|

市场调查报告书

商品编码

1851607

液压泵:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Hydraulic Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

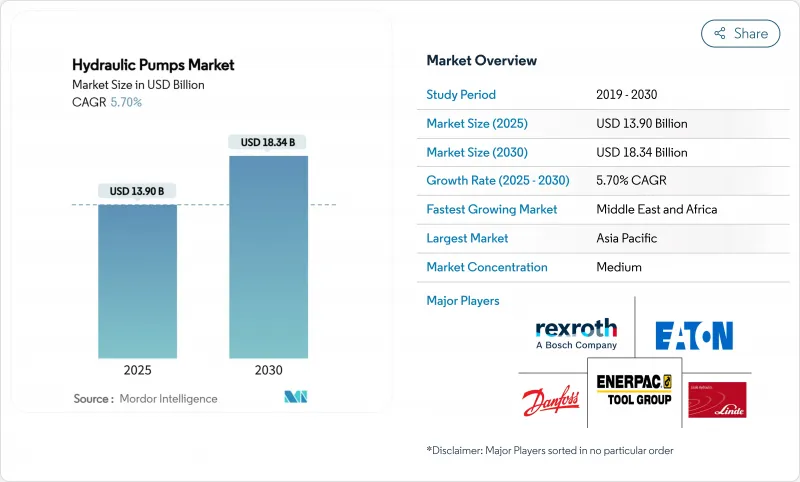

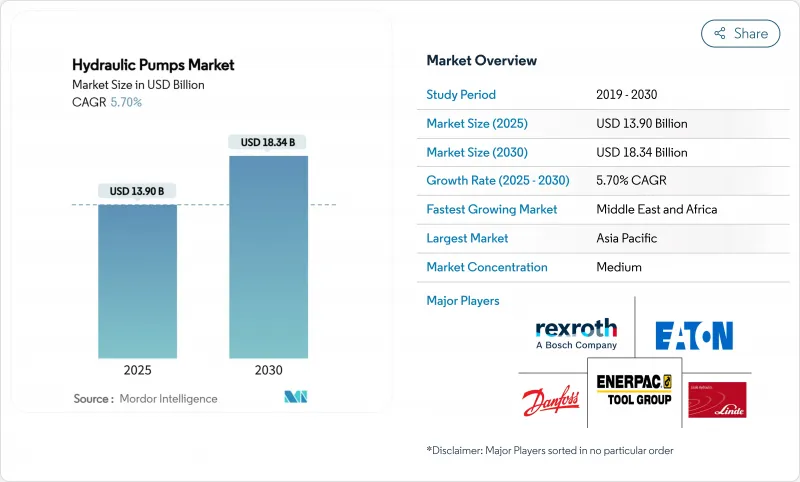

预计到 2025 年,液压帮浦市场规模将达到 139 亿美元,到 2030 年将成长至 183.4 亿美元,复合年增长率为 5.70%。

建筑、可再生能源和自动化製造业对大容量流体动力设备的强劲需求正推动市场稳步扩张。中国和印度的基础设施更新计画以及欧盟和北美流程工业的升级改造持续支撑着基准需求。能源转型投资正在为风力发电机变桨和偏航系统、氢电解槽压缩模组以及电网级电池冷却迴路等领域创造新的机会。製造商正积极回应,推出更有效率的活塞泵设计、智慧控制包以及符合循环经济指令的再製造服务。市场竞争依然适中,全球领导企业正着力强化其数位化产品组合,而区域供应商则专注于成本敏感应用领域。

全球液压帮浦市场趋势与洞察

中国和印度的基础设施更新计划

预计到2025年,两国政府资助的在建工程将推动每年对液压泵的需求超过1,350万台。公共部门计划的在地化政策鼓励合资企业,并将约42亿美元引入高科技帮浦的生产领域,加速国内产能建设。采用中国设备标准的区域承包商正在将其供应链扩展到中东和非洲,从而拓宽亚太地区製造商的出口前景。预计这些项目将支撑到2027年的基准需求,特别是对额定压力高于5000 psi的液压泵的需求。

