|

市场调查报告书

商品编码

1630171

硬体OTP权杖认证:市场占有率分析、产业趋势与成长预测 (2025-2030)Hardware OTP Token Authentication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

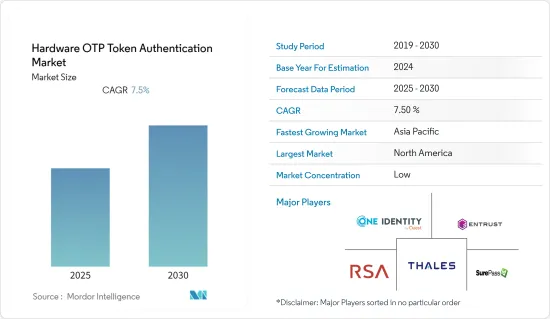

硬体OTP权杖认证市场预计在预测期内复合年增长率为 7.5%

主要亮点

- 与这些硬体设备相关的可移植性元素进一步消除了对用于身分识别管理的外部软体或硬体的需求。这些代币提供的更高层级的安全性是增强全球各个最终用户产业需求的关键因素。

- 企业、BFSI、政府、医疗保健和其他细分市场(游戏、服务供应商等)是需要多因素身份验证才能存取资讯和使用服务的最终用户行业细分市场。许多政府机构的强制性法规要求使用 OTP。

- 软体 OTP、简讯、电子邮件、生物辨识等是硬体OTP权杖的替代。儘管如此,硬体符记仍被认为更安全,因为它们不需要网路来存取密码或 PIN,也不易受到骇客攻击等威胁。

- 硬体多重验证 (MFA) 通常以智慧卡、USB 安全金钥和 OTP 产生器的形式出现。许多组织都利用基于硬体的安全性来应对风险最高的使用者和事件。然而,部署通常完全专注于风险管理期间进行的成本、复杂性、影响和可能性计算。

- 金融服务机构提供的线上资源是高度拥挤的市场中的关键竞争优势,促使公司提供更多线上功能和特性,以超越竞争对手。这些组织对OTP权杖身份验证等安全身份验证解决方案的需求推动了市场扩张。

- COVID-19 大流行影响了多个全球市场。银行、金融服务和保险、政府机构、企业安全和医疗保健行业都受到了严重打击,儘管方式完全不同。此外,疫情改变了人们对製造业全球供应链的看法,出现了更多在地化价值链和区域化。这样做主要是为了最大限度地减少未来疫情造成的类似风险。然而,自 COVID-19 以来,市场需求保持稳定,供应商不断推出新服务。

硬体OTP权杖认证市场趋势

离线硬体OTP权杖认证占据主要市场占有率

- 可中断的硬体OTP权杖要求您手动将数字复製到密码栏位中。单独的路径是指既不物理也不逻辑连接到客户端电脑的路径。未连接的令牌不需要特定的输入设备,而是使用内建萤幕来显示产生的身份验证凭证。这是由使用者使用键盘或小键盘手动输入的。

- 无连线令牌是最常见的安全符记类型,通常与密码结合使用以进行线上验证的双重认证。这些设备已经使用了 30 多年,并经历了各种演变以防止犯罪分子访问它们。据泰雷兹集团称,公共部门是加密解决方案的最大采用者,69% 的受访者表示他们正在整个企业中采用加密。

- 无连接硬体OTP权杖身份验证因其易用性和增强的连接和网路设备安全性而拥有最大的市场占有率。由于网路钓鱼和网路攻击的增加,企业正在使用与网路断开且公众无法存取的 OTP 硬体设备。这项倡议往往成为推动市场扩张的关键因素之一。此外,这些设备具有较长的电池寿命和最高的安全性,使其广泛用于支援各个最终用户行业的操作、维护和管理。

北美实现显着成长

- 美国是资料外洩事件最多的国家,报告了 2,330 起资料外洩事件。据白宫经济顾问委员会称,危险的网路活动每年给美国经济造成约 570 亿美元至 1,090 亿美元的损失。资料外洩事件的增加导致许多组织采用硬体 OTP 设备,为使用者提供另一层安全保护来保护自己。

- 强大的身份验证系统透过合併临时一次性动态密码(OTP) 等附加安全凭证来保护网路存取和最终用户数位身份,从而解决静态密码的限制。高级硬体符记使用基于微处理器的智慧卡来计算动态密码。智慧卡在身份验证方面具有多项显着优势,包括处理能力、资料储存容量、便携性和易用性。

- 公司在全球范围内运营,员工出差到世界各地的各个办事处。 OTP权杖验证为组织提供了额外的安全层,以支援存取和保护员工资讯。动态密码(也称为一次性密码 (OTP))是一种强式身分验证形式,可为企业网路、电子银行和其他包含敏感资料的系统提供更好的保护。

- 一些企业网路、电子商务网站和线上社群仅需要使用者名称和密码即可登入并存取个人和敏感资料。根据美国人口普查局的数据,2022年7月至9月美国零售电商销售额达到约2,660亿美元,较上季成长3%。

