|

市场调查报告书

商品编码

1630177

电阻RAM:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Resistive RAM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

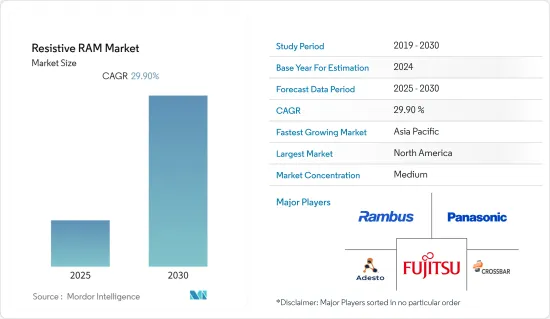

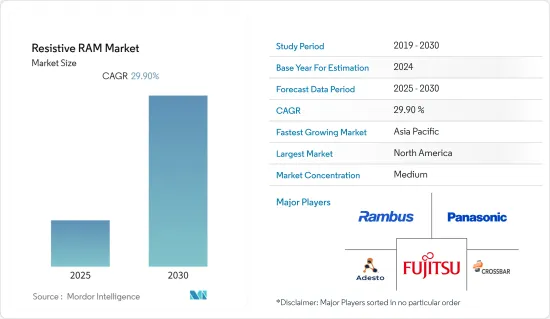

电阻式 RAM 市场预计在预测期内复合年增长率为 29.9%

主要亮点

- 此外,世界不同地区越来越多地采用可穿戴设备和人工智慧设备等感测器技术,推动了对高速资料传输和高储存密度的需求,极大地促进了电阻式随机存取记忆体市场的成长它带来了机会和可能性。

- 此外,多家记忆体公司正在投资 ReRAM 技术。例如,去年四月,非挥发性记忆体技术供应商 CrossBar Inc. 宣布将其 ReRAM 技术用于安全储存和处理,其中抵抗逆向工程和物理攻击是我所做的系统的基本要求。该公司的技术目前可用于需要更高等级内容安全性的记忆体应用。

- 电阻式随机存取记忆体 (ReRAM) 作为非挥发性记忆体 (NVM) 的替代品越来越受欢迎,尤其是在效能和能源效率不断提高的云端和资料中心中。 ReRAM 技术实现了 64pJ/单元程式能量,比 NAND 提高了 20%,可满足用户透过视讯串流等加值服务以及透过物联网 (IoT) 的机器对资料日益增长的需求,同时展示更低的读取延迟和更快的写入版本比闪存。此外,3D 垂直 ReRAM 阵列提供高效能记忆体子系统,可取代资料中心环境中基于 DRAM 或基于快闪记忆体的标准 SSD,从而以更小的外形规格和更低的能耗提供更快的资料处理、储存和搜寻。

- 然而,电阻式随机存取记忆体成本的上升和各种技术应用的复杂性构成了阻碍预测期内市场成长的重大挑战。

- 此外,COVID-19 的爆发主要是由于供应链中断,一些公司出现了用于製造的电感器和电容器等组件的短缺,这很可能减缓了市场的整体预期成长。然而,在接下来的几年中,新材料的创新和引入预计将推动全球各行业对电阻式随机存取记忆体的需求。

电阻式随机存取记忆体 (RAM) 市场趋势

消费性电子领域对连网型设备的需求不断增长,推动了对 ReRAM 的需求

- ReRAM 的运算速度比常规 RAM 更快,适用于读取密集型应用,使其成为伺服器储存层级记忆体的理想选择。此外,家用电子电器对互连设备的需求不断增长,感测器技术(包括穿戴式装置和人工智慧设备)的使用增加,以及工业参与者的发展预计将有助于市场发展。

- 例如,去年八月,全球能源技术营运商、全球最大的微型逆变器太阳能发电和储存系统製造商 Enphase Energy, Inc. 开始与 Home Connect 进行新的合作。这种可存取的数位网路使得使用单一应用程式控制许多製造商的家用电子电器产品成为可能。

- 与NAND快闪记忆体等其他非挥发性储存技术相比,ReRAM 的主要优势是其更快的切换速度。 ReRAM 的功耗比NAND快闪记忆体低很多。这使其成为工业、汽车和物联网 (IoT) 应用感测器设备记忆体的理想选择。神经形态计算是 ReRAM 的另一个潜在应用。

