|

市场调查报告书

商品编码

1629780

酒精饮料包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Alcoholic Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

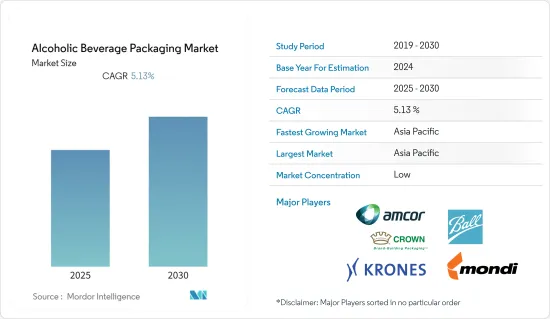

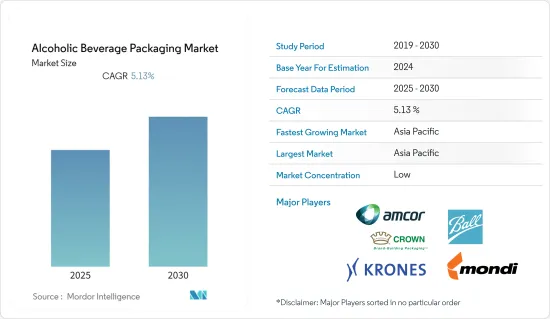

预计酒精饮料包装市场在预测期内复合年增长率为 5.13%

主要亮点

- 事实证明,近几十年来,全球酒精饮料的消费量显着增加。根据《柳叶刀》的研究,全球整体人均酒精消费量从1990年的59公升增加到2017年的65公升。此外,在接下来的13年里,人均酒精消费量预计将增加17%,到2030年将达到76公升。酒精饮料消费的成长是推动市场成长的关键因素之一。

- 此外,为了最大程度地减少包装废弃物,由于人们意识到使用 100% 可回收产品,因此人们越来越关注包装回收。这增加了对永续包装产品的需求,支持酒精饮料包装市场的成长。

- 然而,政府对有害材料和非生物分解产品的使用的严格规定限制了製造商使用某些包装材料。此外,生产成本的增加也限制了所研究市场的成长。

酒精饮料包装市场趋势

玻璃包装占有很大份额

- 玻璃 100% 可回收,且不会影响品质和坚固性。大多数回收的玻璃瓶被用来生产新的玻璃瓶。由于玻璃容器在葡萄酒包装中的重要性日益增加以及市场需求强劲,对玻璃容器的需求可能会成长。

- 全球超过50%的酒精消费都是以葡萄酒的形式消耗的,OIV预测全球葡萄酒产量将增加17%。顾客开始接受葡萄酒的替代包装,例如盒中袋 (BiB),但仅限于大量购买。

- 根据美国葡萄酒研究所2019年4月发布的报告,2017年美国生产了约10亿加仑葡萄酒。美国是葡萄酒消费量最多的国家,占全球的15%。因此,玻璃包装领域在葡萄酒包装应用中占据主导地位。

- 此外,啤酒产业在过去几年中呈现稳定成长。不断成长的啤酒产业或许会在玻璃包装领域展现出重大发展。例如,在欧洲,2017 年玻璃占回收材料总量的 22%,仅次于纸张。

亚太地区预计将主导市场

- 该地区啤酒和烈酒的消费量正在增加,这是市场成长的主要动力。世界卫生组织表示,92% 的印度酒精消费者更喜欢烈酒,而不是啤酒和葡萄酒。随着公司转向永续包装产品,该地区越来越多地采用酒精饮料玻璃包装。

- 该地区庞大的消费群,加上中国和印度等人口大国的存在、可支配收入的增加以及新兴国家对酒精消费的接受度不断提高,推动了所研究市场的成长。

- 根据《刺胳针》的研究,从 1990 年到 2017 年,东南亚和西太平洋地区的人均酒精消费量分别增加了 104% 和 54%。亚洲人口中位数年龄为30.7岁,为酒精饮料市场创造了巨大的潜在机会,并增加了对酒精饮料包装的需求。

酒精饮料包装产业概况

市场竞争激烈,有多家提供酒精饮料包装解决方案的公司。因此,市场适度分散,许多公司正在製定扩大策略。

- 2019 年 4 月 - 帝亚吉欧集团 (Diageo PLC) 致力于最大程度地减少塑胶废弃物,宣布其啤酒品牌 Guinness 将在全球停止使用塑胶包装。该公司将投资 1600 万欧元用于这项倡议以及纸板的采用,纸板是一种 100% 可回收且生物分解性的塑胶替代品。

- 2019 年 3 月 - Amcor Limited 收购竞争对手 Bemis Company Inc.透过合併这两位市场领导者,Amcor 旨在为股东、客户、员工和环境创造更强大的价值提案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 酒精饮料消费量增加

- 人们越来越关注回收

- 产品长期储存的需求不断增加

- 市场限制因素

- 实施有关包装材料的严格规定

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按材质

- 玻璃

- 金属

- 塑胶

- 其他的

- 副产品

- 能

- 瓶子

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他的

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 公司简介

- Amcor PLC

- Ball Corporation

- Krones AG

- Mondi PLC

- Crown Holdings Inc.

