|

市场调查报告书

商品编码

1629808

输送机 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Conveyors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

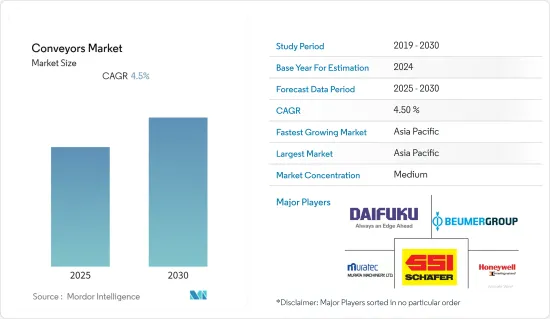

预计输送机市场在预测期内复合年增长率为 4.5%

主要亮点

- 随着库存单位 (SKU) 的快速成长,批发商和经销商需要协助做出明智的业务决策,这反过来意味着他们可以利用其劳动力、设备和技术来变得更具创新性。推动这些自动化物料输送系统需求的关键因素是成本节约、劳动效率和空间限制。

- 影响输送系统市场的因素有很多,包括工业成长、扩张、工业现代化以及产品和製程的特定条件。输送机系统有助于简化笨重物料输送任务。它们透过减少和最大限度地减少生产週期时间和错误,在营运中发挥重要作用。

- 供应链和业务流程变得越来越复杂,客户需求也不断增加。同时,各国经济和个人市场参与企业之间的竞争压力日益增加。因此,对外包模式和自动化的需求不断增加。

- 我们也看到对各种产品快速交付的需求不断增长,这需要高效的库存管理和逆向物流系统。汽车、零售、食品和饮料行业的新兴市场发展也可能支持该市场的成长。

- COVID-19 的传播对所研究的市场产生了积极影响,特别是在被视为基本服务的食品饮料和製药领域。随着这些领域的产品销售不断增长,製造设施正在全天候工作以运输最终产品,而这只有透过输送机等机械才能实现。

输送机市场趋势

零售业经历了显着成长。

- 自动化和基于 IT 的解决方案使零售业发生了巨大变化。零售商正在采用自动化仓储和配送解决方案来优化商店空间的使用并保持利润。零售业使用输送机进行配送、仓储、分拣和越库作业。随着网路购物的兴起,亚太地区和拉丁美洲/中东/非洲市场条件有利。

- 线上零售的日益普及,加上消费行为的变化,可能会对输送机和分类系统的实施产生正面影响。此外,许多已经投资分类设备的公司预计将增加产能,以应对不断增长的需求。例如,2022 年 10 月,UPS 在米兰贝加莫机场增设了新设施,扩大了运能。此外,新设施占地 5,000平方公尺,包括分类设备,每小时可处理 3,800 个包裹,是先前建筑的两倍。

- 消费者购买力的增强、生活方式的改变、工人阶级的壮大、外国直接投资等政府监管的放鬆。这些因素正在推动连锁超级市场和配送中心的成长,并推动对新配送中心和仓库的需求。

- 此外,根据美国商务部的数据,2021年美国仓储业创造了近505亿美元的收入,美国有超过19,000个仓库。

预计亚太地区将占据最大的市场占有率

- 全球许多已开发国家的国际公司都在亚太地区设立了生产设施,特别是在印度和中国等新兴国家。製造活动的成长导致该地区越来越多地采用输送机系统。

- 此外,消费能力的增强、生活水准的提高和国内生产总值的成长正在推动对製成品的需求,这反过来又导致这些自动化系统的采用增加。例如,最初,印度製造工厂的大多数带式输送机都是低速类型。然而,随着消费者对产品需求的增加而扩大设施,越来越多地采用高速带式输送机。

- 在预测期内,印度零售、机场、邮政和小包裹行业的需求将增加。零售市场主要是由电子市场的出现和网路购物的,这催生了履约中心和仓库。由于通讯设备使用的增加,互联网也正在推动电子商务和行动商务的成长。

- 总部位于东京的橡胶公司普利司通公司也报告称,该公司 2021 年从中国和亚太地区创造了 3,869 亿日圆(28.9 亿美元)的收入,这两个地区在输送机製造中发挥着不可或缺的作用。

- 此外,经济产业省 (METI) 预计,2021 年日本橡胶产业的橡胶基输送机和电梯带销售额将比 2020 年增加 7 亿日圆(520 万美元)。

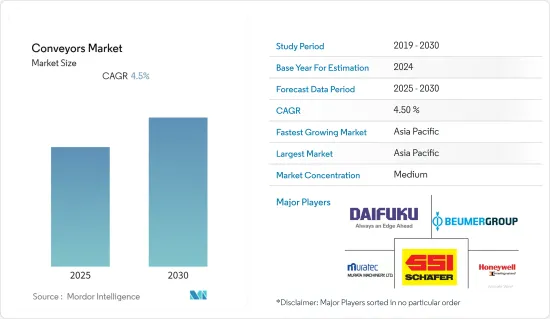

输送机产业概况

由于有许多主要企业向国内和国际市场供应产品,输送机市场竞争非常激烈。市场适度细分,主要企业采取产品创新、併购等策略。该市场的主要企业包括 Daifuku、SSI Schaefer AG 和 Murata Machinery Ltd。

