|

市场调查报告书

商品编码

1630212

记忆体内:市场占有率分析、产业趋势/统计、成长预测(2025-2030)In-Memory Database - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

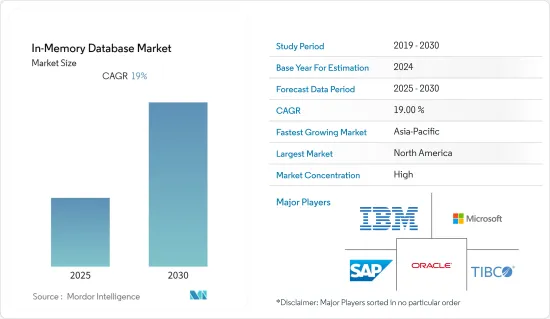

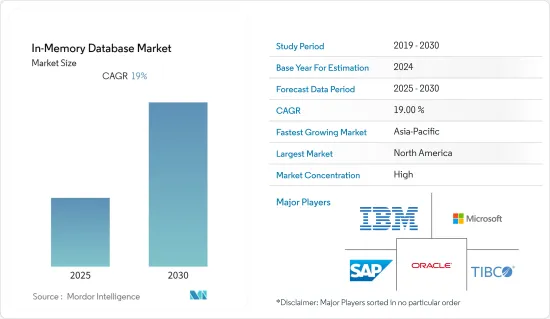

记忆体内市场预计在预测期内复合年增长率为 19%。

主要亮点

- 记忆体内运算作为一种提高效能和处理能力的新方法在世界范围内越来越受欢迎。记忆体内运算市场的推动因素包括企业越来越多地使用记忆体内资料库和运算、航空公司越来越多地使用记忆体运算来满足 SLA,以及航空公司越来越多地使用记忆体记忆体内运算来满足 SLA。为了改进而传播巨量资料。

- 随着机器学习和人工智慧使企业、银行和其他服务的资料处理变得更容易、更快捷,从而改变科技产业,它也不断成长。据IBM称,去年北美地区的人工智慧采用率,实施型人工智慧的采用率达25%,探索性人工智慧的采用率达43%。

- 记忆体内体资料库市场由多种因素驱动,包括透过资料分析即时解决问题和加速企业数位转型的能力。这些设备产生的资料可以提供独特的、与个人相关的资料,可以利用这些数据获得见解,这被证明是产业游戏规则的改变者。智慧型手机和物联网等各种趋势正在促进资料生成的增加。

- 与人工智慧和机器学习等其他趋势一起,这些物联网设备正在越来越多的行业中使用。透过记忆体内即时使用这些资料在这方面发挥着重要作用。

- COVID-19的爆发对记忆体内市场的扩张产生了重大影响。这是因为行动电话用户数量的增加、智慧型装置使用的扩大以及电子商务的蓬勃发展为市场成长提供了诱人的可能性。 COVID-19不仅在医疗领域造成了问题,而且在社会、经济和能源领域也造成了问题。这场危机对社会各方面都有直接和间接的影响。同时,数位化、人工智慧产业可以为管制病毒传播提供专业协助。由于 COVID-19 大流行,人们的健康意识变得更加强烈,许多医生和医护人员开始透过应用程式提供服务。预计这一因素将推动市场成长。

记忆体内市场趋势

通讯终端用户产业占主要市场占有率

对于任何需要快速可靠地存取资料的应用程式来说,记忆体内技术都是必不可少的选择。特别适合记忆体内系统的应用程式范例包括需要大量事务和非常快速的回应时间的网路和通讯应用程式。事实上,专门的记忆体内技术在通讯业的应用已经有一段时间了。

- 通讯业正在经历重大的业务改革。产生的资料量呈指数级增长。造成这种情况的主要原因之一似乎是通讯技术的进步以及科技公司颠覆性Over-The-Top服务的开发。

- 通讯业者和 IT 公司越来越多地使用记忆体内来防范攻击、最大限度地减少资料遗失并强化大型、复杂和多样化组织的安全系统。由于通讯领域资料外洩的增加,对记忆体内的需求预计会增加。例如,去年 9 月,澳洲电信业者Optus 遭受了毁灭性的资料洩露,1,100 万用户的个人资讯被洩露。

