|

市场调查报告书

商品编码

1630222

零售就绪包装:市场占有率分析、产业趋势、成长预测(2025-2030)Retail Ready Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

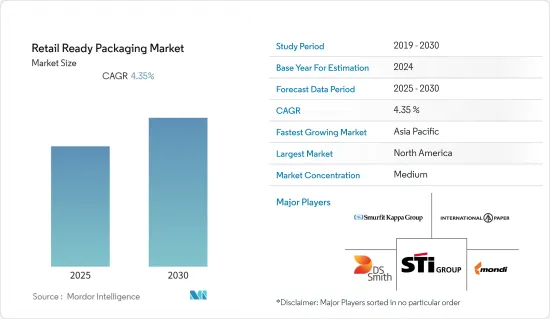

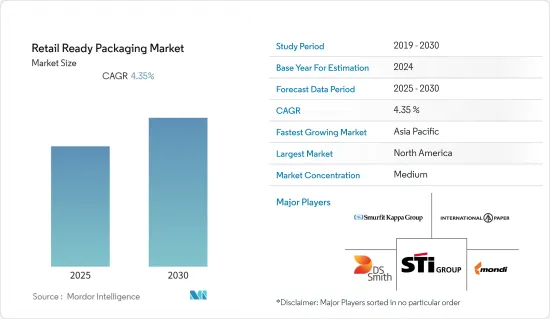

零售现成包装市场预计在预测期间内复合年增长率为 4.35%。

主要亮点

- RRP不仅减少了包装废弃物,还透过减少劳动力来降低营运成本。建议零售价也受到零售商的青睐,因为它使消费者的购物体验更加高效,并且往往会诱发衝动购买。

- 快速成长的量贩店和俱乐部商店预计将推动研究市场的需求。此外,根据印度零售商协会 (RAI) 的数据,由于消费者需求增加,零售业在 2021 年 9 月实现了 COVID-19 之前销售额的 96%。购买力的增强导致需求的增加。

- 快速消费品产品凭藉其创造性和有效的功能设计,可以协助零售商进行产品识别,以促进有效备货,提高商店效率,并提高拆包和补货的效率,因为将产品直接放在零售上,增加了零售包装的需求。

- 此外,根据 IBEF 的数据,印度线上零售市场预计到 2030 年将达到 3,500 亿美元,高于 2021 年估计的 550 亿美元。

- 然而,包装流程缺乏标准化正在阻碍市场成长。此外,不同的产品由于运输和磨损程度不同,需要不同的包装品质。对所有产品使用相同的包装流程会降低产品的使用寿命和质量,进一步限制零售包装市场的成长。

- 在快速消费品 (FMCG) 市场中,人们对传统媒体管道(电视、广播、电影院等)碎片化的认识不断增强,以及 POS提案的影响正在推动多个零售商和品牌提出建议零售价要求与此相结合,零售店正在成为一个更强大的行销环境。因此,全球瓦楞纸箱需求的成长速度预计将是瓦楞包装整体需求的两倍。

- PMMI 研究显示,近 28% 的消费者愿意为更方便的包装金额更多费用。未来,预计这将为零售包装市场创造更多机会。

零售包装市场的趋势

模切展示容器占较大份额

- 零售业的快速发展是推动全球模切展示容器市场成长的关键因素之一。模切展示容器被认为是一种现代零售包装解决方案,预计将随着大卖场和超级市场的发展而发展。

- 量贩店和俱乐部商店的快速扩张以及小型商店的推出预计将推动所研究市场的需求,因为这些商店的品种比传统商店更有限。这些商店可以受益于模切展示容器的快速和高效的货架空间。

- 製造商和零售商对模切展示容器获得了大力支持,因为它们透过可重复使用的功能提供安全性,有助于降低成本,这基本上使模切展示容器成为全球领先的选择,我们正在推动市场成长。

- 与标准瓦楞纸箱相比,模切包装是复杂包装需求的更好选择。例如,GWP Packaging 于 2022 年 2 月在威尔特郡生产工厂投资 60 万欧元(632,100 美元)购买新晶粒机。这项投资将使GWP能够在包装产品需求强劲的地区扩大产能。

- 此外,中等收入群体可支配收入的增加、快节奏的生活方式以及包装食品消费的增加预计将推动零售现成包装市场的成长,从而与模切展示容器市场的成长进行比较这是一个非常重要的因素。

北美占据主要市场占有率

- 北美强大的财务状况使其能够投资尖端解决方案和技术。这些优势使该地区的组织在零售包装市场上具有竞争优势。

- 此外,该地区也是几家主要的球包装供应商的所在地,包括国际纸业公司(美国)、Georgia-Pacific LLC(美国)和 WestRock Company(美国)。因此,该地区的零售瓦楞包装市场在营运商之间竞争激烈。

