|

市场调查报告书

商品编码

1629779

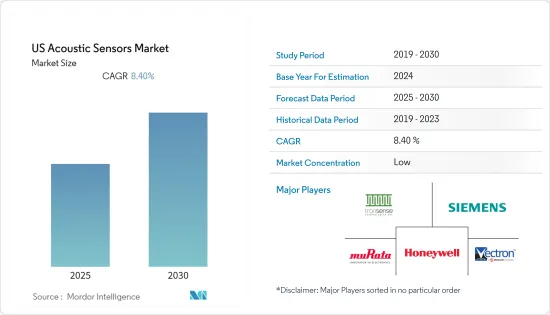

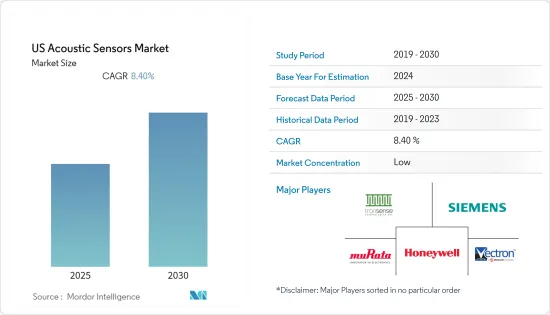

美国声学感测器:市场占有率分析、行业趋势、统计和成长预测(2025-2030)US Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

美国声学感测器市场预计在预测期内复合年增长率为 8.4%

主要亮点

- 由于声波感测器的需求和製造不断增长,美国是全球SWA感测器市场的主要创新者和投资者之一。该地区的最终用户产业正在增加对先进技术的投资和采用低成本组件,从而扩大了该地区 SAW 感测器的范围。

- 此外,全球市场上的大多数主要供应商都位于美国,这使得该地区在研究市场上具有优势。此外,大多数这些区域供应商在产品创新和技术进步方面明显领先于全球竞争对手,这有助于区域市场以及全球市场的成长。美国是世界上最重要的声表面波感测器市场之一。

- 2007-2008年金融危机后崛起的半导体公司仍专注于创新,与其他竞争对手相比,保持相对较高的研发支出和併购。许多行业专家声称,由于大流行,同样的趋势将在预测期内反映出来。

- 2020年11月,美国工业协会(SIA)宣布,2020年10月全球半导体销售额达390亿美元,较2019年10月成长6%,较2020年9月成长3.1%。同月,WSTS 预测 2020 年全球半导体销售额将成长 5.1%,2021 年将成长 8.4%。

美国声学感测器市场趋势

压力感测器推动市场成长

- 压力感测器是一种由测量施加到感测器上的实际压力的压敏元件(使用不同的运行原理)和将此资讯转换为输出讯号的组件组成的设备。由于石油和天然气、航太、汽车、医疗、消费品和工业等各行业的应用不断扩大,这些感测器正在经历显着成长。

- 石油和天然气行业中永久声学监测系统越来越多地采用表面声波压力感测器,取代了主导井下压力表市场的石英晶共振器和光纤,增加了石油和天然气行业中表面声波压力感测器的采用。产业将在预测期内成为市场驱动力。

- 这些压力感知器可用于汽车轮胎压力监测系统。这种类型的感测器利用了 SAW 可以无线使用且无需电池的特性。 1 端口 SAW共振器和天线允许轮胎压力监测系统 (TMPS) 透过不同频率的讯号进行激励并从 SAW 接收回来。

- 近年来,我们看到了配备创新轮胎压力控制系统的专用越野和越野车辆。例如,在梅赛德斯的G63 AMG 6X6上,驾驶可以分别检查和更改前轴和后轴的轮胎压力。据报道,该系统只需不到 20 秒即可将轮胎压力从 0.5 巴增加到 1.8 巴。

- 此外,自 2002 年以来,NHTSA 已强制要求使用 TPMS(胎压监测系统)。因此,在强劲的汽车产业的支持下,美国汽车产业正在引领市场。

消费性电子市场占有率最高

- 智慧型手机销售的增加以及家用电子电器中新兴射频技术的采用增加,导致声学感测器和其他相关设备的销售大幅增长,扩大了研究市场的范围。

- LTE、4G 和 5G 设备(尤其是 5G 智慧型手机)生产的扩大也为 SAW 技术供应商带来了巨大的成长机会。射频滤波器正在成为各种智慧型手机的标准部件,因为它们将无线电讯号与用于发送和接收讯息的不同频段分开。全新先进 SAW 滤波器在 2.7GHz 以下频段提供比同类 BAW 滤波器更高效能的解决方案,从而随着 5G 技术的出现提供高成长机会。

