|

市场调查报告书

商品编码

1630211

混合整合平台:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Hybrid Integration Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

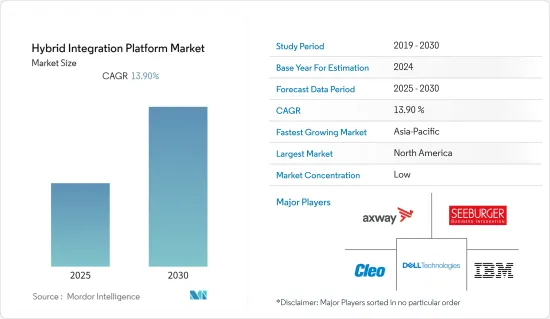

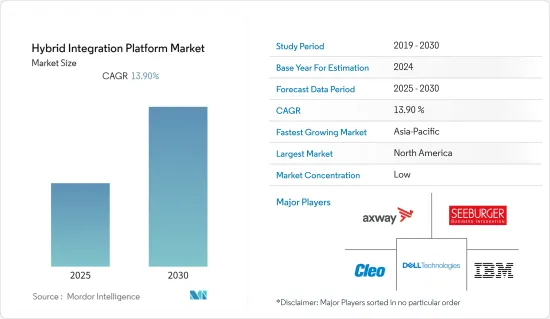

混合整合平台市场预计在预测期内复合年增长率为 13.9%。

主要亮点

- 近年来,对混合云端的需求不断增加,因此需要混合整合平台来确保成功部署。透过成功的混合云端部署实现的成本节约和扩充性正在增强跨行业组织的能力。因此,业内其他公司也计划利用这一点并扩大该技术的使用。

- 混合整合平台透过 BYOD(企业行动)和巨量资料连接企业、客户和供应商之间的网络,从而实现本地和云端基础的应用程式的整合。因此,混合整合平台的采用正在增加。推动混合整合平台需求的另一个关键因素是对云端基础的应用程式、资料和服务的需求不断增长。

- 为了最大限度地实现工业数位化,各行业越来越多地采用云端基础的解决方案是推动工业混合整合平台市场在预测期内成长的关键因素。世界各国政府都在数位化方面投入巨资,以提高工作效率和弹性。许多公司担心不同云端环境之间的互通性和资料安全性。这种安全需求正在推动对混合整合平台的需求。

- 然而,与开放原始码整合和互通性相关的高风险被认为是采用混合整合平台的主要限制。随着企业环境的发展,对混合云端解决方案和服务的需求不断增加。企业目前面临着利用资料库中的巨量资料来获得竞争优势的挑战。因此,企业被迫适应混合云端服务。一些最终用户(例如 BFSI 和医疗保健)正在选择混合服务,而不是完全切换到云端。这些采用策略正在为市场上的混合整合平台创造机会。

根据分析,在COVID-19大流行期间,引入用于患者治疗和管理的虚拟解决方案是医疗保健行业混合整合平台成长的关键驱动力。疫情过后,由于各种终端用户数位化程度的提高,市场大幅成长。混合云提供了高可用性、扩充性、业务永续营运、容错、灾害復原、自动软体更新和灵活性等基本功能。随着各公司对云端采用的兴趣日益浓厚,随着时间的推移,许多新功能和服务不断涌现。

混合整合平台市场趋势

混合云端的采用增加推动市场成长

- 该地区的企业正在迁移到云端,以获得敏捷性、业务创新、成本效率、扩充性和快速反应能力等优势。最重要的是,企业正在使用多个云端。例如,您可以使用销售团队作为 CRM 和行销云,并使用 AWS 作为开发云。

- 在金融和医疗保健等具有严格合规标准的行业中,公司正在使用公共、本地伺服器和私有云端解决方案的组合来满足法规合规性和资料安全措施的要求。

- 连接本地和云端应用程式以推动数位业务转型的需求不断增长,可能会影响未来几年混合整合平台市场的成长。

- 据 Flexera Software 称,截至 2022 年 3 月,80% 的企业受访者表示他们已经部署了混合云端。在大多数情况下,迁移到混合云端解决方案意味着同时运行私有云端公共云端。

