|

市场调查报告书

商品编码

1630183

刚性散装包装:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Rigid Bulk Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

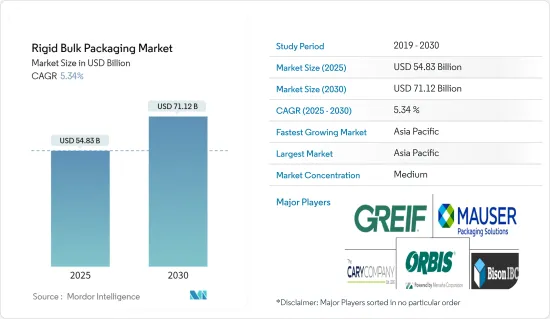

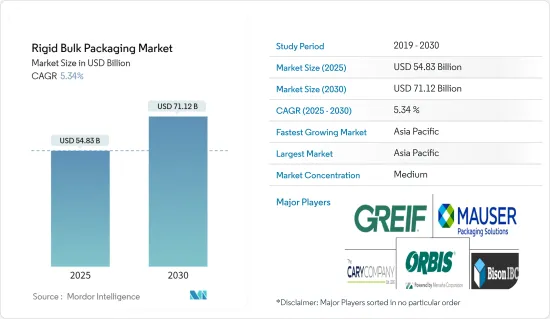

硬质散装包装市场规模预计到2025年为548.3亿美元,预计到2030年将达到711.2亿美元,预测期内(2025-2030年)复合年增长率为5.34%。

主要亮点

- 随着地区之间运输的资源和产品数量不断增加,散装包装变得至关重要。刚性散装包装市场包括用于储存和运输散装液体和颗粒材料的解决方案。这包括食品成分、溶剂、化学品、药品,甚至是大量处理的工业设备。

- 硬质散装包装市场与全球进出口活动密切相关。重工业对桶和桶等产品表现出强劲的需求。另一方面,物流和短途运输严重依赖物料输送货柜和中型散货箱(IBC)。

- 随着各种最终用户产业对化学品和石油润滑剂的需求不断增加,以及对加强供应链能力的重视,对工业钢桶的需求预计将激增。根据 InfralineEnergy 的报告,印度是该地区第二大润滑油消费国,也是美国和中国之后的世界第三大润滑油消费国。

- 润滑油在加工工业中发挥着重要作用,对于汽车零件(尤其是煞车和引擎)至关重要,可确保其平稳运行。由于活塞发动机润滑油进出口的增加以及重视车辆性能的消费者数量的增加,该市场正在不断增长。化工、采矿和非传统能源等行业预计将成为工业润滑油的最大消费者。这一趋势增强了对工业润滑油的需求,并标誌着市场上硬包装的使用不断增加。

- 塑胶污染极大地导致了环境退化,许多研究都强调了其有害影响。作为回应,欧洲与其他几个国家一起颁布了法规来限制全球塑胶的使用。这些全球立法倡议迫使企业进行创新,并专注于工业包装中的永续和可重复使用的产品。

刚性散装包装市场趋势

工业容器桶市场预计将占据主要份额

- 工业桶经常用于运输和储存危险和非危险材料。最常用于化工、化肥、石油和石油工业。支持工业滚筒市场成长的因素之一是这些细分市场的不断扩张以及过去十年国际贸易活动的活性化。

- 传统的蓝色塑胶桶常见于仓储设施、超级市场、仓库等。许多工业产品都装入蓝色塑胶桶中。食品级塑胶桶是安全储存和运输食品的理想选择。此外,在长期运输和储存消耗品之前,食品企业使用的塑胶桶必须经过适当的净化并证明其安全。

- 此外,该国不断扩大的农业部门预计将显着增加对钢桶的需求,特别是在化学品、粮食和化肥应用方面。根据国际谷物理事会(IGC)2024年4月发布的报告,全球粮食产量将从2020/2021年的22.27亿吨持续成长至2023/2024年的23.01亿吨,并且还在增加。预计这种需求成长趋势将在预测期内持续下去,从而导致对刚性散装包装容器和桶的需求增加。

- 最常见的工业储存类型之一是塑胶桶。大批量工业产品的长期储存和运输具有多种功能和许多好处。大多数塑胶桶为蓝色,由 HDPE(高密度聚苯乙烯)製成。塑胶桶有多种尺寸,大多数尺寸从 30 公升到 220 公升不等。

- 此外,纸板桶由于能够提高生产力和降低成本,在化学和肥料行业中越来越受到重视。各国之间化肥和化学品的运输预计将扩大,加速各种工业桶的成长。

- 此外,各个最终用户产业对化学品和石油润滑剂的需求不断增加,以及对加强供应链能力的大力关注,预计将推动对工业钢桶的需求。据InfralineEnergy称,印度是该地区第二大润滑油消费国,也是仅次于美国和中国的全球第三大润滑油消费国。

亚太地区占最大市场占有率

- 亚太地区的工业和製造业正在迅速发展,随着製造地不断扩大到中国、印度和印尼等新兴经济体,硬质散装包装的使用预计将会增加。中国纸板桶产量呈现乐观成长态势。就以金额为准,它令马来西亚和新加坡等其他国家相形见绌。

