|

市场调查报告书

商品编码

1630235

行动人工智慧 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Mobile Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

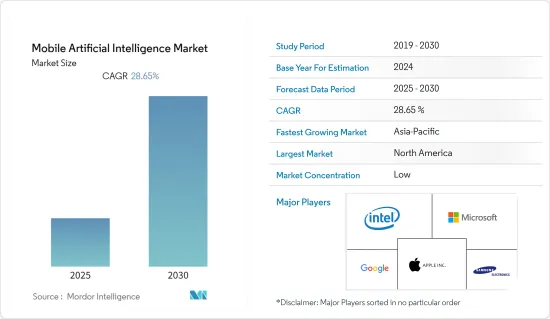

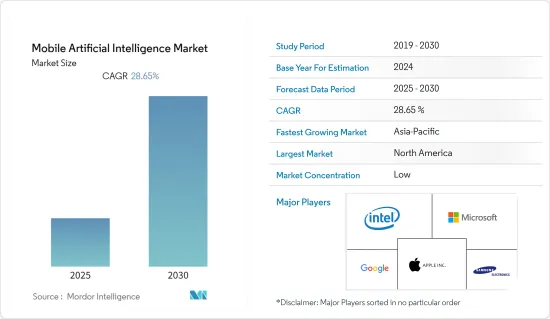

预计行动人工智慧市场在预测期内复合年增长率为28.65%

主要亮点

- 该市场是由认知计算的兴起和人工智慧应用数量的增加所推动的。人工智慧和机器学习等技术允许认知运算系统查看大量资料,找到见解,并利用这些见解来学习和改进。越来越多的行业和组织正在使用认知解决方案来改善业务并提高生产力,包括资料量、洞察生成、行动规划和管理。

- 人工智慧 (AI) 已经渗透并颠覆了全球各个最终用户产业的 IT 产业。人工智慧为企业及其客户带来了显着的突破。随着虚拟助理、自动驾驶汽车和聊天机器人等技术发展的涌入,人工智慧预计将颠覆我们使用行动装置的方式。具有一定程度自主运作的机器必须能够在某种意义上理解周围的环境。

- 推动市场成长的关键因素是人工智慧应用在各个最终用户行业的兴起以及对认知计算和自动化的需求不断增加。此外,越来越多的人在日常生活中使用行动设备,包括职场、学校和个人目的。因此,使这些设备自动化变得越来越重要,这样它们就不需要人工干预。

- 随着数位化,对行动装置的依赖日益增加,职场的 BYOD 趋势正在刺激行动装置的使用增加。此外,对行动装置的日益依赖将增加使用行动装置来做出关键决策,从而进一步加强为这些装置配备人工智慧以做出自动化决策的需求不断增加。

- 此外,透过物联网连网型设备的增加也增加了对这些设备进行人工智慧辅助控制的需求。为了将人工智慧融入行动装置中,最重要的是将该技术融入晶片组中。

- COVID-19的兴起为全球行动人工智慧市场的成长创造了巨大的机会。人工智慧在医疗保健和自我诊断系统中的使用越来越多,刺激了市场需求。

行动人工智慧市场趋势

智慧型手机应用推动市场成长

- 随着越来越多的人需要即时语音处理和影像识别,智慧型手机人工智慧处理器的市场正在扩大。大多数人工智慧处理器都包含额外的神经处理单元 (NPU),用于处理认知任务、平行工作并消耗更少的电力。装置端 AI 使用专用的 AI 晶片组,到 2022 年应该会出现在所有顶级智慧型手机中。大多数新型高阶智慧型手机都配备了具有专用神经处理单元的人工智慧晶片。

- 人工智慧正在成为智慧型手机最重要的部分,其用途不仅仅是数位助理。借助Edge-AI技术,许多以前在后端执行的AI功能现在可以在智慧型手机本身上执行。随着每次更新,人工智慧 (AI) 和机器学习 (ML) 都在使行动电话硬体和软体变得更好。这会影响负责人和客户,让每个人的生活变得更轻鬆。