- 2022 年3 月- 霍尼韦尔宣布与Clearpath Robotics 旗下部门OTTO Motors 合作,在日益稀缺的就业市场中为北美各地的仓库和配送中心提供一些劳动力最密集的职位。这一问题。此次合作将使Honeywell客户能够透过在其设施中安装 OTTO 的自主移动机器人 (AMR) 来提高效率、减少错误并提高安全性。这些 AMR 还描述了一种灵活而强大的托盘运输方法,通常主要透过堆高机和输送机系统来完成。

- 2022 年 5 月 - Viastrore Systems GmbH 宣布 Interroll 和 Viastore 同意在输送机技术领域进行更密切的合作。在德国斯图加特举办的国际物流展览会LogiMAT上,两家公司的代表握手并巩固了相应的合作。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对处理大量产品和提高生产力的需求不断增长

- 电子商务快速成长

- 市场限制因素

- 初始投资高

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 依产品类型

- 腰带

- 滚筒

- 调色盘

- 开卖

- 按地区

- 北美洲

- 按最终用户

- 飞机场

- 零售

- 车

- 製造业

- 饮食

- 药品

- 采矿*(请注意,我们涵盖所有其他地区的类似最终用户细分)

- 按国家/地区

- 美国

- 加拿大

- 欧洲

- 按最终用户

- 按国家/地区

- 法国

- 德国

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 按最终用户

- 按国家/地区

- 澳洲

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 按最终用户

- 按国家/地区

- 阿根廷

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 按最终用户

- 按国家/地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 公司简介

- Daifuku Co. Ltd

- SSI Schaefer AG

- Murata Machinery Ltd

- Mecalux SA

- BEUMER Group GmbH & Co. KG

- KNAPP AG

- KUKA AG(Swisslog AG)

- Honeywell Intelligrated Inc.

- Kardex Group

- Viastrore Systems GmbH

- Bastian Solutions Inc.

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 57250

The Conveyors Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- With the rapidly increasing growth in Stock-Keeping Units (SKUs), wholesalers and distributors need help to make informed decisions about their operations, which drives the need for the more innovative use of labor, equipment, and technology. The main factors driving the need for these automated material handling systems are cost savings, labor efficiency, and space constraints.

- Various factors, such as industrial growth, expansions, modernization of industries, and product and process-specific conditions, influence the conveyor systems market. Conveyor systems help simplify the task of handling bulky materials. It plays a vital role in operations by reducing and minimizing production cycle time and errors.

- Supply chains and business processes are becoming increasingly complex, and customers are demanding more. At the same time, competitive pressure is also growing among national economies and individual market players. Therefore, outsourcing models and automation are gaining demand.

- It has also been observed that there is an increasing need for delivering various products in small time frames that require efficient inventory management and reverse logistic systems. The developing automotive, retail, and food and beverage industries are also likely to fuel the growth of the market studied.

- The spread of COVID-19 has positively affected the market studied, especially in the food & beverage and pharmaceutical sectors, which have been deemed under essential services. Due to increased sales of the products under these segments, manufacturing facilities have been working round the clock to deliver the end products, which was only possible with the usage of conveyor belts, among other machines.

Conveyor Market Trends

Retail Segment to Witness Significant Growth

- The retail industry has transformed significantly with automation and IT-based solutions. Retailers are adopting automated warehousing and distribution solutions to optimize store space utilization and stay profitable. The retail sector utilizes conveyors for distribution, warehousing, sorting, and cross-docking. Growth in shopping through online mode in the Asia-Pacific and LAMEA regions has created a conducive market environment.

- The increasing usage of online retailing, coupled with changing consumer behavior toward goods purchasing, is likely to positively impact the adoption of conveyor and sortation systems. In addition, many companies already invested in the sortation facility are expected to increase their capacity, owing to the rising demand. For instance, in October 2022, UPS expanded its presence at Milan Bergamo Airport by adding a new facility to expand capacity. Moreover, the new facility measures 5,000 sq. meters and has sorting facilities, processing 3,800 packages per hour - twice as many as the previous building.

- The increasing purchasing power of consumers, changing lifestyles, growing working-class segment, and relaxation in government regulations such as Foreign Direct Investment. These factors have boosted the growth of supermarket chains and distribution centers, driving the demand for new distribution centers and warehouses, which is then expected to drive the conveyor market.

- Furthermore, According to the US Department of Commerce, the warehousing and storage industry in the US generated almost USD 50.5 billion in the year 2021, and there were over 19,000 warehouses in the united states, which will drive the market for conveyors in the US.