工业自动化(工业4.0维修)

采用变频驱动的智慧电源单元可将待机能耗降低 25%。物联网闸道可将即时资料传输至预测性维护平台,降低营运成本 45%,并将计画外排放事件减少 75%。数位双胞胎模型可远端最佳化,从而节能 30%,并将总拥有成本降低 20%。美国网路安全与基础设施安全局 (CISA) 发布了关于泵浦控制器漏洞的建议,该漏洞的 CVSS 评分为 9.8,网路安全问题日益受到关注。

镍钢价格波动剧烈

随着美国基础设施建设支出恢復,含镍合金成本在2024年底前持续上涨,随后开始回落,并在2025年初反弹,这挤压了泵浦製造商的利润空间,并使库存计划变得更加复杂。高压(3000 psi以上)型号的泵浦将受到最大衝击,因为安全标准要求使用优质钢材。依赖进口优质合金的中国製造商面临外汇风险和物流额外费用。

细分市场分析

受移动机械需求的推动,齿轮泵预计在2024年将保持37%的市场份额。活塞泵的成长速度将超过市场平均水平,到2030年将以6.80%的复合年增长率增长,因为原始设备製造商(OEM)正朝着更高的容积效率和更精确的排气量控制方向发展。派克汉尼汾的PV140系列活塞螺旋泵将继续服务那些需要平稳流量和船用级可靠性的特定应用领域。

第二代活塞式液压帮浦采用硬化滑阀和强化斜盘,将平均故障间隔时间延长至15,000小时,使用寿命是上一代产品的两倍。此技术在加长型堆高机、挖土机和射出成型机的应用,凸显了系统在能源优化和排放减排方面的专注。预计活塞式液压泵在工业和可再生能源领域的市场份额将持续扩大。

到2024年,3000-5000 psi等级的泵浦将占全球市场价值的42%,涵盖主流建筑和农业钻机。 5000 psi以上的泵浦市场正以每年8.30%的速度成长,主要受氢气压缩、离岸风电和先进加工中心等产业的推动。 North Ridge Pumps公司获得ATEX防爆认证的多级增压帮浦可满足电解槽开发商在1000 bar压力下连续运作的需求。而3000 psi以下的泵浦则可在对成本敏感且性能阈值的市场中保持产能稳定性。

上游创新主要集中在密封系统和精细加工表面,以限制极端压力下的洩漏。双相不銹钢和奈米涂层等材料科学突破旨在提高抗疲劳性,而即时压力衰减演算法则可防止灾难性故障。这些进步正在增强高压液压泵专家在能源转型计划中的市场份额。

液压泵市场按泵浦类型(齿轮泵浦、叶片泵浦及其他)、工作压力范围(<3,000 psi、3,000-5,000 psi、>5,000 psi)、应用领域(移动液压、工业机械、流程、能源)、天然气使用者产业(建筑、石油及其他)及地区进行细分。市场预测以美元计价。

区域分析

亚太地区的领先地位源自于其无与伦比的生产规模和国内消费能力,光是中国在2025年就计画采购1,350万台。印度的智慧城市计画等政府项目正在资助水资源管理、地铁建设和经济适用房计划,这些项目都需要高压液压系统。川崎的K3VL轴向柱塞系列液压系统经常被指定用于高阶挖土机。供应链中断和技术纯熟劳工短缺正在推动自动化和区域分散化向越南和印尼转移。

中东的快速成长依赖石油和天然气再投资以及可再生能源多元化发展。沙乌地阿拉伯公共投资基金正投入数十亿美元建造太阳能和风力发电场,液压偏航变桨驱动装置有助于确保涡轮机的运作。阿联酋的电网升级改造正在进口高压泵,用于变电站冷却和海水淡化。在达曼和阿布达比的联合生产缩短了前置作业时间,并满足了在地采购的要求。

