|

市场调查报告书

商品编码

1630194

聚氨酯泡沫涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Spray Polyurethane Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

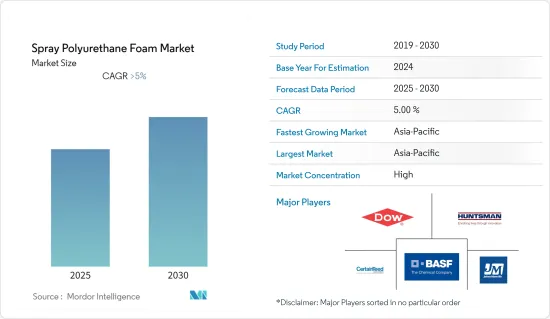

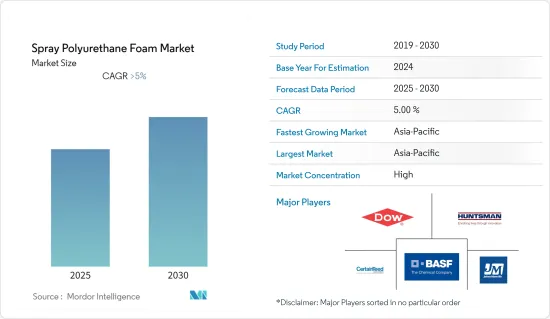

预计聚氨酯泡沫涂料市场在预测期内的复合年增长率将超过5%。

主要亮点

- COVID-19造成供应链和原材料中断,导致汽车和建筑等行业放缓,导致聚氨酯泡沫涂料产量下降。预计到预测期结束时(2021年),喷涂聚氨酯市场将达到疫情前的水准。这是因为经济开始好转,供给状况有改善。

- 对温室气体排放的日益关注以及市场作为建筑耐久性管理策略关键部分的巨大潜力是短期内推动市场成长的主要因素。

- 另一方面,玻璃纤维和纤维素隔热产品越来越受欢迎,这可能会减缓市场成长。

- 未来几年,随着模板提昇在混凝土抬升业务中变得越来越流行,市场将有更多赚钱的机会。

- 亚太地区在聚氨酯泡沫涂料(SPF)材料的消费中占据主要份额。由于节能建筑和石棉遏制应用的增加,预计该地区在预测期内也将出现最快的成长。

聚氨酯泡沫涂料市场趋势

增加在绝缘应用中的使用

- 聚氨酯泡沫涂料用于隔热材料应用,其消费量随着时间的推移而稳定增加。然而,聚氨酯泡沫涂料隔热材料在过去十年中经历了快速增长。

- 节能信託基金的计算显示,住宅的热量损失有 25% 通过屋顶,35% 通过墙壁,25% 通过窗户和通风口,15% 通过地板。因此,空心墙和阁楼或屋顶隔热是任何人都可以安装的两种最有效的能源效率措施。

- 聚氨酯泡沫涂料在建筑物外墙上的广泛使用,如墙壁、天花板、地板、阁楼、拱腹、阁楼和屋顶,与提高能源效率,特别是减少建筑物漏风的立法有直接关係。

- 在亚太地区,由于主要经济体的人口成长和快速都市化,住宅建设需求不断增加。根据 Global Construction Perspectives 和 Oxford Economics 的一项研究,印度未来 14 年每天需要建造 31,000 套住宅,才能满足不断增长的住宅需求。 2030年终,将建成住宅。