- 开发「企业用户」友善的混合整合平台服务和功能来解决业务问题也有望推动混合整合平台市场的成长。此外,对混合云的需求正在增长,政府可能会颁布立法来增加对混合整合平台的需求,从而推动市场向前发展。

- 此外,去年 3 月,罗杰斯和微软宣布了一项为期五年的策略合作,帮助企业、中小企业利用混合工作和支援 5G 的解决方案来加速数位化和全面数位化。罗杰斯选择 Microsoft Azure 作为其基础架构和技术工作负载的策略云。该公司利用 Azure 的公共云端功能来推动创新,实现新的客户体验,并使员工能够在整个企业内更灵活地协作。

亚太地区预计将成为成长最快的市场

- 由于云端服务采用率的增加和有利的政府法规,预计亚太地区在预测期内将显着成长。

- 由于混合云端的使用增加、先进的数位化以及最终用户行业组织支出的增加,简化了复杂的资讯储存过程,亚洲市场正在迅速扩张。

- 根据 NASSCOM 的数据,上年度印度的软体即服务投资以 17 亿美元排名第二。企业和其他组织正在增加对混合云服务的投资,因为他们需要在封锁期间在线上工作,而且由于冠状病毒的爆发,他们无法经常出差。

- 亚太地区的公司正在积极寻求策略联盟和收购。去年1月,全球领先的IT基础设施服务供应商之一Kindril与日本领先的解决方案整合商之一TIS建立策略合作伙伴关係,以加速其客户的数位转型。 Kindler 和 TIS 将共同开发加速企业自动化和现代化的营运工具,包括自动化和远端控制工具的修补程式和更新,以有效且有效率地支援高品质的营运服务。此外,Kindler和TIS拥有广泛的IT资源,包括资料中心、大型主机和多样化的云端环境,将共同优化IT资源和专家,为客户开发最佳的基础架构。

- 此外,去年10月,提供边缘云端服务的Zadara与提供网路基础设施服务的KINX Inc.达成策略伙伴关係,透过KINX向韩国市场提供储存即服务。 KINX 的 CloudHub 配置为专用网络,是韩国最大的云端平台,连接九家主要云端服务供应商。 CloudHub建置安全可靠、功能丰富且高度可用的多重云端和混合云端解决方案。 KINX 的多重云端和混合云端系统将受益于 Zadara zStorage 储存服务。

混合整合平台产业概况

混合整合平台市场高度分散,主要企业包括 Axway Software、Cleo Communications, Inc、Dell Technologies、Seeburger AG 和 IBM Corporation。此外,混合整合平台正在各个行业中使用,为供应商提供了成长机会。市场参与者利用伙伴关係、合併、投资、创新和收购来改进他们的产品并获得可持续的竞争优势。

2022 年 10 月,微软和 Meta 合作,为未来的工作和娱乐打造身临其境型体验。 Meta Quest 装置上提供的 Microsoft 365 程式可让使用者将他们最喜欢的生产力工具(如 Word、Excel、PowerPoint、Outlook 和 SharePoint)中的资料带入虚拟实境。未来,Meta Quest 装置将能够使用 Windows 365,允许使用者使用自己的程式、内容和偏好来串流 Windows 云端 PC。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

第六章 市场促进因素

- BYOD 采用率增加

- 混合云端的采用率提高

第七章 市场限制因素

- 与开放原始码整合相关的风险

第八章市场区隔

- 按组织规模

- 大公司

- 小型企业

- 按最终用户产业

- BFSI

- 政府/国防

- 卫生保健

- 零售

- 资讯科技和电讯

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第9章 竞争格局

- 公司简介

- Axway Software

- Cleo Communications, Inc.

- Dell Technologies

- Seeburger AG

- IBM Corporation

- Microsoft Corporation

- MuleSoft LLC(Salesforce.com)

- Oracle Corporation

- SnapLogic Inc.