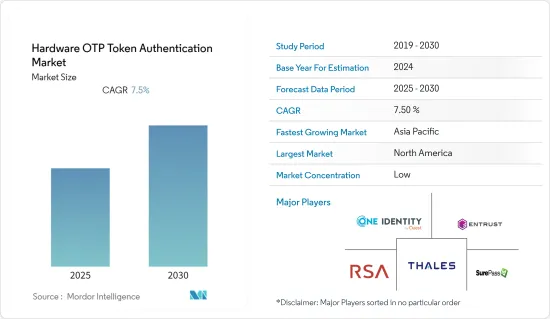

硬体OTP权杖认证产业概述

硬体OTP权杖认证市场高度整合,由多个主要参与者组成。该领域的几家公司正在利用战略合作计划来提高盈利。主要企业正透过策略联盟、扩张、伙伴关係、合资、收购等方式扩大在该市场的影响力。主要参与企业包括 One Identity LLC、Entrust Datacard Corporation、RSA Security LLC、Thales Group (Gemalto NV)、SurepassID Corp.、Authenex Inc.、Dell Technologies Inc.、Microcosm Ltd. 和 Broadcom Inc. (Symantec Corporation)。

2022 年 5 月,RSA 旗下的可信任身分识别平台 SecurID 宣布,联邦风险与授权管理计画 (FedRAMP) 已核准SecurID 联邦网路安全解决方案在政府机构中使用。公共部门相信我们的多因素身份验证 (MFA) 和身分管理解决方案可以帮助员工、合作伙伴和承包商在不影响安全性或便利性的情况下完成更多工作。 RSA Federal 具有独特的优势,可透过满足不断变化的需求并防范不断变化的攻击手法的网路安全策略来支援政府机构的需求。截至 2022 年 4 月,银行业的许多组织正在使用硬体符记RSA SecurID 进行多重验证 (MFA)。然而,有时您可能需要让您的员工记住并使用硬体符记登入。此步骤会增加支援成本、降低使用者体验并降低工作效率。这一步正是一位银行业客户正在努力解决的问题。因此,RSA 和 Twilio 合作探索利用 Twilio 验证服务作为替代 MFA 的方法。此步骤允许员工使用发送到行动电话的动态密码(OTP) 登入安全系统。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 工业吸引力-波特五力

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对硬体OTP权杖认证市场的影响

第五章市场动态

- 市场驱动因素

- 基于互联网的交易数量增加

- 银行业和金融业投资增加

- 市场问题

- 生物识别的普及和可靠性提升

第六章 市场细分

- 按类型

- 连接类型

- 未连接型

- 非接触式

- 按最终用户产业

- 银行、金融服务和保险

- 政府机构

- 企业安全

- 医疗保健

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- One Identity LLC

- Entrust Datacard Corporation

- RSA Security LLC

- Thales Group(Gemalto NV)

- SurepassID Corp.

- Authenex Inc.

- Dell Technologies Inc.

- Microcosm Ltd

- Broadcom Inc.(Symantec Corporation)

- VASCO Data Security International Inc.

- swIDch

第八章投资分析

第9章市场的未来

The Hardware OTP Token Authentication Market is expected to register a CAGR of 7.5% during the forecast period.

Key Highlights

- The portability factor associated with these hardware devices further eliminates the need for external software and hardware for identity management. The enhanced level of security provided by these tokens is a significant factor reinforcing their demand across the various end-user industries worldwide.

- Enterprises, BFSI, government, healthcare, and other segments (gaming, service providers, etc.) are a few of the end-user industry segments requiring multi-factor authentication for granting access to information or usage of services. The mandatory regulations from many government bodies make it necessary to use OTP.

- Software OTP, SMS, email, biometrics, etc., substitute hardware OTP tokens. Still, hardware tokens are considered more secure as they do not require a network to access the passcode or PIN and are not susceptible to hacks, among other threats.

- Hardware multi-factor authentication (MFA) typically comes in the form of smart cards, USB security keys, and OTP generators. Many organizations have leveraged hardware-based security for the most high-risk users and events. Still, the rollout was often entirely focused due to cost, complexity, impact, and likelihood calculations performed during risk management.

- The online resources offered by financial services organizations are their primary competitive advantage in a highly crowded market, motivating businesses to provide more online features and functions to outperform the competition. The market's expansion will be aided by these organizations' search for safe authentication solutions like OTP token authentication.

- The COVID-19 pandemic impacted multiple global markets. The banking, financial services & insurance, government, enterprise security, and healthcare industries have suffered drastically, though in very different ways. Moreover, the pandemic has changed the perception of the global supply chain in manufacturing, where more localized value chains and regionalization have come into the picture. These are primarily done to minimize similar future risks posed by the pandemic. However, post-COVID-19, the demand for the market remained constant, and vendors have been introducing new services.

