|

市场调查报告书

商品编码

1630187

贴合黏剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Laminating Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

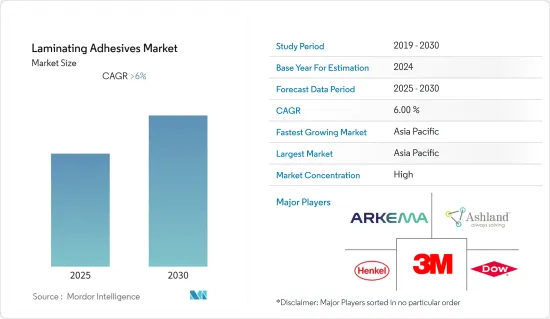

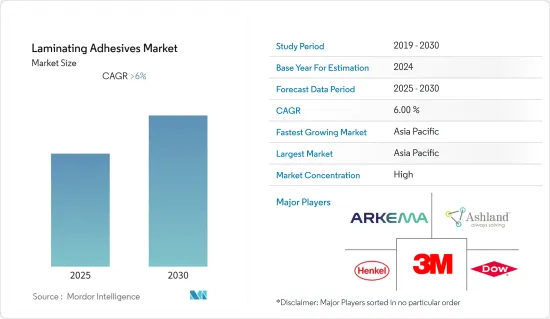

预计贴合黏剂市场在预测期内复合年增长率将超过 6%

新冠疫情大流行对目前的研究市场产生了负面影响。然而,在新冠疫情大流行之后,由于包装和运输对黏合层压板的需求增加,促进了黏合层压板市场的復苏。短期内,食品和饮料行业对包装食品的需求不断增加预计将推动市场成长。

主要亮点

- 另一方面,对塑胶废物和水性黏合剂性能限制的日益担忧预计将阻碍市场成长。

- 由于食品和饮料行业对软包装的需求不断增加,包装行业在市场中占据主导地位,预计在预测期内将增长。

- 亚太地区主导全球市场,最大的消费来自中国和印度等国家。

贴合黏剂市场趋势

包装产业可望主导市场

- 包装是製造业企业考虑的重要因素之一。随着製造设备、食品加工厂的增加和工业生产的增加,全球包装产业正经历强劲成长。

- 近年来,随着製造业和工业部门适应软包装,包装产业经历了转型。在全球包装产业中,硬包装产业的份额正被软包装产业夺走。软包装因其具有重量轻、易于搬运、占用空间小、保质期长、易于运输、不易损坏、可印刷性高等优点而受到欢迎。

- 贴合黏剂广泛应用于软包装。软包装中的贴合加工是用黏合剂连接两个或多个包装捲材的过程。这些网可以是薄膜、纸或铝箔的形式。将贴合黏剂施加到幅材的吸收性较低的基底上,然后压到第二幅材上。

- 消费者对便利包装和包装产品的偏好不断变化,促进了食品和饮料行业包装的成长。食品加工产业是软包装的最大用户,占总需求的50%以上。

- 随着人口的增加,对包装食品的需求不断增加,以及不同地区众多的市场成长机会,许多食品製造跨国公司(MNC)正在建立製造设施,这正在增加包装需求,并推动对贴合黏剂的需求不断增加。

- 美国是北美最大的包装商品消费国,其次是加拿大和墨西哥。这场流行病也改变了消费模式,使软包装变得更加重要,特别是考虑到与未包装商品相关的风险。预计这将推动未来对贴合黏剂的需求。

- 根据 Statista 的数据,美国有机包装食品市场将于 2022 年增至 213.9 亿美元,而 2017 年为 160.9 亿美元。因此,对包装食品的需求不断增长预计将推动对贴合黏剂的需求。

- 因此,随着包装需求的增加,预计贴合黏剂市场在预测期内也将出现显着的需求成长。

亚太地区主导市场

- 亚太地区在全球市场占有率中占据主导地位。中国、印度和日本等国家的製造业活动不断增加,以及对软包装的需求不断增长,正在推动贴合黏剂在该地区的使用。

- 由于中国、印度和日本等主要国家的食品需求,亚太地区是包装产业最大的消费国。与其他国家相比,中国包装产业起步较晚,历经数十年才发展成为颇具规模的产业。

- 中国包装产业的成长主要得益于中阶人口的成长、供应链系统的完善以及电子商务活动的兴起。此外,在后疫情时代,全国范围内对食品安全和品质的日益关注预计将推动食品加工业的发展,并进一步推动未来几年的包装需求。

- 印度是包装食品和饮料的主要消费国之一。印度包装工业协会 (PIAI) 表示,预测期内包装产业预计将成长 22%。

- 未来几年,印度对冷冻食品的需求预计将增加 17% 左右。此外,随着印度政府对食品加工产业的重视,未来五年加工农产品的供应预计将增加,这将刺激该国包装产业的需求,从而导致贴合黏剂市场的成长。

- 上述因素,加上政府的支持,可能会导致预测期内该地区贴合黏剂消费需求的增加。

贴合黏剂产业概况

贴合黏剂市场因其性质而得到巩固。市场的主要参与企业包括(排名不分先后)Henkel AG &Co.KGaA、Arkema Group、Dowdupont Inc、Ashland 和 3M。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 软包装产业快速成长

- 食品和饮料业对包装食品的需求增加

- 抑制因素

- 水性黏合剂的性能限制

- 人们对塑胶垃圾的担忧与日俱增

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(收益单位:百万美元)

- 类型

- 溶剂型

- 水性的

- 无溶剂

- 其他类型(UV 和 EB)

- 目的

- 包装

- 食品包装

- 医疗包装

- 其他的

- 工业的

- 运输

- 其他的

- 包装

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema

- Ashland

- Coim Group

- DIC India Limited

- Dowdupont Inc.

