|

市场调查报告书

商品编码

1630190

云端机器人 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Cloud Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

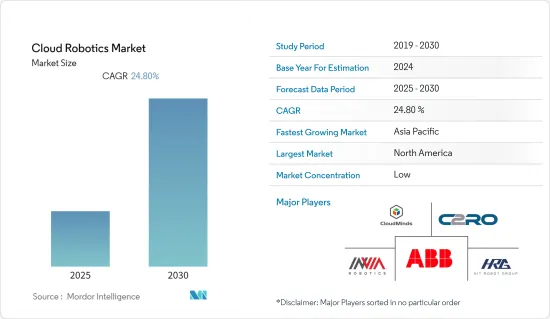

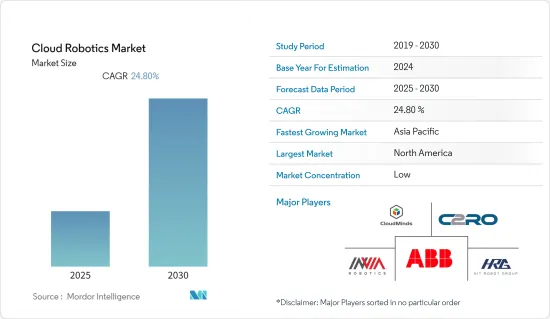

云端机器人市场预计在预测期内复合年增长率为 24.8%

主要亮点

- 在预测期内,云端基础的人工智慧和连接可能会显着推动云端机器人市场的发展。许多科技巨头开发了广泛使用的基于人工智慧的系统。因此,这些厂商对机器人市场的投资也将带来新的云端机器人解决方案的创新。

- 机器人、远端操作、MEC 和核心云端技术的整合有望改变各行业的业务运营、工业流程和消费者服务。云操作以及地面和空中机器人将极大地支援专用和通用机器人领域。在后一个例子中,我们相信,随着最终用户使用自主和远端操作的机器人来执行各种个人服务业务,普及率将会增加。

- 云端机器人市场预计将产生更广泛的机器人服务。这包括多种好处,包括更灵活的服务执行、减少操作摩擦(由于专有介面减少)以及云端基础的应用程式范例中的机器人即服务 (RaaS) 提高经济效益。最初,工业和政府客户将受益最多,其次是某些关键产业领域的公司。云端机器人市场最终将只向有限数量的客户开放。

- 机器人公司正在努力提高技术感知和理解工作环境的能力,并发展适应移动中动态操作情况的能力。这种情境察觉是透过整合感测器和机器学习来实现的。

- 智慧型设备的日益普及、频宽的发展以及云端流服务的兴起也促进了连网机器人市场的成长。 GSMA 预测,到 2025 年,物联网连接设备数量将达到约 251 亿台,高于 2017 年的 75 亿台。这为互联机器人及其平台市场带来了巨大的机会。

- 主要市场参与企业正在全球推出新的解决方案,增强云端机器人市场的未来成长机会。例如,2021年2月,HPE发布了HPE Open RAN解决方案堆迭,实现了Open RAN在全球5G网路中的大规模商业实施。 HPE Open RAN 解决方案堆迭包括 HPE编配和自动化工具、特定于 RAN 的基础设施设计以及通讯业者最佳化的设备。

- 由于许多公司因封锁而减少了员工,并且越来越多的公司需要集中监控来控制各种工业设备,因此对云端机器人的需求正在增加。因此,工业化程度的提高和自动化要求的提高增加了对云端机器人的需求。此外,製造业不断增长的需求以及医疗和化学行业对机器人和自动化解决方案快速增长的需求正在推动市场扩张。

云端机器人市场趋势

工业机器人需求不断成长推动市场成长

- 随着云端运算、巨量资料等新技术的发展,云端技术与机器人系统的融合将使得高效能、高复杂度的多机器人系统的设计成为可能。物联网的渗透和机器人技术投资的增加对工业机器人技术的成长做出了重大贡献。

- 国际机器人联合会表示,全球机器人安装量正在迅速恢復,使 2021 年成为机器人产业 (IFR) 历史上最成功的一年。 “持续的自动化趋势和持续的技术创新已将所有行业的需求推向高水准。” 」