- 当地和知名公司对复杂产品包装解决方案的兴趣日益浓厚,从而产生了更高品质的纸板桶。零售业的成长和对可回收纸板桶等轻质散装容器的日益偏好是影响纸板桶市场的关键因素。使用纸板桶的主要优点是可回收,亚太地区硬质散装市场前景广阔。

- 二十多年来,在居民消费和资本投资、工业产值、进出口持续成长的拉力下,中国经济维持了较高的成长速度。过去几十年来,中国对工业包装的需求也遵循着类似的趋势。此外,预计未来十年生产和需求将继续增长,这有望支持该国工业包装市场的成长。

- 据印度品牌公平联合会称,印度是全球最大的学名药供应国。印度製药业供应全球一半以上的疫苗需求、美国40%的非专利药需求和英国所有药品的25%。在全球范围内,印度的药品产量排名第 3 位,金额排名第 14 位。随着製药业的发展,该国的药品包装业务也将成长,并有望推动该地区的刚性散装包装市场。

- 此外,亚洲国家化学品及相关工业出口的成长正在推动对硬质散装包装产品(如桶、容器、圆桶和提桶)的需求。根据印度储备银行和商业情报总局的资料,2023 财年印度有机和无机化学品出口额超过 24,353.6 亿印度卢比(290.2 亿美元)。这高于上一财年 21,890.7 亿印度卢比(260.8 亿美元)的估值。因此,化学品出口的激增预计将导致预测期内市场走强。

刚性散装包装产业概述

刚性散装包装市场已细分,主要参与者包括 Greif Inc.、FDL Packaging Group、Mondi PLC 和 BWAY Corporation。此外,包装市场的其他主要企业正在采取收购和伙伴关係策略来进入市场并增加其产品。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 市场动态

- 市场驱动因素

- 永续和可回收包装材料的出现

- 化学和製药业产量增加

- 市场限制因素

- 环境法规是市场成长的挑战

- 市场驱动因素

第五章市场区隔

- 按材质

- 塑胶

- 金属

- 木头

- 其他的

- 副产品

- 工业散装货柜

- 鼓罐

- 桶罐

- 盒子

- 其他散装货柜

- 按最终用户产业

- 食物

- 饮料

- 工业的

- 医药/化工

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚洲

- 印度

- 中国

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 北美洲

第六章 竞争状况

- 公司简介

- ORBIS Corporation

- FDL Packaging Group Ltd

- Bison IBC Ltd

- Wadpack Pvt Ltd

- Greif Inc.

- The Cary Company

- Hoover Container Solutions

- ITP Packaging

- Mauser Packaging Solutions

- Mondi PLC

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 60379

The Rigid Bulk Packaging Market size is estimated at USD 54.83 billion in 2025, and is expected to reach USD 71.12 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

Key Highlights

- As the volume of resources and products transported across regions continues to rise, the significance of bulk packaging has become paramount. The rigid bulk packaging market comprises solutions for storing and transporting bulk liquids and granulated substances. These include food ingredients, solvents, chemicals, pharmaceuticals, and even industrial equipment, all handled in large quantities.

- The rigid bulk packaging market is closely tied to global import and export activities. Heavy manufacturing industries show a strong demand for products like drums and pails. In contrast, logistics and short-distance transportation of goods heavily rely on materials handling containers and intermediate bulk containers (IBCs).

- With a growing demand for chemicals and petroleum lubricants across diverse end-user industries and a pronounced emphasis on bolstering supply chain capabilities, the need for industrial steel drums is set to surge. As reported by InfralineEnergy, India ranks as the second-largest lubricant consumer in its region and holds the third position globally, trailing only the United States and China.

- Lubricants play a crucial role in processing industries and are vital for automobile parts, especially brakes and engines, ensuring their smooth operation. The market is witnessing growth, fueled by rising imports and exports of piston engine lubricants and an increasing consumer emphasis on vehicle performance. Industries such as chemicals, mining, and unconventional energy are anticipated to be the largest consumers of industrial lubricants. This trend bolsters the demand for industrial lubricants and hints at a heightened use of rigid packaging in the market.

- Plastic pollution has significantly contributed to environmental degradation, with numerous studies highlighting its detrimental effects. In response, European regions, alongside several other nations, have enacted regulations to curb plastic usage globally. These worldwide legislative measures have forced companies to innovate, focusing on sustainable and reusable products in industrial packaging.

Rigid Bulk Packaging Market Trends

The Industrial Containers and Drums Segment is Expected to Hold a Significant Share

- Industrial drums are frequently used for transporting and storing hazardous and non-hazardous commodities. They are most commonly used in the chemical, fertilizer, oil, and petroleum industries. One factor supporting the growth of the industrial drum market is the continued expansion of these segments and rising international trade activities over the past 10 years.

- Traditional blue plastic drums are familiar in storage facilities, supermarkets, and warehouses. Many industrial objects fit in blue plastic drums. Food-grade plastic drums are ideal for securely storing and transporting food. Additionally, plastic drums used in the food business should be properly decontaminated and certified as safe before transporting and storing consumables over an extended period.