- 近年来,我们看到对穿戴式装置、物联网和基于人工智慧的系统等连网型设备的巨大需求。这些设备中使用电阻式 RAM 来增加储存容量。此外,随着智慧城市和智慧家庭的出现,连接设备的数量预计将增加,对大记忆体容量伺服器的需求也预计会增加。

- 为了满足新的物联网需求,多家公司正在引入连接和扩展远端控制的创新技术,以实现即时、安全和高频宽的物联网应用。例如,去年 9 月,安全智慧无线创新先驱 Silicon Labs 宣布推出定义物联网的新产品,包括 Amazon Sidewalk、Matter、Wi-SUN 和 Wi-Fi 6。创新解决方案组合,这些解决方案专注于互通性、支援多重通讯协定并显着扩展我们强大且安全的产品组合。

亚太地区预计将占据主要市场份额

- 预计在预测期内,亚太地区将在全球变阻随机存取记忆体市场中占据强势地位。中国、韩国和印度是推动亚太地区市场成长的主要国家。家用电子电器和汽车产业的崛起正在推动亚太国家对电阻式随机存取记忆体的需求。

- 此外,许多公司正在该地区建立资料中心,这也增加了电阻式RAM市场的需求。由于企业伺服器、资料中心、人工智慧和互联基础设施的成长,印度、中国和日本等新兴市场将推动该地区的市场成长。

- 中国正在发展国内积体电路产业,并计划製造更多晶片。此外,该地区製造商的大量存在也是市场的主要贡献因素。中国是全球一些晶圆代工厂的所在地,这些工厂在全球半导体产业中日益壮大。

- 基于ReRAM技术的製造商投资不断增加,推动了市场成长率。例如,专注于新型ReRAM记忆体产品及相关衍生产品研发的鑫源半导体,已成长为中国领先的新型记忆体技术公司。

- 此外,2022年3月,富士通半导体储存解决方案有限公司宣布推出MB85AS12MT,这是富士通ReRAM产品系列中容量最高的12Mbit ReRAM。该新产品是一款非挥发性记忆体,具有 12Mbit 的大容量,封装尺寸约为 2mm x 3mm。

电阻式随机存取记忆体 (RAM) 产业概述

电阻式RAM市场的竞争非常激烈,有几家大公司进入市场。 Rambus Inc.、Panasonic Corporation、Adesto Technologies、Fujitsu Ltd 和 Crossbar Inc. 等主要公司都在该市场营运。这些领先公司专注于扩大产能并利用策略合作措施来提高市场占有率和盈利。

2022 年 11 月,英飞凌科技将台积电的电阻式 RAM (RRAM) 非挥发性记忆体 (NVM) 技术整合到其新一代汽车微控制器中。 RRAM 是一种新兴的微控制器嵌入式快闪记忆体技术,可提供汽车设计所需的可靠性,并可扩展到 28 奈米以上製程技术。该技术具有很强的抗干扰能力,无需擦除即可逐位写入,同时提供与当前快闪记忆体技术相当的耐用性和资料保存。

为全球半导体产业开发下一代储存技术的 Weebit Nano Limited 宣布,其电阻式随机存取记忆体 (ReRAM) 模组将获得全面的技术资格,该模组主要由其研发合作伙伴 CEA-Leti 製造。 。这是 Weebit ReRAM 技术的首次全面认证,也是每个半导体产品新目标製程中必须完成的重要一步。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 对物联网、云端运算和巨量资料的需求不断增长

- 自动化机器人应用需求快速成长

- 市场限制因素

- 技术应用的复杂性增加

第 6 章 技术概览

- 材料类型

- OxRRAM

- CBRAM

- 奈米金属丝

- 解决方案类型概述

第七章市场概况

第八章市场区隔

- 目的

- 嵌入式(类比IC、MCU/SoC/ASIC/ASSP、记忆体内运算)

- 独立(快速/可靠的记忆体、程式码/资料储存、低延迟储存、持久记忆体)

- 最终用户

- 工业/物联网/穿戴/汽车

- SSD/资料中心/工作站

- 地区

- 美洲

- 欧洲

- 中国

- 日本

- 亚太地区(不包括中国和日本)

第9章 竞争格局

- 公司简介

- Crossbar Inc.