- 例如,美国科技公司于2020年2月宣布推出Qualcomm ultraSAW滤波器技术。这是该公司无线技术组合的另一项突破性创新,主要针对 5G/4G 行动装置。据该公司称,RF 滤波器可将不同频段的无线电讯号分开,并将插入损耗提高多达 1 dB,使高通的 ultraSAW 滤波器成为比 2.7 GHz 以下频段的竞争滤波器性能更高的解决方案。 。

- 许多研究人员也正在探索 SAW MEMS 麦克风的潜力,它也可用作无线被动加速计和压力感测器。预计到2024年,全球MEMS麦克风市场将超过16.7亿美元。

美国声学感测器产业概况

声学感测器是相对容易製造的设备。因此,市场高度分散,许多全球和本地製造商为市场动态做出了贡献。儘管MEMS市场正在稳步成长,主要企业都面临着激烈的竞争,迫使它们降低价格并降低利润率。新参与企业市场。

- 2020 年 12 月,美国声学高频段射频滤波器整合装置製造商 (IDM) Akoustis Technologies Inc. 宣布,其 5.2/5.6GHz 射频共存滤波器解决方案将是第二个 Wi-Fi 6 解决方案。我们客户的设计胜利。该公司预计将于2021年上半年开始生产。

- 2020 年 9 月,桑迪亚国家实验室在为 Autonomous Medical Devices Incorporated (AMDIs) Optikus 手持式诊断设备开发整合核酸扩增系统方面取得了重大进展。在这项工作中,我们开发了一种针对 SARS-CoV-2 的环介导等温扩增 (LAMP) 引子组,并在 SAW 感测器上证明了直接扩增。

- 2020 年 5 月,总部位于圣地牙哥的 Roswell BIoTechnologies 和奈米创新者 Imec 合作,于 2021 年将首款分子电子生物感测器晶片推向市场。此类晶片可用于检测 COVID-19 和其他疾病、精准医疗,甚至在可携式或手持装置上进行低成本基因序列测定。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 通讯市场的成长

- 製造成本低

- 市场限制因素

- 声学感测器的技术问题

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场区隔

- 按类型

- 有线

- 无线的

- 按波浪类型

- 表面波

- 体波

- 按感测参数

- 温度

- 压力

- 扭力

- 大量的

- 湿度

- 黏度

- 化学蒸气

- 按用途

- 车

- 航太/国防

- 家用电子电器产品

- 医疗保健

- 工业的

- 其他的

第六章 竞争状况

- 公司简介

- Siemens AG

- Transense Technologies plc

- pro-micron GmbH

- Honeywell Sensing and Productivity Solutions

- Murata Manufacturing Co., Ltd.

- Vectron International, Inc.(Microchip technology Incorporated)

- ifm efector, inc.

- Dytran Instruments, Inc.

- Campbell Scientific, Inc.

第七章 投资机会

第八章市场的未来

简介目录

Product Code: 56514

The US Acoustic Sensors Market is expected to register a CAGR of 8.4% during the forecast period.

Key Highlights

- The United States is one of the foremost innovators and investors in the global SWA sensor market, owing to the growing regional demand and manufacturing of acoustic wave sensors. The regional end-user industry is increasingly investing in advanced technologies and adopting low-cost components, expanding the scope of SAW sensors in the region.

- In addition to that, most of the significant global market vendors are US-based, which provides an upper hand to the region in the studied market. Also, most of these regional vendors are far ahead of their global competitors in terms of product innovation and technological advancement, which is also helping the regional market's growth along with the global market's. The United States is one of the significant markets for surface acoustic wave sensors globally.

- After the financial crisis of 2007-2008, the semiconductor companies that emerged strongest still focused on innovations and maintained relatively higher R&D spending and M&As, as compared to other competitors. Many industry experts claim that the same trend is expected to reflect the forecast period due to the pandemic.

- In November 2020, the Semiconductor Industry Association (SIA) of the United States announced that sales of global semiconductors reached USD 39.0 billion for October 2020, an increase of 6% compared to October 2019 and 3.1% more than September 2020. In the same month, WSTS also forecasted that the projected annual global sales of semiconductors for 2020 would increase by 5.1%, followed by 8.4% in 2021.

US Acoustic Sensors Market Trends

Pressure Sensors to Drive the Market Growth

- The pressure sensor is an instrument consisting of a pressure-sensitive element to determine the actual pressure applied to the sensor (using different working principles) and some components to convert this information into an output signal. These sensors have witnessed significant growth due to the increasing applications across various industries, such as oil and gas, aerospace, automotive, healthcare, consumer goods, industrial, etc.

- The growing adoption of surface acoustic wave pressure sensors for permanent sound monitoring systems in the oil and gas industry has replaced the quartz crystals, and fiber optics which dominated the market for downhole pressure gauges, is expected to drive the market in the forecast period.