北美和欧洲拥有技术先进的设备车队。美国的《基础设施投资与就业法案》重振了土木工程支出,推动了滑移装载机和摊舖机的更换。欧盟促进循环经济的法规正在创造新的再製造收入,并增加对符合EN ISO 14971认证的环保泵浦的需求。这两个地区都面临技术人员老化的挑战,因此远距离诊断的应用日益普及,以缓解服务瓶颈。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 中印基础设施更新计划

- 工业自动化(工业4.0改装)

- 非公路用电气化需要电动液压泵

- 对风力发电机偏航和变桨系统的需求

- 氢气电解槽的建造(泵压超过1000巴)

- 强制性再製造配额(欧盟循环经济)

- 市场限制

- 镍和钢铁价格波动剧烈

- 全电动致动器的快速普及

- 智慧型帮浦的网路安全风险

- 註册流体动力工程师短缺

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按泵类型

- 齿轮

- 叶片

- 活塞

- 拧紧

- 按工作压力范围

- 小于3000磅/平方英寸

- 3,000-5,000 psi

- 超过5000磅/平方英寸

- 按最终用户行业划分

- 建造

- 石油和天然气

- 发电业务

- 饮食

- 水和污水

- 化学

- 其他(农业、矿业、汽车业)

- 透过使用

- 移动式油压设备

- 工业机械

- 过程能源(包括风能、水能和氢能)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他拉丁美洲地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bosch Rexroth AG

- Eaton Corporation plc

- Danfoss Power Solutions A/S

- Enerpac Tool Group Corp.

- Linde Hydraulics GmbH and Co. KG

- Dynamatic Technologies Limited

- HYDAC International GmbH

- Parker Hannifin Corporation

- Kawasaki Heavy Industries Ltd.

- Daikin Industries Ltd.

- Bucher Hydraulics GmbH

- KYB Corporation

- Shimadzu Corporation

- Permco Inc.

- Casappa SpA

- Ningbo Baichi Hydraulic

- HAWE Hydraulik SE

- Sun Hydraulics LLC

- Bosch Mahle Turbosystems Hydraulic(BMT)

- Bosch Rexroth India Pvt Ltd(regional)

第七章 市场机会与未来展望

The hydraulic pumps market size is estimated at USD 13.9 billion in 2025 and is forecast to climb to USD 18.34 billion by 2030, advancing at a 5.70% CAGR.

Robust demand for high-capacity fluid-power equipment in construction, renewable energy, and automated manufacturing keeps the market on a steady expansion path. Infrastructure renewal programmes in China and India, combined with process-industry upgrades in the European Union and North America, continue to anchor baseline demand. Energy transition investments are unlocking new opportunities in wind-turbine pitch and yaw systems, hydrogen electrolyser compression modules, and grid-scale battery storage cooling circuits. Manufacturers are responding with higher-efficiency piston pump designs, intelligent control packages, and remanufacturing services that align with circular-economy mandates. Competition remains moderate, with global leaders reinforcing digital portfolios while regional suppliers target cost-sensitive applications.

Global Hydraulic Pumps Market Trends and Insights

Infrastructure renewal programs in China and India

Government-funded construction pipelines in both nations sustain annual demand for more than 13.5 million hydraulic pump units by 2025. Localization rules for public-sector projects incentivise joint ventures, channelling roughly USD 4.2 billion into high-tech pump production and accelerating domestic capability building. Regional contractors adopting Chinese equipment standards are extending the supply chain into the Middle East and Africa, broadening export prospects for APAC manufacturers. These programmes are expected to underpin baseline demand through 2027, particularly for units rated above 5000 psi.

