|

市场调查报告书

商品编码

1630233

短波红外线(SWIR):全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Shortwave Infrared - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

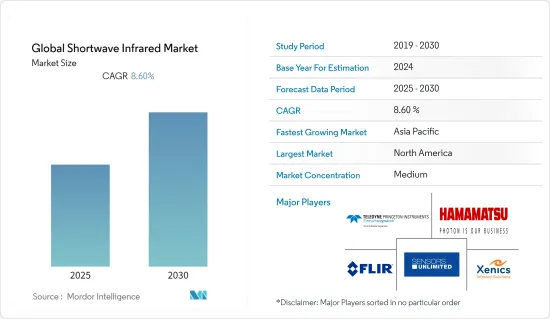

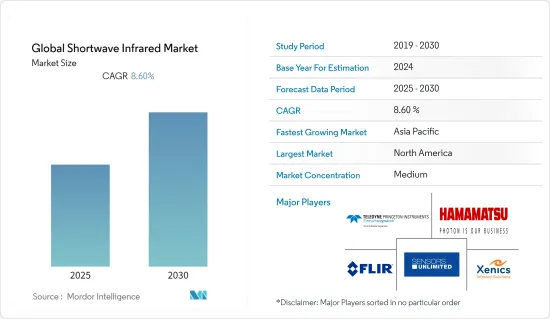

预计全球短波红外线(SWIR) 市场在预测期内的复合年增长率为 8.6%。

主要亮点

- SWIR 用于半导体製造等各行业的检查目的。同时,国防应用对小型化和低功耗技术日益增长的需求正在对市场产生积极影响。

- 旨在升级军事和国防装备的有利政府措施预计将在预测期内推动短波红外线市场的发展。监视和物体检测科学研究中不断增加的应用也支持了该市场的成长。监视和检查应用中对短波红外线产品的需求不断增长预计也将推动市场成长。在军事应用中使用短波红外线技术的主要优点是短波红外线相机可以透过雾、雨和具有挑战性的大气条件进行成像并提供具有更高对比度的资料。

- SWIR 摄影机已成为监视录影机,以确保危险区域的安全。它们可以附着在建筑物、卡车和无人机上来侦测人类活动和威胁。此外,地质学家还使用这类相机来研究地球的几个物理方面。

- 此外,短波红外线还具有功耗低、可感知温度的优点,使其可用于火灾侦测。 DigitalGlobe(美国商业太空影像和地理空间材料提供者)地球观测卫星上的短波红外线(SWIR) 感测器可以透过地面燃烧物体的浓烟云看到。

- 短波红外线相机也经常用于车辆导航。随着无人驾驶汽车变得越来越普遍,短波红外线技术可以帮助在雾、雪、灰尘和雨中导航。随着短波红外线相机在自动驾驶汽车中的使用越来越多,以色列公司 TriEye 正在为消费性汽车的仪表板开发一款短波红外线相机,该相机可以在雪、雾、灰尘和雨中成功导航。

- 然而,由于全球封锁影响了自动驾驶汽车测试,COVID-19 为汽车产业自动驾驶汽车的发展带来了挫折。此外,随着远距工作的引入,越来越多的人搬到农村和郊区,估计大多数国家的都市化正在放缓。这减缓了自动驾驶汽车的开发和市场渗透,为自动驾驶汽车测试和使用带来了挑战,阻碍了市场成长。

短波长红外线(SWIR) 市场的趋势

军事和国防领域预计将推动市场成长

- 热成像用于国防应用,以促进在近乎或完全黑暗的情况下的高解析度视觉和识别。红外线 (IR) 波长对于军事和国防研究与开发至关重要。因为大部分的监视和瞄准都是在黑暗中进行。

- SWIR 区域弥补了可见光波长与红外线热敏度峰值之间的差距,提供比可见光波长更少的散射,并可远距检测低水平反射光,使其能够穿透烟雾和雾气,非常适合成像。此外,短波红外线相机是用于安全和监控的有用设备,有时单独使用或与其他成像器结合使用。