- 越来越严格的建筑规范,例如加州的 Title 24 和国际规范委员会的国际节能规范,正在迫使建筑商使用较少石化燃料并节省能源的材料。

- 此外,根据哈佛大学住宅研究联合中心的数据,光是美国人每年就花费超过 4,000 亿美元用于住宅重建和维修,其中可能包括隔热材料的使用,因此需求不断增加。

- 根据欧盟统计局公布的资料,2021年建筑收入大幅增加。

- 由于这些原因,未来几年在隔热材料中使用 SPF 可能会扩大聚氨酯泡沫涂料的市场。

亚太地区主导市场

- 由于各国政府在该地区建筑和涂料行业的支出增加,预计亚太地区将成为预测期内最大的市场。

- 中国是亚太地区GDP最大的经济体。儘管国家成长率依然较高,但正逐步放缓,经济正从投资转向消费、从製造业转向服务业、从外需转向内需再平衡。

- 根据中国「十四五」规划,预计到2025年都市区常住人口将增加65%。预计这将增加未来几年对所研究市场的需求。

- 随着中国从疫情中恢復过来,许多住宅建设计划已经开始。香港住宅委员会的目标是在截至 2030 年的 10 年内提供 301,000 个公共住宅。

- 「Atma Nirbhar Bharat」和「印度製造」等倡议预计将促进汽车工业的发展,因此可能对未来几年聚氨酯泡沫涂料的需求产生积极影响。

- 根据NAP 2021,马来西亚汽车製造业预计到2030年每年生产147万辆汽车。从现在到2030年,该国用于汽车製造的聚氨酯泡沫涂料的需求预计将增加。

- 由于上述因素,预计亚太地区将在预测期内主导聚氨酯泡沫涂料市场。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 人们对温室气体排放的担忧日益加剧

- 作为建筑耐久性管理策略关键组成部分的巨大潜力

- 在冷藏空间、步入式冰箱、管道、储罐等工业隔热材料的重要性日益增加。

- 抑制因素

- 玻璃纤维和纤维素绝缘解决方案的竞争加剧

- 严格的环境保护局 (EPA) 和职业安全与健康管理局 (OSHA) 法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 依产品类型

- 双组份高压喷涂泡沫

- 双组份低压喷涂泡沫

- 单组分泡棉 (OCF)

- 其他产品类型

- 按用途

- 绝缘

- 防水的

- 石棉封装

- 密封剂

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ACCELLA CORPORATION

- BASF SE

- CERTAINTEED

- Dow

- Huntsman International LLC

- Icynene-Lapolla

- INVISTA

- ISOTHANE LTD.

- Johns Manville

- NCFI Polyurethanes

- SOPREMA

- Specialty Products Inc.

第七章 市场机会及未来趋势

- 应用程式成为管道工程的新行业标准

- 散装混凝土产业中模板吊挂的成长趋势

简介目录

Product Code: 61474

The Spray Polyurethane Foam Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- COVID-19 caused disruption in the supply chain and raw materials, leading to a slowdown in industries like automotive and construction, owing to which the production of spray polyurethane foams decreased. The spray polyurethane market is expected to reach its pre-pandemic level by the end of the forecast period, which is 2021. This is because the economy started to get better and the supply situation got better.

- Growing concerns about greenhouse gas emissions and the market's strong potential as a key part of a building's durability management strategy are the main things that will drive the market's growth in the short term.

- On the other hand, fiberglass and cellulose insulation products are becoming more popular, which will likely slow the growth of the market.

- In the next few years, the market is likely to have more chances to make money because foam lifting is becoming more popular in the concrete raising business.

- Asia-Pacific holds a significant share in the consumption of spray polyurethane foam (SPF) materials. The region is also expected to witness the fastest growth during the forecast period, powered by the increase in energy-efficient construction and asbestos encapsulation applications.

Spray Polyurethane Foam Market Trends

Increasing Usage in the Insulation Applications

- Spray polyurethane foam has been used in insulation applications, and its consumption has steadily grown over time. However, spray polyurethane foam insulation has experienced exponential growth during the past decade.

- The Energy Saving Trust calculates that 25% of heat loss in homes is through the roof, 35% is through the walls, 25% is through windows or draughts, and 15% is through the floor. Hence, cavity walls and loft or roof insulation are two of the most effective energy efficiency measures anyone may install.

- The widespread use of spray polyurethane foam in building envelope assemblies, including walls, ceilings, floors, attics, crawl spaces, and roofing, is linked directly to code-mandated improvements in energy efficiency and, specifically, requirements for reducing building air leakage.