- 此外,工业机器人的销售也大幅回升。全球出货量达到创纪录的 486,800 台,与前一年同期比较增长 27%。亚洲/澳洲的需求增幅最大,安装量成长 33%,达到 354,500 台。美洲销量为 49,400 辆,成长 27%。在欧洲,销量为 78,000 辆,实现了 15% 的两位数成长。

- 由于智慧工厂系统的采用,工业机器人在过去十年中出现了巨大的需求。随着工业机器人的发展,程式设计机器人在即时应用、准确性、稳健性、相容性等方面都达到了较高的性能水准。

- 中小型产业小批量、经济高效的解决方案的可用性正在影响工业自动化的采用。除此之外,透过将机器人、机器和自动化设备连接到云端,製造商可以从其自动化系统中获得最高水准的效能和执行时间。

亚太地区实现显着成长

- 亚太市场的推动因素是最终用户越来越多地采用云端运算以及机器人和自动化技术。该地区,特别是中国、印度和日本,拥有世界上最高的自动化采用率。

- 中国是亚太地区公有云的最大投资者。本地IaaS市场已成为中小企业建立游戏、视讯、行动互联网IT资源的首选。

- 随着下游製造业的復苏以及锂电池、新能源汽车等产品产量的扩大,预计中国工业机器人将快速成长。

- 过去八年,中国已成为全球最大的工业机器人市场。根据工业信部发布的五年规划,预计2021年至2025年我国机器人产业营业收入将以每年20%的速度成长。

- 对先进汽车製造的需求不断增长正在推动美国和中国公司之间的机器人伙伴关係。这很可能有助于中国发展云端服务并进一步开发亚太云机器人市场。

- 该地区的主要参与企业正在投资开发机器人云端解决方案。例如,2021年4月,达闼科技宣布完成总额超过1.53亿美元的B+轮资金筹措。这家总部位于上海的服务机器人公司表示,将继续开发住宅用的人形模型。

- CloudMinds 还声称正在利用云端运算为零售、教育、医疗保健和酒店业开发服务机器人。该公司的产品包括轮式人形机器人「XR-1服务机器人」、安全机器人「Cloud Patrol」和SoftBank Robotics的人形机器人「Cloud Pepper」。这些是透过 RaaS(机器人即服务)范例提供的。

- 此外,新加坡的 ASORO 实验室也建构了云端运算基础设施来产生环境的 3D 模型。这使得机器人能够比实验室中的电脑更快地同时定位和绘製地图。

云端机器人产业概况

云机器人市场较为分散。整体而言,现有竞争对手之间的竞争是温和的。此外,我们预期大公司和新兴企业之间会进行以创新为重点的收购和合作。

- 2021 年 11 月 - 智慧自动化产品、数位解决方案、技术和业务流程管理 (BPM) 领域的全球公司 Datamatics 宣布,Western Bainoona Group (WBG) 已成功采用 Datamatics TruBot 机器人流程自动化 (RPA) 解决方案。 WBG 是中东和非洲着名的工程和建设公司。在 RPA 和物联网 (IoT) 实施的早期阶段,四个关键业务已数位化,实现平稳、无错误的资料和支付处理流程。

- 2021 年 6 月 - 慧与宣布收购 Defined AI。这家总部位于旧金山的公司使用开放原始码机器学习 (ML) 平台提供强大且有弹性的软体堆迭,用于训练任何规模的人工智慧模型。透过将 Defined AI 独特的软体解决方案与世界领先的 AI 和高效能运算 (HPC) 服务相结合,HPE 使几乎所有行业的 ML 工程师都能够开发和训练机器学习模型,资料产生更快、更准确的见解。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 利用市场促进因素和市场限制因素

- 市场驱动因素

- 云端技术的兴起

- 各种最终用户对机器人技术的采用增加

- 市场限制因素

- 安全和隐私问题

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章技术概况

第六章 市场细分

- 副产品

- 软体

- 按服务

- 按用途

- 工业机器人

- 服务机器人

- 按最终用户产业

- 製造业

- 军事/国防

- 零售/电子商务

- 医学生命科学

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Hit Robot Group Co. Ltd

- ABB Ltd

- inVia Robotics Inc.