- Software AG

- TIBCO Software Inc.

- Talend Inc.

- Elastic.io

第十章投资分析

第十一章市场的未来

The Hybrid Integration Platform Market is expected to register a CAGR of 13.9% during the forecast period.

Key Highlights

- The demand for hybrid cloud in recent years has gained traction, as has the need for hybrid integration platforms for its successful deployment. The cost savings and scalability achieved by the successful deployment of hybrid clouds have increased the competencies of organizations across industries. So, the other companies in the industry also plan to use this to expand the use of the technology.

- Hybrid integration platforms connect the network between enterprises, customers, and suppliers via BYOD (enterprise mobile) and big data, allowing on-premises applications to integrate with cloud-based applications. As a result, hybrid integration platform adoption is increasing. Another important element driving demand for hybrid integration platforms is the growing need for cloud-based apps, data, and services.

- The increasing deployment of cloud-based solutions across various sectors to maximize industrial digitalization is a significant driving factor for the growth of the industrial hybrid integration platform market throughout the forecast period. Various governments throughout the globe are investing heavily in digitalization to improve job efficiency and flexibility. Many companies are concerned about interoperability across different cloud environments and data security. This security need drives the demand for hybrid integration platforms.

- However, the high risks associated with open-source integration and interoperability are considered major restraints for adopting hybrid integration platforms. The demand for hybrid cloud solutions and services has increased as the enterprise environment has evolved. Organizations are currently facing the challenges of utilizing big data in their databases for competitive advantage. It has pushed enterprises to adapt to hybrid cloud services. Some end users, such as BFSI and healthcare, choose hybrid services instead of completely switching to the cloud. Such adoption measures have created an opportunity for the hybrid integration platform in the market.

During the COVID-19 pandemic, deploying virtual solutions for treating and managing patients was analyzed as a significant driving factor for the growth of the hybrid integration platform in the healthcare sector. After the pandemic, the market grew significantly with increased digitization among various end users. The hybrid cloud provided essential features like high availability, scalability, business continuity, fault tolerance, disaster recovery, automatic software updates, flexibility, etc. With the growing interest in cloud adoption by various enterprises, many new features and services have emerged over time.

Hybrid Integration Platform Market Trends

Increasing Adoption of Hybrid Cloud Drives the Market Growth

- Enterprises across regions are switching to the cloud to benefit in terms of agility, operational innovation, cost-effectiveness, scalability, and the ability to respond faster. Most importantly, enterprises use more than one cloud. For example, they might use Salesforce for CRM and marketing clouds and AWS for the development cloud.

- In industries like finance and healthcare, where compliance standards are rigid, enterprises often have a mix of public, on-premise servers and private cloud solutions, owing to the regulatory compliance and data security measures they must adhere to.

- The growing need to connect on-premises and cloud applications to drive digital business transformation is probably going to have an impact on the growth of the hybrid integration platform market over the next few years.

- According to Flexera Software, as of March 2022, 80 percent of enterprise respondents stated they had implemented a hybrid cloud in their organizations. Most of the time, moving to hybrid cloud solutions means running both private and public clouds at the same time.

- Developing "business user"-friendly hybrid integration platform services and capabilities to tackle business difficulties is also expected to boost the hybrid integration platform market's growth. Also, the need for a hybrid cloud is growing, and the government is likely to pass laws that will increase the demand for hybrid integration platforms, which will move the market forward.

- Furthermore, in March last year, Rogers and Microsoft announced a five-year strategic collaboration to assist large, small, and medium-sized company clients in accelerating digitization and entirely using hybrid work and 5G-enabled solutions. Rogers has chosen Microsoft Azure as its strategic cloud for infrastructure and technology workloads. The company would use Azure's public cloud capabilities to drive innovation, unleash new customer experiences, and empower workers to collaborate more agilely throughout the enterprise.