- These pressure sensors can be used in a car tire pressure monitoring system. This kind of sensor takes advantage of the fact that a SAW can be used wirelessly and without a battery. With a one-port SAW resonator and antenna, the Tire Pressure Monitoring System (TMPS) can be stimulated by signals of different frequencies and then received back from the SAW.

- In the past few years, exclusive cross-country and off-road cars have been witnessed installing innovative tire pressure control systems. For instance, the G63 AMG 6X6 from the Mercedes enables the driver to check and vary the tire pressure of both the front and rear axles separately. Reportedly, the system takes less than 20 seconds to raise the tire pressure from 0.5 bar to 1.8 bar.

- Furthermore, the NHTSA has mandated the use of TPMS (tire pressure monitoring system) since 2002. Hence, the US automotive sector has been leading the market studied, owing to a robust automotive sector.

Consumer Electronics holds the highest market share

- There is a significant surge in acoustic sensors and other related equipment sales due to the increasing smartphone sales and the increasing adoption of emerging RF technologies in consumer electronics, expanding the scope of the market studied.

- The growing production of LTE, 4G & 5G devices, especially 5G smartphones, also creates a massive growth opportunity for the SAW technology provider. RF filters are becoming standard components in these devices as they isolate radio signals from the different spectrum bands used by various smartphones to receive and transmit information. New advanced SAW filters offer a higher performance solution than competing for BAW filters in the sub-2.7 GHz frequency range, hence having higher growth opportunities with the emergence of 5G technology.

- For instance, in February 2020, US-based Qualcomm Technologies Inc. announced the Qualcomm ultraSAW filter technology, another groundbreaking innovation in its wireless technology portfolio mainly targeting 5G/4G Mobile Devices. According to the company, RF filters isolate radio signals from the different spectrum bands, and by achieving as much as 1 dB improvement in insertion loss, Qualcomm ultraSAW filters offer a higher performance solution than competing filters in the sub-2.7 GHz frequency range.

- Many researchers are also exploring the scope of the SAW MEMS microphone that can also be used as a wireless passive accelerometer and pressure sensor. The global MEMS microphone market will be expected to cross USD 1.67 billion by 2024.

US Acoustic Sensors Industry Overview

Acoustic sensors are a relatively simple device to manufacture. Consequently, the market is highly fragmented, with many global and local manufacturers contributing to the market dynamics. The MEMS market is seeing steady growth, but companies have to face cut-throat competition leading to brutal price declines and low margins. The market is continually adding new entrants into the market.

- December 2020, a US-based integrated device manufacturer (IDM) of acoustic wave high-band RF filters for mobile and other wireless applications, Akoustis Technologies Inc, announced that the company had been awarded a design win from a second Wi-Fi 6 customer for its 5.2/5.6 GHz RF coexistence filter solutions. The company expects the design to enter production in the first half of 2021.

- September 2020, US-based Sandia National Laboratories have made significant progress toward developing an integrated nucleic acid amplification system for Autonomous Medical Devices Incorporated (AMDIs) Optikus handheld diagnostic device. This effort developed a set of loop-mediated isothermal amplification (LAMP) primers for SARS-CoV-2 and then demonstrated amplification directly on the SAW sensor.

- May 2020, San Diego-based Roswell Biotechnologies and nano innovator, Imec collaborated to make the first molecular electronics biosensors chips commercially available in 2021. Such chips would help detect COVID-19 and other diseases and for precision medicine, as well as low-cost genome sequencing on portable or even handheld devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Telecommunications Market

- 4.2.2 Low Manufacturing Costs

- 4.3 Market Restraints

- 4.3.1 Technical Challenges Associated with Acoustic Sensors

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Wave Type

- 5.2.1 Surface Wave

- 5.2.2 Bulk Wave

- 5.3 By Sensing Parameter

- 5.3.1 Temperature

- 5.3.2 Pressure

- 5.3.3 Torque

- 5.3.4 Mass

- 5.3.5 Humidity

- 5.3.6 Viscosity

- 5.3.7 Chemical Vapor

- 5.4 By Application

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Consumer Electronics

- 5.4.4 Healthcare

- 5.4.5 Industrial

- 5.4.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Transense Technologies plc

- 6.1.3 pro-micron GmbH

- 6.1.4 Honeywell Sensing and Productivity Solutions

- 6.1.5 Murata Manufacturing Co., Ltd.

- 6.1.6 Vectron International, Inc. (Microchip technology Incorporated)

- 6.1.7 ifm efector, inc.

- 6.1.8 Dytran Instruments, Inc.

- 6.1.9 Campbell Scientific, Inc.

7 INVESTMENT OPPORTUNITIES

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219