- Further, the expanding agricultural industry in the country is anticipated to generate considerable demand for steel drums, particularly in chemicals, food grains, and fertilizer applications within the region. According to the International Grains Council (IGC) report published in April 2024, global grain production has consistently increased from 2,227 million metric tons in FY 2020/2021 to 2,301 million metric tons in FY 2023/2024. This rising demand trend is expected to continue during the forecast period, leading to an increased demand for rigid bulk packaging containers and drums.

- One of the most common types of industrial storage is plastic drums. The long-term storage and transportation of large quantities of industrial commodities serve multiple functions and offer numerous advantages. Most plastic drums are blue and made of HDPE (high-density polyethylene), a robust type of plastic that can be molded easily and lasts for many years. Plastic drums come in a variety of sizes, often ranging from 30 to 220 liters.

- Moreover, fiber drums are becoming more prominent in the chemical and fertilizers industry because they improve productivity and reduce expenses. The expansion of fertilizer and chemical traffic between various countries is predicted to accelerate the growth of different industrial drums.

- Further, the rise in the demand for chemicals and petroleum lubricants from various end-user industries and a significant focus on strengthening the supply chain capability is expected to drive the need for industrial steel drums. According to InfralineEnergy, India is the second-largest lubricant consumer in the region and the third-largest globally, after the United States and China.

Asia-Pacific to Hold the Largest Market Share

- The rapidly evolving industrial and manufacturing industry in Asia-Pacific is expected to increase the usage of rigid bulk packaging as manufacturers continue expanding their manufacturing bases to emerging economies like China, India, and Indonesia. China has shown optimistic growth in the production of fiber drums. In terms of value, it has a strong hold over other countries such as Malaysia and Singapore.

- The rising concerns for sophisticated product packaging solutions by local and renowned players have translated into better quality fiber drums. The growing retail industry and the increasing preference for lightweight bulk containers such as recyclable fiber drums are key factors affecting the fiber drums market. The primary benefit of utilizing fiber drums is their recyclability, leading to a positive outlook for the rigid bulk market in Asia-Pacific.

- The Chinese economy maintains a high speed of growth, which has been stimulated by consecutive increases in consumer consumption and capital investment, industrial output, and import and export for over two decades. The demand for industrial packaging in China has followed a similar trend in the past few decades. Also, both production and demand are expected to continue to grow in the next decade, which is expected to support the growth of the industrial packaging market in the country.

- India is the world's top supplier of generic pharmaceuticals, according to the Indian Brand Equity Federation. The Indian pharmaceutical industry supplies more than half of the global demand for vaccines, 40% of the generic demand in the United States, and 25% of all pharmaceuticals in the United Kingdom. Globally, India ranks third in terms of pharmaceutical production by volume and 14th by value. The country's pharmaceutical packaging business will grow as the pharmaceutical industry grows, driving the rigid bulk packaging market in the region.

- Also, the growth of chemical and allied industry exports from Asian countries is driving the demand for rigid bulk packaging products like drums, containers, drums, and pails. Data from the Reserve Bank of India and the Directorate General of Commercial Intelligence reveal that in fiscal year 2023, India exported organic and inorganic chemicals worth over INR 2435.36 billion (USD 29.02 billion). This marked an uptick from the prior fiscal year's valuation of INR 2189.07 billion (USD 26.08 billion). As a result, this surge in chemical exports is poised to strengthen the market during the forecast period.

Rigid Bulk Packaging Industry Overview

The rigid bulk packaging market is fragmented, with many major players like Greif Inc., FDL Packaging Group, Mondi PLC, and BWAY Corporation. Additionally, the other major players in the packaging market are adopting acquisition and partnership strategies to enter the market and grow offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Dynamics

- 4.4.1 Market Drivers

- 4.4.1.1 Emergence of Sustainable and Recyclable Packaging Materials

- 4.4.1.2 Growing Production Volume of Chemical and Pharmaceutical Industries

- 4.4.2 Market Restraint

- 4.4.2.1 Environmental Legislations Challenge the Market Growth

- 4.4.1 Market Drivers

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Pastic

- 5.1.2 Metal

- 5.1.3 Wood

- 5.1.4 Other Materials

- 5.2 By Product

- 5.2.1 Industrial Bulk Containers

- 5.2.2 Drums

- 5.2.3 Pails

- 5.2.4 Boxes

- 5.2.5 Other Bulk Containers

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Industrial

- 5.3.4 Pharmaceutical and Chemical

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.3 Asia

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia and New Zealand

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ORBIS Corporation

- 6.1.2 FDL Packaging Group Ltd

- 6.1.3 Bison IBC Ltd

- 6.1.4 Wadpack Pvt Ltd

- 6.1.5 Greif Inc.

- 6.1.6 The Cary Company

- 6.1.7 Hoover Container Solutions

- 6.1.8 ITP Packaging

- 6.1.9 Mauser Packaging Solutions

- 6.1.10 Mondi PLC

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219