- C2RO Cloud Robotics

- CloudMinds Technologies Co. Ltd

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Rapyuta Robotics Co. Ltd

- Tend AI Inc.

- V3 Smart Technologies PTE Ltd

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 61413

The Cloud Robotics Market is expected to register a CAGR of 24.8% during the forecast period.

Key Highlights

- The cloud-based AI and connectivity are likely to significantly shape the cloud robotics market's development over the forecast period. Many technology giants have developed AI-based systems that are being widely used. Hence, the investment by these vendors in the robotics market will also innovate new solutions for cloud robotics.

- The convergence of robots, teleoperation, MEC, and core cloud technologies is poised to alter enterprise operations, industrial processes, and consumer services across various industry verticals. Cloud operations and terrestrial and aerial robots will significantly assist the purpose-built and general-purpose robotics segments. In the latter instance, mass consumerization will occur when end-users acclimate to autonomous and remote-control robots for a wide range of personal services tasks.

- The cloud robotics market will give birth to a greater range of robotics services. This is due to various variables, including significantly more flexible service execution, lower operational friction (due to fewer proprietary interfaces), and improved economics via robotics-as-a-service in a cloud-based application paradigm. Initially, industrial and government clients will profit the most, followed by enterprises in specific leading industry sectors. The cloud robotics market will eventually become available to customers in a limited capacity.

- Robotics businesses are working to improve their technology's ability to sense and understand their work settings and cultivate the ability to adjust to dynamic operational conditions on the go. This situational awareness is made possible by integrating sensors and machine learning.

- Increasing adoption of smart devices, the evolution of bandwidth, and rising cloud streaming services are also owing to the growth of the connected-robots market. The GSMA predicted that by 2025, there would be around 25.1 billion IoT-connected devices, which was 7.5 billion in 2017. This offers a massive opportunity for connected robots and their platform market.

- The key market players are globally coming up with new solutions, which enhance the future growth opportunities for the Cloud Robotic market. For instance, in February 2021, HPE announced the HPE Open RAN Solution Stack, enabling the commercial implementation of Open RAN at scale in global 5G networks. The HPE Open RAN Solution Stack contains orchestration and automation tools from HPE, RAN-specific infrastructure designs, and telco-optimized equipment.

- Lockdowns reduced the number of workforces in numerous businesses, which increased demand for cloud robotics as more and more companies need centralized monitoring to take control of diverse industrial instruments. Thus, growing industrialization and an increase in automation requirements increased the demand for cloud robotics. Furthermore, the growing need for manufacturing industries, as well as the spike in demand for robotics and automation solutions in the healthcare and chemical industries, fuel market expansion.

Cloud Robotics Market Trends

Rising Demand for Industrial Robotics to Augment the Market Growth

- With the development of cloud computing, big data, and other emerging technologies, the integration of cloud technology and robotic systems allows for designing multi-robot systems with high performance and high complexity. Growing penetration of the IoT and investments in robotics have been the major contributors to the growth of industrial robotics.

- According to the International Federation of Robotics, robot installations worldwide have recovered rapidly, making 2021 the most successful year in the robotics industry's history (IFR). "Demand reached high levels across industries due to the ongoing trend toward automation and continued technological innovation." Even the pre-pandemic record of 422,000 installations per year in 2018 was broken in 2021."

- Furthermore, Industrial robot sales have made a significant comeback. A new high of 486,800 units was shipped globally, a 27% increase over the previous year. Asia/Australia witnessed the greatest increase in demand, with installations increasing 33% to 354,500 units. With 49,400 units sold, the Americas climbed by 27%. With 78,000 units installed, Europe had a double-digit increase of 15%.

- Industrial robotics have been witnessing a huge demand over the past decade, owing to the adoption of smart factory systems. With the development of industrial robots, programmed robots have reached high-performance levels in real-time applications, accuracy, robustness, and compatibility.

