of the market studied and result in the market vendors partnering with technology companies to introduce those features and widen their product differentiation advantages for bulk purchasers.

- Moreover, the region is witnessing traction for eco-friendly blister packaging. For example, Sonoco offers EnviroSense, a paper blister for retail packaging, and is designed as an alternative to plastic blister packages. Additionally, with this, the comany has aimed to reduce the use of plastic by the end of 2025

MEA Blister Packaging Market Trends

Pharmaceutical is Expected to Witness a Significant Growth

- The pharmaceutical sector poses a different set of demands for blister packaging solutions, concerning insulation from external surroundings, cost-effectiveness, high levels of protection, and the ease of handling and retaining the effectiveness of the medicine. These packs are uniquely suited to meet stringent regulations and are highly valued for protective properties, cost-effectiveness, adaptability, and the pharmaceutical and packaging industry's requirements.

- When medicines are blister packaged, adherence is improved because consumers can keep track of their medications and dosage. The unit dosage feature of blisters reduces the risk of incorrect dosing.

- The retail-level preparation of prescription drugs is troubling pharmaceutical technicians or pharmacists. The administration of medicines in the open atmosphere of the supermarket and drug store may negatively affect sensitive medicines when they are transferred from container to container. Blister packaging can guarantee the process of distribution directly to the customer.

- Protecting product integrity continues to be the primary goal of pharmaceutical packaging, but there is continued work on cost reduction in the packaging process in all areas of the packaging industry.

- For Example, The Polybar barrier films product families provided by Amcor cover a wide range of moisture barriers whilst also providing good crush resistance to ensure the best protection for pharmaceutical applications such as tablets and capsules. It uses materials such as Aclar, COC, PE, PVC, and PVdc, among others.

- However, due to the supply chain disruption caused due to the impact of COVID-19, the exports of pharmaceutical products decreased across Africa in 2020. For instance, according to Trade Map, the value of pharmaceutical products exported from Morocco reduced to USD 109.9 million in 2020 compared to USD 117.08 million in 2019.

Africa to hold the Largest Market Share

- Blister packaging in the country is widely used to contain the APIs manufactured by various CMO vendors. In the MEA region, South Africa is known as one of the largest CMO markets in Africa. Some of the major factors responsible for South Africa's attractive pharmaceutical contract manufacturing are its well-established and stable markets and high turnover to investments.

- The tax structures and duties are possible challenges for foreign companies that aim to enter the market. On the other hand, increasing governmental support, rising health expenditure, and initiatives taken to support innovations in drug formulation and pharmaceutical interest are expected to bolster the opportunities available in the country.

- Moreover, Nigeria is one of the most promising and rapidly growing pharmaceutical manufacturing regions in West Africa, with more than 150 pharmaceutical formulation manufacturing facilities. The major drivers of growth in pharmaceutical contract manufacturing are cost advantage, increased demand for biological production, government regulations, and patent expiry.

MEA Blister Packaging Industry Overview

The Middle East and Africa Blister Packaging are highly concentrated. Partnership, mergers, and acquisitions have been a significant strategy for the vendors in the market for producing products that are acceptable in the end-user industry, where packaging materials undergo stringent quality tests not to contaminate the contents impact health. Maintaining a continuous flow of raw materials remain a challenge that prompts partnerships. Some of the major players in the market are Amcor Ltd, Sonoco Products Company, Constantia Flexibles GmbH, Honeywell International Inc., among others.

- April 2021- Amcor announced customer trials for recyclable Polyethylene-based thermoform blister packaging. The new packaging is designed to meet the stringent requirements of highly specialized and regulated pharmaceutical packaging and creates a more sustainable alternative for the most in-demand healthcare packaging type. This innovation also benefits from up to 70% reduction in its carbon footprint when compared to packaging alternatives on the market.

- July 2021 - Huthamaki launched Push Tab paper-based blister solution for the healthcare industry. The paper used by the comany is FSC certified and acts as an alternative to traditional push-through packaging made of thermoformed PVC and aluminum, thus reducing the environmental impact across the value chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing geriatric population and prevalence of diseases

- 4.2.2 Product innovations such as downsizing coupled with relatively low costs

- 4.3 Market Challenges

- 4.3.1 Dynamic nature of regulations and inability to support heavy goods

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Intensity of Competitive Rivalry

- 4.4.5 Threat of Substitutes

- 4.5 Assessment of the impact of COVID-19 on Blister Packaging Market

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Thermoforming

- 5.1.2 Coldforming

- 5.2 By Material

- 5.2.1 Plastic Films

- 5.2.2 Paper and Paperboard

- 5.2.3 Aluminum

- 5.2.4 Other Materials

- 5.3 By End-User Industry

- 5.3.1 Consumer Goods

- 5.3.2 Pharmaceutical

- 5.3.3 Industrial

- 5.3.4 Other End-User Industries

- 5.4 By Country

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 South Africa

- 5.4.4 Other Regions in Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 MTS Medication Technologies

- 6.1.3 Constantia Flexibles GmbH

- 6.1.4 Sonoco Products Company

- 6.1.5 Klockner Pentaplast Group

- 6.1.6 Du Pont De Nemours and Company

- 6.1.7 Honeywell International Inc.

- 6.1.8 The Dow Chemical Company