- 巨量资料和不断增长的行动宽频使用也推动了通讯业对记忆体内资料库的需求。 2021年,4G技术占据58%的市场占有率。然而,根据 GSMA 的数据,这一比例预计到 2025 年将下降至 55%。届时,新的5G技术预计将占行动技术的25%。

- 使用记忆体内的分销网路参与者包括行动网路营运商以及目标商标产品製造商和基础设施供应商。该市场预计将显着成长,特别是随着越来越多的人利用云端和行动等技术。

记忆体内系统具有强大的云端企业管理能力,能够整合资料仓储和客户端业务应用,提高资料吞吐量。它还可以进行即时分析,帮助组织预见并主动解决许多问题。

北美占很大份额

- 北美地区引领着许多技术发展,其中计算是主要驱动力之一。受调查的市场主要由北美企业主导。技术发展和创新的遗产是主要驱动力。 IBM 公司、甲骨文公司、SAP SE、Altibase 公司、Aerospike 公司和微软公司等公司均位于该地区。

- 加拿大市场预计将在该地区发挥核心作用,因为加拿大拥有零售、IT 和其他行业等各行业的大量公司。即使是美国工业也从加拿大的业务中产生了大量收益。

- 儘管记忆体内,但最近才开始被企业采用。由于它最近被采用,北美地区对于市场供应商来说是一个利润丰厚的市场,主要供应商都希望将低成本、高性能的产品推向市场。

- 人们越来越认识到 BI 软体提供的许多优势,为企业提供了广泛的选择来专注于目标客户并改善使用者体验。例如,美国食品公司 Wendy's 和 Ruby Tuesday 严重依赖 BI 软体来改善客户互动。因此,这些因素正在推动市场扩张。

此外,推动北美记忆体内成长的一个基本因素是行动装置使用量的增加。根据美国人口普查局和消费者科技协会的数据,美国智慧型手机销售额从 2021 年的 730 亿美元增加到去年的 747 亿美元。

记忆体内产业概述

记忆体内市场适度整合。该行业的一些市场参与者包括 IBM 公司、微软公司、甲骨文公司、SAP SE 和 TIBCO Software Inc.。这些物联网设备在各行业中被广泛采用,人工智慧和机器学习等其他趋势也见证了渗透率的提高。

去年,IBM 和 SingleStore 于 2022 年 12 月宣布推出 SingleStoreDB。从与 IBM 合作推出 SingleStoreDB 作为解决方案开始,两家公司现在正在寻求建立策略合作关係,为资料密集型专案提供最灵活、可扩展的资料平台。 IBM 已将 SingleStoreDB 发布为 Azure、AWS 和 Microsoft Azure Marketplace 上的服务。

2022 年 4 月,McObject 发布了适用于 Green Hills Software 的 Integrity RTOS 的 eXtremeDB/rt资料库管理系统 (DBMS)。第一个也是唯一一个满足资料时间和确定性一致性基本标准的商用现成 (COTS) 即时 DBMS 称为 eXtremeDB/rt。 EXtremeDB 最初是作为嵌入式系统的记忆体内统一资料库系统来构思、建构和实现的。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 市场驱动因素

- 降低硬体成本

- 巨量资料和物联网等趋势的渗透率提高

- 资料量的增加与企业业务的转变

- 市场限制因素

- 与 VLDB 整合的弹性

- COVID-19 市场影响评估

第五章技术概况

- 按类型

- 线上事务处理(OLTP)

- 线上分析处理(OLAP)

- 按许可证类型

- 开放原始码

- 所有权

- 商业的

第六章 市场细分

- 依行业类型

- 小到中尺寸

- 大规模

- 按最终用户产业

- 通讯/IT

- BFSI

- 物流/运输

- 零售

- 娱乐媒体

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 北美洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- TIBCO Software Inc.