Asia Pacific is Expected to Hold the Largest Market Share

- Many international corporations from developed countries across the globe have set up their production facilities in the APAC region, especially in developing countries such as India and China, because of the availability of cheaper factors of production (labor, raw material, and equipment). The growth of manufacturing activities has increased the adoption of conveyor systems in this region.

- Moreover, increasing spending power, improving the standard of living, and higher GDP, among other factors, are increasing the demand for manufactured goods, which in turn is leading to the increased adoption of these automated systems. For example, the majority of belt conveyors in Indian manufacturing facilities were initially of the low-speed type. The expansion of these facilities, fueled by increased public demand for goods, led to the adoption of high-speed belt conveyors.

- In India, demand will increase from the retail, airport, and post and parcel industries during the forecast period. The retail market is primarily driven by the emergence of the e-market and customers shopping online, which gave rise to fulfillment centers and warehouses. Also, with the increased usage of communication devices, the internet is helping the growth of e-commerce and m-commerce.

- Also, the Tokoyo-based rubber company Bridgestone Corporation reported that the company was able to generate JPY 386.9 billion (USD 2.89 billion) in 2021 from China and Asia-Pacific, which play an essential part in the making of conveyors.

- Furthermore, the Ministry of Economy, Trade, and Industry (METI) stated that the sales value of conveyor and elevator beltings made from rubber in the rubber industry in Japan increased by JPY 700 million (USD 5.2 million) in 2021, compared to 2020, which was an increase of 4.58% of the sales.

Conveyor Industry Overview

The Conveyor Market is highly competitive owing to the presence of many prominent players supplying their products in domestic and international markets. The market appears to be moderately fragmented, with the major players adopting strategies like product innovation and mergers and acquisitions. Some of the major players in the market are Daifuku Co. Ltd, SSI Schaefer AG, and Murata Machinery Ltd, among others.

- March 2022 - Honeywell announced a collaboration with OTTO Motors, a division of Clearpath Robotics, giving warehouses and distribution centers throughout North America an automated option to address some of the most labor-intensive roles in an increasingly scarce job market. The collaboration also allows Honeywell customers to increase efficiency, reduce errors and enhance safety by installing OTTO's autonomous mobile robots (AMRs) in their facilities. These AMRs also provide a flexible and powerful way to transport pallets, typically accomplished primarily with forklifts and conveyor systems.

- May 2022 - Viastrore Systems GmbH announced that Interroll and Viastore had agreed to work more closely together in the field of conveyor technology in the future. The managing directors locked the corresponding cooperation with a handshake at LogiMAT, the international trade fair for intralogistics solutions, in Stuttgart, Germany.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Handling Larger Volumes of Goods and Improving Productivity

- 4.2.2 Rapid Growth of E-commerce

- 4.3 Market Restraints

- 4.3.1 High Initial Investments

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Belt

- 5.1.2 Roller

- 5.1.3 Pallet

- 5.1.4 Overhead

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 By End User

- 5.2.1.1.1 Airport

- 5.2.1.1.2 Retail

- 5.2.1.1.3 Automotive

- 5.2.1.1.4 Manufacturing

- 5.2.1.1.5 Food and Beverage

- 5.2.1.1.6 Pharmaceuticals

- 5.2.1.1.7 Mining *(Kindly note that similar end-user segment coverage is provided for all other regions in the scope)

- 5.2.1.2 By Country

- 5.2.1.2.1 United States

- 5.2.1.2.2 Canada

- 5.2.2 Europe

- 5.2.2.1 By End User

- 5.2.2.2 By Country

- 5.2.2.2.1 France

- 5.2.2.2.2 Germany

- 5.2.2.2.3 Italy

- 5.2.2.2.4 Netherlands

- 5.2.2.2.5 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 By End User

- 5.2.3.2 By Country

- 5.2.3.2.1 Australia

- 5.2.3.2.2 China

- 5.2.3.2.3 India

- 5.2.3.2.4 Japan

- 5.2.3.2.5 South Korea

- 5.2.3.2.6 Rest of APAC

- 5.2.4 Latin America

- 5.2.4.1 By End User

- 5.2.4.2 By Country

- 5.2.4.2.1 Argentina

- 5.2.4.2.2 Brazil

- 5.2.4.2.3 Mexico

- 5.2.4.2.4 Rest of Latin America

- 5.2.5 Middle East & Africa

- 5.2.5.1 By End User

- 5.2.5.2 By Country

- 5.2.5.2.1 United Arab Emirates

- 5.2.5.2.2 Saudi Arabia

- 5.2.5.2.3 South Africa

- 5.2.5.2.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Daifuku Co. Ltd

- 6.1.2 SSI Schaefer AG

- 6.1.3 Murata Machinery Ltd

- 6.1.4 Mecalux SA

- 6.1.5 BEUMER Group GmbH & Co. KG

- 6.1.6 KNAPP AG

- 6.1.7 KUKA AG (Swisslog AG)

- 6.1.8 Honeywell Intelligrated Inc.

- 6.1.9 Kardex Group

- 6.1.10 Viastrore Systems GmbH

- 6.1.11 Bastian Solutions Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219