- The availability of small-capacity and cost-effective solutions from small-and medium-sized industries is influencing the adoption of industrial automation. Apart from this, connecting robots, machines, and automation equipment to the cloud allow manufacturers to unlock the highest levels of performance and uptime from their automation systems.

Asia-Pacific to Witness a Significant Growth

- The market in Asia-Pacific is driven by the growing penetration of cloud computing, coupled with the incorporation of robotics and automation among the end-users. The automation adoption rate in this region, especially in China, India, and Japan, is the highest globally.

- China is the biggest spender on public cloud in the Asia-Pacific region. The local IaaS market is the first choice for small- and medium-enterprises for IT resources construction in games, video, and mobile internet.

- Industrial robots are predicted to increase rapidly in China as the downstream manufacturing sector recovers and the production of lithium batteries, new energy vehicles, and other industries expand.

- For the past eight years, China has been the world's largest market for industrial robots. According to a five-year plan released by the Ministry of Industry and Information Technology, China's robotics industry's operating revenue is predicted to rise at a 20 percent annual pace from 2021 to 2025.

- The growing demand for advanced automotive manufacturing drives robotics partnerships between the United States and Chinese companies. This may help China advance cloud services, which will likely further develop the Asia-Pacific cloud robotics market.

- The key players in this region are investing in developing robotic cloud solutions. For instance, In April 2021, CloudMinds Technology Inc. announced a Series B+ round of funding totaling more than USD 153 million. According to the Shanghai-based service robotics company, it will continue to develop humanoid models for residential use.

- It also stated that CloudMinds develops service robots for retail, education, healthcare, and hospitality that employ cloud computing. Its products include the wheeled humanoid XR-1 Service Robot, the Cloud Patrol security robot, and Cloud Pepper, a SoftBank Robotics humanoid. It has made them available through a robotics-as-a-service (RaaS) paradigm.

- Furthermore, ASORO labs of Singapore built a cloud computing infrastructure to generate a 3D model of the environment. This allows robots to perform simultaneous localization and mapping much faster than the labs' computers.

Cloud Robotics Industry Overview

The Cloud Robotics market is fragmented. Overall, the competitive rivalry among existing competitors is moderate. Moreover, acquisitions and collaboration of large companies with startups are expected, focusing on innovation.

- November 2021 - Datamatics, a global Intelligent Automation Products, Digital Solutions, Technology, and Business Process Management (BPM) Company, announced the successful adoption of its Datamatics TruBot Robotic Process Automation (RPA) Solution at Western Bainoona Group (WBG). WBG is a prominent engineering and construction firm in the Middle East and Africa (MEA). Four important activities were digitalized during the initial stage of RPA and Internet of Things (IoT) implementation to ensure a smooth and error-free data and payment processing flow.

- June 2021 - Hewlett Packard Enterprise has announced the acquisition of Determined AI. This San Francisco-based business provides a powerful and resilient software stack for training AI models at any scale using its open-source machine learning (ML) platform. HPE will combine Determined AI's unique software solution with its world-leading AI and high-performance computing (HPC) services to enable ML engineers in practically every industry to develop and train machine learning models to generate faster and more accurate insights from their data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Prominence of Cloud Technology

- 4.3.2 Increasing Adoption of Robotics across Various End Users

- 4.4 Market Restraints

- 4.4.1 Security and Privacy Concerns

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Application

- 6.2.1 Industrial Robot

- 6.2.2 Service Robot

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Military and Defense

- 6.3.3 Retail and E-commerce

- 6.3.4 Healthcare and Life Sciences

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hit Robot Group Co. Ltd

- 7.1.2 ABB Ltd

- 7.1.3 inVia Robotics Inc.

- 7.1.4 C2RO Cloud Robotics

- 7.1.5 CloudMinds Technologies Co. Ltd

- 7.1.6 Google LLC

- 7.1.7 IBM Corporation

- 7.1.8 Microsoft Corporation

- 7.1.9 Rapyuta Robotics Co. Ltd

- 7.1.10 Tend AI Inc.

- 7.1.11 V3 Smart Technologies PTE Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219