- Aerospike Inc.

- GridGain Systems Inc.

- VMware Inc.(Pivotal Software Inc.)

- Redis Labs Inc.

- Altibase Corp.

- Raima Inc.

- VoltDB Inc.

- Couchbase Inc.

- DataStax Inc.

- McObject LLC

- MemSQL Inc.

第八章 市场机会及未来趋势

第九章投资分析

The In-Memory Database Market is expected to register a CAGR of 19% during the forecast period.

Key Highlights

- In-memory computing is gaining popularity worldwide as a novel means of boosting performance and processing. The market for in-memory computing is being driven by the growing use of in-memory databases and computing in corporate firms, the growing use of in-memory computing by airlines to meet SLAs, and the spread of big data to automate and improve decision-making.

- It also grows as machine learning and artificial intelligence transform the technology industry by making data processing easier and faster for corporations, banks, and other services. According to IBM, in the last year, North American AI adoption rates will have reached 25% for implemented AI and 43% for researching AI.

- The in-memory database market is being driven by many things, such as the ability to solve problems with data analytics in real time and speed up digital transformation for businesses.The data generated by these devices can provide unique data pertaining to individuals that can be leveraged to gain insights, which prove to be game changers for industries. Smartphones and various trends, like the Internet of Things, contribute to increasing data production.

- Along with other trends like AI and machine learning, these IoT devices are being used in more and more industries. Using this data in real time in in-memory databases is a crucial part of this.

- The COVID-19 outbreak significantly influenced the expansion of the in-memory database market, as the growing number of mobile phone users, expanding use of smart devices, and booming e-commerce sector gave the market attractive potential for growth. COVID-19 created issues across the social, economic, and energy sectors, as well as in medical care. This crisis has several direct and indirect consequences for all aspects of society. Meanwhile, the digital and artificial intelligence industries can provide professional help in managing and controlling the viral spread. Due to the COVID-19 pandemic, increased health awareness among people led to many physicians and health workers delivering their services via apps. This factor is expected to boost the market's growth.

In Memory Database Market Trends

Telecommunication End-User Industry to Hold Significant Market Share

In-memory database technology is an essential option for any application requiring data to be promptly and reliably available. Examples of applications especially well-suited to in-memory database systems include networking and telecommunications applications with huge trading volumes and demands for exceptionally quick response times. In reality, the communications industry has been utilizing specialized in-memory technology for some time.

- The telecommunications industry has been going through some massive operational transformations. The data generated has been increasing exponentially. One of the primary reasons for this could be the advancement of telecom technologies and the development of disruptive over-the-top offerings by technology companies.

- In-memory databases are increasingly being used in telecom and IT enterprises to protect against attacks, minimize data loss, and strengthen security systems in big, complex, and varied organizations. The need for in-memory databases is anticipated to rise due to the increased number of data breaches in the telecommunications sector. For instance, in September last year, the Australian telecommunications firm Optus had a disastrous data breach that allowed access to the personal information of 11 million subscribers.

- Big data and growing mobile broadband usage have also increased the demand for in-memory databases in the telecom industry. In 2021, 4G technology held a 58% market share. However, by 2025, that percentage is expected to fall to 55%, according to the GSMA. By then, mobile technology is expected to be 25% dominated by the new 5G technology.

- Operators of mobile networks are not the only distribution network participants to use in-memory databases; original equipment manufacturers and infrastructure suppliers are also among them. The market is expected to grow a lot because more and more people are using technologies, especially cloud and mobility.

In-memory database systems are highly capable of doing enterprise management on the cloud, as they merge the data warehouse with clients' business applications, thus increasing data throughput. It also provides real-time analytics, which can assist organizations in foreseeing many issues and solving them beforehand.