- Sidel SA

- Oi SA

- Ardagh Group SA

- Berry Global Inc.

- Nampak Limited

- Stora Enso Oyj

- Gerresheimer AG

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 56567

The Alcoholic Beverage Packaging Market is expected to register a CAGR of 5.13% during the forecast period.

Key Highlights

- It was observed that the global consumption of alcoholic beverages has been increasing significantly, over the decades. According to the study conducted by Lancet, alcohol per-capita consumption increased from 59 liters in 1990 to 65 liters in 2017, globally. Furthermore, in the following 13 years, alcohol per-capita consumption is expected to grow by 17%, reaching 76 liters in 2030. The rising alcoholic beverage consumption is one of the key factors driving market growth.

- Additionally, owing to the awareness regarding the usage of 100% recyclable products, in order to minimize packaging waste, the focus on recycling packagings is growing. This is, thus, fuelling the demand for sustainable packaging products and supporting the growth of the alcoholic beverage packaging market.

- However, stringent government regulations on the use of hazardous and non-biodegradable products have limited the manufacturers to a few packaging materials. Furthermore, the increasing cost of production is also restricting the growth of the market studied.

Alcoholic Beverage Packaging Market Trends

Glass Packaging Segment to Account for a Crucial Share

- Glass is 100% recyclable without the loss of quality and sturdiness. The majority of utilized glass bottles are used for the production of new glass bottles. The demand for glass containers may likely expand, owing to its increasing importance in wine packaging and robust demand in the market.

- More than 50% of the alcohol consumed globally is in the form of wine, and OIV has projected a 17% growth in the production of wine, globally.Though the customers have started accepting wine in alternative packagings, like Bags in a Box (BiB), it is limited to bulk purchasing.

- According to the report by the Wine Institute of America, released in April 2019, almost 1 billiongallons of wine wereproduced in the United States in 2017. The United States isthe highest consumerof wine,with a 15% global share. Thus, the glass packaging segment dominates the wine packaging application.

- Additionally, the beer industry has shown steady growth over the past years. Thegrowing beer industry may possibly show significant development in the glass packaging segment. For instance,in Europe, out of the overall recycling materials, glass captured 22% share in 2017, after paper.

Asia-Pacific Region is Expected to Dominate the Market

- The increasing consumption of beer and spirit drinks in the region has been a significant factor for the growth of the market. WHO has stated that 92% of the alcohol consumers in India prefer spirits over beer and wine. As the players are moving toward sustainable packaging products, the adoption of glass packaging for alcoholic beverages is growing in the region.

- The huge consumer base in the region, reinforced by the presence of highly populated countries, like China and India, increasing disposable incomes, and the growing acceptance of alcohol consumption in developing nations are the major factors driving the growth of the market studied.

- The study by Lancet has stated that per capita alcohol consumption in Southeast Asia and West Pacific increased by 104% and 54%, respectively, from 1990 to 2017. The Asian population represents the median age of 30.7 years, which presents huge potential opportunities for the alcoholic beverages market, thus augmenting the demand for alcoholic beverage packaging.

Alcoholic Beverage Packaging Industry Overview

The availability of several players providingpackagingsolutions for alcoholic beverages has intensified the competition in the market. Therefore, the market is moderately fragmented, with many companies developing expansion strategies.

- Apr 2019 -Diageo PLCannounced that it will not be using plastic packaging, globally, for its beer brand, Guinness, with a focus on minimizing plastic waste. The company is planning to invest EUR 16 million for this move and for the introduction of 100% recyclable and biodegradable cardboard to replace plastic.

- Mar 2019 - Amcor Limited acquired its rival Bemis CompanyInc. By combining these two market leaders, Amcor aims tocreate a stronger value proposition for shareholders, customers, employees, and the environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumption of Alcoholic Beverages

- 4.2.2 Increased Focus on Recycling

- 4.2.3 Rising Demand for Long Shelf Life of the Product

- 4.3 Market Restraints

- 4.3.1 Implementation of Stringent Regulations on Packaging Materials

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Glass

- 5.1.2 Metal

- 5.1.3 Plastic

- 5.1.4 Other Materials

- 5.2 By Product

- 5.2.1 Cans

- 5.2.2 Bottles

- 5.2.3 Other Products

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 Unites States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Ball Corporation

- 6.1.3 Krones AG

- 6.1.4 Mondi PLC

- 6.1.5 Crown Holdings Inc.

- 6.1.6 Sidel SA

- 6.1.7 Oi SA

- 6.1.8 Ardagh Group SA

- 6.1.9 Berry Global Inc.

- 6.1.10 Nampak Limited

- 6.1.11 Stora Enso Oyj

- 6.1.12 Gerresheimer AG

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219