- 虚拟助理的能力正在稳步提高。如今,语音辨识即使在拥挤的情况下也能比人类听得更清楚。随着时间的推移,虚拟助理将成为使用者手机介面中更重要的部分,人工智慧可能会开始识别使用者提供的自然人类语言。未来几年,智慧型手机製造商预计将引入更先进的人工智慧和机器学习,根据脸部特征的变化(例如留鬍鬚或戴眼镜)来识别人。

- 此外,全球行动电话普及率的不断提高也支持了市场的成长。例如,北美的行动电话行动电话用户。到 2025 年,渗透率预计将成长 2%,达到 3.45 亿个人行动用户。

大型科技公司之间不断增加的合併和联盟也正在推动市场成长。苹果是全球人工智慧领域的主要企业买家。例如,苹果收购了最多的人工智慧公司,领先埃森哲、Google、微软和Facebook。所有其他公司的人工智慧收购也有所增加。

预计北美将占据最大的市场占有率

- 就需求而言,北美预计将占据很大一部分市场,因为在政府法规和合规性方面,北美是新兴企业和中小企业开展业务的好地方。此外,随着这些公司的各种市场发展,该地区预计将在技术采用方面处于领先地位,并成为北美领先的行动人工智慧解决方案提供商的所在地,从而在预测期内增加市场成为重要的驱动力。

- 美国政府决定与工业界、大学、国际合作伙伴和盟友以及其他非联邦实体合作,鼓励联邦政府对人工智慧研发(R&D)进行投资。这是支援AI技术实现大跃进。 2023 财年网路与资讯科技研发 (NITRD) 研发支出为 96 亿美元,比 2022 财年的要求增加 18 亿美元。增补称,这一增长是由于国防部发布了2023财年人工智慧研发经费资讯。

- 人工智慧已融入Google的核心。该公司已成功从行动优先转向人工智慧优先。人工智慧已整合到我们日常使用的所有 Google 应用程式中,包括 Google搜寻引擎、Google 地图、Google Photos、YouTube 和 Gmail 智慧回应。 Google 透过 TensorFlow 和 Cloud AutoML 等技术产品推动人工智慧发展,并透过开放原始码计划帮助开发人员和小型企业进行创新。

- 人工智慧和物联网在许多行业中变得司空见惯,语音助理和智慧音箱也是如此。因此,该地区对行动人工智慧的需求正在增加。

在北美,医疗保健数位基础设施的变化、成熟的医疗保健产业以及越来越多的患者了解人工智慧的好处也推动了市场成长。在北美,医疗保健领域对人工智慧的需求将推动几个主要参与企业进入该市场。

行动人工智慧产业概况

人工智慧由复杂的演算法组成,在当前市场中正在迅速成长。多个行业现在正在采用人工智慧演算法,使复杂的系统更容易使用,从而加剧市场竞争。主要参与企业包括英特尔公司、微软公司和 Alphabet Inc. (Google LLC)。

2022 年 5 月,致力于人工智慧和深度学习处理器的英特尔资料中心团队 Habana Labs 宣布发布用于推理和训练的第二代机器学习处理器 Habana Gaudi2 和 Habana GrecoT。这些新晶片为客户提供用于训练和推理部署以及资料中心工作负载的高效能、高效能深度学习运算选项,从而填补了市场空白。它还使各种规模的公司更容易开始使用人工智慧。

2022 年 3 月,Nvidia 公司推出了新的晶片和技术,据称可以加速日益复杂的人工智慧演算法。该公司宣布了新型图形晶片 (GPU) 的具体规格,该晶片将成为其人工智慧基础设施的核心,包括 H100 晶片和名为 Grace CPU Superchip 的新型处理器晶片组,两者均来自英国晶片製造商基于Arm 技术。这是自上个月收购 Arm 计画落空以来,Nvidia 首款基于 Arm 的半导体。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 行动装置中对人工智慧处理器的需求增加

- 认知运算的兴起和人工智慧应用的增加

- 行动装置的扩展

- 市场限制因素

- AI处理器价格上涨

第六章 市场细分

- 按用途

- 智慧型手机

- 相机

- 无人机

- 机器人

- 车

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Intel Corporation

- Microsoft Corporation

- Alphabet Inc.(Google LLC)

- Apple Inc

- Samsung Electronics Co. Ltd.