- 此类短波红外线设备的应用包括设施、港口和边防安全、监视和秘密行动,例如低照度影像处理、军事驾驶员视力增强以及军事红外线雷射点照明和追踪。

- 例如,FLIR Systems 生产基于焦面阵列(FPA) 的 InGaAsSWIR 相机,该公司也单独销售这种相机。这些 FPA 采用电容式电阻放大器电路设计,并针对从安全成像到需要多个输出和动态视窗的高速科学雷射测试等应用进行了最佳化。

- 政府在军事和国防设备上的支出被认为是市场成长的关键因素之一。例如,根据美国国防部的数据,总统要求的 2021 年预算为 7,054 亿美元,与 2020 财年授权的 7,046 亿美元相比略有增加。此外,根据英国国会的数据,2020/21年度国防支出为现金424亿英镑,比上年度名义增加25亿英镑。 2024/25年度国防现金预算预计将比2020/21年度增加62亿英镑。

预计北美将占据主要市场占有率

- 由于美国和加拿大是全球领先的汽车市场,北美地区预计将占据 SWIR 市场的很大份额。

- 美国也拥有世界上最大的国防预算,使其成为短波红外线相机和技术的重要市场。 2019财年,《国防授权法》增加了一项新规定,禁止美国联邦政府机构购买中国製造的安全设备。他们特别提到了杭州海康威视数位技术有限公司和浙江大华技术有限公司等中国公司。其他国内供应商现在有巨大的机会来填补市场空白。

- 此外,随着多项颠覆性技术的出现,短波红外线相机的应用领域正在向多个领域扩展,为该地区短波红外线相机供应商创造了成长机会。

- SWIR相机可以区分颜色并分析温度、水蒸气和材料的化学成分等特性,使其适用于工业检查、艺术检查、光谱和天文学等应用。

- 因此,该地区的公司正在努力推出创新产品,以满足客户不断变化的需求。例如,2022 年 4 月,首款大众市场短波红外线(SWIR) 感测技术製造商 TriEye 宣布与全球公司东芝泰利公司合作,推出用于自动化的整合摄影机。两家公司都致力于将短波红外线相机商业化,用于工业流程和应用。此次合作利用 TriEye 的 SWIR 感测技术为视觉系统提供新的资讯层,重塑工业部门并提高流程能力。

短波红外线(SWIR) 产业概述

短波长红外线(SWIR) 市场正在发展成为一个整合结构,主要供应商致力于研发以推进所提供的技术。其中包括 Princeton Instruments、Zenix、Sensors Unlimited(联合技术公司)、FLIR Systems、Hamamatsu Photonics 和 Hamamatsu Photonics。

- 2022 年 7 月 - Artiluxand II-VI 推出一款在短波长红外线区域工作的轻巧 3D 相机。这款相机专为消费和汽车市场的 3D 感测而设计,并将 Artilux 的 GeSi 感测器阵列与 II-VI 的磷化铟半导体雷射结合。本产品采用基于可扩展 CMOS 技术平台的高频宽、量子效率 GeSiSWIR 感测器阵列。

- 2021 年 10 月 - SWIR Vision Systems Inc. 是一家针对工业自动化、自动驾驶汽车和其他应用的下一代影像感测器解决方案公司,宣布已完成 500 万美元的 A 轮资金筹措。 SWIR Vision 的取得专利的感测器解决方案基于独特的量子点光电二极体感测器设计,已在全球范围内提供高解析度、商用短波红外线(SWIR) 相机。据悉,本轮资金筹措将有助于增强公司的技术力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 最终用户行业的应用程式增加

- 对小型化和低功耗技术的需求

- 市场限制因素

- SWIR 相机和检测器的高成本

- COVID-19 对市场的影响

第五章市场区隔

- 依技术

- 未冷却的

- 冷却型

- 依产品类型

- 短波红外面阵相机

- 短波红外线线性相机

- 按最终用户产业

- 国防/军事

- 医疗保健与研究

- 车

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 公司简介

- Flir Systems Inc.