Industrial automation (Industry 4.0 retrofits)

Smart power units equipped with variable-frequency drives trim idle-time energy consumption by 25%. IoT gateways stream real-time data into predictive-maintenance platforms, cutting operating costs by 45% and reducing unplanned emissions events by 75%, as shown in UK water-utility trials with Sulzer controllers. Digital twin models enable remote optimisation that delivers 30% energy savings and 20% reduction in total cost of ownership. Cyber-security remains a rising concern following US CISA advisories on pump-controller vulnerabilities carrying CVSS scores up to 9.8.

Volatile nickel-steel prices

Nickel-bearing alloy costs climbed through late-2024 on renewed US infrastructure spending before receding, then rebounded in early-2025, compressing pump-maker margins and complicating inventory planning. High-pressure (>3000 psi) models suffer the most, as safety codes mandate premium steel grades. Chinese producers, reliant on imported high-grade alloy, face added currency risk and logistics surcharges.

Other drivers and restraints analyzed in the detailed report include:

- Off-highway electrification needs electro-hydraulic pumps

- Hydrogen electrolyser build-out (>1000 bar pumps)

- Rapid penetration of all-electric actuators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gear pumps retained 37% revenue share in 2024 on the strength of mobile-machinery demand. Piston pumps are outpacing at 6.80% CAGR to 2030 as OEMs migrate toward higher volumetric efficiency and precise displacement control. Parker Hannifin's PV140 piston series recorded 14,000 operating hours between overhauls in Australian mining vehicles, illustrating lifecycle cost advantages. Vane and screw pumps continue serving niche applications requiring smooth flow or marine-grade reliability.

Second-generation piston designs use hardened spool valves and reinforced swash plates to extend mean-time-between-failure to 15,000 hours, doubling service life relative to legacy units. Their adoption in telehandlers, excavators, and injection-moulding machines underscores a systemic pivot toward energy optimisation and reduced CO2 footprints. The hydraulic pumps market size for piston technology is expected to capture an incremental share in both industrial and renewable-energy installations.

The 3000-5000 psi class represented 42% of global value in 2024, covering mainstream construction and agricultural rigs. Pumps rated above 5000 psi are growing 8.30% annually, propelled by hydrogen compression, offshore wind, and advanced machining centres. North Ridge Pumps' multi-stage boosters, certified for ATEX zones, meet electrolyser developers' need for continuous duty at 1000 bar. Below-3000-psi units maintain volume stability in cost-sensitive markets where performance thresholds remain modest.

Upstream innovation focuses on sealing systems and micro-finish surfaces to curb leakage at extreme pressures. Material-science breakthroughs in duplex stainless and nano-coatings aim to raise fatigue resistance, while real-time pressure-derating algorithms prevent catastrophic failures. These advances reinforce the hydraulic pumps market share held by high-pressure specialists amid energy-transition projects.

Hydraulic Pumps Market Segmented by Pump Type (Gear, Vane, and More), Operating-Pressure Range (<3, 000 Psi, 3, 000 - 5, 000 Psi, >5, 000 Psi), Application (Mobile Hydraulics, Industrial Machinery, Process and Energy), End-User Vertical (Construction, Oil and Gas, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC's leadership derives from unmatched production scale and domestic consumption, with China alone purchasing 13.5 million units in 2025. Government programmes such as India's Smart Cities Mission funnel capital into water-management, metro-rail, and affordable-housing projects requiring high-pressure hydraulic systems. Japanese suppliers continue to set benchmarks for reliability; Kawasaki's K3VL axial piston line is frequently specified on premium excavators. Supply-chain disruptions and skilled-labour shortages encourage automation and regional diversification into Vietnam and Indonesia.

The Middle East's swift growth rests on oil-and-gas reinvestment and renewable diversification agendas. Saudi Arabia's Public Investment Fund channels billions into solar- and wind-farm construction, where hydraulic yaw and pitch drives underpin turbine uptime. UAE's transmission grid upgrades import high-pressure pumps for substation cooling and seawater desalination. Joint-venture manufacturing in Dammam and Abu Dhabi shortens lead times and meets local-content mandates.

