|

市场调查报告书

商品编码

1630199

可再生能源复合材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Composite Materials in Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

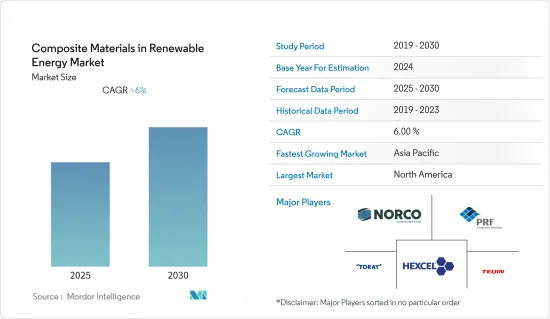

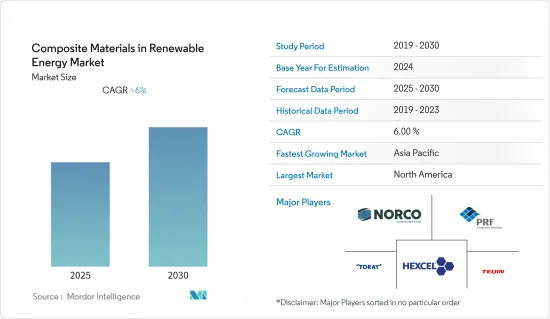

可再生能源复合材料市场预计在预测期内复合年增长率将超过 6%。

由于原材料供不应求, COVID-19 对整个行业成长产生了重大影响。然而,全球可再生能源需求的增加推动了疫情后的市场成长。

主要亮点

- 推动市场的主要因素之一是对风力发电机叶片製造的长期需求。

- 然而,对高研发投资的需求阻碍了市场成长。

- 结构生命週期内维护成本的降低预计将为所研究的市场提供显着的成长机会。

- 北美市场占有率最高,预计在预测期内将主导市场。

可再生能源复合材料的市场趋势

风电应用主导市场

- 风能是全球成长最快的能源来源。这一成长的主要驱动力是风力发电成本大幅下降并持续下降,使得竞争逐年加剧。

- 风力发电机叶片製造技术在过去几年中取得了显着进展。在涡轮叶片的製造中使用复合材料对于降低成本有重大影响。

- 随着全球风力发电市场的成长和叶片尺寸的不断增加,风电场开发商可能需要更多的复合材料来满足这些需求。

- 许多研究和开发工作也集中在使风力涡轮机叶片更容易回收。 2021 年 9 月,西门子歌美飒推出了 RecyclableBlade,这是世界上第一个用于海上商业用途的可回收风力发电机叶片。

- 美国总统计划在2030年安装30GW离岸风力发电。 2021年5月,拜登政府也核准了美国水域首个大型离岸风力发电计划-位于麻萨诸塞州海岸的800兆瓦葡萄园风电发电工程。

- 2021年,Copower Ocean将建造第一个全尺寸长丝缠绕玻璃纤维增强复合复合材料(GFRP)浮标式波浪能转换器原型,到2025年将扩大到工业规模的海洋能源发电场。目标是

- 由于上述原因,风电应用可能在预测期内主导市场。

北美市场占据主导地位

- 可再生能源中使用的复合材料绝大多数在北美生产,其中美国占据了大部分需求。

- 风电是美国最大的再生能源来源(不包括水力发电),约占能源消耗的2.5%。

- 此外,对更长涡轮叶片的需求增加将推动复合材料的消费。未来三到五年,离岸风力发电产业预计将在 8-10 MW 涡轮机中使用 300 英尺长的复合材料叶片。

- 美国能源局设定的目标是到2030年美国20%的电力来自风力发电。 2021年,美国风电产业新增风电装置容量13,413兆瓦,使总装置容量达到135,886兆瓦。

- 此外,2021年9月,维斯塔斯风力系统公司宣布了订单为美国290兆瓦风发电工程交付涡轮机的订单。该计划的一部分将为密西根州的 Deerfield 2 风电场提供 16 台 6.0 MW 运转模式的 V162-6.2 MW 涡轮机和一台 5.6 MW 运转模式的 V150-6.0 MW 涡轮机。

- 此外,为了支持该行业的成长,美国已将联邦生产税额扣抵(PTC) 延长五年,以提高市场稳定性。

- 这些因素正在增加该国复合材料的利用率,并且北美地区可能在预测期内主导市场。

可再生能源复合材料产业

可再生能源复合材料市场适度分散,市场占有率由许多参与者瓜分。市场主要企业包括(排名不分先后)Hexcel Corporation、Teijin Limited、Toray Industries, Inc.、Plastic Reinforcement Fabrics Ltd.、Norco Composites &GRP 等。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 司机

- 与金属结构相比重量更轻

- 对更长风力发电机叶片的需求增加

- 其他司机

- 抑制因素

- 需要高额研发投入

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 依纤维类型

- 纤维增强聚合物(FRP)

- 碳纤维增强塑胶(CFRP)

- 玻璃纤维增强塑胶(GRP)

- 其他纤维类型

- 按用途

- 太阳能

- 风力

- 水力发电

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- Changzhou Tiansheng New Materials Co. Ltd

- EPSILON Composite Tous droits reserves

- EURO-COMPOSITES

- Evonik Industries AG

- Gurit

- Hexcel Corporation

- JEC GROUP

- Norco Composites & GRP

- Plastic Reinforcement Fabrics Ltd

- Solvay

- Teijin Limited

- Toray Industries, Inc.