- Hamamatsu Photonics KK

- Sensors Unlimited(United Technologies Company)

- Teledyne Princeton Instruments

- Xenics

- Leonardo DRS

- Sofradir

- Allied Vision Technologies GmbH

- InView Technology Corporation

- IRCameras LLC

- Raptor Photonics

- Princeton Infrared Technologies, Inc.

- Sierra-Olympic Systems, Inc.

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 65023

The Global Shortwave Infrared Market is expected to register a CAGR of 8.6% during the forecast period.

Key Highlights

- SWIR is used for testing purposes in various industries, such as semiconductor manufacturing. Along with this, the increasing need for miniaturization and low-power consumption technology across defense applications positively influences the market.

- Favorable government initiatives aimed at military and defense equipment upgrades are expected to drive the SWIR market during the forecast period. Increasing applications in scientific research for surveillance and object detection also support the growth of this market. Also, the growing demand for SWIR products for monitoring and inspection application is expected to drive market growth. The primary advantage of using SWIR technology in military applications is that SWIR cameras can see through and image higher contrast images and provide data even through the mist, rain, and challenging atmospheric conditions.

- SWIR cameras have emerged to provide surveillance for securing risky zones. They can be mounted on buildings, trucks, and unmanned aerial vehicles and can detect any human activity or threats. Moreover, such cameras are adopted by geologists for studying several physical aspects of the earth.

- Additionally, SWIR has the advantage of low power consumption and can sense temperature, making it useful for detecting fires. A shortwave infrared sensor on the Earth Observation satellite from DigitalGlobe (an American commercial provider of space imagery and geospatial material) can see through dense smoke clouds from burning objects on the ground.

- SWIR cameras are being used more frequently for vehicle navigation. As driverless vehicles become more common, SWIR technology can aid in navigating through fog, snow, dust, and rain. Due to the expanding use of SWIR cameras in autonomous vehicles, the Israeli firm TriEyeintends to create a SWIR camera for the dashboard of consumer cars that can successfully navigate through snow, fog, dust, and rain.

- However, COVID-19 has caused a setback in the development of autonomous cars in the automotive industry as the global lockdown has impacted the testing of autonomous vehicles. Also, with the implementation of remote working, it is estimated that urbanization in most countries is decelerating as more people move to rural and suburban areas. This is causing testing and utilization challenges for Autonomous vehicles which delays their development and rollout time, hampering the growth of the studied market.

Shortwave Infrared Market Trends

The Military and Defense Sector is Expected to Drive the Market Growth

- Infrared imaging is employed in defense applications to facilitate high-resolution vision and identification in near and total darkness. The infrared (IR) wavelengths are crucial for military and defense research and development because so much surveillance and targeting occur in darkness.

- The SWIR region bridges the void between visible wavelengths and peak thermal sensitivity of infrared, scattering less than visible wavelengths and detecting low-level reflected light at longer distances, which is ideal for imaging through smoke and fog. Moreover, SWIR cameras are helpful security and surveillance devices, sometimes by themselves and often combined with other imagers.

- Applications for these SWIR devices include facility, port, border security and surveillance, and other covert operations such as low-light-level imaging, military driver vision enhancement, and military IR laser spotting and tracking.

- For instance, FLIR Systems makes InGaAsSWIR cameras based on its focal-plane array (FPA), which the company also sells separately. These FPAs have a capacitive trans-impedance amplifier circuit design optimized for applications ranging from security imaging to high-speed scientific laser testing, which requires multiple outputs and dynamic windowing.

- Government spending on military and defense equipment may be one of the significant factors for the market's growth. For instance, according to the US Department of Defense, compared to the FY 2020 authorized amount of USD 704.6B, the President's budget request of USD 705.4B represents a minor gain in 2021. Further, according to the United Kingdom parliament, the defense spending in 2020/21 was GBP 42.4 billion in cash terms, a nominal rise of GBP 2.5 billion over the previous year. The yearly defense budget in 2024/25 is estimated to be GBP 6.2 billion more in cash terms than in 2020/21.