- DS Smith 和 RockTenn 最近宣布的两件式零售包装授权合约就证明了这个市场在美国也被广泛采用了。

- 例如,2022 年2 月,美国最大的杂货供应商Kroger Co. 和TerraCycle 的循环再利用平台Loop 为顾客推出了一种比一次性塑料更可重复利用的新购物方式,并提供了多种独特的产品。这是美国第一个此类伙伴关係关係,客户将能够在波特兰大都会区的 25 家 Kroger 旗下 Fred Meyer 商店购买 20 多种包装在可重复使用容器中的领先消费品牌产品。

- 此外,沃尔玛和克罗格等该地区的零售商也越来越多地采用零售包装解决方案。这些商店制定了指导方针,在采用现代包装设计时帮助标准化和过渡货架。例如,沃尔玛发布了《零售就绪指南》,为零售店的展示和货架包装制定标准。这些指南将帮助生产商了解建议零售价要求以及如何在商店中使用它们。

零售包装产业概述

由于许多在国内和国际范围内运营的参与者,零售包装市场竞争非常激烈。市场集中度中等,主要企业包括 Mondi Group、Smurfit Kappa、DS Smith PLC、International Paper Company 和 STI Group。

2022 年 6 月,斯道拉恩索推出了 AvantForte WhiteTop,这是一种完全由原生纤维製成的全新牛皮纸内衬。这款白顶牛皮纸内衬旨在满足生鲜食品、电子商务和货架包装等高端竞争市场的需求。

2022 年 5 月,纸包装产品综合工厂 Smurfit Kappa UK Limited 宣布收购位于北德文郡巴恩斯特普尔的 Atlas Packaging。 Atlas Packaging 是一家自主纸板包装公司。阿特拉斯包装在英国拥有强大的市场影响,能够满足广大客户的需求并提供价值。该公司是货架包装、礼盒和电子商务领域颇具影响力的参与者,提供各种创新产品。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力——波特五力

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 消费者对便利、环保的购物解决方案的兴趣日益浓厚

- 简化供应链流程的需求日益增长

- 市场挑战

- 缺乏标准化和额外的供应链成本

第六章 市场细分

- 依材料类型

- 纸和纸板

- 塑胶

- 其他材料类型

- 按包装类型

- 模切展示容器

- 瓦楞纸箱

- 收缩包装托盘

- 变形的情况

- 塑胶容器

- 其他包装

- 按最终用户使用情况

- 食物

- 饮料

- 家居用品

- 其他最终用户用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Mondi Group

- Smurfit Kappa Group

- DS Smith PLC

- International Paper Company

- STI Group

- Cardboard Box Company

- Weedon Group

- Caps Cases Limited

- Vanguard Packaging Incorporated

- WestRock Company

第八章投资分析

第9章市场的未来

The Retail Ready Packaging Market is expected to register a CAGR of 4.35% during the forecast period.

Key Highlights

- Not only can RRP reduce packaging waste, but it can also lower operating costs by reducing labor. Retailers also prefer RRP because it creates a more efficient consumer shopping experience and frequently triggers impulse purchases.

- Rapidly growing mass retail and club stores are expected to drive demand for the studied market. Furthermore, according to the Retailers Association of India (RAI), the retail industry achieved 96% of pre-COVID-19 sales in September 2021, owing to rising consumer demand. Increasing purchasing power has resulted in increased demand.

- FMCG goods increased demand for retail-ready packaging because of its creative and effective functional design, which aids retailers in product identification to facilitate effective stocking, improve store efficiency, and reduce labor efforts by placing products directly on retail shelves without unpacking inner contents and turnover time for re-stocking, which ultimately increases a store's sales and profit.

- In addition, according to IBEF, the online retail market in India is expected to reach USD 350 billion by 2030, up from an estimated USD 55 billion in 2021, as the country's online shoppers grow.

- However, the lack of standardization in the packaging process stifles market growth. Furthermore, different products require various packaging qualities, as they are subjected to varying transport levels and wear and tear. Using the same packaging process for all products reduces product life and quality, further limiting the growth of the retail-ready packaging market.

- In Fast Moving Consumer Goods (FMCG) markets, the fragmentation of traditional media channels (such as TV, radio, and cinema) and increased awareness of the impact of Point-of-Sale propositions, combined with multiple retailers' and brand owners' RRP requirements, are resulting in the retail store becoming a much more powerful marketing environment. As a result, global demand for decorative corrugate cases is expected to grow at twice the rate of corrugated overall.

- According to a PMMI study, nearly 28% of consumers are willing to pay more for additional conveniences in terms of packaging. In the future, this is expected to create even more opportunities for the retail-ready packaging market.

Retail Ready Packaging Market Trends

Die-cut Display Container to Hold Significant Share

- One of the important elements contributing to the growth of the global die-cut display container market is the rampant evolution in the retail sector. Die-cut display container is considered a modern retail packaging solution and is expected to develop along with the progression of hypermarkets and supermarkets.