- Evonik Industries AG

- Flint Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- hubergroup

- LD Davis.

- Sika AG

- TOYOCHEM CO., LTD.

- Toyo-Morton, Ltd.

第七章市场机会与未来趋势

- 加速使用无溶剂层压黏合剂

The Laminating Adhesives Market is expected to register a CAGR of greater than 6% during the forecast period.

The Covid pandemic negatively affected the current studies market. However, post covid pandemic, the rising demand for adhesive laminates from packaging and transportation helped revive the market for adhesive laminates. Over the short term, the increasing demand for packed food from the food and beverage industry is expected to drive the market's growth.

Key Highlights

- On the flip side, growing concerns regarding plastic disposal and performance limitations of water-based adhesives are expected to hinder the growth of the market studied.

- The packaging industry dominated the market and is expected to grow during the forecast period, owing to the increasing demand for flexible packaging in the food and beverage industry.

- Asia-Pacific dominated the market across the world, with the largest consumption from the countries such as China and India.

Laminating Adhesives Market Trends

The Packaging Industry is Expected to Dominate the Market

- Packaging is one of the key factors considered by firms engaged in the manufacturing industry. The global packaging industry is witnessing robust growth with the growing number of manufacturing units, food processing plants, and increasing industrial production.

- In the last few years, the packaging industry is experiencing a transition where the manufacturing and industrial sectors adapted to flexible packaging. The rigid packaging industry is losing its share of the flexible packaging industry in the global packaging industry. The benefits of lightweight, easy handling, less space-consuming, longer shelf life, easy transit, damage resistance, and better printability have made flexible packaging popular.

- Laminating adhesives are extensively used in flexible packaging. Laminating in flexible packaging is a process where two or more packaging webs are joined together using a bonding agent. These webs can be in the form of films, papers, or aluminum foils. Laminating adhesive is applied to the less absorbent substrate of the web, which is then pressed against the second web.

- This shift in consumer preference for convenient packaging and packaged products contributed to packaging growth in the food and beverage sector. The food-processing sector is the largest user of flexible packaging, accounting for more than 50% of the total demand.

- With the increasing population, rising demand for packaged foods, and numerous market growth opportunities in different regions, many food manufacturing multinational companies (MNCs) are setting up their manufacturing facilities, which, in turn, is increasing the demand for packaging and boosting the demand for laminating adhesives.

- The United States is North America's largest consumer of packaged goods, followed by Canada and Mexico. Due to the pandemic, consumption patterns have also changed, and flexible packaging became much more significant, particularly given the risks associated with unpackaged goods. It is expected to boost the demand for laminating adhesives in the future.

- According to Statista, the market for organic packaged food in the United States is increased to USD 21.39 billion in 2022 compared to USD 16.09 billion in 2017. Thus, the rising demand for packaged food is expected to boost the demand for laminating adhesives.

- Hence, with the increasing demand for packaging, the market for laminating adhesives is also expected to register a noticeable growth in demand during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing manufacturing activities and the increasing need for flexible packaging in countries such as China, India, and Japan, the usage of laminating adhesives is increasing in the region.

- Asia-Pacific is the largest consumer of the packaging industry, owing to the demand for food in major economies such as China, India, and Japan. Compared to other countries, China is a late starter in the packaging industry, which grew into a large-scale industry over the decades.

- The packaging industry growth in China is mainly attributed to the rising middle-class population, improvement of the supply-chain system, and emerging e-commerce activities over the years. Furthermore, the growing attention to food safety and quality in post-pandemic times across the nation is likely to drive the food processing industry, which will further contribute to the packaging demand in the coming years.

- India is one of the major consumers of packaged foods and beverages. According to the Packaging Industry Association of India (PIAI), the packaging industry is expected to grow at 22% during the forecast period.

- The demand for frozen foods in India is expected to grow by approximately 17% in the next few years. Moreover, with the Indian government focusing on the food processing sector, the supply of processed agri-foods is expected to rise over the next five years, which, in turn, may stimulate the demand for the packaging industry in the country and consequently help to laminate adhesives market to grow.

- The factors above, coupled with government support, may contribute to the increasing demand for laminating adhesives consumption in the region during the forecast period.

Laminating Adhesives Industry Overview

The Laminating Adhesives Market is consolidated in nature. The major players in this market (not in a particular order) include Henkel AG & Co. KGaA, Arkema Group, Dowdupont Inc, Ashland, and 3M.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Growth in the Flexible Packaging Industry

- 4.1.2 Increasing Demand for Packed Food from the Food and Beverage Industry

- 4.2 Restraints

- 4.2.1 Performance Limitations of Water Based Adhesives

- 4.2.2 Growing Concerns Regarding Plastic Disposal

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Revenue in USD Million)

- 5.1 Type

- 5.1.1 Solvent-borne

- 5.1.2 Water-borne

- 5.1.3 Solvent-less

- 5.1.4 Other Types (UV and EB)

- 5.2 Application

- 5.2.1 Packaging

- 5.2.1.1 Food Packaging

- 5.2.1.2 Medical Packaging

- 5.2.1.3 Other Packaging

- 5.2.2 Industrial

- 5.2.3 Transportation

- 5.2.4 Other Applications

- 5.2.1 Packaging

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Coim Group

- 6.4.5 DIC India Limited

- 6.4.6 Dowdupont Inc.

- 6.4.7 Evonik Industries AG

- 6.4.8 Flint Group

- 6.4.9 H.B. Fuller Company

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 hubergroup

- 6.4.12 LD Davis.

- 6.4.13 Sika AG

- 6.4.14 TOYOCHEM CO., LTD.

- 6.4.15 Toyo-Morton, Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Accelerating Usage of Solvent-less Lamination Adhesives