North America is Expected to Hold Significant Market Share

- Owing to the presence of the United States and Canada, amongst the prominent automotive markets across the globe, the North American region is expected to hold a significant share of the SWIR market.

- The United States also has the biggest defense budget in the world, making it a significant market for SWIR cameras and technology. For fiscal 2019, a new provision to the National Defense Authorization Act prohibits US federal agencies from purchasing security equipment made in China. They especially mentioned Chinese firms like Hangzhou Hikvision Digital Technology Co. and Zhejiang Dahua Technology Co. Other national vendors now have a great chance to fill the market void.

- Further, with the advent of several disruptive technologies, the application areas of SWIR cameras have increased in several sectors, thereby acting as a growth opportunity for the providers of SWIR cameras in the region.

- The capability of SWIR cameras to differentiate between colors and analyze properties like temperature, water vapor, and chemical composition of materials makes them suitable for applications like industrial inspection, art inspection, spectroscopy, and astronomy.

- Thus, the companies in the region are striving to launch innovative products to cater to the evolving needs of their customers. For instance, in April 2022, TriEye, a producer of the first mass-market Short-Wave Infrared (SWIR) sensing technology, announced a collaboration with Toshiba Teli, a global player in providing integrated cameras for automation. The two companies are working to commercialize a SWIR camera for industrial-related processes and applications. The partnership will leverage TriEye'sSWIR sensing technology to provide vision systems with an additional layer of information, reshaping the industrial sector and enhancing process capabilities.

Shortwave Infrared Industry Overview

Due to the presence of major vendors engaging in R&D to advance the technology provided, the shortwave infrared market is evolving toward a consolidated structure. The significant businesses include Princeton Instruments, Xenics, Sensors Unlimited (a United Technologies Company), FlirSystems Inc., Hamamatsu Photonics K.K., and Hamamatsu Photonics K.K.

- July 2022 - Artiluxand II-VI launched a miniature 3D camera that operates in the shortwave infrared. The camera, designed for 3D sensing in consumer devices and the automotive market, combines Artilux's GeSi sensor arrays with II-VI's indium phosphide semiconductor lasers. It features a high-bandwidth and high-quantum-efficiency GeSiSWIR sensor array based on a scalable CMOS technology platform.

- October 2021 - SWIR Vision Systems Inc., a next-generation image sensor solutions company catering to industrial automation, autonomous vehicles, and other applications, announced that it had closed a USD 5 million Series A financing round. Based on a unique quantum-dot photodiode sensor design, SWIR Vision's patented sensor solutions have provided high resolution, commercially available short-wavelength infrared (SWIR) cameras worldwide. The funding round is reported to aid the company in enhancing its technical abilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Applications across End-user Industries

- 4.4.2 Need for Miniaturisation and Low-power Consumption Technology

- 4.5 Market Restraints

- 4.5.1 High Cost of SWIR Cameras and Detectors

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Uncooled

- 5.1.2 Cooled

- 5.2 By Product Type

- 5.2.1 SWIR Area Cameras

- 5.2.2 SWIR Linear Cameras

- 5.3 By End-User Industries

- 5.3.1 Defense and Military

- 5.3.2 Healthcare & Research

- 5.3.3 Automotive

- 5.3.4 Other End-user

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Latin America

- 5.4.4.2 Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Flir Systems Inc.

- 6.1.2 Hamamatsu Photonics K.K.

- 6.1.3 Sensors Unlimited (United Technologies Company)

- 6.1.4 Teledyne Princeton Instruments

- 6.1.5 Xenics

- 6.1.6 Leonardo DRS

- 6.1.7 Sofradir

- 6.1.8 Allied Vision Technologies GmbH

- 6.1.9 InView Technology Corporation

- 6.1.10 IRCameras LLC

- 6.1.11 Raptor Photonics

- 6.1.12 Princeton Infrared Technologies, Inc.

- 6.1.13 Sierra-Olympic Systems, Inc.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219