North America Region to Hold Significant Share

- The North American region has been at the helm of many technological developments, and computing has been one of the key drivers. In the market studied, the majority of the landscape is dominated by North American players. The legacy of technological development and innovation has been a significant driver. Companies like IBM Corporation, Oracle Corporation, SAP SE, Altibase Corporation, Aerospike Company, and Microsoft Corporation are all based in the region.

- The Canadian market is anticipated to take center stage in the region as the country includes a considerable number of enterprises in various industrial sectors, such as retail, IT, or any other industry. Even US industries have substantial revenue from their operations in Canada.

- Although in-memory technology is still being developed, its adoption in enterprises has only recently begun.Since its adoption has begun fairly recently, the North American region has been lucrative for market vendors, and all the major players are looking to flood the market with low prices and high-performing offerings.

- The increasing awareness of the many advantages BI software provides gives businesses a wide range of options for focusing on their target audiences and improving the user experience. For instance, American food companies Wendy's and Ruby Tuesday heavily rely on BI software to improve customer interactions. As a result, these elements fuel market expansion.

In addition, the fundamental element that contributes to the growth of in-memory databases in North America is the rise in the utilization of mobile devices. The US Census Bureau and the Consumer Technology Association say that smartphone sales in the US went from USD 73 billion in 2021 to USD 74.7 billion in the last year.

In Memory Database Industry Overview

The in-memory database market is moderately consolidated. Some of the market players operating in the industry include IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and TIBCO Software Inc., among others. The wide adoption of these IoT devices across industries and other trends, like AI and machine learning, is witnessing increased penetration.

Last year, IBM and SingleStore announced SingleStoreDB for December 2022. With the introduction of SingleStoreDB as a solution with IBM, companies are now moving forward in their strategic relationship to provide the quickest, most scalable data platform to power data-intensive programs. IBM has released SingleStoreDB as a service on Azure, AWS, and the Microsoft Azure Marketplace.

In April 2022, for the Integrity RTOS from Green Hills Software, McObject released the eXtremeDB/rt database management system (DBMS). The first and sole commercial off-the-shelf (COTS) real-time DBMS that satisfies the basic criteria of temporal and deterministic consistency of data is called eXtremeDB/rt. EXtremeDB was initially conceptualized, built, and implemented as an in-memory integrated database system for embedded systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Decreasing Hardware Cost

- 4.4.2 Increasing Penetration Of Trends Like Big Data And IOT

- 4.4.3 Increase In The Volume Of Data Generated And Shift Of Enterprise Operations

- 4.5 Market Restraints

- 4.5.1 Resilience In Integration With VLDB'S

- 4.6 Assessment of COVID-19 Impact on the Market

5 TECHNOLOGY SNAPSHOT

- 5.1 By Type

- 5.1.1 Online Transaction Processing (OLTP)

- 5.1.2 Online Analytical Processing (OLAP)

- 5.2 By Type of License

- 5.2.1 Open Source

- 5.2.2 Proprietary

- 5.2.3 Commercial

6 MARKET SEGMENTATION

- 6.1 By Industry Type

- 6.1.1 Small and Medium

- 6.1.2 Large

- 6.2 By End-user Industry

- 6.2.1 Telecommunication and IT

- 6.2.2 BFSI

- 6.2.3 Logistics and Transportation

- 6.2.4 Retail

- 6.2.5 Entertainment and media

- 6.2.6 Healthcare

- 6.2.7 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Oracle Corporation

- 7.1.4 SAP SE

- 7.1.5 TIBCO Software Inc.

- 7.1.6 Aerospike Inc.

- 7.1.7 GridGain Systems Inc.

- 7.1.8 VMware Inc. (Pivotal Software Inc.)

- 7.1.9 Redis Labs Inc.

- 7.1.10 Altibase Corp.

- 7.1.11 Raima Inc.

- 7.1.12 VoltDB Inc.

- 7.1.13 Couchbase Inc.

- 7.1.14 DataStax Inc.

- 7.1.15 McObject LLC

- 7.1.16 MemSQL Inc.