|

市场调查报告书

商品编码

1630184

耐化学涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Chemical Resistant Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

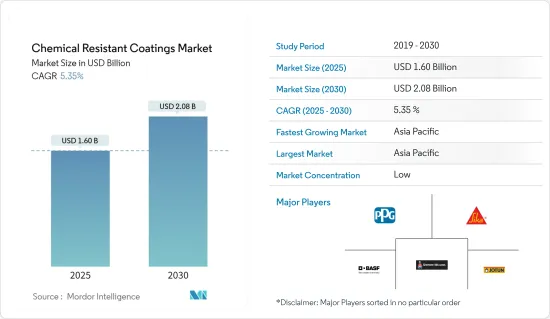

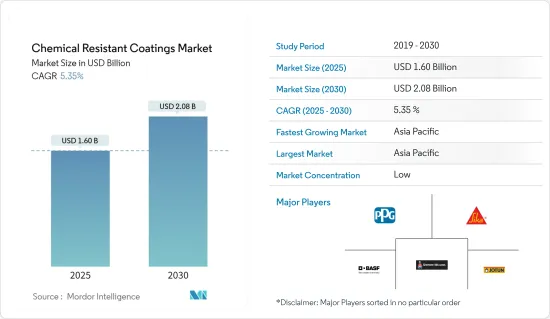

耐化学涂料市场规模预计到 2025 年为 16 亿美元,预计到 2030 年将达到 20.8 亿美元,预测期内(2025-2030 年)复合年增长率为 5.35%。

耐化学腐蚀涂料市场受到了 COVID-19 的负面影响。 2020 年上半年实施了封锁和旅行限制,导致上半年大部分时间工业停摆。由于世界各国政府的监管,石油和天然气需求大幅下降。然而,下半年,大多数行业都在以最低产能运作,旅行限制的取消和停工的放鬆对受访市场来说是积极的迹象。

主要亮点

- 短期来看,亚太地区基础设施发展和工业化活动的扩大,以及亚太和北美地区石油和天然气活动的扩大是市场成长的主要驱动力。

- 另一方面,复杂的製造流程和高投资成本预计将阻碍市场成长。

- 木质素基聚氨酯的发展预计将为市场提供成长机会。

- 预计亚太地区在预测期内将占据最大的市场占有率。

耐化学腐蚀涂料的市场趋势

石油和天然气领域主导市场

- 石油和天然气领域是耐化学涂料市场的主要最终用户之一。由于业务运营涉及高温环境,该细分市场本质上需要耐化学性。此外,除了高温之外,涂料还用于保护暴露在潮湿和潮湿气候条件下的金属和钢骨免受腐蚀和化学物质的影响。

- 海上石油和天然气生产涉及一些最恶劣的条件。因此,在那里使用的涂层系统也必须满足类似的条件。

- 在海上,长时间暴露在穿透性紫外线下以及不断接触汹涌的海水,增加了对耐化学腐蚀涂料的需求。

- 美国在过去连续六年保持世界主要石油生产国的地位。 2023 年,平均石油产量达到创纪录的 1,290 万桶/日,超过了 2019 年创下的纪录。 2023年12月,美国月均原油产量突破1,330万桶/日(b/d),创月度新高。

- 二迭纪盆地横跨德克萨斯州西部和新墨西哥州东部,近年来对推动美国原油和天然气总产量快速成长发挥了至关重要的作用。美国目前的原油产量达到前所未有的水平,约为每天 1,350 万桶。此外,主要能源公司正在整合其业务,以增加德克萨斯州和新墨西哥州二迭纪盆地的产量。埃克森美孚拟以约600亿美元收购页岩巨头先锋自然资源公司,雪佛龙计画以530亿美元收购赫斯公司。

- 在印度,石油和天然气公司 (ONGC) 于 2024 年 1 月开始在孟加拉湾附近的克里希纳戈达瓦里盆地的一个深水区块生产石油。该区块剩余油气天然气田预计于2024年中期投入运营,尖峰时段产量预计将超过每天45,000桶石油和1,000万立方公尺天然气。

- 沙乌地阿拉伯探明石油蕴藏量约占全球17%,位居全球第二,是最重要的石油净出口国。石油出口收益已用于现代化基础设施、创造就业机会和改善社会指标。沙特阿美公司是一家领先的综合能源和化学公司,业务涉及上、中、下游多个领域。

- 2023年3月,沙乌地阿美宣布2023年资本支出目标为450亿美元至550亿美元。该计画的目标是到2027年将石油产量增加到每天1,300万桶。然而,由于2024年1月沙乌地阿拉伯能源部命令造成的干扰,阿美公司取消了将原油产能从1,200万桶/日增加至1,300万桶/日的计画。