- Rapidly expanding mass retail and club stores and the launch of smaller-format locations are expected to drive the demand for the studied market, as these stores carry a limited product selection than their traditional counterparts. These stores can benefit from the Die-cut Display Container's ability to speed stock shelves and increase shelf-space efficiency.

- Manufacturers and retailers are gaining massive traction towards die-cut display containers as it helps to reduce cost in terms of providing safety to the product due to reusable features, which essentially drives the growth of the global die-cut display container market.

- Die-cut packaging is an excellent choice for more complex packaging needs than a standard cardboard box. GWP Packaging, for example, invested EUR 600,000 (USD 632,100) in a new die cutter at their Wiltshire production facility in February 2022. The investment will allow GWP to expand capacity in an area with robust demand for packaging products.

- In addition, the increasing disposable income among the middle-class income group, fast-paced lifestyle, and increasing consumption of packaged food is expected to drive the growth of the retail ready packaging market, which is a relatively high contributing factor towards the growth of the die-cut display container market.

North America to Hold Significant Market Share

- North America's strong financial condition allows it to invest in cutting-edge resolutions and technologies. These advantages have given regional organizations a competitive advantage in the retail-ready packaging market.

- Moreover, the region has the existence of several major corrugated board packaging vendors, such as International Paper Company (United States), Georgia-Pacific LLC (United States), and WestRock Company (United States). Hence, there is intense competition among players operating in the retail-ready packaging market in the region.

- The market is also becoming increasingly adopted in the United States, evidenced by the recent announcement of a licensing agreement involving two-piece retail-ready packaging between DS Smith and RockTenn.

- For instance, in February 2022, The Kroger Co., America's largest grocery vendor, and Loop, TerraCycle's circular reuse platform, introduced a new way for customers to shop, offering various products in reusable packaging than single-use plastic. Customers can walk into one of 25 Kroger-owned Fred Meyer stores in the Portland metro area and purchase more than 20 products from leading consumer brands packaged in reusable containers, owing to a first-of-its-kind partnership in the United States.

- Furthermore, retailers in this region, such as Walmart, Kroger, and others, are increasingly adopting retail-ready packaging solutions. These stores are establishing guidelines to assist in standardizing and transitioning their shelves as they adopt the latest package designs. Walmart, for instance, has published a Retail Ready Guide to set standards for retail display and shelf packaging for their stores going forward. These guidelines help producers understand the requirement of RRPs and how they must be leveraged in stores.

Retail Ready Packaging Industry Overview

The Retail Ready Packaging Market is competitive because of the presence of many players running their businesses within national and international boundaries. The market is mildly concentrated, with major players like Mondi Group, Smurfit Kappa, DS Smith PLC, International Paper Company, and STI Group, among others.

In June 2022, AvantForte WhiteTop, a brand-new kraftliner created from only virgin fiber by Stora Enso, was made commercially available. The white top kraftliner is designed to meet the needs of high-end, competitive markets, including fresh food, e-commerce, and shelf-ready packaging.

In May 2022, Smurfit Kappa UK Limited, an integrated plant of paper-based packaging products, announced the acquisition of Atlas Packaging based in Barnstaple, North Devon. Atlas Packaging is an autonomous corrugated packaging provider. The company is well invested with a strong market presence in the UK, allowing it to meet the needs of and deliver value to its broad customer base. With an influential company in shelf-ready packaging, gift boxing, and the e-commerce sector, they offer an exciting and wide range of innovative products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumer Interest Towards Convenient and Eco-friendly Shopping Solutions

- 5.1.2 Growing Need for Streamlining the Supply Chain Process

- 5.2 Market Challenges

- 5.2.1 Lack of Standardization and Additional Supply Chain Cost

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Paper and Paperboard

- 6.1.2 Plastics

- 6.1.3 Other Material Types

- 6.2 By Type of Package

- 6.2.1 Die-cut Display Containers

- 6.2.2 Corrugated Cardboard Boxes

- 6.2.3 Shrink Wrapped Trays

- 6.2.4 Modified Cases

- 6.2.5 Plastic Containers

- 6.2.6 Other Type of Packages

- 6.3 By End-User Application

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Household Products

- 6.3.4 Other End-User Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdoms

- 6.4.2.3 France

- 6.4.2.4 Rest of the Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of the Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mondi Group

- 7.1.2 Smurfit Kappa Group

- 7.1.3 DS Smith PLC

- 7.1.4 International Paper Company

- 7.1.5 STI Group

- 7.1.6 Cardboard Box Company

- 7.1.7 Weedon Group

- 7.1.8 Caps Cases Limited

- 7.1.9 Vanguard Packaging Incorporated

- 7.1.10 WestRock Company