- 4DS Memory Limited

- Dialog Semiconductor PLC

- Fujitsu Semiconductor Memory Solution Limited

- Weebit-Nano Ltd

- Xinyuan Semiconductor(Shanghai)Co., Ltd.

第十章投资分析

第十一章 投资分析市场的未来展望

The Resistive RAM Market is expected to register a CAGR of 29.9% during the forecast period.

Key Highlights

- Further, the growing adoption of sensor technology, such as wearable and AI-enabled devices in various regions throughout the world, has boosted the demand for fast data transfers and high storage density, which in turn is providing a tremendous chance or possibility for the growth of the resistive random access memory market globally.

- Moreover, various multiple memory companies are investing in ReRAM technology. For instance, in April last year, CrossBar Inc., a non-volatile memory technology provider, announced new applications of its ReRAM technology for usage in secure storage and processing, where resistance to reverse engineering and physical attacks is an essential requirement of the system. The company's technology is now being offered for use in memory applications requiring higher levels of content security.

- Resistive random-access memory (ReRAM) is gaining traction as non-volatile memory (NVM) alternative, particularly in cloud and data center contexts where performance and energy efficiency are constantly improving. ReRAM technology has demonstrated lower read latency and quicker write version than flash memories while also achieving 64pJ/cell program energy, which is a 20% improvement over NAND, as the demand for data grows from users through premium services such as video streaming and from machines through the Internet of Things (IoT). In addition, the 3D vertical ReRAM arrays provide high-performance memory subsystems capable of replacing standard DRAM- or flash-based SSDs in data center environments, allowing faster data processing, storage, and retrieval in significantly smaller form factors with lower energy consumption.

- However, the soaring costs of resistive random-access memory and the complexity in various technological applications have become crucial challenges that can hinder the market's growth throughout the forecast period.

- Moreover, the COVID-19 pandemic is likely impeding the overall anticipated growth of the market, mainly attributed to the supply chain disruption, with several companies witnessing a scarcity of components like inductors and capacitors for manufacturing. But over the subsequent years, the innovation and implementation of new materials are expected to boost the demand for resistive random access memory in diverse verticals throughout the world.

Resistive Random Access Memory (RAM) Market Trends

Increasing Demand of Connected Devices Under Consumer Electronics Segment is Fueling the Demand for ReRAM

- ReRAMs can compute faster than ordinary RAMs, are better for read-intensive applications, and are ideal for storage-class memory in servers. Further, rising consumer electronics demand for interconnected devices, the increasing usage of sensor technologies, including wearable and AI-enabled gadgets, and developments by industry players, are expected to contribute to market growth.

- For instance, in August last year, Enphase Energy, Inc., a worldwide energy technology business and the world's largest producer of microinverter-based photovoltaic and storage systems launched a new collaboration with Home Connect. This accessible digital network enables home appliances of many manufacturers to be controlled with a single app.

- Higher switching speed constitutes a principal advantage of ReRAM over other nonvolatile storage technologies such as NAND flash. ReRAM draws much less power than NAND flash. That makes it best suited for memory in sensor devices for industrial, automotive, and internet of things (IoT) applications. Neuromorphic computing is another potential application for ReRAM.

- Over the past few years, a significant demand for connected devices, such as wearables, IoT, and AI-based systems, has been witnessed. Resistive RAMs are used in these devices to increase storage capacities. Moreover, with the upcoming smart cities and smart homes, the number of connected devices is bound to increase, which, in turn, will increase the demand for strong memory capacity servers.

- To serve emerging IoT requirements, several companies are introducing innovations to connect and scale remote operations, bringing real-time, secure, and bandwidth-heavy IoT applications to fruition. For instance, in September last year, Silicon Labs, the pioneer in secure, smart wireless innovation for a better-connected world, unveiled a portfolio of innovative solutions that significantly expanded its interoperability-driven, multiprotocol-supporting, and robustly-secure range with new solutions to advance the breakthroughs and patterns defining the Internet of Things, such as Amazon Sidewalk, Matter, Wi-SUN, and Wi-Fi 6.