第七章市场机会与未来趋势

- 降低结构生命週期内的维护成本

The Composite Materials in Renewable Energy Market is expected to register a CAGR of greater than 6% during the forecast period.

COVID-19 highly impacted overall industry growth due to the raw material supply shortage. However, increased demand for renewable energy globally propelled the market growth post-pandemic.

Key Highlights

- One of the major factors driving the market is the demand for longer wind turbine blade manufacturing.

- However, the need for high R&D investments is hindering the market's growth.

- Lower maintenance costs over the structure's lifespan are expected to provide a significant growth opportunity for the market studied.

- North America accounts for the highest market share and is expected to dominate the market during the forecast period.

Composite Materials in Renewable Energy Market Trends

Wind Power Application to Dominate the Market

- The wind is the fastest-growing energy source globally. The prime factor for this increase is that the wind energy cost dropped and continues to drop dramatically, making it more competitive each year.

- The technology for manufacturing wind turbine blades significantly progressed over the past years. Using composites in turbine blade manufacturing, highly influences the decrease in cost.

- As the wind energy market grows globally and blade sizes continue to increase, wind farm developers will need more composite materials to help meet these demands.

- Many R&D efforts also focus on making wind blades more recyclable. In September 2021, Siemens Gamesa launched RecyclableBlade, the world's first recyclable wind turbine blade for commercial use offshore.

- The US President planned to deploy 30 GW of offshore wind energy in offshore wind by 2030. In May 2021, the Biden administration also approved the first major offshore wind project in US waters, the 800-MW Vineyard Wind energy project off the coast of Massachusetts.

- In 2021, CorPower Ocean built the first full-scale prototype of its filament-wound glass fiber-reinforced composite (GFRP) buoy-shaped wave energy converters, which the company aims to scale up into industrial-scale ocean energy farms by 2025.

- Due to the above reasons, wind power applications will likely dominate the market studied over the forecast period.

North America to Dominate the Market

- North America dominates the composite materials in renewable energy, with most of the demand coming from the United States.

- Wind power is the largest renewable energy source in the United States (excluding hydroelectricity), accounting for around 2.5% of energy consumption.

- Furthermore, the rising demand for long turbine blades will boost composite material consumption. In the next three to five years, 300-foot-long composite blades on 8 to 10 MW turbines are expected in the offshore wind energy sector.

- The US Department of Energy set an objective that by 2030, 20% of US electricity will be produced from wind energy. In 2021, the United States wind industry installed 13,413 MW of new wind capacity, bringing the cumulative total to 135,886 MW.

- Additionally, in September 2021, Vestas Wind Systems AS announced orders to deliver turbines for 290 MW of wind projects in the United States. Part of this project is supplying 16 units of the V162-6.2 MW turbines in a 6.0 MW operating mode and one V150-6.0 MW machine in a 5.6 MW operating mode for the Deerfield 2 wind farm in Michigan.

- Additionally, to boost the growth of this industry, the United States extended the federal Production Tax Credit (PTC) by five years, thereby creating exceptional market stability.

- These factors above are augmenting the composites' usage in the country, owing to which the North American region is likely to dominate the market studied during the forecast period.

Composite Materials in Renewable Energy Industry Overview

The composite materials in the renewable energy market are moderately fragmented as the market share is divided among many players. Key players in the market include Hexcel Corporation, Teijin Limited, Toray Industries, Inc., Plastic Reinforcement Fabrics Ltd., and Norco Composites & GRP, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Reduced Weight Compared to Metallic Structures

- 4.1.2 Augmenting Demand for Longer Wind Turbine Blades

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Need for High Investments in R&D

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Fiber Type

- 5.1.1 Fiber-Reinforced Polymers (FRP)

- 5.1.2 Carbon-Fiber-Reinforced Polymers (CFRP)

- 5.1.3 Glass-Reinforced Plastic (GRP)

- 5.1.4 Other Fiber Types

- 5.2 Application

- 5.2.1 Solar Power

- 5.2.2 Wind Power

- 5.2.3 Hydroelectricity

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis ** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Changzhou Tiansheng New Materials Co. Ltd

- 6.4.2 EPSILON Composite Tous droits reserves

- 6.4.3 EURO-COMPOSITES

- 6.4.4 Evonik Industries AG

- 6.4.5 Gurit

- 6.4.6 Hexcel Corporation

- 6.4.7 JEC GROUP

- 6.4.8 Norco Composites & GRP

- 6.4.9 Plastic Reinforcement Fabrics Ltd

- 6.4.10 Solvay

- 6.4.11 Teijin Limited

- 6.4.12 Toray Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Lower Maintenance Costs over the Lifespan of the Structure