- Across the Asia-Pacific region, demand for residential construction has been rising owing to the growing population and rapid urbanization across major economies. According to a study done by Global Construction Perspectives and Oxford Economics, India will need to build 31,000 homes every day for the next 14 years to keep up with the growing demand for housing in the country. By the end of 2030, this will add up to 170 million homes.

- More and more strict building codes, like Title 24 in California and the International Energy Conservation Code from the International Code Council, force builders to use materials that use less fossil fuel and save energy.

- Furthermore, according to the Harvard Joint Center for Housing Studies, Americans alone spend more than USD 400 billion per year on residential renovations and repairs, which may include the use of insulation, which in turn increases their demand.

- The demand for building insulation is expected to rise in Germany as residential construction expands.As per data published by Eurostat, building construction revenue increased significantly in 2021.

- Because of all of these things, the use of SPF for insulation is likely to grow the market for spray polyurethane foam over the next few years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to be the largest market during the forecast period because the government is spending more on the construction and coating industries there.

- China is the largest economy in the Asia-Pacific region in terms of GDP. The growth rate in the country remains high but is gradually diminishing, and the economy is rebalancing from investment to consumption, manufacturing to services, and external to internal demand.

- According to China's 14th five-year plan, the number of permanent urban residents is supposed to rise to 65% by 2025. This is expected to increase demand for the market studied in the years to come.

- As China recovered from the pandemic, many residential construction projects kicked off in the country. Hong Kong's housing authorities launched a number of initiatives to jumpstart the construction of low-cost housing.The officials aim to provide 301,000 public housing units in 10 years, until 2030.

- Government reforms aided significant growth in industrial production as well as end-user demand for automobiles in India.Initiatives, such as "Atma Nirbhar Bharat" and "Make in India," are expected to boost the automotive industry, thereby positively impacting the demand for spray polyurethane foams in the coming years.

- Under the NAP 2021, the automotive manufacturing industry in Malaysia is expected to produce 1.47 million vehicles annually by 2030. From now until 2030, this is expected to increase the demand for spray polyurethane foam used to make cars in the country.

- Owing to all the aforementioned factors, the Asia-Pacific region is expected to dominate the spray polyurethane foam market during the forecast period.

Spray Polyurethane Foam Industry Overview

The spray polyurethane foam market is consolidated by nature. Some of the major players in the market include (in no particular order) BASF SE, Huntsman International LLC, Johns Manville, Dow, and CERTAINTED, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Concerns Related to Greenhouse Gas Emissions

- 4.1.2 Strong Potential as a Key Component of the Durability Management Strategy for a Building

- 4.1.3 Growing Significance in Industrial Insulation for Cold Storage Spaces, Walk-in Refrigerators, Pipes, Tanks, and Others

- 4.2 Restraints

- 4.2.1 Growing Competition from Fiberglass and Cellulose Insulation Solutions

- 4.2.2 Stringent Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) Regulations

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Two-component High-Pressure Spray Foam

- 5.1.2 Two-component Low-Pressure Spray Foam

- 5.1.3 One Component Foam (OCF)

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Insulation

- 5.2.2 Waterproofing

- 5.2.3 Asbestos Encapsulation

- 5.2.4 Sealant

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACCELLA CORPORATION

- 6.4.2 BASF SE

- 6.4.3 CERTAINTEED

- 6.4.4 Dow

- 6.4.5 Huntsman International LLC

- 6.4.6 Icynene-Lapolla

- 6.4.7 INVISTA

- 6.4.8 ISOTHANE LTD.

- 6.4.9 Johns Manville

- 6.4.10 NCFI Polyurethanes

- 6.4.11 SOPREMA

- 6.4.12 Specialty Products Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications as the New Industry Standard for Pipeline Engineering

- 7.2 Growing Trend of Foam Lifting in the Concrete Raising Industry

02-2729-4219

+886-2-2729-4219