- 因此,石油和天然气行业的成长预计将在预测期内增加对所研究市场的需求。

中国主导亚太市场

- 在亚太地区,中国是GDP最大的经济体。中国在亚太地区的建筑业中占据主导地位,在住宅和基础设施计划上进行了大量投资。

- 中国国家统计局资料显示,2023年建筑业对GDP的贡献率约为6.8%。

- 住宅及城乡建设部2024年1月宣布,至2023年,我国将实施都市区老龄住宅小区维修计划5.37万个,惠及897万户家庭。这些维修计划一年内就吸引了近2,400亿元人民币(约337.8亿美元)的巨额投资。

- 近年来,主要建筑公司(欧盟)向中国扩张进一步推动了该行业的成长。此外,到2030年,中国预计将在建设上花费约13兆美元。

- 国家能源总署预计,2023年我国原油和总合总产量预计将突破3.9亿吨油当量,再创历史新高。原油产量突破2.08亿吨,较2022年增加超过300万吨。而且,中国天然气产量连续7年每年稳定成长100亿立方米,上年达2,300亿立方米。

- 2021年至2025年的五年间,中国国家石油公司(NOC)预计将在钻井和油井服务上花费超过1,200亿美元。由于中国对石油和天然气的需求不断增长,预计未来几年该国的钻探活动将会很高。

- 由于上述因素,预计亚太地区对耐化学腐蚀涂料的需求在预测期内将大幅增加。

耐化学腐蚀涂料产业概况

耐化学腐蚀涂料市场是细分的,并且有大型跨国公司。主要参与企业包括PPG工业公司、西卡股份公司、宣伟公司、BASF公司和佐敦公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大亚太和北美的石油和天然气活动

- 亚太地区基础建设发展与工业化进程

- 抑制因素

- 生产流程复杂、投资成本高

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 树脂

- 环氧树脂

- 聚酯纤维

- 氟树脂

- 聚氨酯

- 其他的

- 科技

- 100%固体

- 溶剂型

- 粉末

- 水性的

- 最终用户产业

- 化学

- 石油和天然气

- 海洋

- 建筑基础设施

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Akzonobel NV

- Daikin Industries Ltd

- Hempel AS

- Jotun

- Kansai Paint Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

- VersaFlex Incorporated

第七章 市场机会及未来趋势

- 木质素基聚氨酯的开发

- 其他机会

The Chemical Resistant Coatings Market size is estimated at USD 1.60 billion in 2025, and is expected to reach USD 2.08 billion by 2030, at a CAGR of 5.35% during the forecast period (2025-2030).

Due to COVID-19, the chemical resistant coatings market has been negatively impacted. Due to the imposed lockdowns in the first half of 2020, and travel restrictions, the industries were shut for the most part of the first half of the year. The Oil and gas demand has fallen drastically due to the restrictions imposed by the governments across the globe. However, in the second half of the year most of the industries were working at a minimum capacity, and the lifting of travel restrictions and relaxation of the lockdowns are a positive sign for the market studied.

Key Highlights

- Over the Short term, the major factor driving the growth of the market studied include growing infrastructure and industrialization activities in Asia-Pacific region and expansion in oil and gas activities in Asia-pacific and North America region.

- On the flipside, complex production process and high investment cost are expected to hinder the growth of the market studied.

- The development of lignin-based polyurethanes is expected to give the market a chance to grow.

- Asia-Pacific is expected to hold the most considerable market share over the forecast period.

Chemical Resistant Coatings Market Trends

Oil and Gas Segment to Dominate the Market

- Oil and gas sector is one of the major end-users for the chemical resistant coatings market. The sector essentially requires chemical resistance, owing to a high temperature environment in its business operations. In addition, apart from high-temperature, the coating is used to prevent metal and steel structures from corrosion and chemicals, as they are exposed to moist and damp climatic conditions.

- Offshore oil and gas production has some of the most demanding conditions. Therefore, coating systems used in it are to be equipped likewise.

- Offshore, prolonged exposure to penetrating UV rays and constant contact with rough seawater increases the need for chemical-resistant coatings.

- The United States has maintained its position as the leading crude oil producer globally for the past six consecutive years. In 2023, the country achieved a record-breaking average crude oil production of 12.9 million barrels per day (b/d), surpassing the previous record set in 2019. In December 2023, the average monthly crude oil production in the United States reached a monthly record high, surpassing 13.3 million barrels per day (b/d).