North America and Europe maintain technologically advanced fleets. The US Infrastructure Investment and Jobs Act revived civil works outlays, fuelling replacements across skid-steer loaders and pavers. EU regulations promoting circular-economy compliance create new remanufacturing revenue and elevate demand for eco-design pumps certified under EN ISO 14971. Both regions contend with an ageing technician workforce, prompting wider deployment of remote diagnostics to ease service bottlenecks.

- Bosch Rexroth AG

- Eaton Corporation plc

- Danfoss Power Solutions A/S

- Enerpac Tool Group Corp.

- Linde Hydraulics GmbH and Co. KG

- Dynamatic Technologies Limited

- HYDAC International GmbH

- Parker Hannifin Corporation

- Kawasaki Heavy Industries Ltd.

- Daikin Industries Ltd.

- Bucher Hydraulics GmbH

- KYB Corporation

- Shimadzu Corporation

- Permco Inc.

- Casappa S.p.A.

- Ningbo Baichi Hydraulic

- HAWE Hydraulik SE

- Sun Hydraulics LLC

- Bosch Mahle Turbosystems Hydraulic (BMT)

- Bosch Rexroth India Pvt Ltd (regional)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure renewal programmes in China and India

- 4.2.2 Industrial automation (Industry 4.0 retrofits)

- 4.2.3 Off-highway electrification needs electro-hydraulic pumps

- 4.2.4 Wind-turbine yaw and pitch system demand

- 4.2.5 Hydrogen electrolyser build-out (>1 000 bar pumps)

- 4.2.6 Mandatory remanufacturing quotas (EU Circular Economy)

- 4.3 Market Restraints

- 4.3.1 Volatile nickel-steel prices

- 4.3.2 Rapid penetration of all-electric actuators

- 4.3.3 Cyber-security risks in smart pumps

- 4.3.4 Shortage of certified fluid-power technicians

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Pump Type

- 5.1.1 Gear

- 5.1.2 Vane

- 5.1.3 Piston

- 5.1.4 Screw

- 5.2 By Operating-Pressure Range

- 5.2.1 <3,000 psi

- 5.2.2 3,000 - 5,000 psi

- 5.2.3 >5,000 psi

- 5.3 By End-user Vertical

- 5.3.1 Construction

- 5.3.2 Oil and Gas

- 5.3.3 Power Generation

- 5.3.4 Food and Beverage

- 5.3.5 Water and Waste-water

- 5.3.6 Chemicals

- 5.3.7 Others (Agriculture, Mining, Automotive)

- 5.4 By Application

- 5.4.1 Mobile Hydraulics

- 5.4.2 Industrial Machinery

- 5.4.3 Process and Energy (incl. wind, hydro, hydrogen)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of Latin America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Bosch Rexroth AG

- 6.4.2 Eaton Corporation plc

- 6.4.3 Danfoss Power Solutions A/S

- 6.4.4 Enerpac Tool Group Corp.

- 6.4.5 Linde Hydraulics GmbH and Co. KG

- 6.4.6 Dynamatic Technologies Limited

- 6.4.7 HYDAC International GmbH

- 6.4.8 Parker Hannifin Corporation

- 6.4.9 Kawasaki Heavy Industries Ltd.

- 6.4.10 Daikin Industries Ltd.

- 6.4.11 Bucher Hydraulics GmbH

- 6.4.12 KYB Corporation

- 6.4.13 Shimadzu Corporation

- 6.4.14 Permco Inc.

- 6.4.15 Casappa S.p.A.

- 6.4.16 Ningbo Baichi Hydraulic

- 6.4.17 HAWE Hydraulik SE

- 6.4.18 Sun Hydraulics LLC

- 6.4.19 Bosch Mahle Turbosystems Hydraulic (BMT)

- 6.4.20 Bosch Rexroth India Pvt Ltd (regional)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment