|

市场调查报告书

商品编码

1630175

全球专业电子代工组装市场:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Electronic Contract Assembly - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

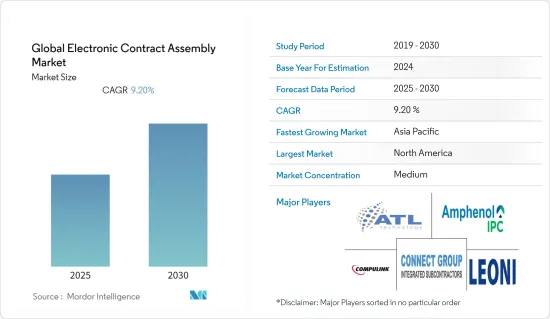

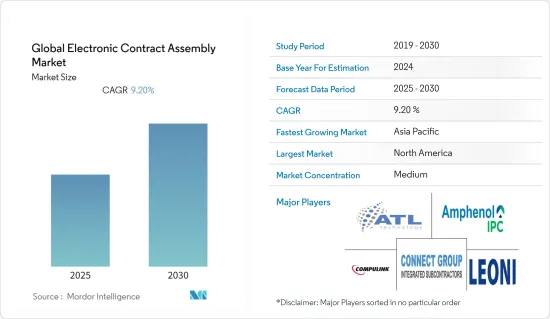

全球专业电子代工组装市场预计在预测期内复合年增长率为 9.2%

主要亮点

- 不稳定的经济状况正迫使製造商重新思考传统的经营模式并专注于收益。大多数经营团队将合约组装主要视为降低成本、提高灵活性和简化生产流程的机会。

- 透过业务给电子製造服务供应商,目的地设备製造商 ( OEM ) 可以大幅降低固定成本,同时腾出资金投资于新产品开发和行销等策略措施。减少直接就业也可以降低人事费用。

- 由于建立内部生产是大多数公司面临的重大挑战,因此外包被认为是降低成本的理想选择。因此,对该服务的需求预计很快就会以健康的速度成长。 PCB 组装服务被大多数OEM广泛考虑,因为它们缺乏技术知识,并被视为任何电子设备的重要组成部分。

- 一方面,汽车产业正在迅速增加电子产品的使用,以提高舒适性、安全性、性能和整体驾驶体验。由于延长了车辆保固期,汽车製造商要求层级供应商提供更高的可靠性、提高製造效率并显着减少保固缺陷。

- 医疗电子也是合约组装能够提高效率、降低成本的关键领域之一。由于医疗生物医学市场的持续成长,Saline Lectronics 等公司长期以来一直投资于製造电路基板组件所需的认证。

- COVID-19 疫情对全球供应链的持续影响加剧了电子产业现有的挑战。由于距离病毒控制还有几个月的时间,製造商现在正在重新考虑他们的策略,并专注于寻找中国以外的供应链来源。

专业电子代工组装市场趋势

消费性电子产品推动市场成长

- 通讯设备和电脑产品预计将成为推动电子产业成长最大的主要领域。外包流程已成为电子产业持续扩张、成本逐年下降的关键因素,并成为拉动消费需求的强大因素。

- 物联网 (IoT) 的出现为家用电子电器製造商创造了许多新的机会。智慧型手錶等穿戴式装置采用晶片和软性感测器。这些装置设计和製造技术的突破会对PCB市场产生重大影响。过去十年来,多个地区的网路连线系统数量也有所增加。

- 苹果等主要OEM也从富士康聘请电子产品契约製造,富士康拥有约 35 万名员工,生产全球约一半的 iPhone。在繁忙的夏季,工厂每天生产约 50 万部 iPhone,然后秋季新 iPhone 上市。

- 此外,对具有互动式和快速响应介面的高性能、超薄、轻型显示器的需求正在将材料需求推向极限。这些先决条件正在推动各种应用的显示材料技术以取得新的进步,从触控萤幕中的 ITO 取代到柔性设备中的显示创新。

- 在医疗领域,穿戴式装置(戴在手腕或身上的东西)的概念需要灵活的印刷电子产品,而远端监控(居家医疗)则需要具有更高连接性的设备。这些趋势也影响设计管理并为合约组装製造商创造机会。

亚太地区将经历最高的成长

- 在预测期内,拥有大量OEM的亚太地区预计将成为合约组装的重要市场。鑑于政府技术的发展,特别是日本智慧型设备和智慧医疗的发展,中国、印度和日本等地区可能会推动需求。

- 国内消费性电子产品尤其是家庭自动化领域的需求快速成长。据知名家用电子电器製造商TCL称,由于重要的智慧产品的推动,中国家用电子电器市场的市场规模预计将增长至目前规模的三倍。

- 中国在半导体、家用电子电器以及其他IT和通讯设备製造业的强势地位使其成为全球最重要的市场之一。

- 该国目前约占全球电子产品生产和组装能力的60-70%。根据半导体产业协会的数据,该国半导体销售收入从 824 亿美元(2015 年)增加到 1,437 亿美元(2019 年)。该国在5G技术方面也处于世界领先地位,预计到2020年下半年将在50个城市实现网路全覆盖。

- 该地区的公司在开发柔性印刷电路板和刚柔结合印刷电路板等技术方面也取得了长足进步。在PCB製造技术不断升级的过程中,中国产品结构稳定优化。此外,人工智慧、巨量资料、云端运算等一系列新设立的策略性产业将属于先进製造业,导致对组装参与企业的依赖。

- 然而,大流行的爆发迫使该地区的参与企业遵守全国范围内的封锁。截至 2020 年 3 月下旬,富士康和纬创资通暂时停止在印度工厂的生产,以遏制 COVID-19 的传播。这些公司也是大型电子公司的製造合作伙伴。

专业电子代工组装产业概况

专业电子代工组装市场是细分且竞争激烈的。新兴经济体中参与企业正在向生产和设计部门提供低成本的外包服务,以增加竞争。此外,主要企业正在寻求透过併购来获得竞争优势。宣布市场的一些关键发展。

- 2020 年 3 月 - Advanced Circuits 在钱德勒开设最新工厂。该公司投资 700 万美元新建了占地 50,000 平方英尺的办公地点,并于 2019 年 9 月开业。除了该公司位于科罗拉多州科罗拉多和明尼苏达州枫树林的製造工厂之外,还拥有这家最先进的工厂。它的规模是亚利桑那州坦佩之前工厂的两倍。

- 2020 年 3 月 - Sanmina Corporation 宣布扩建泰国工厂。该工厂预计将拥有先进的自订封装和组装能力,用于製造先进的光学、高速、高频微电子组件和产品。此次扩张将进一步支援网路、5G、资料中心、汽车/雷射雷达以及航太和国防市场新技术产品的快速成长。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 市场限制因素

第六章 市场细分

- 活动类型

- PCB组装服务

- 电缆/线束组装服务

- 薄膜/小键盘开关组装服务

- 目的

- 医疗保健

- 车

- 工业的

- 资讯科技和电讯

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Amphenol Interconnect Products Corp.(AIPC)

- ATL Technology

- Compulink Cable Assemblies Inc.

- Connect Group NV

- Leoni Special Cables Ltd

- Season Group International Co. Ltd

- Volex Group PLC

- Mack Technologies Inc.

- TTM Technologies Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 59163

The Global Electronic Contract Assembly Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- Volatile economic conditions have forced the manufacturers to reassess their traditional business models and concentrate on the bottom line. A majority of the executives view contract assembling as an opportunity, primarily to reduce costs, improve flexibility, and streamline their production processes.

- Outsourcing tasks to an electronics manufacturing services provider primarily allows the original equipment manufacturers (OEMs) to significantly cut their fixed costs while freeing cash to invest in strategic initiatives, such as new product development or marketing. It also lets a company reduce labor costs by shrinking its direct workforce.

- The establishment of in-house production is a crucial challenge faced by the majority of the players, owing to which outsourcing is considered a preferable option for them to save costs. As such, the demand for this service is expected to rise at a healthy rate shortly. PCB assembly services are widely considered by most OEMs, as they lack the technical knowledge and are considered crucial components in any electronic device.

- For one, the automotive industry is rapidly increasing its use of electronics to enhance comfort, safety, performance, and overall driving experience. As a result of more extended vehicle warranty periods, automobile manufacturers are demanding higher reliability, improved manufacturing efficiency, and vastly reduced warranty failures from their Tier 1 suppliers.

- Healthcare electronics is another primary sector where contract assembly is seen to reduce costs while improving efficiency. Due to the continued growth in the medical and biomedical markets, companies like Saline Lectronics have previously invested in certifications necessary for circuit board assembly manufacturing.

- Adding to the electronics industry's existing challenges is the ongoing impact of the COVID-19 outbreak on the global supply chain. With still months away from the containment of the virus, manufacturers are currently focusing on rethinking their strategies and looking beyond China to find alternative supply chain sources.

Electronic Contract Assembly Market Trends

Consumer Electronics to Drive the Market Growth

- Communications and computer products are expected to be the leading segments driving the most significant growth in the electronics industry. Outsourcing processes has become a critical element in keeping the electronics industry expanding and handling costs to the margin each year, a leading factor in stimulating consumer demand.

- With the emergence of the internet of things (IoT), there have been many new opportunities for consumer electronics manufacturers. Wearable devices, such as smartwatches, incorporate chips and flexible sensors. Breakthrough in designing these devices and manufacturing technology may have a significant impact on the PCB market. The amount of systems connected over the internet is also expanding in multiple regions over the past decade.

- The leading OEMs, such as Apple, also employ electronic contract manufacturing from Foxconn, which employs approximately 350,000 people and produces about half of the world's iPhones. Before the fall release of a new iPhone in the busy summer months, the factory produces around 500,000 phones a day.

- Furthermore, demand for high-performance, ultra-thin, and light displays with interactive, quick reacting interfaces pushes material requirements to the edge. These prerequisites drive new advances in display materials technology for various applications, from ITO replacements for touch screens to display innovations for flexible devices.

- In the healthcare prospect, the concept of wearables (wrist and body-worn) calls for flexible printed electronics, while remote monitoring (home healthcare) calls for more connected devices. These trends again impact the design controls and provide an opportunity for the contract assembly companies.

Asia Pacific to Witness Highest Growth

- Housing a significant number of OEMs, the region is estimated to be a substantial market for contract assembly during the forecast period. The regions, including China, India, and Japan, are likely to drive the demand, considering the government's technology development, especially in the smart devices and smart healthcare in Japan.

- The domestic demand for consumer electronics, especially in the home automation space, increased quickly. In China, the consumer electronics market's market is estimated to witness growth by three times its current size, with the critical smart products, according to a well-known home appliance maker, TCL.

- China is one of the significant markets globally, owing to its strong position in the semiconductor, consumer electronics, and other telecommunications devices and equipment manufacturing industries.

- The country currently has about 60-70% of the world's electronics production and assembly capacity. According to the Semiconductor Industry Association, the country's semiconductor sales revenue grew from USD 82.4 billion (2015) to USD 143.7 billion (2019). The country is also leading the world in 5G technology, with full network coverage planned in 50 cities in late-2020.

- The companies in the region are also making significant achievements in developing technologies, such as Flex PCB and Flex rigid PCB. In the continuous upgrades of PCB manufacturing technology, China experiences a stable and optimized product structure. Furthermore, a series of newly established strategic industries in AI, Big Data, and cloud computing belong to advanced manufacturing, leading to the dependence on assembly players.

- However, the pandemic outbreak has made players in the region comply with the nationwide lockdown. As of late March 2020, Foxconn and Wistron suspended production at their plants in India to reduce the spread of COVID-19. These companies are also manufacturing partners to major electronics companies.

Electronic Contract Assembly Industry Overview

The electronics contract assembly market is fragmented and is quite competitive. Market players in developing economies offer low-cost, outsourced services to the production and designing sectors to increase their competitiveness. Furthermore, key players are striving to gain a competitive advantage by engaging in mergers and acquisitions. Some of the key developments in the market are:

- March 2020 - Advanced Circuits inaugurated its newest facility at Chandler. The company has invested USD 7 million in this new 50,000-square-foot location, which opened in September 2019. This State-of-the-art facility is a welcome addition to the company's manufacturing facilities in Aurora, Colorado, and Maple Grove, Minnesota. It is twice the size of the old facility in Tempe, Arizona.

- March 2020 - Sanmina Corporation announced the expansion of its facility in Thailand. The facility is expected to have advanced custom packaging and assembly capabilities to manufacture advanced optical, high speed, and radiofrequency microelectronic assemblies and products. This expansion further supports rapid growth for new technology products across the networking, 5G, data center, automotive/LIDAR, and aerospace and defense markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 Type of Activity

- 6.1.1 PCB Assembly Services

- 6.1.2 Cable/Harness Assembly Services

- 6.1.3 Membrane/Keypad Switch Assembly Services

- 6.2 Application

- 6.2.1 Healthcare

- 6.2.2 Automotive

- 6.2.3 Industrial

- 6.2.4 IT and Telecom

- 6.2.5 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amphenol Interconnect Products Corp. (AIPC)

- 7.1.2 ATL Technology

- 7.1.3 Compulink Cable Assemblies Inc.

- 7.1.4 Connect Group NV

- 7.1.5 Leoni Special Cables Ltd

- 7.1.6 Season Group International Co. Ltd

- 7.1.7 Volex Group PLC

- 7.1.8 Mack Technologies Inc.

- 7.1.9 TTM Technologies Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219