- Nvidia Corporation

- IBM Corporation

- Qualcomm Technologies Inc

- MediaTek Inc.

- Huawei Technologies Co. Ltd.

第八章投资分析

第9章市场的未来

The Mobile Artificial Intelligence Market is expected to register a CAGR of 28.65% during the forecast period.

Key Highlights

- The rise of cognitive computing and the growing number of AI applications drive the market. With technologies like AI and ML, cognitive computing systems can look at a huge amount of data, find insights, and use those insights to learn and improve. Cognitive solutions are being used by more and more industries and organizations to improve their operations, such as data volume, insight generation, action planning, and management, which increases productivity.

- Artificial intelligence (AI) has permeated and disrupted the IT industry across various end-user industries worldwide. AI leads to remarkable breakthroughs for businesses and their customers. With the influx of technological developments such as virtual assistance, self-driving cars, chatbots, etc., AI is expected to disrupt the way mobile devices are used. A machine that operates with a degree of autonomy needs to, in some sense, be able to understand its surroundings.

- The main things that are making the market grow are the rise of AI applications in many different end-user industries and the growing demand for cognitive computing and automation.Also, more and more people are using mobile devices in their daily lives, such as at work, in school, and for personal use. This makes it more important to automate these devices so they don't need human help.

- With digitization, the dependence on mobile devices is increasing BYOD trends in the workplace, stimulating an increase in the use of mobile devices. Also, the increased usage of mobile devices to make important decisions due to the increased dependency on these devices is further stimulating the need for AI in these devices to make automated decisions.

- Furthermore, the growth of connected devices due to IoT is augmenting the need for AI-assisted control of these devices. The market is also growing because more and more people want processors and chipsets in these devices that can handle AI.This is because putting AI into a mobile device is most important when it comes to integrating the technology into the chipsets.

- The rise of COVID-19 created huge opportunities for the growth of the mobile AI market worldwide. The increasing use of AI in health care and self-diagnosis systems boosted the market's demand.

Mobile Artificial Intelligence Market Trends

Smartphone Application Drive Growth of The Market

- The market for smartphone AI processors is growing because more and more people want real-time voice processing and image recognition. Most AI processors have extra built-in neural processing units (NPUs) that can do cognitive tasks, work in parallel, and use little power. On-device AI uses AI-specific chipsets, and by 2022, all top-of-the-line smartphones should have them. Most new high-end smartphones include AI chips with a dedicated neural processing unit.

- AI is becoming the most important part of smartphones, and it can be used for a lot more than just digital assistants. With Edge-AI technology, many AI functions that used to be done on the back end can now be done on the phone itself. With each update, artificial intelligence (AI) and machine learning (ML) make hardware and software for mobile phones better. This affects marketers and customers and makes life easier for everyone.

- The features of the virtual assistant are steadily improving. Some speech recognition now provides a greater understanding than a human listener, even in crowded conditions. Over time, virtual assistants are likely to become a much more significant part of the user's phone interface, and AI will identify the natural human language the user provides. In the coming years, smartphone manufacturers are expected to implement even more advanced AI and ML to identify people as their facial features change, such as growing a beard or wearing glasses.

- Moreover, the growing penetration of cell phones worldwide is also helping the market grow. For example, the mobile penetration in North America had 321 million unique mobile subscribers. By 2025, the penetration rate will increase by 2% to 345 million individual mobile subscribers.