Hardware OTP Token Authentication Market Trends

Disconnected Hardware OTP Token Authentication to Hold Significant Market Share

- A disconnected hardware OTP token requires manually copying the number into the passcode field. A separate path has no physical or logical connection to the client's computer. Disconnected tokens do not need a specific input device, instead using a built-in screen to display generated authentication credentials. This is manually entered by the user using the keyboard or keypad.

- Disconnected type tokens are the most common type of security token and are typically used in combination with passwords in two-factor authentication for online identities. These devices have been in use for over 30 years and have undergone various evolutions to prevent access by criminals. to avoid miscreants getting access to it. According to Thales Group, the Public sector was the heaviest adopter of encryption solutions, with 69%of respondents indicating that their enterprise was employing enterprise-wide encryption.

- The disconnected hardware OTP token authentication segment has the largest market share due to its ease of use and the increased security against connected or networked devices. Due to the rise in phishing and cyberattacks, organizations are using OTP hardware devices isolated from the network and inaccessible from the surface world. This step is often among the key factors driving market expansion. Additionally, these devices have an extended battery life and offer maximum security, so they are widely used to support the operation, maintenance, and management of varied end-user industries.

North America to Witness Considerable Growth

- The United States is the most significant contributor to breach activity, with 2,330 breaches reported. As per the White House Council of Economic Advisers, the U.S. economy loses approximately USD 57 billion to USD 109 billion per year to dangerous cyber activity. The increase in data breaches is pushing many organizations to adopt hardware OTP devices that provide another layer of security for the user to secure themselves.

- A robust authentication system addresses static password limitations by incorporating additional security credentials, such as temporary one-time passwords (OTPs), to protect network access and end-user digital identities. The advanced hardware tokens use microprocessor-based smart cards to calculate one-time passwords. Smart cards offer several substantial authentication advantages, including processing power, data storage capacity, portability, and ease of use.

- Enterprises are operating globally, and their employees travel to various offices worldwide. The OTP token authentication allows access and provides an additional layer of security to the organizations to secure their employee's information. One-time passwords (also known as One-time passcodes (OTP)) are a form of strong authentication, providing much better protection to corporate networks, eBanking, and other systems containing sensitive data.

- Several enterprise networks, e-commerce sites, and online communities require only a username and password for login and access to personal and sensitive data. According to U.S. Census Bureau, from July to September 2022, U.S. retail e-commerce sales amounted to nearly USD 266 billion, marking a three-percent increase compared to the previous quarter.

Hardware OTP Token Authentication Industry Overview

The Hardware OTP Token Authentication Market is highly consolidated and consists of several major players. Several companies in this sphere are leveraging strategic collaborative initiatives to increase their profitability. The key players have formed strategic collaborations, expansions, partnerships, joint ventures, acquisitions, and others to increase their footprints in this market. Key players in the market are One Identity LLC, Entrust Datacard Corporation, RSA Security LLC, Thales Group (Gemalto NV), SurepassID Corp., Authenex Inc., Dell Technologies Inc., Microcosm Ltd, Broadcom Inc. (Symantec Corporation), and many more.

In May 2022, SecurID, a trusted identity platform and an RSA company announced that the FedRAMP (Federal Risk and Authorization Management Program) had approved SecurID Federal cybersecurity solutions for use by government agencies. The public sector trusts our multi-factor authentication (MFA) and identity management solutions to enable employees, partners, and contractors to do more without compromising security or convenience increase. RSA Federal is uniquely positioned to support the needs of government agencies with a cybersecurity strategy that meets evolving needs and defends against evolving threat vectors. In April 2022, many organizations in the banking sector use RSA SecurID in hardware tokens for multi-factor authentication (MFA). However, employees may need to remember their hardware tokens and be able to log in. This step results in higher support costs, poor user experience, and lost productivity. This step is precisely the challenge one of her clients in the banking industry is trying to tackle. As such, RSA and Twilio have teamed up to explore ways to leverage the Twilio Verify Service as his alternative MFA. This step allows employees to log into the secure system using a one-time password (OTP) sent to their mobile phones.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Hardware OTP Token Authentication Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Number of Internet-based Transactions

- 5.1.2 Increasing Investments from Banking and Finance Industry

- 5.2 Market Challenges

- 5.2.1 Growing Use and Reliability of Bio-metric Authentication

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Connected

- 6.1.2 Disconnected

- 6.1.3 Contactless

- 6.2 By End-user Industry

- 6.2.1 Banking, Financial Services & Insurance

- 6.2.2 Government

- 6.2.3 Enterprise Security

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 One Identity LLC

- 7.1.2 Entrust Datacard Corporation

- 7.1.3 RSA Security LLC

- 7.1.4 Thales Group (Gemalto NV)

- 7.1.5 SurepassID Corp.

- 7.1.6 Authenex Inc.

- 7.1.7 Dell Technologies Inc.

- 7.1.8 Microcosm Ltd

- 7.1.9 Broadcom Inc. (Symantec Corporation)

- 7.1.10 VASCO Data Security International Inc.

- 7.1.11 swIDch