Asia Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific is expected to expand at a significant rate over the forecast period, owing to the high adoption of cloud services and favorable government regulations.

- With the rising use of hybrid clouds, high digitalization, and increasing expenditure by organizations in end-user industries, the market is quickly expanding in Asia, easing the complicated process of storing information.

- According to NASSCOM, software-as-a-service investment in India would have come in second with USD 1.7 billion in the previous year. Infrastructure-as-a-service investment would have reached USD two billion.Businesses and other organizations are investing more in hybrid cloud services because they need to work online during the lockdown and can't travel as much because of the coronavirus outbreak.

- In the Asia-Pacific region, companies actively make strategic partnerships and acquisitions. In January last year, Kyndryl, one of the major global providers of IT infrastructure services, announced that it was expanding its strategic relationship with TIS, one of the leading Japanese solution integrators, for the Japanese market, intending to expedite clients' digital transformation. Kyndryl and TIS would work together to develop operational tools to encourage corporate automation and modernization, such as automation tools and remote-control tool patches and updates that can effectively and efficiently support high-quality operational services. Furthermore, with a wide range of IT resources, such as data centers, mainframes, and varied cloud environments, Kyndryl and TIS collaborate to optimize IT resources and specialists to develop the best infrastructure for clients.

- Furthermore, in October last year, Zadara, a provider of edge cloud services, announced a strategic partnership with KINX Inc., a provider of internet infrastructure services, to provide its zStorage, storage-as-a-service, to the Korean market via KINX's CloudHub. KINX's CloudHub, configured as a private network, is Korea's biggest cloud platform, connecting nine of the main cloud service providers. CloudHub creates multi-cloud and hybrid cloud solutions that are safe, secure, versatile, and highly available. KINX's multi-cloud and hybrid cloud systems would benefit from Zadara zStorage storage services.

Hybrid Integration Platform Industry Overview

The hybrid integration platform market is highly fragmented, with significant players like Axway Software, Cleo Communications, Inc., Dell Technologies, Seeburger AG, and IBM Corporation. Moreover, a hybrid integration platform is used in various industries to provide vendors with growth opportunities. Players in the market are using partnerships, mergers, investments, innovations, and acquisitions to improve their products and gain a competitive edge that will last.

In October 2022, Microsoft and Meta partnered to create immersive experiences for the future of work and play. Microsoft 365 programs are available on Meta Quest devices, allowing users to engage with material from their favorite productivity tools such as Word, Excel, PowerPoint, Outlook, and SharePoint in virtual reality. In the future, Meta Quest devices will be able to use Windows 365, and users will be able to stream a Windows Cloud PC with their own programs, content, and preferences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

6 Market Drivers

- 6.1 Increasing Adoption of BYOD

- 6.2 Increasing Adoption of Hybrid Cloud

7 Market Restraints

- 7.1 Risks Involved in Open Source Integration

8 MARKET SEGMENTATION

- 8.1 By Organization Size

- 8.1.1 Large Enterprises

- 8.1.2 Small- and Medium-size

Enterprises (SME)

- 8.2 By End-User Industry

- 8.2.1 BFSI

- 8.2.2 Government and Defense

- 8.2.3 Healthcare

- 8.2.4 Retail

- 8.2.5 IT and Telecom

- 8.2.6 Other End-User Industries

- 8.3 Geography

- 8.3.1 North America

- 8.3.2 Europe

- 8.3.3 Asia Pacific

- 8.3.4 Rest of the World

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Axway Software

- 9.1.2 Cleo Communications, Inc.

- 9.1.3 Dell Technologies

- 9.1.4 Seeburger AG

- 9.1.5 IBM Corporation

- 9.1.6 Microsoft Corporation

- 9.1.7 MuleSoft LLC (Salesforce.com)

- 9.1.8 Oracle Corporation

- 9.1.9 SnapLogic Inc.

- 9.1.10 Software AG

- 9.1.11 TIBCO Software Inc.

- 9.1.12 Talend Inc.

- 9.1.13 Elastic.io