A growing number of mergers and partnerships between big tech companies also helped the market grow. Apple is the leading buyer of companies in the global artificial intelligence space. For instance, Apple acquired the most AI companies, defeating Accenture, Google, Microsoft, and Facebook. All of the other companies also had an increased number of AI acquisitions.

North America to Occupy the Largest Market Share

- North America is expected to make up a big part of the market in terms of demand since it is a good place for startups and SMEs to do business in terms of government regulations and compliance. Also, due to various developments made by these companies, the region is expected to lead in technology adoption and be home to major AI solution providers for mobile applications based in North America, hence driving the market to grow significantly in the forecast period.

- The U.S. government has decided to encourage federal investment in AI research and development (R&D) in partnership with industry, universities, international partners and allies, and other non-federal entities.This is to help AI technology make big leaps forward. Networking and Information Technology Research and Development (NITRD) is getting USD 9.6 billion for research and development in FY 2023, which is USD 1.8 billion more than what was asked for in FY 2022. According to the supplement, the rise is because the Department of Defense will release information about funding for AI research and development in FY 2023.

- AI is built into Google's core. The company successfully transitioned from a mobile-first to an AI-first world. AI is integrated into all Google apps we use daily, including Google search engines, Google Maps, Google Photos, YouTube, and Gmail Smart Reply. Google is driving AI through its technological offerings, such as TensorFlow and Cloud AutoML (to name a few), and assisting developers and SMBs in innovating through open-source projects.

- Artificial intelligence and the internet of things are becoming more common in many industries, and voice assistants and smart speakers are becoming more popular. This is increasing the need for mobile AI in the area.

In North America, the growth of the market is also due to the changing digital infrastructure in healthcare, a well-established healthcare sector, and more patients learning about the benefits of AI. In North America, the need for artificial intelligence in healthcare is likely to push several key players into the market.

Mobile Artificial Intelligence Industry Overview

The artificial intelligence (AI) market for mobile devices is very fragmented because there are many players in most parts of the world.Artificial intelligence consists of complex algorithms, which are increasing rapidly in the current market. Nowadays, several industries adopt artificial intelligence-algorithms that are easy to access for complex systems, creating intense competition in the market. Key players are Intel Corporation, Microsoft Corporation, Alphabet Inc. (Google LLC), etc.

In May 2022, Habana Labs, Intel's data center team that works on AI and deep learning processors, announced the release of Habana Gaudi2 and Habana GrecoT, its second-generation machine-learning processors for inference and training.These new chips fill a void in the market by giving clients high-efficiency and high-performance deep learning computing options for both training and inference deployments and data center workloads. They also make it easier for businesses of all sizes to start using AI.

In March 2022, Nvidia Corp. showed off new chips and technology that it says can speed up the processing of AI algorithms that are getting more complicated. The company released specifics of new graphic chips (GPU) that would be at the heart of AI infrastructure, including the H100 chip and a novel processor chipset called the Grace CPU Superchip, both of which are based on the technology of British chip maker Arm Ltd. It's Nvidia's first Arm-based semiconductor since its plan to buy Arm fell through last month.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for AI-capable Processors in Mobile Devices

- 5.1.2 Rise of Cognitive Computing and Increasing Number of AI Applications

- 5.1.3 Increasing Penetration of Mobile Devices

- 5.2 Market Restraint

- 5.2.1 Premium Pricing of AI Processors

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Smartphone

- 6.1.2 Camera

- 6.1.3 Drone

- 6.1.4 Robotics

- 6.1.5 Automotive

- 6.1.6 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Alphabet Inc. (Google LLC)

- 7.1.4 Apple Inc

- 7.1.5 Samsung Electronics Co. Ltd.

- 7.1.6 Nvidia Corporation

- 7.1.7 IBM Corporation

- 7.1.8 Qualcomm Technologies Inc

- 7.1.9 MediaTek Inc.

- 7.1.10 Huawei Technologies Co. Ltd.