- The Permian Basin, spanning western Texas and eastern New Mexico, has played a pivotal role in driving the surge in total crude oil and natural gas production across the United States in recent years. The United States is currently producing an unprecedented volume of oil, reaching approximately 13.5 million barrels per day. In addition, major energy corporations are consolidating their operations to boost production from the Permian Basin in Texas and New Mexico. ExxonMobil intends to acquire the shale giant Pioneer Natural Resources for nearly USD 60 billion, while Chevron is planning to purchase Hess for USD 53 billion.

- in Indua, in January 2024, the state-run Oil and Natural Gas Corporation (ONGC) initiated oil production from its deep-water block in the Krishna-Godavari basin off the coast of the Bay of Bengal. The block's remaining oil and gas fields are anticipated to commence operations by mid-2024, with peak production estimated at 45,000 barrels of oil per day and over 10 million metric standard cubic meters per day of gas.

- With approximately 17% of the world's proven petroleum reserves, Saudi Arabia ranks among the most significant net petroleum exporters, boasting the second-largest proven oil reserves globally. Proceeds generated from oil exports have been used to modernize infrastructure, create employment, and improve social indicators. Saudi Aramco, a leading integrated energy and chemicals company, operates extensively across upstream, midstream, and downstream segments.

- In March 2023, Aramco unveiled a capital expenditure goal of USD 45-USD 55 billion for FY 2023, representing its most significant capital spending plan. This initiative aimed to support an increase in oil production to 13 million barrels per day by 2027. However, the disruption caused by the Saudi Ministry of Energy's order in January 2024 prompted Aramco to halt its plans to elevate crude production capacity from 12 million to 13 million barrels daily

- Therefore, the growing oil and gas sector is expected to boost the demand for the market studied, during the forecast period.

China to Dominate the Asia-Pacific Market

- In Asia-Pacific, China is the largest economy, in terms of GDP. China is the dominant force in the Asia-Pacific construction landscape, fueled by substantial investments in residential and infrastructure projects.

- Data from China's National Bureau of Statistics highlights that in 2023, the construction sector contributed approximately 6.8% to the nation's GDP.

- In 2023, China undertook renovation projects for 53,700 aging residential communities in urban areas, benefiting 8.97 million households, as the Ministry of Housing and Urban-Rural Development reported in January 2024. These renovation endeavors attracted hefty investments of nearly CNY 240 billion (around USD 33.78 billion) for the year.

- In the recent years, the entry of major construction players (from the European Union) in China has further fueled the growth of this industry. Moreover, China is expected to spend nearly USD 13 trillion on building by 2030.

- According to the National Energy Administration, China's combined crude oil and natural gas production in 2023 was forecasted to exceed 390 million tons of oil equivalent, reaching a new historical high. Crude oil output exceeded 208 million tons, indicating a growth of over 3 million tons compared to 2022. Additionally, China's natural gas production steadily increased by 10 billion cubic meters annually for the past seven years, reaching 230 billion cubic meters in the preceding year.

- China's national oil companies (NOCs) are expected to splurge more than USD 120 billion on drilling and well services in the five years between 2021 and 2025. Due to China's growing demand for oil and gas, the country is expected to witness a high level of drilling activity in years to come.

- Owing to above-mentioned factors, the demand for chemical resistant coatings in Asia-Pacific is expected to increase significantly over the forecast period.

Chemical Resistant Coatings Industry Overview

The chemical resistant coatings market is fragmented, with the presence of majorly multi-national players. Some of the major players include PPG Industries Inc., Sika AG, The Sherwin-Williams Company, BASF SE, and Jotun, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expansion of Oil and Gas Activities in APAC and North America

- 4.1.2 Growing Infrastructure and Industrialization in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Complex Production Process and High Investment Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Fluoropolymers

- 5.1.4 Polyurethane

- 5.1.5 Other Resins

- 5.2 Technology

- 5.2.1 100% Solids

- 5.2.2 Solvent Borne

- 5.2.3 Powder

- 5.2.4 Water-borne

- 5.3 End-user Industry

- 5.3.1 Chemical

- 5.3.2 Oil and Gas

- 5.3.3 Marine

- 5.3.4 Construction and Infrastructural

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Qatar

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Akzonobel NV

- 6.4.3 Daikin Industries Ltd

- 6.4.4 Hempel AS

- 6.4.5 Jotun

- 6.4.6 Kansai Paint Co. Ltd

- 6.4.7 PPG Industries Inc.

- 6.4.8 RPM International Inc.

- 6.4.9 Sika AG

- 6.4.10 The Sherwin-Williams Company

- 6.4.11 VersaFlex Incorporated

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Lignin-based Polyurethanes

- 7.2 Other Opportunities