The Asia Pacific Expected to Hold a Major Share of the Market

- The Asia Pacific is expected to have a strong position in the global resistive random access memory market over the forecast period. China, South Korea, and India are some of the major countries that drive market growth in the Asia Pacific region. The increasing consumer electronics and automotive industry primarily fuel the demand for resistive random access memory in Asia Pacific countries.

- Moreover, many organizations are establishing data centers in this region, which will also extend the demand for the resistive RAM market. Developing nations, such as India and China, and Japan, will drive the market's growth in this region owing to the growing enterprise server, data centers, AI, and connected infrastructure.

- China is developing its domestic IC industry and plans to make more chips. The significant presence of manufacturers in the region is also a major contributing factor to the market. China is home to several global foundries with growing clout in the global semiconductor sector.

- The growing investments in the ReRAM technology-based manufacturers are boosting the market growth rate. For instance, Xinyuan Semiconductor, which focuses on the R&D of ReRAM's new memory products and associated derivative goods, has grown into China's leading new memory technology firm.

- Further, in March 2022, Fujitsu Semiconductor Memory Solution Limited revealed the release of the MB85AS12MT, a 12Mbit ReRAM with the highest capacity in Fujitsu's ReRAM product line. This new invention is non-volatile storage with a high memory capacity of 12Mbit in a compact package size of about 2mm x 3mm.

Resistive Random Access Memory (RAM) Industry Overview

The Resistive RAM Market is moderately competitive and consists of several major players. Market players such as Rambus Inc., Panasonic Corporation, Adesto Technologies, Fujitsu Ltd, and Crossbar Inc., among others, are some of the major companies operating in the market. These major players are focused on expanding their production capacity and leveraging strategic collaborative initiatives to increase their market share and profitability.

In November 2022, Infineon Technologies launched TSMC's Resistive RAM (RRAM) Non-Volatile Memory (NVM) technology in its next generation of automotive microcontrollers. RRAM is an emerging embedded flash technology for microcontrollers that scales to 28nm process technologies and beyond with the reliability needed for automotive designs. The technology is more immune to interference and enables bit-wise writing without the requirement of erasing while having endurance and data retention performance comparable to current flash memory technology.

In October 2022, Weebit Nano Limited, a developer of next-generation memory technologies for the worldwide semiconductor industry, declared that it had completed the complete technology qualification of its Resistive Random-Access Memory (ReRAM) module that is mainly manufactured by its R&D partner CEA-Leti. This is the first-ever full qualification of Weebit ReRAM technology, a crucial step that must be completed for every semiconductor product on each new target process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for IoT, Cloud Computing, and Big Data

- 5.1.2 Surging Demand for Application of Automation Robots

- 5.2 Market Restraints

- 5.2.1 Complexity in Technological Applications

6 TECHNOLOGY SNAPSHOT

- 6.1 Material Type

- 6.1.1 OxRRAM

- 6.1.2 CBRAM

- 6.1.3 Nano Metal Filament

- 6.2 Overview of Solution Types

7 NVM MARKET OVERVIEW - Providing coverage for overall NVM (non-volatile memory) shipments. Shipments will be provided in terms of the number of equivalent 12-inch wafers, along with major trends and recent developments, etc.

8 MARKET SEGMENTATION

- 8.1 Application

- 8.1.1 Embedded (Analog ICs, MCU/SoC/ASIC/ASSPs, In-Memory Computing)

- 8.1.2 Standalone (Fast/Reliable Memory, Code/Data Storage, Low-latency Storage and Persistent Memory)

- 8.2 End-user

- 8.2.1 Industrial/IoT/Wearables/Automotive

- 8.2.2 SSD/Datacenters/Workstations

- 8.3 Geography

- 8.3.1 Americas

- 8.3.2 Europe

- 8.3.3 China

- 8.3.4 Japan

- 8.3.5 Asia-Pacific (excluding China and Japan)

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Crossbar Inc.

- 9.1.2 4DS Memory Limited

- 9.1.3 Dialog Semiconductor PLC

- 9.1.4 Fujitsu Semiconductor Memory Solution Limited

- 9.1.5 Weebit-Nano Ltd

- 9.1.6 Xinyuan Semiconductor (Shanghai) Co., Ltd.